2025 and Beyond: Key Trends Shaping India’s Streaming Landscape

Game Changing Year for The Indian "Eyeball" Economy

Hey Streamers 👋,

A warm welcome to the 66th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

2025 and Beyond: Key Trends Shaping India’s Streaming Landscape

And….Action!

Streaming in India - 2025 promises to be a year of Innovation

As we close ‘24 and look toward 2025, India’s media and entertainment (M&E) sector is set to witness transformative changes. Here are the key trends shaping the landscape:

1. The Rise and Rise of the Short-Form App

India’s data consumption is unmatched globally, with an average of 20GB per month, set to more than double by 2027 (EY). Coupled with a digital-forward economy, India is ripe for short-form video (SFV) innovation.

Post-TikTok’s ban, homegrown apps like Moj, Josh, and Chingari have taken center stage, fiercely competing to cater to diverse linguistic and cultural audiences. These platforms are innovating with features like advanced algorithms, creator tools, and monetization strategies. The emergence of Reelies, India’s first short-drama app offering cinematic storytelling in bite-sized episodes, exemplifies this evolution. Each story spans 50 episodes, with episodes under 90 seconds, perfectly blending cinematic impact with a social media-friendly format. And it’s a matter of time before other Tier 1 Media companies jump into this race.

India’s vast linguistic diversity and a growing appetite for local content position SFVs (acronym of 2025?) as a major growth driver in 2025. With over 40 million daily active connected TV users and 500 million online gamers by 2025, short-form content will continue shaping how Indians engage with entertainment.

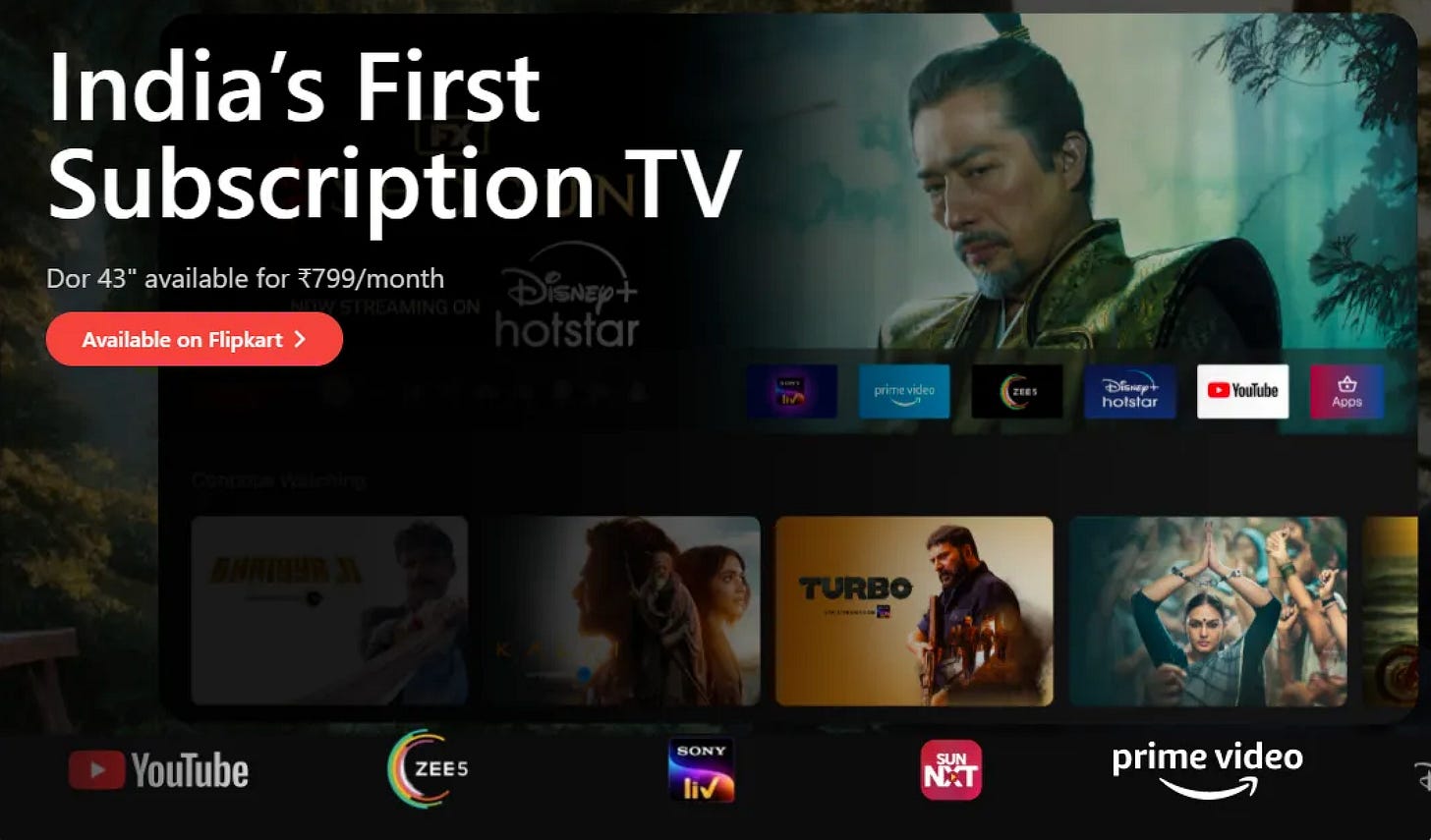

2. CTV Innovation: The Battle of the OS

The connected TV (CTV) revolution in India is just beginning. Companies like Dor OS, supported by Sensara, have set the stage with innovative solutions to redefine the viewing experience. However, Jio is expected to launch affordable TVs with a proprietary OS bundled with their popular Jio Fiber services. Such moves align with Jio’s strategy of offering integrated data and content packages to dominate the market.

While Jio’s scale poses a significant challenge, Dor OS’ underdog position leaves room for nimble competition. Startups like Dor OS must sustain their business by focusing on differentiation through personalization, seamless UX, and partnerships with OTT platforms.

3. The Year of the Indian Creator

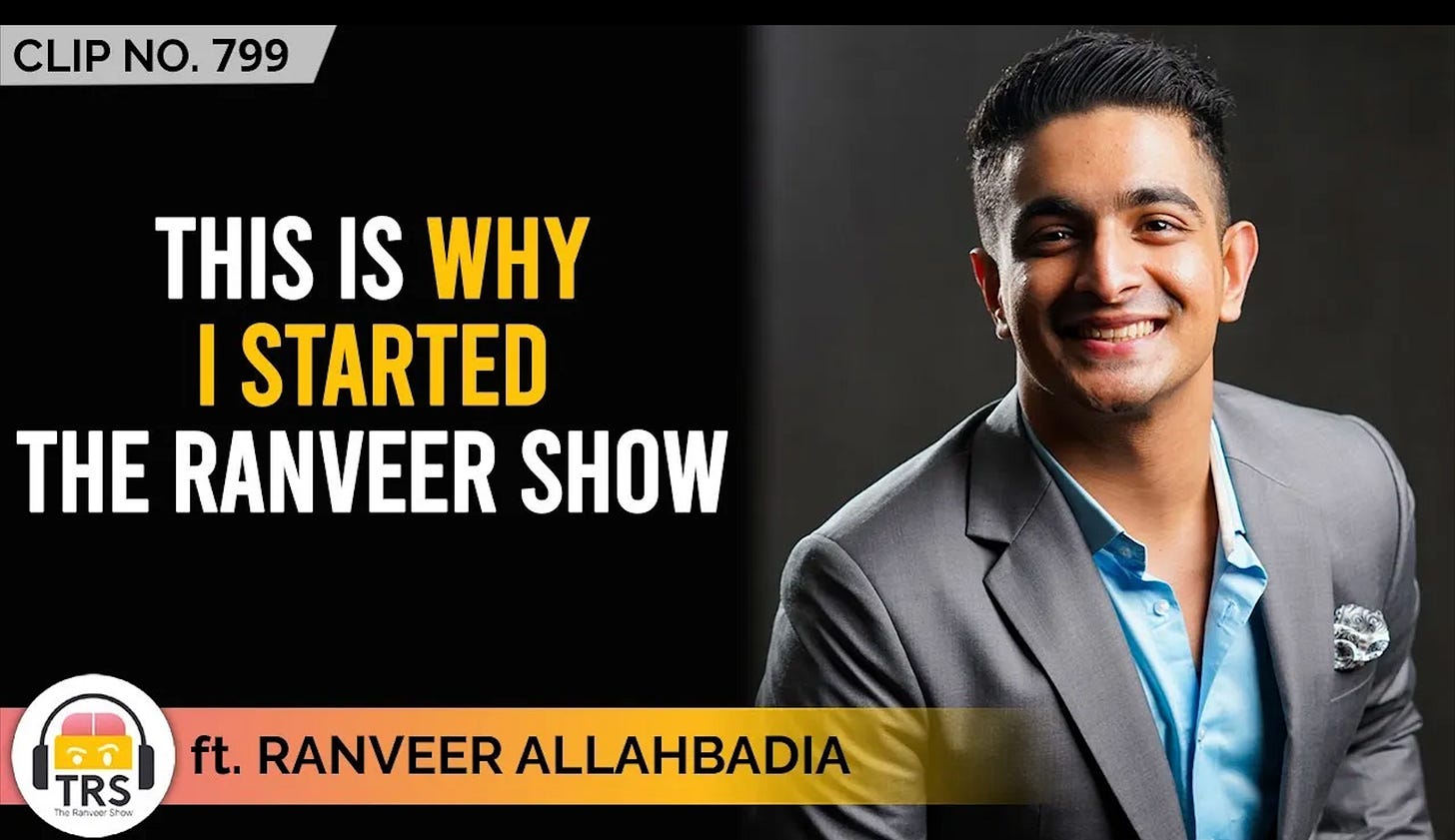

The creator economy in India is projected to grow at a staggering CAGR of 22%, reaching $3.9 billion by 2030. Creators like Ranveer Allahbadia are leading this charge, showcasing the power of diversified content and revenue streams.

Ranveer’s evolution from fitness vlogs to India’s most popular video podcaster highlights the immense potential of the digital space. By expanding into proprietary platforms (in addition to social), creators can:

Own audience data.

Offer exclusive, monetized content.

Build a trifecta of content, commerce, and community.

The rise of tools enabling direct-to-consumer models presents massive opportunities for creators, especially as they diversify revenue beyond ad dependence. Ranveer’s model—integrating content, community, and commerce—offers a blueprint for sustainable growth.

4. 2025: The Year of AI in Media

Artificial intelligence will further disrupt the Indian M&E sector, driving efficiency and creativity. Tessact, Frammer AI, and Gumlet are already pioneering solutions for video production, distribution, and personalization. With innovations like OpenAI’s Sora video model, the use of AI for:

Automated video editing.

Hyper-personalized recommendations.

Real-time analytics for content performance.

will accelerate content production and enhance viewer experiences. Expect AI to revolutionize workflows across gaming, OTT, and advertising.

5. Consolidation in Indian M&E

Following JioCinema’s merger with Disney+ Hotstar, the Indian M&E landscape is primed for further consolidation. A potential Zee-Sony merger could counterbalance Jio’s dominance, creating a robust portfolio of regional and mainstream content. In fact, I expect regional OTTs that have not been managing cash flows and P&Ls effectively to merge with larger players offering potentially a much needed exit to their investors and broader stakeholders.

This trend reflects a shift toward fewer, stronger players battling for market leadership in a competitive, high-growth industry.

6. Live Video Commerce

Live commerce will gain traction in India’s streaming economy, merging shopping with entertainment. Indians spent over 2 million hours video shopping on Flipkart Live, showcasing the appetite for this format. Real-time interactions between brands and consumers drive trust and immediacy in purchasing decisions. Platforms are leveraging influencer partnerships and gamified experiences to enhance user engagement.

As smartphone penetration and internet speeds improve, Tier 2-4 markets will become hotspots for live video commerce. Expect brands (and OTT platforms?) to adopt live-streaming commerce as a core part of their marketing and sales strategies, utilizing influencers and interactive formats to tap into India’s vast and diverse consumer base.

7. The Audio Juggernaut rolls on

The audio segment will continue its rapid growth. Platforms like Kuku FM and Pocket FM are leveraging regional language content to reach diverse audiences. These platforms have popularized podcasts and audiobooks as preferred storytelling mediums. Audio-focused ad networks like PublifyX are creating targeted advertising solutions, allowing brands to reach engaged listeners.

The rise of audio is also driven by low data consumption and high accessibility. From audio series to interactive storytelling, the segment offers untapped potential for creators and advertisers alike. This evolution positions audio as a powerful medium in India’s storytelling ecosystem.

8. Eloelo: Transforming Live Social Streaming

Apps like Eloelo are reshaping how Tier 2-4 users engage with live entertainment. Eloelo blends interactive live video and audio chatrooms with gamification, enabling users to co-stream, gift creators, and participate in unique content formats like astrology sessions, singing battles, and relationship advice.

The app’s localized approach—offering content in seven Indian languages—caters to diverse audiences. Eloelo’s metrics are equally impressive: 1.9 million daily active users, 150,000 monthly active creators, and a 40% monthly user retention rate. By creating a participatory platform that solves for loneliness and fosters real-time connections, Eloelo addresses a critical gap in India’s social streaming market.

Moreover, Eloelo’s gamified live experiences and robust monetization model (virtual gifts, in-app purchases) make it a frontrunner in the next wave of digital interaction. Its emphasis on AR filters, AI moderation, and creator tools ensures a seamless and safe experience for users. With a clear path to profitability and ambitious plans to hit $100 million revenue by 2026, Eloelo is setting benchmarks for India’s live entertainment ecosystem. I expect other players to join in and improve on mistakes made by existing players such as Sharechat, Josh etc.

9. Regional Content: A Massive Hyper-Local Opportunity

Regional content continues to flourish in India’s diverse linguistic and cultural landscape. Platforms like Stage, which focuses on Haryanvi content, demonstrate the untapped potential of hyper-local streaming services. Stage has gained traction with 225,000 paying subscribers in Haryana alone, showcasing the appetite for regional storytelling.

The success of Stage underscores a massive opportunity for new hyper-local players to emerge. By addressing specific regional tastes, languages, and cultural nuances, these platforms can build deeply loyal user bases. Features like interactive content, live streams, and regional dramas can drive engagement and monetization in Tier 2-4 markets.

India’s high level of linguistic fractionalization—the second-largest number of living languages globally—makes it fertile ground for hyper-local streaming platforms. By taking a leaf out of Stage’s book, emerging players can carve out unique spaces in the Indian OTT landscape, catering to underserved audiences and driving regional content consumption.

Final Thoughts: A Year of Innovation

As we step into 2025, Indian streaming is poised for an era of innovation and growth. From short-form video dominance and connected TV battles to AI-driven content creation and a burgeoning creator economy, the future looks bright. With consolidation reshaping the M&E sector, the rise of audio and live commerce, hyper-local platforms, and innovations like Eloelo redefining interactivity, the industry is entering an exciting phase of transformation. Happy New Year to all the readers and I will meet you again in 2025! Cheers

The Boxing Day test match at arguably the best cricket ground in the world, the MCG (Melbourne Cricket Ground) down under promises to be an absolute treat and the perfect end to this year’s cricket - India take on Australia live streamed on Disney+ Hotstar starting December 26th as the Border - Gavaskar series is tied 1-1. Enjoy!

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.