Breaking Down India's OTT Content Consumption Analysis for '24 & Opportunities in 2025

Plus The World's Biggest Coldplay Concert Live Streamed on Disney+ Hotstar

Hey Streamers 👋,

A warm welcome to the 70th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Coldplay Concert on Disney+ Hotstar: A Streaming Triumph That Sets New Benchmarks

The live stream of the Coldplay concert on Disney+ Hotstar was an unforgettable experience, showcasing how technology can elevate live entertainment (concurrent viewers OR subscriber addition numbers are not out yet). Streaming quality was impeccable throughout the event, underscoring Hotstar’s reputation for delivering flawless live experiences, much like its IPL telecasts. The three-hour broadcast on Jan. 26th attracted 8.3 million views and accumulated 165 million minutes of watch time. And the platform enhanced the viewing experience with Dolby 5.1 audio quality!

The concert wasn’t free and registered users on Disney+ Hotstar who weren’t subscribed were greeted with a 15-minute countdown before being prompted to subscribe to continue watching. The pricing options were well-defined: Rs. 499 for three months, Rs. 1499 for a year, or Rs. 499 for a single-device annual plan. This strategy seemed like a calculated move to convert live event viewers into subscribers—something that could set a trend in the OTT space.

A standout feature was the real-time lyric chat window synced with the songs being performed. Trust Hotstar to seamlessly blend gamified, interactive features into live streaming, a skill they’ve mastered from their experience with IPL broadcasts. This feature not only enhanced audience engagement but also created a unique way for fans to connect with the music in real-time.

From a monetization perspective, the event was a resounding success. The live stream was co-powered by Jameson Ginger Ale, with Courtyard by Marriott joining as the Associate Sponsor. Other prominent brands such as Maybelline, Oreo Pokémon Cookies, Absolut mixers, and Johnnie Walker non-alcoholic mixers took center stage with advertisements and product placements during the broadcast. Additionally, Cisco partnered as the technology leader for the event, further demonstrating how live-streaming platforms can attract diverse brand collaborations. These sponsorships not only elevated the event's scale but also showcased a viable revenue model for future live-streamed events.

Looking at the bigger picture, I believe this model will become a trend in India. Platforms like Disney+ Hotstar have shown how combining exclusive live content with subscription nudges and interactive features can increase reach, audience engagement, and revenue streams. Ticketing giants like BookMyShow and others are likely to follow suit, leveraging live-streaming partnerships to connect artists, audiences, and brands in innovative ways.

[Chris Martin singing Vande Mataram on India’s Republic Day concert (26th Jan ‘25), Narendra Modi Stadium, Ahmedabad live streamed on Disney+ Hotstar, Source: Instagram]

For artists, it’s an incredible opportunity to reach global audiences. For viewers, it’s a way to access premium live entertainment without the logistical challenges of attending in person. And for platforms, it’s a chance to capitalize on India’s growing appetite for unique, tech-enabled experiences.

All in all, the Coldplay concert wasn’t just a musical treat—it was a benchmark for how live streaming can reshape the way we experience live events. Disney+ Hotstar has set the stage for a new era of monetized live entertainment, and I can’t wait to see how other players in the ecosystem respond to this emerging trend.

Agenda

Streaming Trends in India ‘24: Breaking Down Ormax Media’s OTT Content Consumption Analysis

International Originals: Netflix’s Power Play

Hindi-Language Content: A Battle of Titans

Regional Content: The Rise of Vernacular Powerhouses

Unscripted Content: Emerging Trends

Platform Performance: Leaders in the Streaming Space

OTT Content Trends that defined ‘24 + 2025 will see more of this?

My Views: Opportunities for Regional OTT Platforms

And….Action!

Streaming Trends in India ‘24: Breaking Down Ormax Media’s OTT Content Consumption Analysis

Squid Game 2 Reigns Supreme: Unveiling the Streaming Landscape in India

The streaming ecosystem in India is evolving at a breathtaking pace, and ‘24 has already delivered some fascinating insights into audience preferences + has some hints of what can come up for content consumption in 2025. An Ormax Media study reveals the key performers and trends shaping the market, with Netflix’s Squid Game 2 taking center stage.

1. International Originals: Netflix’s Power Play

1.1. The Phenomenon of Squid Game 2

Squid Game 2 not only became the most-watched international series in India in ‘24 but also shattered all-time viewership records in the category.

Viewership: 19.6 million Indian viewers.

With a unique storyline and global hype, Netflix has successfully positioned Squid Game 2 as a cultural event rather than just another series.

1.2. Dominance of Franchises

Established franchises continued to thrive, accounting for 7 of the top 10 international entries:

The Boys Season 4: 10.5 million viewers.

The Lord of the Rings: The Rings of Power Season 2: 8.8 million viewers.

This underscores the importance of leveraging loyal fan bases in driving viewership.

1.3. International Films: A Modest Year

Prime Video’s Road House led the international film category, crossing 5 million viewers.

Prime Video dominated the segment with six top-10 entries, while Netflix contributed four.

Unlike series, films faced stiffer competition, reflecting audience preference for episodic storytelling.

2. Hindi-Language Content: A Battle of Titans

2.1. Top Performers

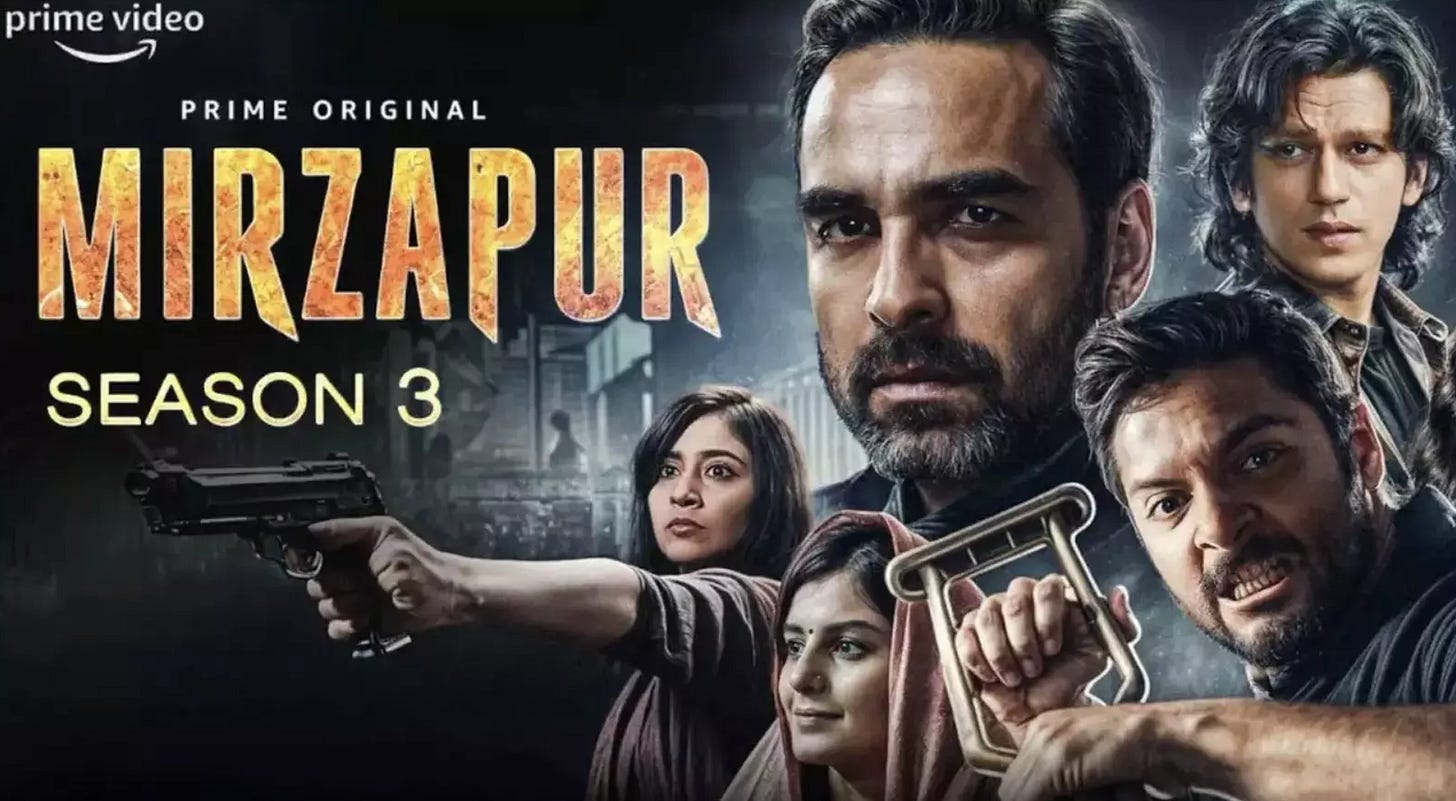

Prime Video’s Mirzapur Season 3:

Viewership: 30.8 million (the highest in the Hindi-language space).

Buzz Score: 63%, ranking third all-time behind Mirzapur Season 2 and The Family Man Season 2.

Netflix’s Do Patti topped Hindi films with 15.1 million viewers, leading the platform’s dominance in the Hindi-language film category (11 of the top 15 entries).

2.2. Audience Sentiment

Panchayat Season 3 emerged as the most-liked Hindi series of 2024, scoring 77 on the Ormax Power Rating (OPR).

This reflects a shift toward heartwarming, relatable narratives resonating deeply with Indian audiences.

3. Regional Content: The Rise of Vernacular Powerhouses

3.1. Telugu Content

Disney+ Hotstar dominated, with Save The Tigers Season 2 leading the charts (5 million viewers).

Regional diversification has been a winning strategy for Hotstar, aligning with India’s linguistic diversity.

3.2. Tamil Content

Prime Video’s Inspector Rishi led with 4.9 million viewers, but Disney+ Hotstar claimed seven of the top 10 Tamil content spots.

This demonstrates the growing appetite for localized content that speaks directly to cultural roots.

4. Unscripted Content: Emerging Trends

4.1. Top Performers

JioCinema’s Bigg Boss OTT Season 3 took the lead with 17.8 million viewers.

Netflix’s The Great Indian Kapil Show Season 1 followed with 15.7 million viewers.

Unscripted formats continue to thrive, driven by their universal appeal and relatability.

5. Platform Performance: Leaders in the Streaming Space

5.1. Netflix

Unparalleled strength in the Hindi film category, with 11 of the top 15 entries.

Squid Game 2 and The Great Indian Kapil Show showcased Netflix’s dual focus on international and localized content.

5.2. Prime Video

A leader in the Hindi-language series category (Mirzapur Season 3) and international films (Road House).

Diverse content offerings cater to multiple audience segments.

5.3. Disney+ Hotstar

Dominance in regional content, particularly Tamil and Telugu, with strong performances in vernacular markets.

Success underscores Hotstar’s regional-first strategy.

5.4. JioCinema

Strategic focus on unscripted content (Bigg Boss OTT Season 3).

JioCinema’s growing prominence reflects the platform’s ability to engage mass audiences.

6. OTT Content Trends that defined ‘24 + 2025 will see more of this?

6.1. Established Franchises Drive Viewership

Franchises are a safe bet, delivering both viewership and brand loyalty. Platforms investing in sequels and spin-offs are reaping rewards.

6.2. Localization is Key

Regional content continues to grow, with vernacular stories drawing significant audiences. Tamil and Telugu content are standout examples.

6.3. Marketing Buzz Matters

Shows like Mirzapur Season 3 generated record buzz, proving the critical role of marketing in audience acquisition and retention.

6.4. Measuring Content Strength

Metrics like Ormax Power Rating (OPR) are becoming essential for understanding audience sentiment beyond viewership.

7. My Views: Opportunities for Regional OTT Platforms

While the larger platforms like Netflix, Prime Video, Disney+ Hotstar, and JioCinema dominate, regional OTT platforms have a fantastic opportunity to focus on hyper-local content and showcase the depth and diversity of Indian languages. Languages like Marathi, Bengali, Odiya, and others remain underrepresented on mainstream platforms, despite their rich storytelling traditions and large potential audiences.

Conspicuously absent from the top-performing platforms in this report is Hoichoi, a torchbearer for Bengali-language content. This raises questions about whether regional platforms are being overshadowed by larger competitors or if they’re struggling to create original content that captures nationwide attention.

Insights from Ormax Media’s Supply Trends

The Ormax study on supply trends highlights that only 9% of streaming originals released in 2024 catered to regional languages outside Hindi, Tamil, and Telugu. This underscores the immense untapped potential for platforms to expand their offerings in languages like Marathi, Bengali, Odiya, and others.

Platforms like Hoichoi and Planet Marathi can invest in unique, culturally rooted narratives to attract and retain audiences.

Events like the Puri Ratha Yatra in Odiya culture or Marathi folk festivals offer opportunities for live-streaming and related original content.

Niche platforms could also explore cross-regional collaborations to pool resources and tap into larger audiences.

By doubling down on hyper-local content, regional platforms can carve out a niche and compete effectively in India’s fast-growing streaming market.

Amazing startup stories from all over India, pitches that come along with their share of drama, excitement and entrepreneurial aspirations and of course sharks that add their own share of masala - Shark Tank India on SonyLIV is a must watch for all aspiring entrepreneurs and investors = all of us! Enjoy.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.