Can FanCode’s Live Sports Streaming Save Dream11?

Assessing FanCode’s capacity to monetize India’s avid fans post-RMG

Hey Streamers 👋,

A warm welcome to the 101st edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

FanCode to the Rescue? Dream11’s RMG Ban and the Pivot to Sports Streaming

Dream Sports’ Pivot: Betting on FanCode, Live Streaming and New Verticals

FanCode: A Quick Overview

Pros: How FanCode Can Fill the Gap for Dream Sports

Cons: Challenges and Uncertainties Ahead for FanCode

Outlook: Can FanCode Salvage Dream11’s Fortunes?

And….Action!

FanCode to the Rescue? Dream11’s RMG Ban and the Pivot to Sports Streaming

The End of Real-Money Gaming [RMG] in India and Dream11’s Predicament

In August 2025, India enacted a blanket ban on real-money online gaming, shutting down an industry that had flourished for over a decade. This new law – the Promotion and Regulation of Online Gaming Act, 2025 – completely outlawed paid online games (whether skill or chance-based) played for monetary stakes. For Dream11, India’s largest fantasy sports platform, the impact was devastating. Dream11’s parent company Dream Sports saw 95% of its revenue and all of its profits erased virtually overnight. A 14-year-old business that boasted over 260 million users was effectively “knockout punched” in just 72 hours as the bill raced through parliament.

Dream11 had historically capitalized on India’s fervent cricket fan base, allowing users to assemble fantasy teams and win cash prizes. It grew into a tech unicorn valued at $8 billion in 2021. Yet with real-money gaming (RMG) now illegal, Dream11 had no choice but to remove paid contests and pivot to free-to-play modes. The company ruled out any legal challenge to the ban – “The government has made it clear they don’t want this… we’d rather build for the future than litigate the past,” said co-founder and CEO Harsh Jain. In other words, Dream Sports decided to adapt rather than fight, even as the rug was pulled out from under its core business.

Dream Sports’ Pivot: Betting on FanCode, Live Streaming and New Verticals

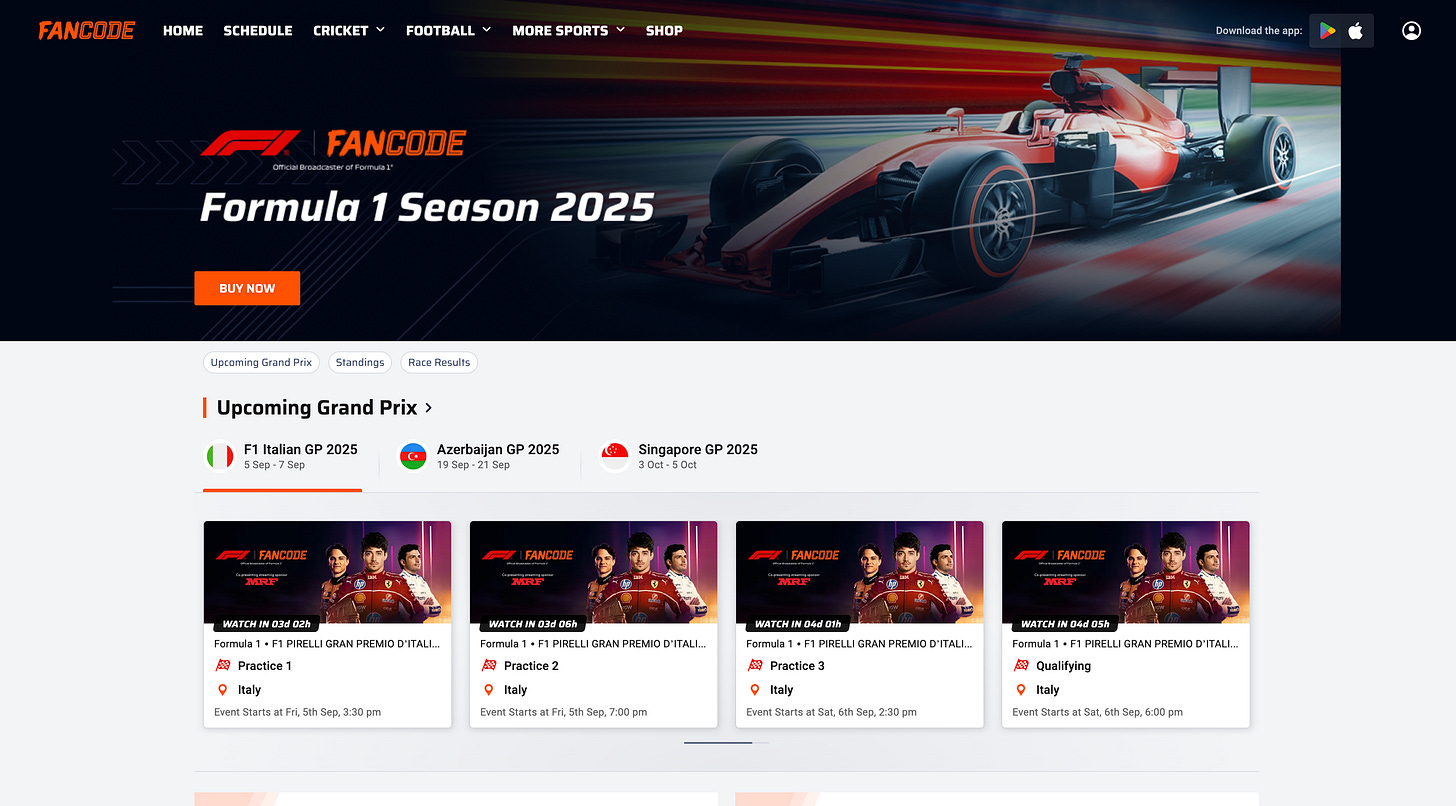

With fantasy RMG off the table, Dream Sports quickly refocused its strategy on alternative ventures. Jain outlined a vision to rebuild around sports AI, free-to-play fan engagement, and streaming. Among these, the sports streaming platform FanCode – a subsidiary of Dream Sports – emerged as a critical piece of the company’s future. Unlike fantasy gaming, FanCode remained unaffected by the ban, and in fact was highlighted as one of Dream Sports’ ongoing businesses, with existing contracts to stream Formula 1 and La Liga in India.

Dream Sports’ leadership is essentially pursuing a “Dream11 3.0” strategy where FanCode helps fill the revenue and engagement void left by fantasy gaming. The company is financially prepared to support this pivot: despite the turmoil, Jain noted they have sufficient cash reserves to survive a few years post-ban, giving time to nurture new initiatives. Dream11 itself has shifted to free fantasy contests (with sponsorship-based prizes) to keep its massive user base engaged. But to salvage Dream Sports’ fortunes, FanCode’s sports content and streaming services now carry high expectations.

(Aside from streaming, Dream Sports has dabbled in other verticals like fintech – reportedly piloting a “Dream Money” app for investments – and continues to run ventures like DreamSetGo (sports travel). However, FanCode is by far the most prominent consumer-facing arm that can immediately leverage Dream11’s 260+ million sports fans.)

FanCode: A Quick Overview

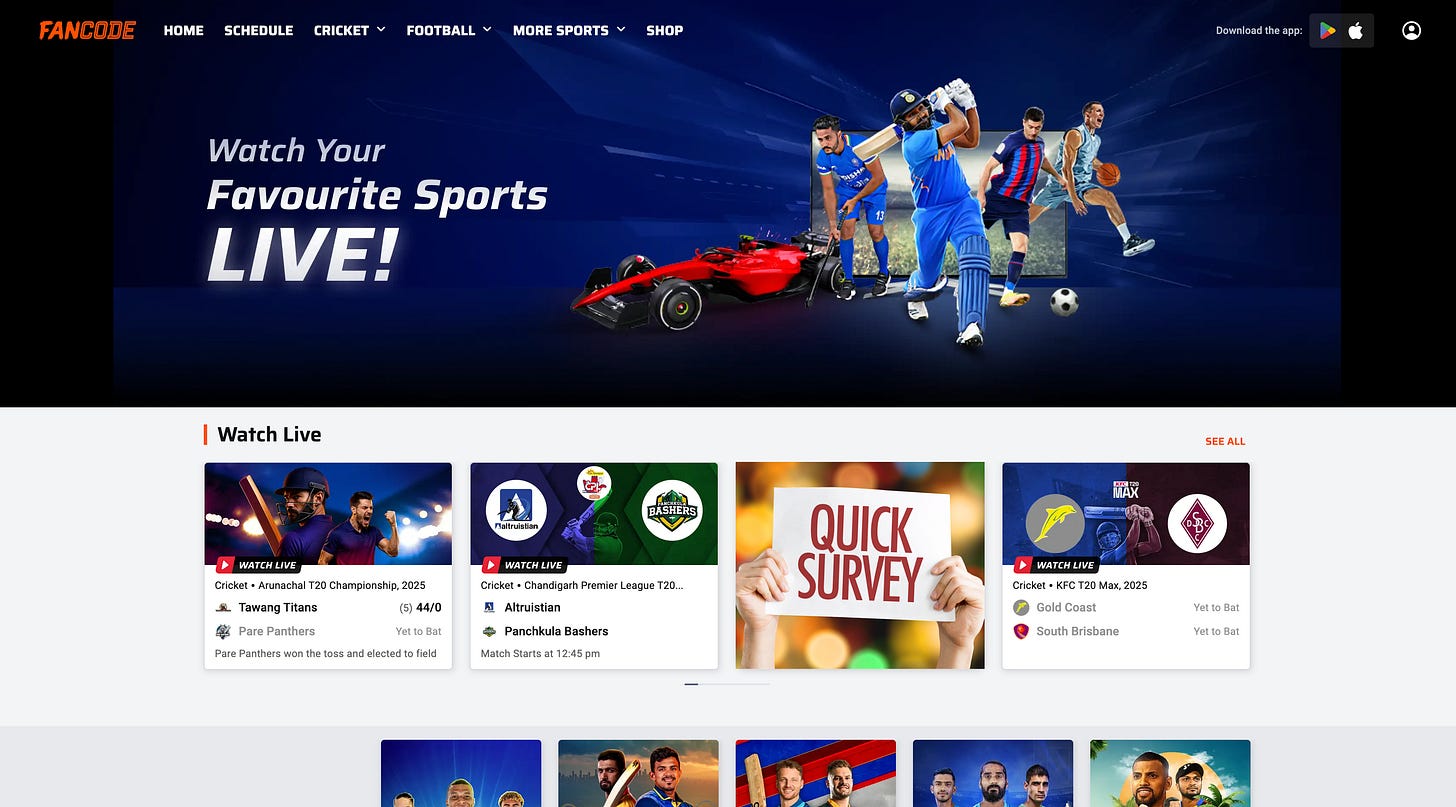

FanCode is an Indian over-the-top (OTT) sports streaming platform launched in 2019 as part of the Dream Sports family. Co-founded by Yannick Colaco and Prasana Krishnan – both seasoned sports media executives – FanCode was created to serve sports content with loyal followings but limited coverage in traditional broadcast. Over the past four years, the platform has grown rapidly, amassing over 100 million users by 2024. It offers live streaming across a wide array of sports, along with interactive live scores, statistics, commentary, and even an integrated e-commerce shop for fan merchandise [now closing down however].

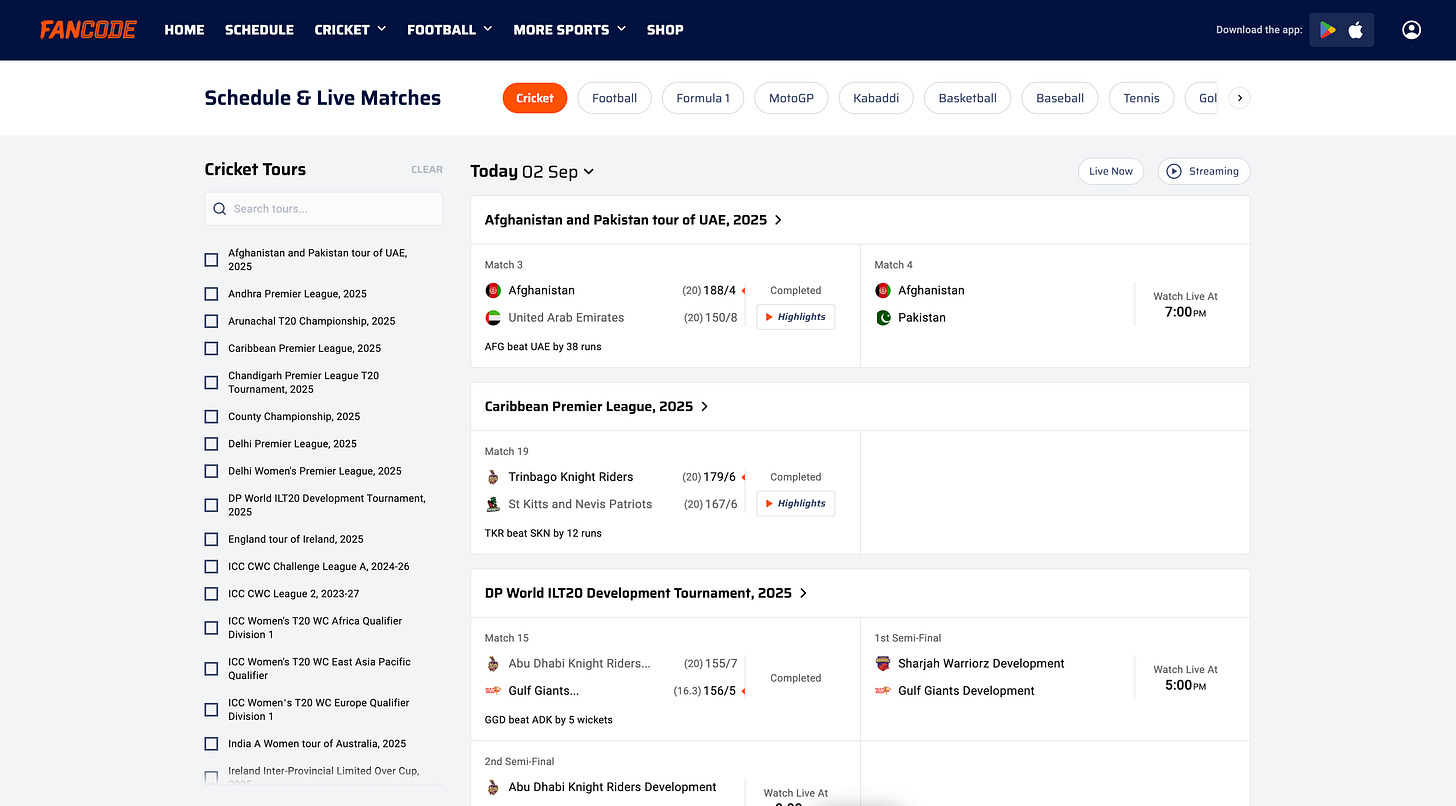

FanCode’s mission from the outset has been to “democratize” sports streaming in India, giving fans access to matches and leagues that big TV channels or mainstream OTT services often ignore. As Colaco described, India has hundreds of millions of sports fans – but only a fraction get to watch beyond marquee events like IPL cricket or World Cups. FanCode identified this gap and positioned itself as the go-to platform for underserved sports content. By 2022, it was streaming thousands of matches per year across cricket, football, and more. In fact, the platform scaled from about 5,000 matches in 9 sports in 2021 to over 20,000 matches in 17 different sports by 2023 [economictimes.indiatimes.com] – an astonishing expansion that reflects its aggressive content acquisition strategy.

Notably, FanCode isn’t just a streaming service; it’s a holistic sports app. Users can read sports news, get fantasy statistics, follow live scores, and purchase team merchandise, all within the FanCode ecosystem. This multi-pronged approach (content + commerce + community) aligns well with Dream Sports’ vision of engaging fans on all fronts. With Dream11’s fantasy operations curtailed, FanCode’s role in keeping sports fans within the Dream Sports umbrella becomes even more pivotal. You can read about Fancode’s content and monetization strategy in greater detail via our earlier newsletter here.

Pros: How FanCode Can Fill the Gap for Dream Sports

In the wake of Dream11’s collapse in monetization, FanCode offers several key advantages that make it a promising vehicle to carry Dream Sports forward:

Established User Base & Brand Backing: FanCode isn’t starting from scratch – it already claims over 100 million users on its platform. This huge base has been built under the same parent brand and overlaps heavily with Dream11’s audience of sports enthusiasts. Dream Sports can leverage cross-promotion (for example, nudging Dream11’s 260 million registered users to try FanCode) to quickly funnel traffic into FanCode’s offerings. The credibility of Dream11’s brand and the trust of its investors also extend to FanCode, which benefits from being part of a now-renowned sports tech group.

Diverse Content Portfolio Year-Round: FanCode’s content strategy of aggregating many “long-tail” sports events means it can keep users engaged throughout the year. Fans of various sports all find something for them on FanCode – whether it’s a La Liga El Clásico football match or a Tamil Nadu Premier League cricket game. This diversity reduces dependence on any single sporting event. Crucially, FanCode has locked in some exclusive must-have content: for instance, if you’re an F1 fan in India, FanCode is essentially your only legal option to watch races live. Similarly, hardcore followers of Spanish football need FanCode for full coverage of La Liga. Such exclusivity can drive subscriber growth even in niche segments. By catering to multiple niches at once, FanCode aggregates a large aggregate audience (the platform says it reaches over 160 million sports fans in India through its partnerships), which could rival the big players over time.

Flexible, Fan-Friendly Monetization: The pay-per-match/tournament model is a strategic boon in a price-sensitive market. It aligns with Indian consumers’ willingness to pay in small increments (“sachets”) for entertainment. This flexibility can convert casual fans who might not otherwise pay for a full subscription. It also allows FanCode to monetize one-off spikes of interest – for example, selling a large number of passes during the Cricket World Cup Qualifiers or a high-profile F1 race. By not forcing long commitments, FanCode lowers the risk for users to try the service. Over time, some of those one-time users might become repeat buyers or upgrade to subscriptions, especially if they enjoy the experience.

Sustainable Content Costs: FanCode deliberately avoids bidding wars for India’s top-tier sports properties like the IPL, ICC Men’s World Cup, or the EPL, which are dominated by giants like Disney, Sony, or Viacom18. This strategy keeps FanCode’s content costs at a manageable level. The rights it acquires, while not cheap, are relatively undervalued assets – they have dedicated followings but less competition in the bidding process. (The one major exception FanCode made was Formula 1, indicating it will seize opportunities if the terms are right.) By maintaining cost discipline, FanCode can operate without the exorbitant losses that some broadcasters incur on marquee events. This could translate to a clearer path to profitability. Additionally, FanCode’s entire tech stack is built in-house and runs on scalable cloud infrastructure, which helps control operational costs as it grows.

Multiple Revenue Streams: Unlike a single-revenue business, FanCode’s hybrid model (subscriptions + microtransactions + ads) spreads out its income sources. This diversification is advantageous for Dream Sports. The synergies between content and commerce also mean FanCode can extract more value from each engaged user. Over time, these complementary streams could compound to make FanCode a robust business. The early traction is visible – FanCode started attracting big-name advertisers and sealed partnerships with multiple IPL teams and international sports bodies for merchandising [now being shut down as per reports].

Alignment with Sports Ecosystem and Fans: FanCode’s emergence actually reinforces Dream Sports’ broader mission of enhancing sports fandom in India. With fantasy sports, Dream11 had already built a community of engaged sports fans. FanCode allows Dream Sports to continue serving that community in a different way – by delivering the content those fans love. This is a natural extension; it keeps Dream’s user base within its ecosystem rather than losing them entirely to other entertainment options. In fact, Harsh Jain noted that Dream11’s massive user base would be a “cushion” as the company resets its strategy. FanCode is one of the key channels to utilize that cushion. If executed well, Dream Sports can migrate many fantasy users into FanCode viewers, thus salvaging user engagement and cross-selling opportunities even if direct monetization shifts from gaming to streaming.

Cons: Challenges and Uncertainties Ahead for FanCode

While FanCode offers hope, it is not a guaranteed savior. There are significant challenges and caveats to consider:

Massive Revenue Gap to Fill: Dream Sports’ fantasy business was a cash cow that generated the vast majority of the company’s $300+ million revenue (as per industry estimates) before the ban. Losing 95% of revenue means FanCode and other new initiatives are under pressure to scale up dramatically [economictimes.indiatimes.com]. Sports streaming, especially in niche content, typically monetizes at a far lower ARPU (average revenue per user) than real-money gaming did. It’s unlikely in the short term that FanCode can match the sheer profitability Dream11 once had. This raises questions about Dream Sports’ valuation and financial health if RMG remains off-limits indefinitely.

Consumer Willingness to Pay: Indian sports audiences have been increasingly spoiled by free or ultra-cheap streaming offerings. For instance, Reliance’s JioCinema streamed the entire 2023 IPL and 2022 FIFA World Cup at no charge to viewers, and Disney+ Hotstar had years of success with low-cost annual sports subscriptions. Convincing users to pay even ₹20-₹100 for a match could be challenging when they are habituated to subsidized models. Piracy and unauthorized streams also remain an issue for European football and F1, which could undercut FanCode’s subscriber base if fans seek out illicit free options. Essentially, FanCode needs to educate the market that certain content won’t be available free and is worth paying for – a shift in mindset that may take time.

Lack of India’s Biggest Sporting Events: FanCode’s content mix, while broad, omits the absolute top draws that drive peak viewership in India. IPL cricket, ICC senior World Cups, Asia Cup, the top international matches of the Indian cricket team, and the English Premier League football – these tentpole properties are tied up with competitors or broadcasters with far deeper pockets. Consequently, FanCode must compete for sports fans’ attention without the marquee events that bring in tens of millions of concurrent viewers. There is a ceiling to how many casual fans will subscribe if FanCode doesn’t carry the likes of IPL or Team India matches. This could cap FanCode’s growth mostly to “avid” fans of specific sports. (On the flip side, focusing on non-mainstream sports is also FanCode’s strategy to avoid direct battles with giants. But it remains a double-edged sword.)

Competitive Pressure and Rights Auctions: The streaming market for sports in India is extremely competitive. While FanCode currently has a relatively unique positioning, there’s nothing stopping larger players from swooping into the same space if they see a viable opportunity. If Jiostar, SonyLIV etc decided to bid for, say, La Liga or F1 in the next cycle, FanCode could find itself outgunned by bigger checkbooks. Its exclusive deals are time-bound – e.g. F1 is through 2025, La Liga for five years – and maintaining or renewing them could become expensive if competition heats up. Additionally, telecom-backed streamers might cross-subsidize sports content (offering it free to drive data or bundle sales), which FanCode, as a standalone service, would find hard to match. The risk is that FanCode may get squeezed between the free strategies of mega-platforms on one side and the niche appeal of its content on the other.

User Retention and Engagement: The very flexibility of FanCode’s pay-per-match model can lead to a fragmented user engagement pattern. A fan might download FanCode and pay for one big game, then disappear for months. Retaining such users and converting them to regular subscribers is not straightforward. FanCode is aware of this concern – it’s why they emphasize having a high volume of content throughout the year to keep users coming back. But ensuring that a one-time viewer of, say, a World Cup qualifier also becomes a viewer of other content requires strong personalization and marketing. There’s a challenge in getting users to mentally consider FanCode as a go-to app (like they might consider JioHotstar or Sony for general entertainment) rather than a one-off utility. In short, building habitual viewership across a disparate sports lineup is an uphill task.

Transition from Gaming to Media: For Dream Sports, operating FanCode is a different ballgame compared to running Dream11. The company needs to excel in media content operations – managing rights negotiations, production quality, streaming technology, subscriber support, etc. – areas that have their own learning curve. The tech and infrastructure demands (like handling live stream traffic spikes, preventing outages, ensuring low latency) are significant. Early on, FanCode had some fan criticism around stream quality for certain events; as it scales, it must maintain a high-quality user experience to compete with polished global platforms. Moreover, the economics of media (potentially high upfront costs, slower monetization) differ from the high-cash-flow nature of gaming. Dream Sports will need patience and continued investment in FanCode, and there’s always execution risk in such a pivot. Any faltering in content delivery or customer satisfaction could limit FanCode’s credibility in the long run.

Outlook: Can FanCode Salvage Dream11’s Fortunes?

From an analytical standpoint, FanCode offers a viable lifeline for Dream Sports in a post-RMG landscape, but it is not a like-for-like replacement. On the positive side, FanCode aligns naturally with Dream Sports’ core competency – understanding Indian sports fans. The platform was already gaining momentum prior to the ban, and now it has a chance to shine as a flagship business. Dream Sports’ leadership appears fully committed to this new direction; they’ve signaled they will focus on what’s “allowed by law” and innovate in sports tech and media.

In the best-case scenario, FanCode could evolve into something of an “Indian DAZN” – a multi-sport streaming powerhouse that thrives on a subscriber base of serious sports fans. The ingredients are there: a large user funnel inherited from Dream11, unique content that few others provide, and a management team experienced in sports broadcasting. FanCode’s early deals (like F1 and La Liga) demonstrate its ability to snatch opportunities and could attract a critical mass of paying users. Moreover, the fact that FanCode has built a lot of tech in-house (supported by cloud infrastructure) means it can scale relatively efficiently and even explore international markets in the future. If FanCode manages to continue its growth trajectory (5x user growth in three years, as reported [economictimes.indiatimes.com]) and perhaps captures a couple more key rights deals, it could substantially cushion the blow of Dream11’s revenue loss.

However, tempering expectations is important. FanCode is unlikely to immediately generate profits anywhere near what Dream11’s fantasy platform did during its peak. Dream Sports might have to undergo a valuation reset and accept a longer road to profitability. The success of FanCode will hinge on execution excellence and perhaps a bit of luck (for example, favorable outcomes in the next auction of certain sports rights, or no further regulatory curveballs in digital media).

It’s also worth noting that Dream Sports is not putting all eggs in one basket. As mentioned, they are exploring sports analytics and AI-driven products, and even foraying into fintech on the side [entrepreneur.com]. FanCode is part of a broader “reset” to reinvent the company’s portfolio. In that context, FanCode doesn’t need to single-handedly replicate Dream11’s past – it just needs to become a strong pillar of a more diversified sports enterprise.

In conclusion, FanCode stands out as Dream Sports’ best hope to navigate the storm caused by the RMG ban. It transforms Dream Sports from a gaming-centric company into a more holistically engaging sports media company. The platform has already proven that fans will come for the content they crave, and the coming years will test whether FanCode can monetize that interest sustainably. If FanCode succeeds, it not only salvages some of Dream11’s lost fortunes but also positions Dream Sports at the forefront of a new era in India’s sports entertainment industry – one where the passion of fans is tapped through viewing and shopping, rather than betting. As Harsh Jain optimistically put it, after losing fantasy gaming, “we’ll do what’s allowed by law… build for the future” [economictimes.indiatimes.com]. FanCode is a major part of that future, and its journey from here could very well determine Dream Sports’ fate in the coming decade.

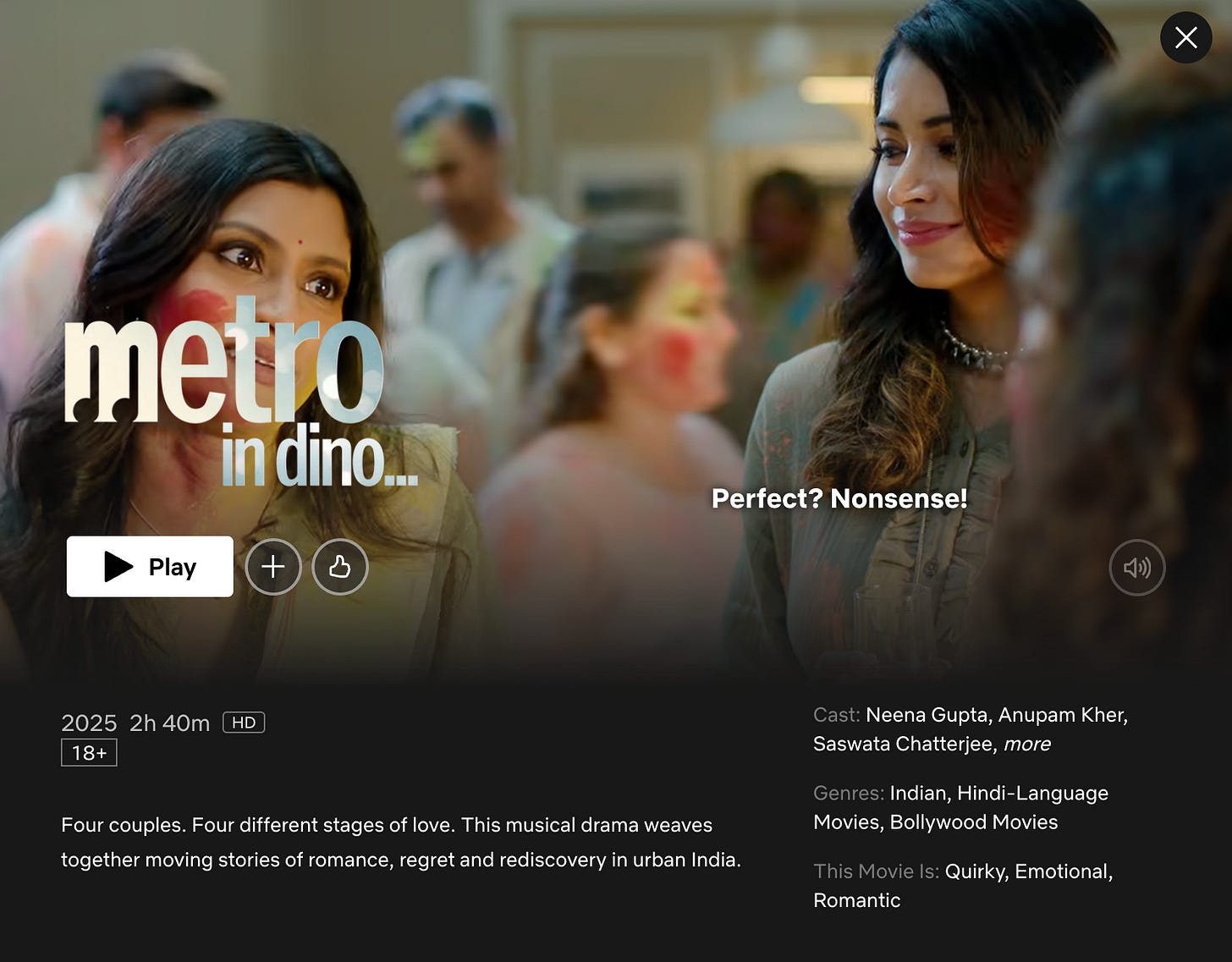

Metro in Dino is set across multiple Indian metropolitan cities, including Mumbai, Delhi, Bengaluru, and Kolkata, with each city playing a role in the interconnected stories of the film's protagonists. Mumbai is particularly prominent as a central setting! Great watch with strong performances from an A list starcast - on Netflix.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” / sports tech fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.