Depth Beats Breadth: Regional OTT Playbook 2025 — Part 2

Stage, Planet Marathi, Chaupal: dialects, diaspora, and distribution.

Hey Streamers 👋,

A warm welcome to the 103rd edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

Regional Indian OTT Streaming Landscape in 2025 [Part 2]

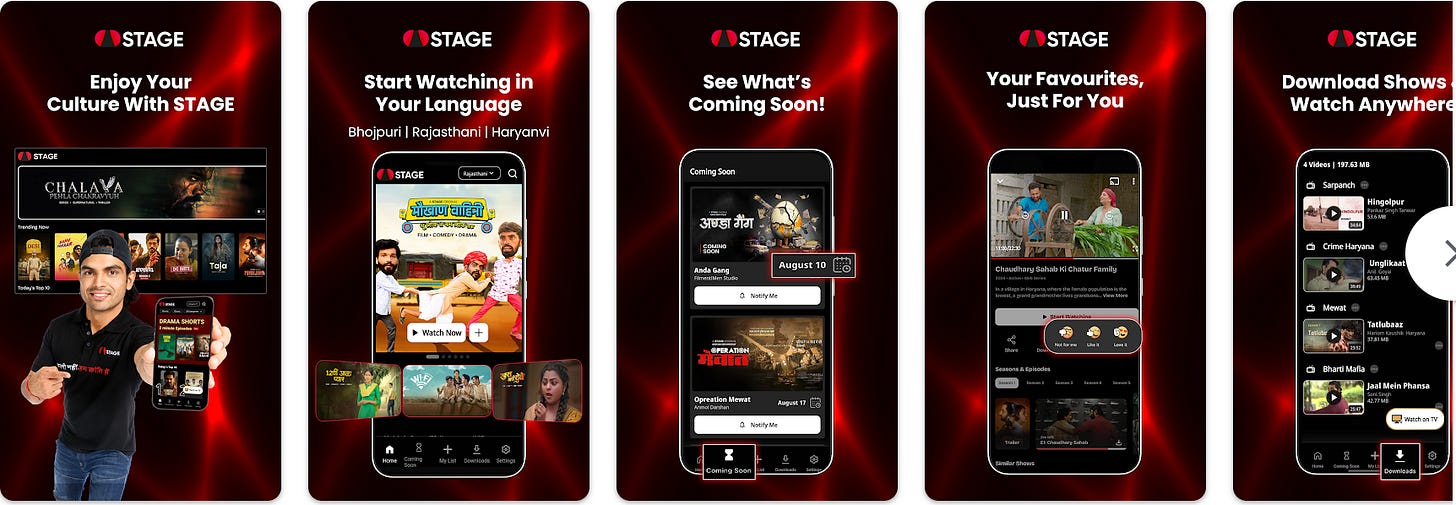

Dialects – Stage

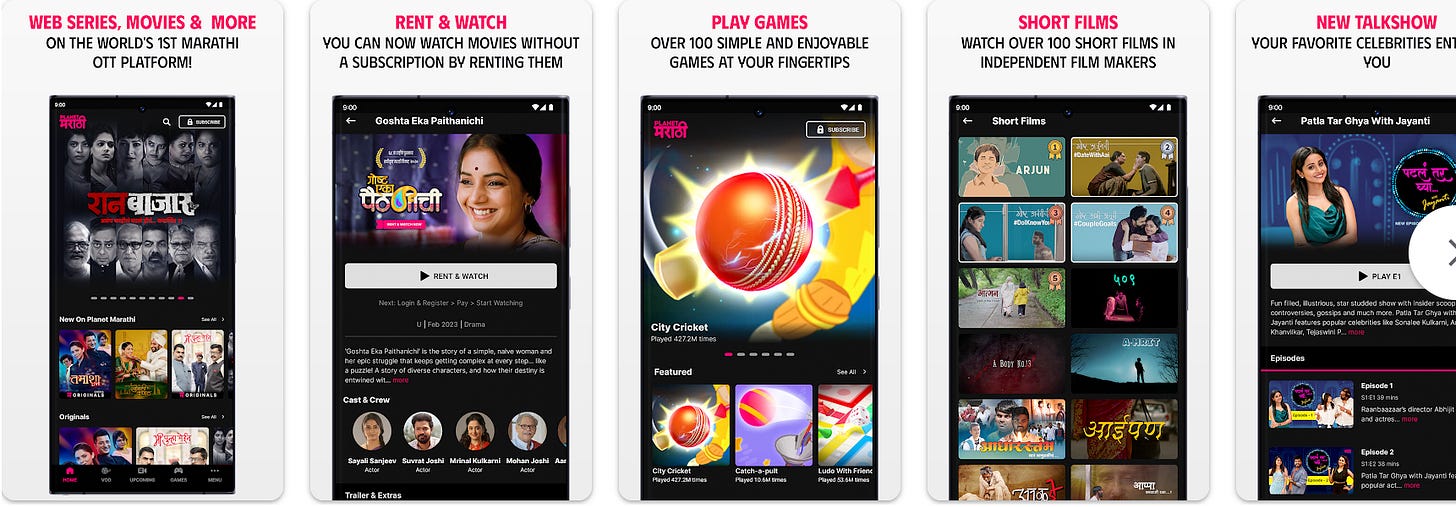

Marathi – Planet Marathi

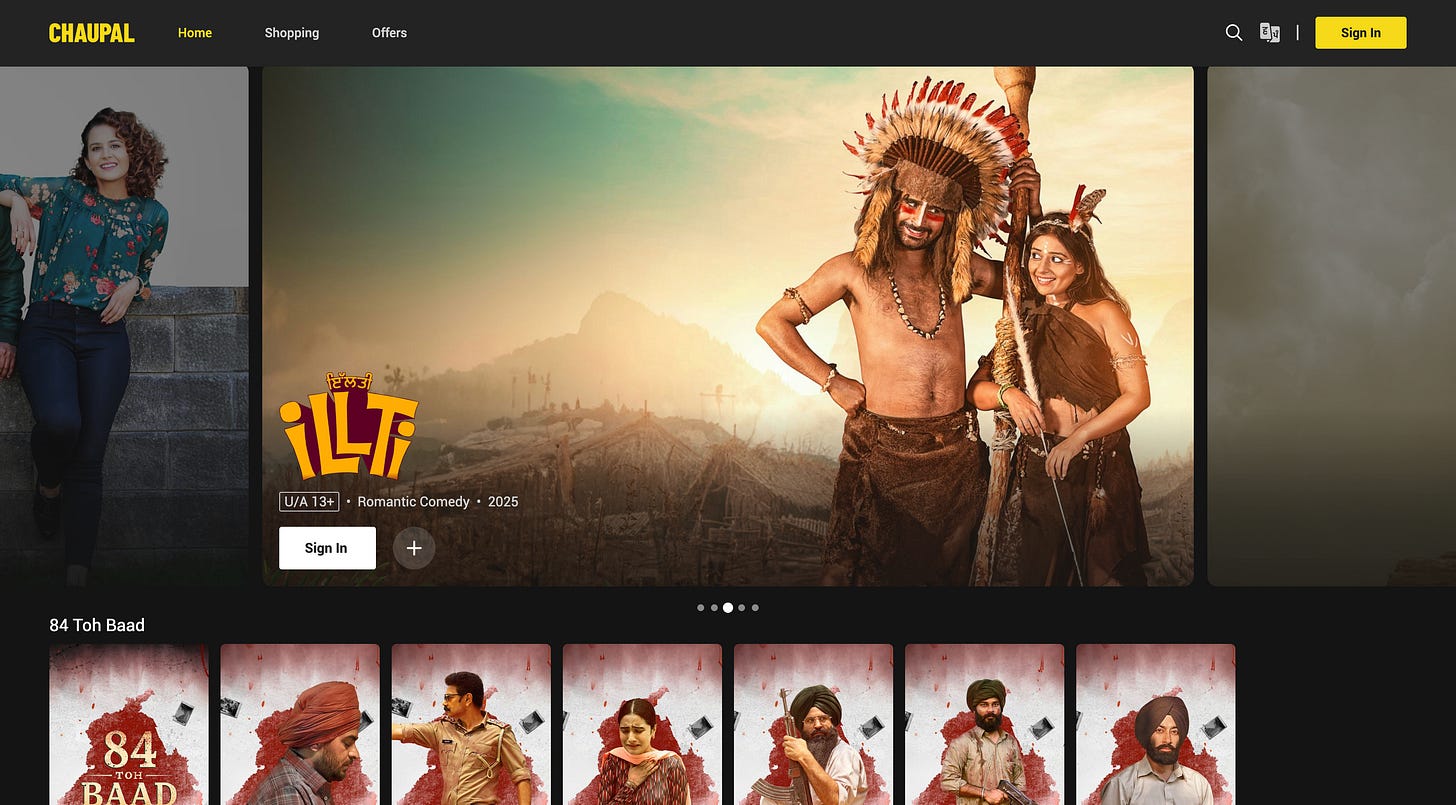

Punjabi – Chaupal

Common Trends and Outlook

And….Action!

Regional Indian OTT Streaming Landscape in 2025 [Part 2]

Depth beats breadth. If Part 1 showed how language-first platforms scaled, Part 2 zooms further in—dialect-first (Stage’s Haryanvi/Rajasthani/Bhojpuri surge), category-defining boutique (Planet Marathi), and community-led Punjabi (Chaupal). The common playbook is clear: ultra-local originals that feel native, SVOD pricing built for households, diaspora as an ARPU kicker, and distribution via telco/aggregator bundles. Under the hood, AI-led dubbing/subs and smarter UIs widen reach across regions. The tension remains profitability vs. growth—expect selective price lifts, shorter windows, and alliances (even M&A) as smaller apps seek scale. Read on for how these three operators execute the strategy—and what it signals for the next wave of regional streaming.

Dialects – Stage

Among regional streamers, Stage stands out for targeting not just a language but local dialects – an ultra-local strategy that has started to pay off remarkably. Stage launched around 2019 focusing on Haryanvi content (the dialect of Haryana) and later expanded to Rajasthani, with a recent foray into Bhojpuri in 2024. In doing so, Stage is tapping audiences often overlooked by both national Hindi and other regional services. As of early 2025, Stage announced some eye-popping growth figures: 4.4 million paying subscribers (households) on a base of over 20 million app installs. Its Annual Recurring Revenue hit ₹180 crore (~$22M) after a 289% surge in revenue and 286% jump in subscribers in 2024 – making it arguably India’s fastest-growing OTT platform. This growth was fueled by hit original shows tailored to local culture, like the Haryanvi web series Videshi Bahu, Kaand 2010, and Rajasthani drama Bhawani, which went viral in their markets. Stage also premiered the National Award-winning Haryanvi film Dada Lakhmi, showing it’s curating premium content for dialect audiences.

Stage’s content approach is pure hyper-local originals – since Haryanvi or Rajasthani have little to no pre-existing library of films/TV, Stage invests in creating web series, comedy sketches, poetry and folk content with local artists. This strategy not only fills a content void but also fosters a community feeling. The platform’s founders often say Stage is as much a cultural movement as a streaming service: by narrating stories in one’s own dialect, it aims to instill pride in local heritage among young viewers. Indeed, Stage reports a large portion of its users are Gen-Z and millennial “Bharat” users from smaller towns. It’s not uncommon to see comments about viewers getting to hear their own village’s dialect on screen for the first time. This community-centric approach also translated into business success – Stage found that people will pay for content in their language if it resonates. Starting initially as a free, ad-supported app, Stage pivoted to a subscription model and proved skeptics wrong by monetizing regional pride. By late 2024, Stage was reportedly generating ₹15 crore+ revenue per month and even its first language (Haryanvi) segment had turned cash-flow positive, a rare feat for an indie OTT.

The monetization is 100% subscription (no ads). Stage uses an affordable pricing model targeting “households” – e.g. one plan might cover multiple family members – to penetrate deeper into rural markets. In March 2025, Stage raised $12.5 million in Series B funding co-led by venture firms Goodwater Capital and Blume Ventures.

This capital is earmarked to expand into more dialects (the founders have mentioned ambitions to launch content for Marathi dialects, other Hindi belt dialects, etc.) and to strengthen production quality further. With Bhojpuri content just launched (Bhojpuri has ~50 million speakers), Stage could unlock another huge user segment. The broader context is that most hyperlocal OTT attempts in India (there have been a few in Gujarati, Punjabi, etc.) struggled to scale or ran out of funds.

Stage is breaking that mold with its explosive growth, though it acknowledges challenges like having to build an entire content industry from scratch in dialects that lack organized film industries. For 2025, the key watch-out is whether Stage can retain users as it scales and whether its unique content can keep flowing. But for now, Stage’s story is one of the most compelling in regional OTT – a testament to the power of going vernacular at the granular level, and evidence that digital media is enabling new cultural voices to find their audience.

Marathi – Planet Marathi

Planet Marathi OTT was* a boutique platform serving Marathi-language content. Launched in late 2020 (fully operational by 2021), it set out to be the go-to OTT for Marathi cinema and original shows – a space that, unlike Tamil or Telugu, was relatively untapped digitally. Backed by entrepreneur Akshay Bardapurkar, Planet Marathi has curated what it claims is the largest library of Marathi content on any OTT, spanning classic and contemporary Marathi films, theater, as well as original web series across genres (romance, comedy, political drama, thrillers, etc.). Notable content includes award-winning films like Goshta Eka Paithanichi and edgy series like Raanbaazaar, which have been talked about in Marathi media.

In terms of performance, Planet Marathi started modestly – in its first year it saw about 550,000 app installs and 24 million video plays. It hasn’t publicly disclosed subscriber counts, but it did announce a 500% increase in subscriber base overseas (in markets like the US, UK, Africa) in one year – indicating that the Marathi diaspora is a key target. To fuel its next stage, the platform raised $5 million in mid-2024 from a U.S.-based PE firm. This funding is being used to strengthen both the content slate and the tech platform. In fact, Planet Marathi partnered with a media-tech company called Dcafe to upgrade its streaming tech, suggesting a focus on improving user experience and possibly integrating better recommendation, payments, etc. On the content front, the investment allows them to commission more originals and acquire marquee film titles. For example, Planet Marathi has been known to nab streaming rights for acclaimed Marathi films and also produce originals that push the envelope (one upcoming political thriller Raaji-Naama was teased in news).

The business model here is mainly SVOD (with subscriptions priced for both domestic and international markets, typically a few hundred rupees annually in India). Given the relatively smaller native audience (Marathi is spoken primarily in Maharashtra), Planet Marathi has likely leaned on strategic marketing – tying up with Marathi film stars for promotions, and pushing its service in local events and Marathi cultural festivals. Its founder has been vocal that Planet Marathi’s mission is to “blur boundaries” and let Marathi content compete with the big leagues. This reflects an ambition to elevate regional content quality. Still, the platform faces the reality that giants like Amazon’s Prime Video and Netflix also acquire Marathi films; hence Planet Marathi is carving a complementary space by focusing on exclusives and nurturing Marathi talent. As per industry chatter, Planet Marathi’s challenge is scaling its subscriber base beyond niche figures – but its 2024 funding suggests optimism. In 2025 & beyond (and if it were to come back to life), it may explore bundling (perhaps joining aggregator apps) to increase reach. Overall, Planet Marathi exemplifies the passion-driven regional OTT: not a market leader by numbers, but enriching the OTT ecosystem with authentic Marathi storytelling and serving a loyal fan base that wasn’t priority for the global players.

Punjabi – Chaupal

Chaupal is a dedicated OTT platform for Punjabi content, launched in mid-2021. It was born from the team behind Pitaara TV, a popular Punjabi movie channel, and was envisioned as a one-stop digital destination for Punjabi movies, web series, music, and more.

The word Chaupal refers to a community gathering place in villages – fittingly, the platform seeks to bring Punjabi communities together through entertainment. Chaupal’s catalog includes a robust library of Punjabi films (from classics to recent hits) and a slate of original Punjabi web series and short films. Interestingly, it has also branched out to host some content in Haryanvi and Bhojpuri on the same app, though its primary focus remains Punjabi. This makes Chaupal somewhat of a multi-language platform for northern heartland content, potentially overlapping a bit with Stage’s territory on dialects.

In 2024, Chaupal made strategic moves to broaden its reach beyond the standalone app audience. It partnered with Amazon Prime Video Channels to be offered as an add-on subscription for Prime members in certain markets like Canada and New Zealand. This is significant because it taps the large Punjabi diaspora in those countries by piggybacking on Amazon’s platform (easing access and payment). Domestically, Chaupal joined forces with OTT aggregators as well – for example, it’s available on the OTTPlay Premium service and Airtel Xstream. Airtel’s own aggregator pack, which launched in 2022-23, now includes Chaupal alongside other regional OTTs. Such collaborations indicate a trend where smaller OTTs gain distribution muscle via alliances with bigger platforms. While Chaupal’s standalone subscriber numbers aren’t public, these partnerships suggest a growing confidence in its content library’s value. Indeed, Chaupal has managed to secure big-ticket Punjabi films for digital release – it offered the streaming premiere of Carry on Jatta 3, a blockbuster Punjabi comedy, giving its subscribers first access to the hit movie. Additionally, it releases new Punjabi films on the platform within a short window after theatrical release, and has produced originals starring well-known Punjabi actors and YouTubers.

Chaupal runs on a subscription model with no advertisements (its tagline emphasizes “Watch anytime, anywhere. No ads.”). The pricing is competitive, targeting both India and overseas Punjabi viewers (likely monthly and annual plans, plus bundle offers via Amazon/aggregators). By focusing intensely on Punjabi culture – from comedy and romance films to music and even potentially live Gurbani streams – Chaupal strengthens user loyalty. The challenge, as with others, is sustaining regular content output, which is why close ties with Punjab’s film industry and Pitaara’s production wing are crucial. As of 2025, the Punjabi OTT space also sees competition from global players (Netflix has Punjabi originals, ZEE5 and others stream Punjabi movies too), but Chaupal’s advantage is its curation and depth for a Punjabi-only audience. It caters to linguistic pride much like others, evidenced by its expansion into multiple countries via Prime Channels to reach Punjabis globally. We can expect Chaupal to continue this dual strategy: exclusive Punjabi content plus wider distribution through alliances, ensuring it remains the top-of-mind choice for Punjabi entertainment aficionados online.

Common Trends and Outlook

Surge in Regional Content Consumption: Across India, viewers are increasingly choosing content in their native languages. Regional language content made up over 50% of total OTT content consumption by 2023 and is projected to exceed 55% by 2026 [fortuneindia.com]. This rising tide lifts regional OTTs – their once niche audiences are now mainstream, and even the big national platforms are investing in regional originals. But the local players have a home-court advantage in authenticity and audience insight.

Hyperlocal Stories, Global Audiences: A striking pattern is how regional OTTs marry local and global. Platforms are greenlighting stories deeply rooted in local culture (village settings, folk legends, regional history) and finding that diaspora audiences abroad eagerly sign up for a taste of home. For example, Hoichoi’s Bengali service derives a significant 40% of its revenue from outside India. By catering to the diaspora with proper apps, payment options, and localized marketing, these services unlock a lucrative segment willing to pay higher ARPUs than domestic users. Simultaneously, this global reach doesn’t dilute their content; rather it reinforces that local is universal when done well.

Monetization Models – SVOD-First with Creative Twists: Most regional OTTs are primarily subscription-driven (SVOD), but they’ve innovated within that realm. Price sensitivity is key: monthly and annual plans are far cheaper than those of international OTTs, often supplemented by micro-packs (e.g., quarterly mobile-only plans for a couple of dollars) to onboard first-time users. While pure-play advertising (AVOD) hasn’t been a focus (users often perceive these niche services as “premium” destinations for ad-free viewing), some like Aha have effectively created a freemium model, keeping a large free library to pull in viewers and then upsell them to paid content. Others, like Hoichoi, remain entirely SVOD but found alternate ad revenue by embedding brands in content (for instance, a web series might subtly feature a sponsor’s product) – Hoichoi reported this approach doubled its ad revenues without running any traditional ads.

Bundling and Partnerships: A common strategy in 2024–25 is piggybacking on larger distribution channels to overcome the reach and payments barriers. Regional OTTs have embraced telco and DTH bundles and the new wave of OTT aggregators. For example, Airtel’s Xstream app bundle includes Hoichoi, ManoramaMAX, Chaupal, Aha, etc., alongside bigger platforms, letting users access multiple services under one login and bill. Similarly, tie-ups like Chaupal on Prime Video Channels or Hoichoi’s partnership with Jio extend these services to users who might not download separate apps. Such deals help regional players save on customer acquisition costs and tap into existing subscriber bases. We also see carrier billing and wallet integrations making it easier for regional audiences to pay for these services (important in smaller towns where credit card penetration is low).

Content & Tech Innovations: Content remains king – all regional OTTs are investing in original programming that reflects local tastes. We’re seeing genre diversification: beyond the staple dramas and rom-coms, there are experiments with thrillers (Hoichoi’s crime sagas), horror (Hoichoi’s mytho-horror niche), reality shows (Aha’s talent competitions), and even animation in local languages. Stage’s success has opened eyes to completely new genres in dialects. Many platforms are also shortening the film release window or doing direct-to-OTT premieres for regional films, which draws cinephiles to subscribe.

On the technology front, regional OTTs are catching up with features like offline downloads, improved UIs, and personalized recommendations. Some, like SunNXT, are exploring multi-audio tracks and subtitling using AI to make one region’s content accessible across languages, essentially recycling content to multiple language markets. This could become a trend – for instance, Hoichoi content dubbed in Hindi, or Tamil shows dubbed to Malayalam, expanding a single platform’s appeal.

Challenges – Profitability and Consolidation: Despite the encouraging growth, the regional OTT sector isn’t without challenges. Most platforms (aside from perhaps Hoichoi and Aha) are still operating in the red, spending heavily on content and marketing to acquire users. The unit economics can be tough: as one industry executive noted, “it’s an industry where you spend ₹1,000 to acquire a customer who leaves after paying you just ₹99” [the-captable.com]. This has led to some shakeout – by 2025 there’s talk of smaller regional OTTs being up for sale or seeking buyouts by larger competitors. Indeed, several southern OTT initiatives backed by TV networks or startups have struggled to scale and either shut down or been subsumed. The consensus is that only a few with strong backing or unique models will survive long-term. That said, those who have built a loyal base enjoy relatively low churn (the community factor helps). Hoichoi, for example, retains ~60% of Indian subscribers on renewal and over 80% of its overseas subscribers [storyboard18.com] – impressive for any OTT. Ultimately, to achieve profitability, many are looking at a mix of cutting content costs (via shorter format content, smarter licensing) and raising ARPU slightly (Hoichoi carefully raised prices in 2024 to support new content, and others may follow).

The Road Ahead: The regional OTT segment in India is poised for further growth and creative disruption. We may see more mergers or alliances, as hinted, where a stronger platform absorbs a weaker one to aggregate audiences (for instance, a pan-South-Indian OTT merging Tamil, Telugu, Malayalam content under one umbrella to rival a JioHotstar). Conversely, new niche players could emerge, backed by studios or government initiatives (e.g., Kerala’s CSpace for Malayalam indie films). One thing is certain: the big OTTs (Netflix, Amazon, Disney+) are now routinely commissioning regional originals, but the passion and cultural depth of homegrown regional services is not easily replicated. These platforms enjoy a certain trust – they are seen as authentic champions of local entertainment – which they can leverage to stay relevant. In 2025 and beyond, expect regional OTTs to continue innovating with format (maybe live streaming local events, regional sports, stage plays, etc.) and to explore monetization beyond subs – perhaps merchandise, live tours, or NFTs related to popular regional characters, thereby unlocking more revenue from their most engaged fans.

In conclusion, India’s regional OTT landscape in 2025 is vibrant and ever-evolving. The common thread among the successful players is a laser-focus on local language audiences, a high degree of community engagement, and savvy business tactics to punch above their weight. They have proven that India is not one monolithic market but a tapestry of many, and catering to those distinct cultural threads – be it in Bengali, Telugu, Malayalam, Marathi, Punjabi or even Haryanvi – can unlock not only millions of viewers but also sustainable businesses in the streaming era. Each of these platforms, with their 2024–25 strategies, contributes to a more diverse, rich OTT ecosystem that reflects the plurality of Indian entertainment.

I thought this was a light hearted watch and being away from India and living in Dubai, for me this show is a fantastic look into everyday urban Indian life - If relatability was the only thing that could make a show interesting and engaging then ‘Aam Aadmi Family’ (now in its fourth season) is the best show on OTT. Living in a spacious villa in Delhi with modest interiors, the Sharmas led by the family patriarch Sharmaji played by the ever-dependable Bijendra Kala, are like any other Indian family. There is inherent love between them but they bicker just as much - watch it to find out more! Zee5 it is.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” / sports tech fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.