'24 Vision: India's Streaming Evolution Unveiled

📺📱🇮🇳 Revealing the Shifting Landscape in Streaming's New Era!

Hey Streamers 👋,

Welcome to the 17th edition of “Streaming in India”, your weekly news digest about streaming players, OTT trends and more in one of the fastest growing video markets. If you are not already a subscriber, please sign up and join 2,200+ others who receive it directly in their inbox every Wednesday.

Today’s program:

Chiratae Ventures’ Consumer Tech Report (Powered by Google) on the Streaming / Digital Opportunities in India

My Views - Lens on this year

And….Action!

Cracking the Code, Unveiling India’s Consumer Landscape - Chiratae’s Ventures’ Report

I wanted to start ‘24 with a gut check on where we stand vis-a-vis the streaming / OTT opportunity in India and taking stock of the landscape we are all playing in. Significant challenges remain, however with the right product, tech, team and content, risk takers in the space will succeed.

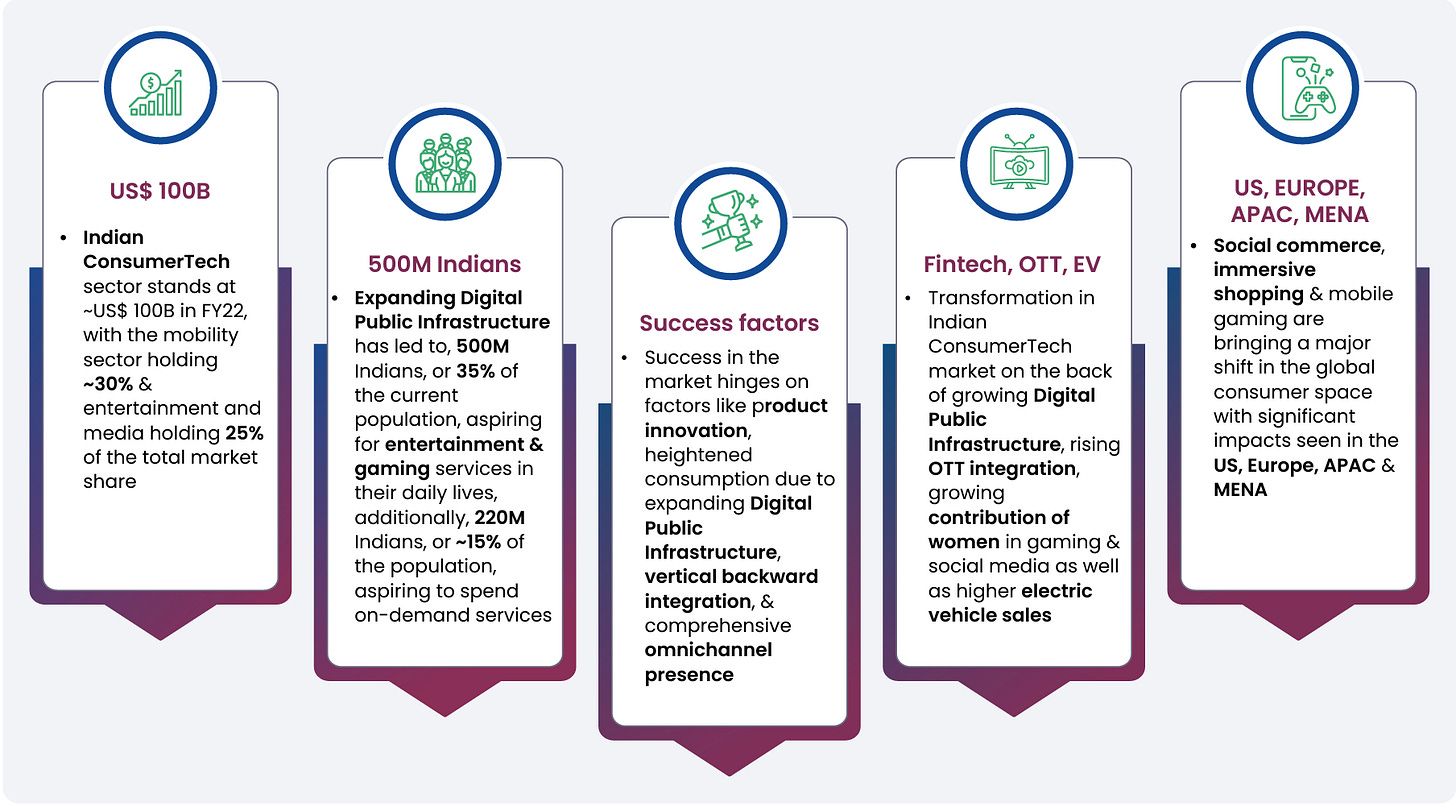

Plus this newsletter’s headline is significantly validated by the latest Chiratae Ventures’ Consumer Tech Report (powered by Google) which showcases the immense opportunity that lies ahead of the Indian streaming industry with a staggering 500 million Indians aspiring for entertainment & gaming services.

Digital public infrastructure & population scale have played a major role in unlocking India’s consumer potential with ConsumerTech market valued at

~US$ 100B (FY22).

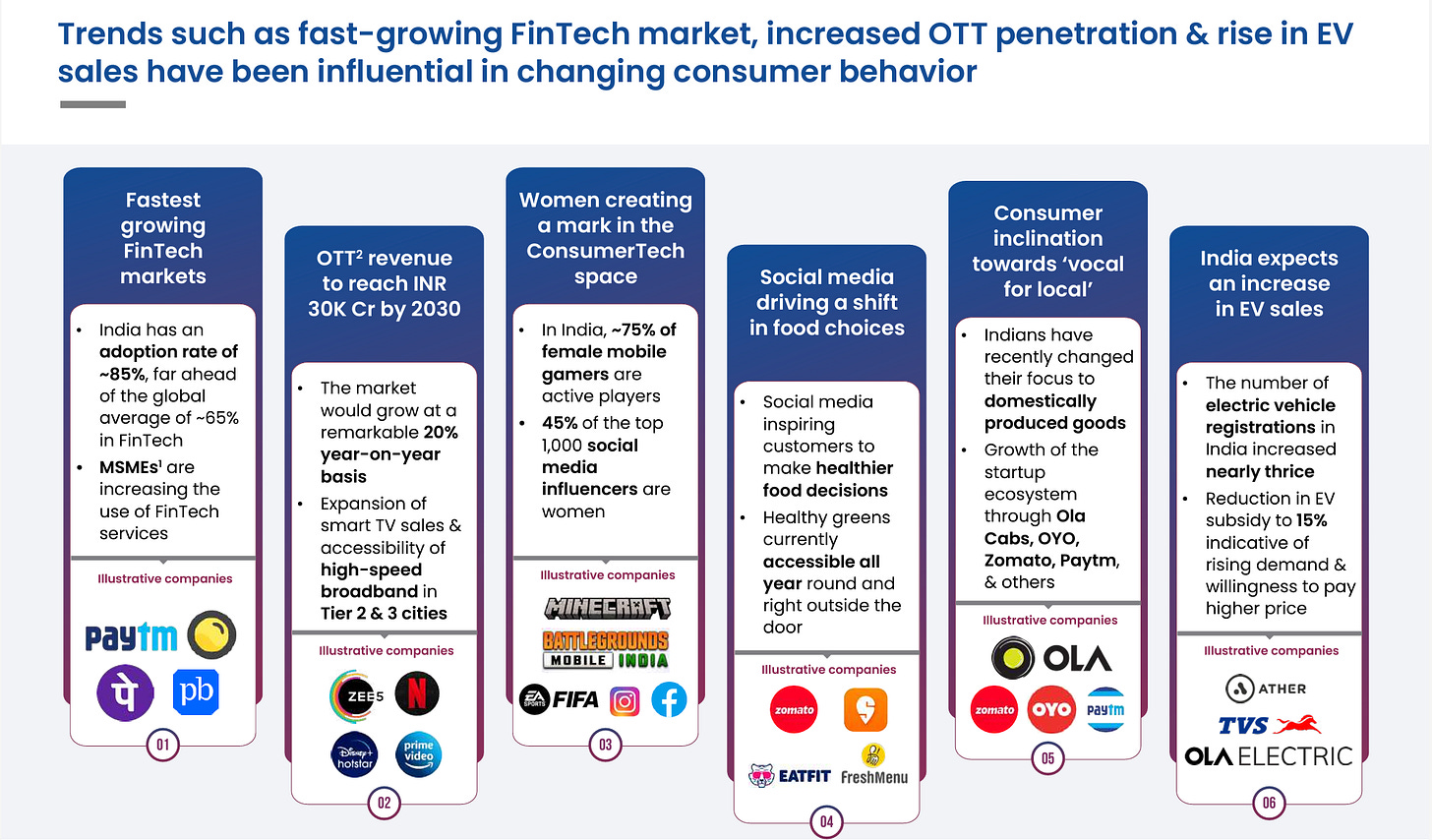

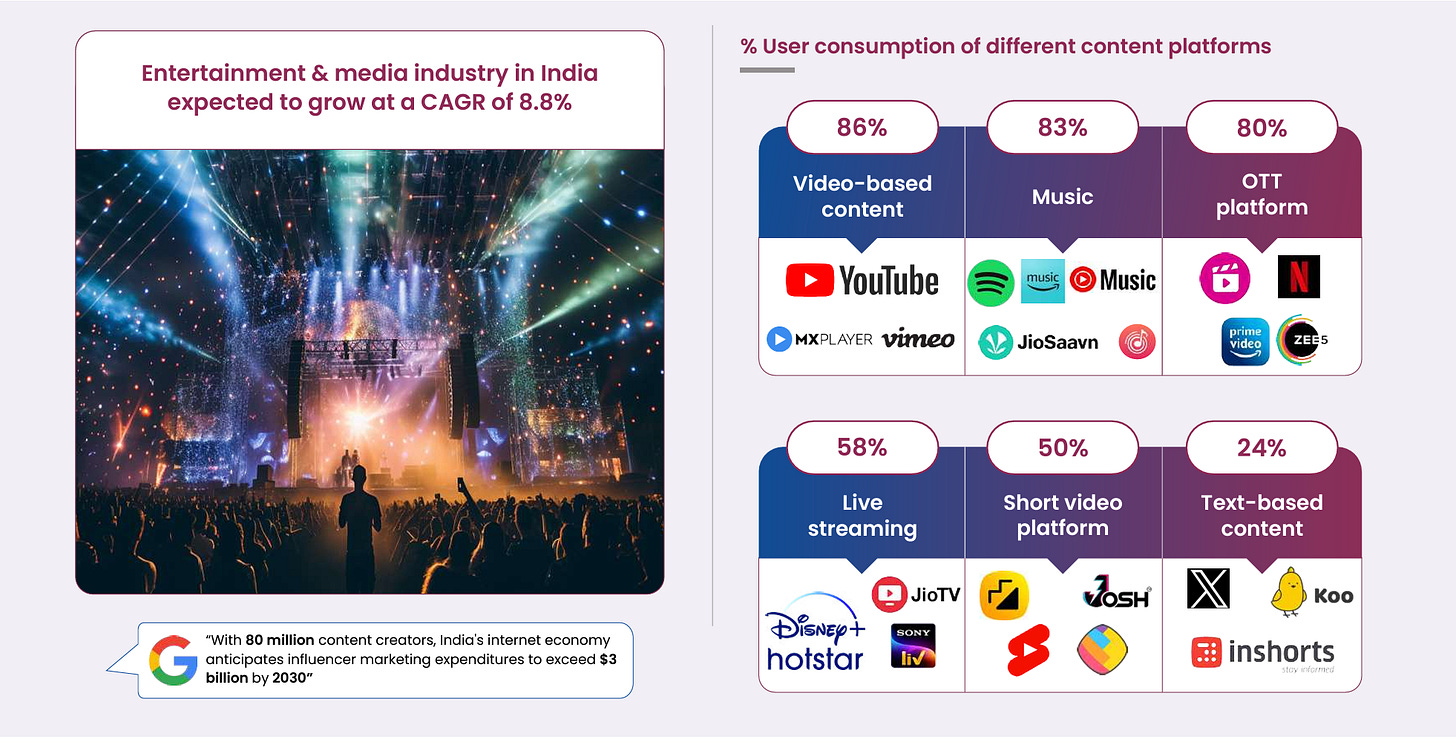

The Indian OTT market is expected to touch Rs. 30,000 crores ($3.6 billion) by 2030 with a remarkable 20% y-o-y growth rate. Expansion of smart TVs (FAST!) and better high speed penetration is set to create further opportunities for streamers.

Fantastic to also see the rise of female social media influencers as well as gamers.

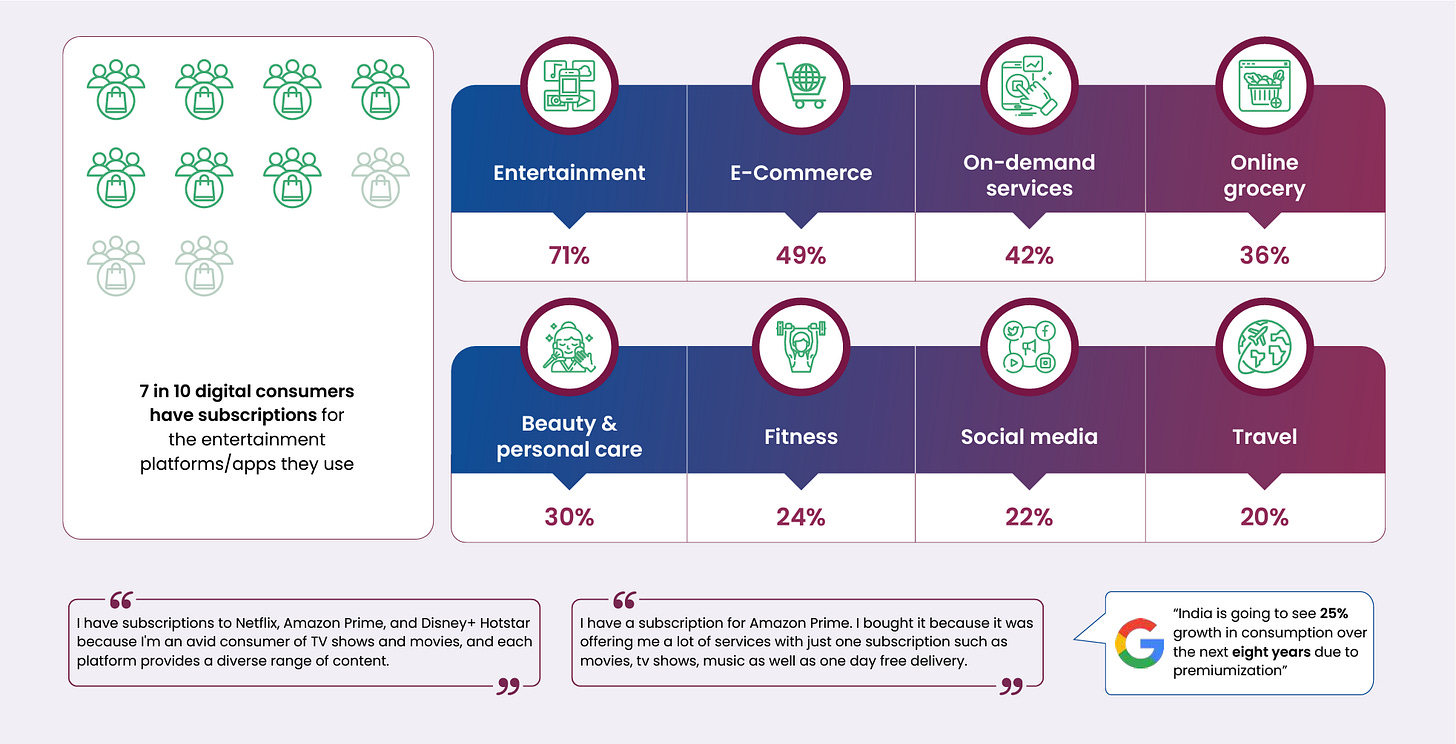

Growing willingness to pay for premium & personalized subscriptions, especially for entertainment (~70%) & e-commerce (~50%) platforms.

India will always be a country where each segment is large enough to warrant a separate business in terms of TAM (Total Addressable Market). Hence, I am not surprised that we have a sizeable population who are willing to subscribe for their favourite entertainment platforms / apps, however I would argue that if were to extrapolate this to a much larger sample size, the findings would probably tilt towards a “free” / ad supported business model as the preferred mode of consumption.

The Amazon Prime Video quote is particularly highlighted - we love to extract maximum value out of any subscription, especially if each $ paid travels farther. Hint to existing OTTs is to look at including additional value / features / functionality beyond just streaming content.

Video-based content is the most consumed content, followed by music and OTT.

My Views - Lens on this year

1. Consolidation - What it means for the consumer and other platforms? Let’s make it the Year of the Underdog

‘24 will mark the beginning of a duopoly in the Indian media, entertainment and OTT industry with the merging of Reliance (Viacom18) - Star India on one hand and Zee - Sony on the other.

The Reliance - Star India combination is set to trigger not only consolidation with other smaller players falling by the way side OR selling out BUT ALSO a major CCI (Competition Commission of India) review.

Between Reliance’s broadcast business Viacom18 and Disney Star, the two hold rights totalling nearly Rs 55,000 crore (~ $6.8 billion) to three major cricket properties in India for the next 4-5 years — the Indian Premier League, International Cricket Council rights for men’s and women’s global events, and India bilateral matches across TV and digital platforms.

Less competition usually does not augur well for consumers as we are then at the mercy of an 800 pound gorilla who could give us content for “free” for a limited time, however then have much more flexibility to increase prices, thereby taking more $ over time / owning a larger share of our wallets.

It is likely that a duopoly in media & entertainment will cause “collusion” and “price fixing”.

However in spite of all the hullabaloo of the giants merging, I still believe that several lesser known / regional OTT platforms are poised for breakout growth this year and will surprise us with quality original content.

2. Aggregation - Aggregator for aggregators?

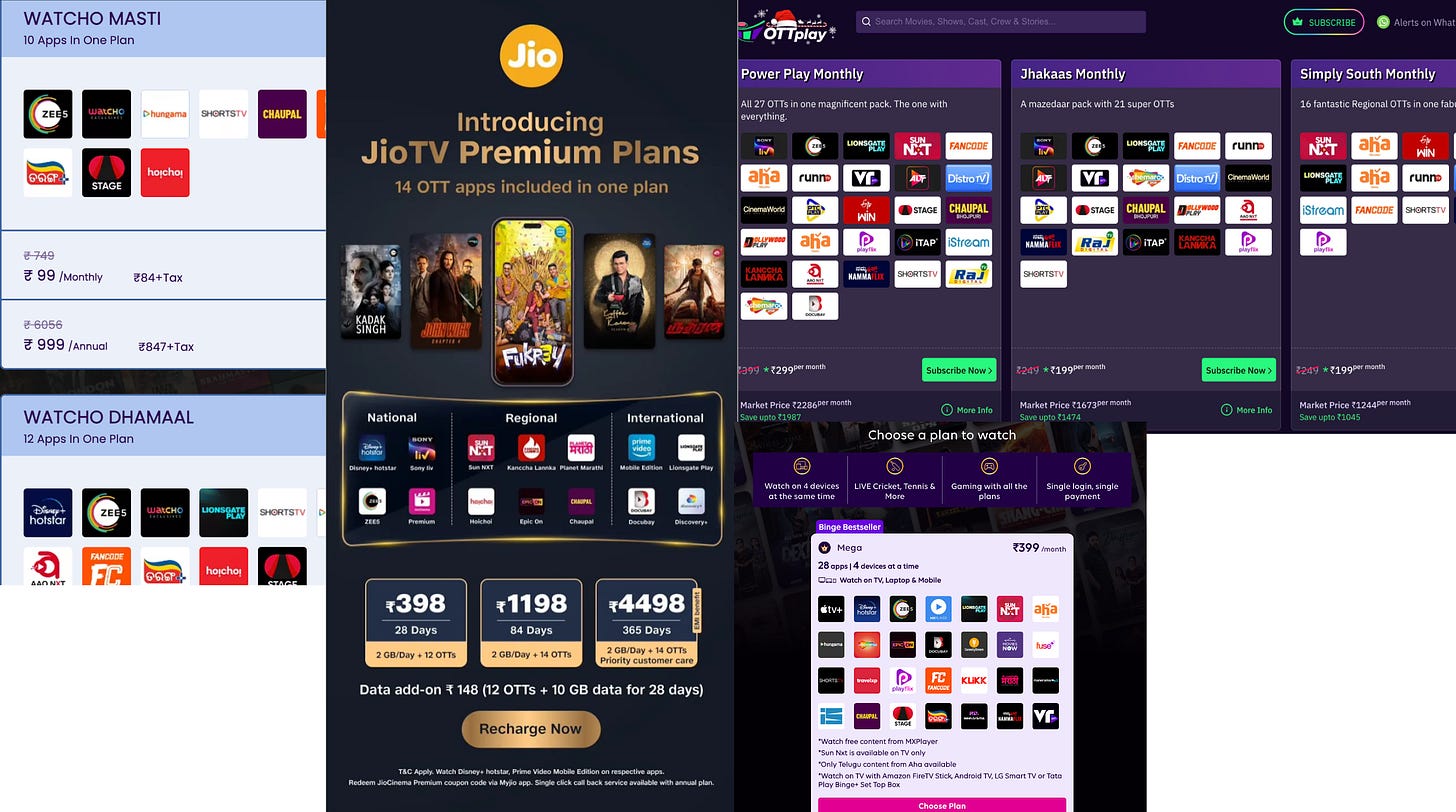

JioTv Plus, Watcho, Tata Play Binge, OTT Play, Playbox TV are just some of the names of OTT app aggregators gaining market share fairly quickly as they aim to add convenience and cost savings for video hungry Indian subscribers.

With one subscription price per month getting users access to a bouquet of their preferred OTTs, the aggregation / bundling model is set to explode and offer even more customization / accessibility options to consumers.

For OTT platforms, it helps reducing CAC (Customer Acquisition Cost), however also reduces ARPU (Average Revenue Per User). But hey, it’s better to have eyeballs versus getting lost amongst the 50+ OTTs.

Maybe an aggregator for aggregators coming up?!

3. National and Regional Content Integration

Content:

Over the past several months, we have seen South Indian film stars & directors working in “Hindi” movies for a broader / national appeal and access to fans and subscribers from across the cultural divide.

‘24 will hopefully kickstart a revolution across the “original content” space on OTT as well where there is cross polination of actors, directors and stories between the North and the South of the country.

Platforms:

Beyond dubbing and sub-titling which have become table stakes for OTT platforms in India (great opportunity to use AI to dub quickly and therefore multiply access to users + 42 Indian languages, and therefore a tremendous opportunity), ‘24 will see large OTT platforms double down on regional content.

For example, SonyLIV, the video streaming platform owned by Sony Pictures Networks India, is betting on shows in Telugu, Tamil and Malayalam, spurred by rapid adoption of online content in the southern states. “We’re looking at an expansion of our content slate plan in the south and will start dropping shows in three languages—Tamil, Telugu and Malayalam, which should be followed by Marathi and Bengali," Saugata Mukherjee, head of content, SonyLIV, said in an interview.

4. FAST - How Fast can it go?

This year will see a plethora of FAST platforms launched - the likes of LG and Xiaomi are set to launch their India focused FAST business and the incumbents Samsung TV Plus, Jio TV, Zee5, Runn Media, Distro etc are going to expand their offerings significantly.

A lot of the FAST growth will depend on how the platforms, content owners and advertisers can come together to monetize this medium. The associated ad tech is still focused on OpenRTB programmatic advertisements which needs to be adapted using PG (Programmatic Guaranteed) and PMP (Private Marketplace) deals (not easy without direct ad sales teams) for ads to be successfully fired on Server Side Ad Insertion (SSAI) set ups.

Also, platforms that focus on creating their own curated FAST channels, interspersed with LIVE events / content will stand a better chance of success. Just throwing library content on a FAST channel with 0 marketing will not work.

5. Video Tech Heroes

GenAI applications in the video tech space are set to explode this year.

From video creation (text/idea/audio to video), contextual video ads (preparing for a cookieless future via object detection & associated ad targeting), video highlights / key moments across sports, news etc, better dubbing / subtitling including lip syncing to different languages, auto meta data tagging / summarisation, digital avatars and lots more - ‘24 will see all of this going mainstream as platform administrators look at ways to reduce costs, increase revenues and transform the user experience.

It goes without saying that this year is about transforming the experience and economics of video streaming - technologies like Server Side Ad Insertion, Context Aware Encoding, Multi Codec / CDN delivery to optimize for bandwidth, quality of experience & costs will have their day in the sun!

With its insatiable appetite for diverse content, the Indian audience continues to push the boundaries of what entertainment can be - ‘24, let the games begin.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

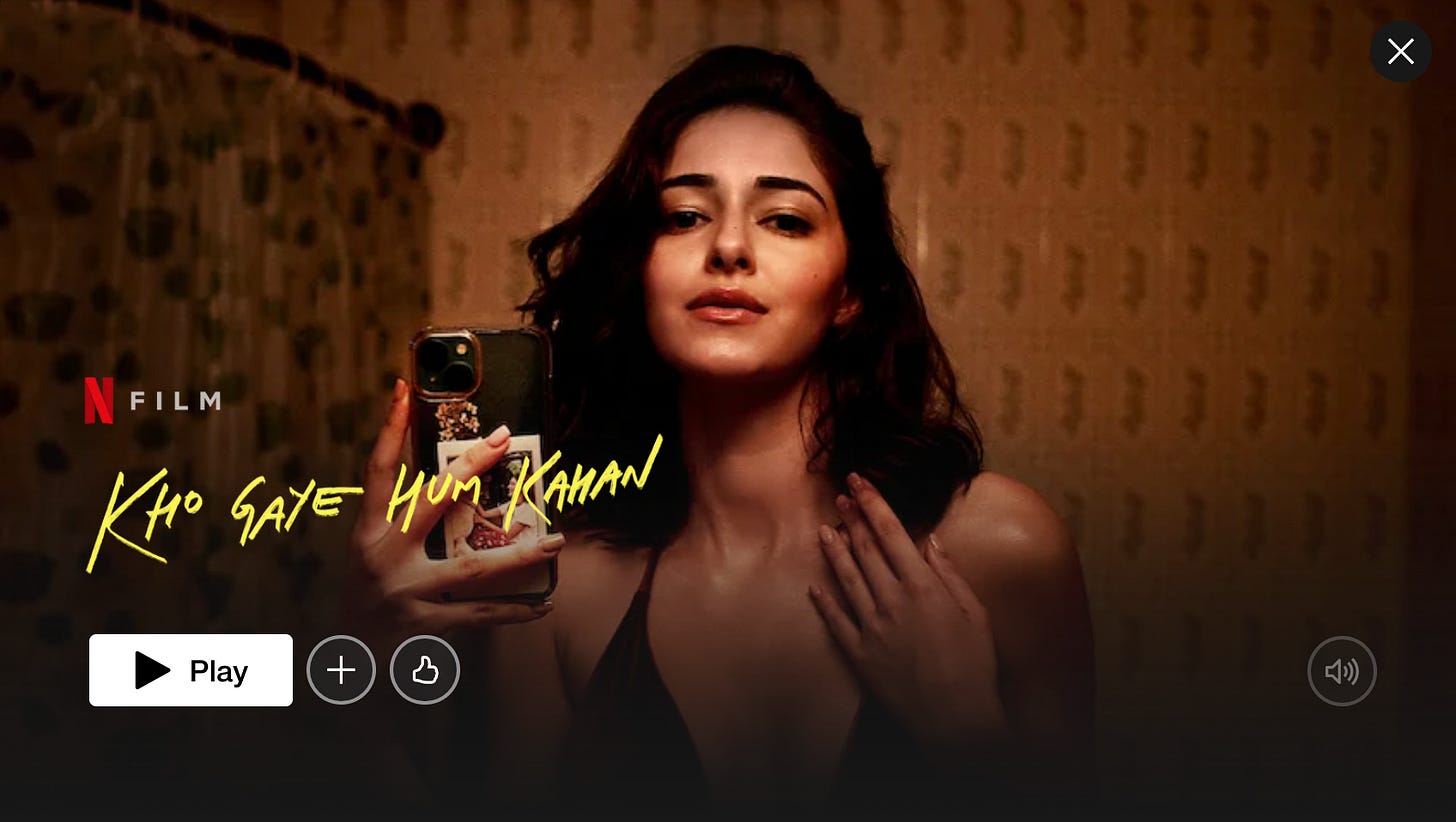

A great way to start the New Year is to watch Kho Gaye Hum Kahan (KGHK) on Netflix, a film that really surprised me. I was not expecting this star cast and story line to deliver. But they do and how - helmed by Arjun Varain Singh, the film is co-written by Reema Kagti and Zoya Akhtar, and produced by Farhan Akhtar and Ritesh Sidhwani. It revolves around three friends, Ahana, Neil and Imaad, who have been together since their school days. They juggle life as 20-somethings in Mumbai, where romance, ambition and heartbreak collide with the addictive draw of social media.

Dil Chahta Hai vibes and a must watch.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Download my market reports STREAMING in MENA and STREAMING in INDIA.

I also work with streaming services, content creators, platform providers or media consultants and help them diversify their revenues. Contact me here.