Diwali on the Big Screen: CTV’s Festive Breakout - Part 2

CTV's Success Metrics & the Future Outlook for CTV Advertising in India

Hey Streamers 👋,

A warm welcome to the 105th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

Metrics, Not Myths: CTV’s Festive-Season Reality Check

Outlook: Diwali and Beyond

And….Action!

Metrics, Not Myths: CTV’s Festive-Season Reality Check

Part 2 of our “CTV Monetization” focused newsletter shares insights on the important aspect of Measurement and Growing Pains as streamers, agencies and brands double down on Connected Television Advertising this festive season.

For all its promise, CTV in India isn’t without challenges. In fact, as CTV ad spending grows, advertisers have been vocal about certain pain points – chiefly around measurement, transparency, and fraud. The festive season amplifies these concerns because so much money is on the line. Here’s an analytical look at the key issues and what’s being done:

1. Unified Measurement (or the lack thereof): Unlike linear TV, which has BARC ratings as a common currency for reach/GRPs, CTV currently lacks an industry-wide standard for audience measurement. Each platform (YouTube, Hotstar, etc.) provides its own metrics, but advertisers want a holistic view – deduplicated reach, frequency and GRPs across all CTV platforms and linear TV combined. “A crucial aspect still absent is the effectiveness measurement,” notes BK Rao of Parle, referring to the ability to quantify incremental reach or GRPs from CTV [bestmediainfo.com]. If an advertiser adds CTV to a TV plan, how many extra people did they reach, or how many more times did the same person see the ad? These questions are hard to answer today. This measurement gap makes some traditional advertisers slightly wary – they’re used to the comfort of a single TV rating point system.

However, progress is underway. Global measurement firms are stepping in: Nielsen has expanded its Digital Ad Ratings in India to include YouTube CTV ads, enabling cross-device reach reporting for YouTube campaigns. And importantly, Comscore is teaming up with Google to launch a dedicated YouTube CTV audience measurement in India in 2025 [exchange4media.com]. Comscore’s plan, announced at Goafest 2025, is to provide continuous, scalable reporting on YouTube CTV viewership (and potentially other platforms down the line) to give advertisers a clearer picture of CTV audiences.

This is a big deal – it mirrors what’s happening in the US with Nielsen’s Gauge and others tracking streaming consumption. By the end of this year, beta data from Comscore’s study is expected, which could be a first step toward an “CTV ratings” service.

The hope is that eventually the industry will have a unified dashboard where a marketer can see, for example, that their Diwali campaign reached X million on linear TV with Y frequency, and an additional Z million on CTV with Q frequency, and overlapping reach of whatever percent. Until then, brands are using proxies – like measuring website traffic lift or sales lift in CTV-exposed areas vs non-exposed – to gauge impact. It works, but it’s not perfect.

2. Transparency and Ad Fraud: Digital advertising’s dark side – fraud and “bad” inventory – has not spared CTV. In fact, the rapid growth of CTV has attracted fraudsters setting up fake CTV app impressions and other schemes. DoubleVerify’s 2024 report highlighted some alarming trends: only 50% of CTV impressions worldwide offered full app transparency (meaning the advertiser knew exactly which app their ad ran on) [campaignindia.in]. In India, where many CTV buys are programmatic, this can be problematic – brands might be unsure if their ad played on a reputable OTT app or some obscure channel nobody watches. Fraud is another worry: bot-driven fraud accounts for 65% of CTV ad fraud incidents, with millions of infected devices globally.

One specific issue is the “TV off” phenomenon – cases where a streaming device remains on (pinging ads) even after the TV is turned off. This leads to wasted impressions. DV estimated that without proper safeguards, advertisers can lose roughly $700,000 per billion CTV impressions to such waste – a non-trivial sum.

Advertisers in India are increasingly cautious about these blind spots. Many are demanding log-level data and third-party verification for CTV campaigns, just as they do for web and mobile. Verification companies like Integral Ad Science (IAS) and DoubleVerify have ramped up efforts in India to monitor connected TV inventory quality.

The good news is that premium publishers (JioHotstar, Google, etc.) are fully on board to combat fraud – after all, they want buyer confidence. The not-so-good news is that fragmentation – so many different CTV apps and devices – makes it complex to standardize transparency. The industry is actively working on CTV standards for app naming, device IDs, etc. to ensure better transparency. During this festive blitz, agencies have been extra vigilant: many now whitelist specific CTV apps for their programmatic buys (to avoid the sketchy long-tail inventory), and they use technology to detect anomalies (like an abnormally high midnight viewership on a cooking app – a red flag for fraud). It’s an ongoing battle, but awareness is high. As one Campaign India piece put it, CTV’s rise is “undeniable,” but the ecosystem is still working through some serious “growing pains” in transparency and fraud that need tightening [campaignindia.in].

3. Performance Attribution: Beyond reach and fraud, there’s the question of ROI measurement. Brands are very interested in the performance outcomes of CTV – e.g. did CTV drive more web visits, app installs, or sales compared to other channels? This is a nuanced area.

CTV is often a top-of-funnel branding medium, but with interactive elements (QR codes, etc.) it’s now contributing to mid-funnel and lower-funnel metrics too. The challenge is attribution: If someone sees a CTV ad and later purchases the product on their phone, connecting those dots isn’t straightforward. Marketers cite this as a pain point – multi-touch attribution models are still evolving to fully credit CTV’s role. Some solutions involve using household IP matching (to link a TV impression to subsequent activity on household devices) or panels that monitor exposure and purchase. These are being tested in India, but haven’t scaled yet. So, advertisers sometimes have to rely on proxy metrics like brand lift surveys or just overall sales trends.

The promising statistic here is that 41% of Indian viewers now prefer ad-supported content over paid subscriptions [campaignindia.in], indicating viewers accept ads on CTV and likely engage with them. Also, 64% of viewers say the context (genre of content) impacts how they perceive ads, hinting that aligning ads with the right content can improve effectiveness. These insights help advertisers optimize and get better ROI, even if the last-mile attribution is imperfect.

In summary, measurement and trust in CTV are works in progress. The industry recognizes that for CTV to truly become “the new prime time” permanently, it must offer the same confidence and clarity that TV did for decades.

The festive season of 2025 might be remembered as the inflection point when CTV proved its reach and engagement – and also when the push for better measurement hit top gear. “If we had this conversation a year ago, I might not have been as confident about CTV. However, today I’m optimistic,” said Srinivas Rao of Wavemaker during IPL, noting how quickly the medium is maturing even on the metrics front [afaqs.com].

Outlook: Diwali and Beyond

As we head deeper into the festive calendar, all signs point to Connected TV truly claiming the mantle of “new prime time” in India. Navratri and Dussehra campaigns have already seen heavy CTV components, and Diwali is expected to bring the largest surge yet. Industry veterans are projecting that 2025’s Diwali-week CTV ad volumes will set new records, possibly doubling what was seen in 2024 for certain platforms.

Early indicators from Onam and Navratri campaigns showed robust digital spends and high engagement on connected devices, and Diwali will likely amplify that trend across the country.

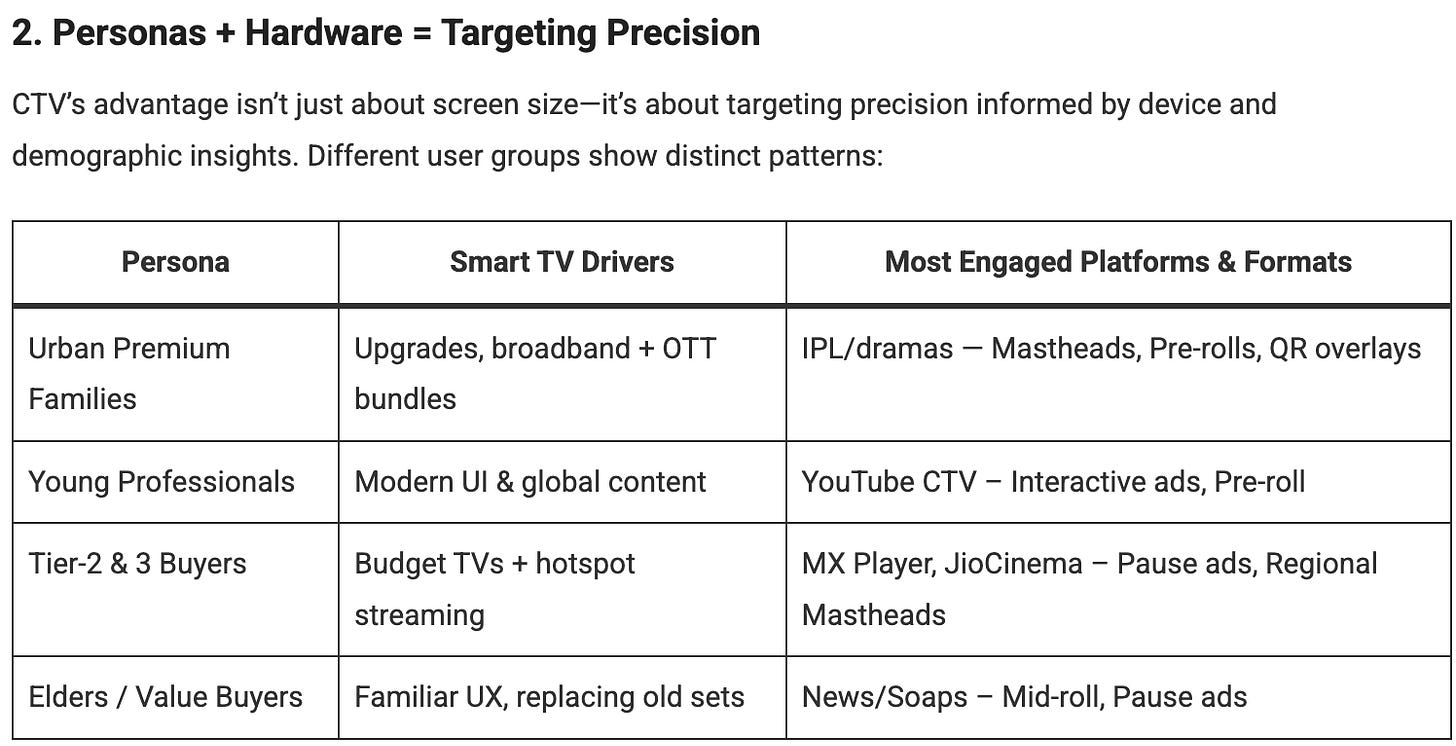

The broader context also favors CTV’s continued rise:

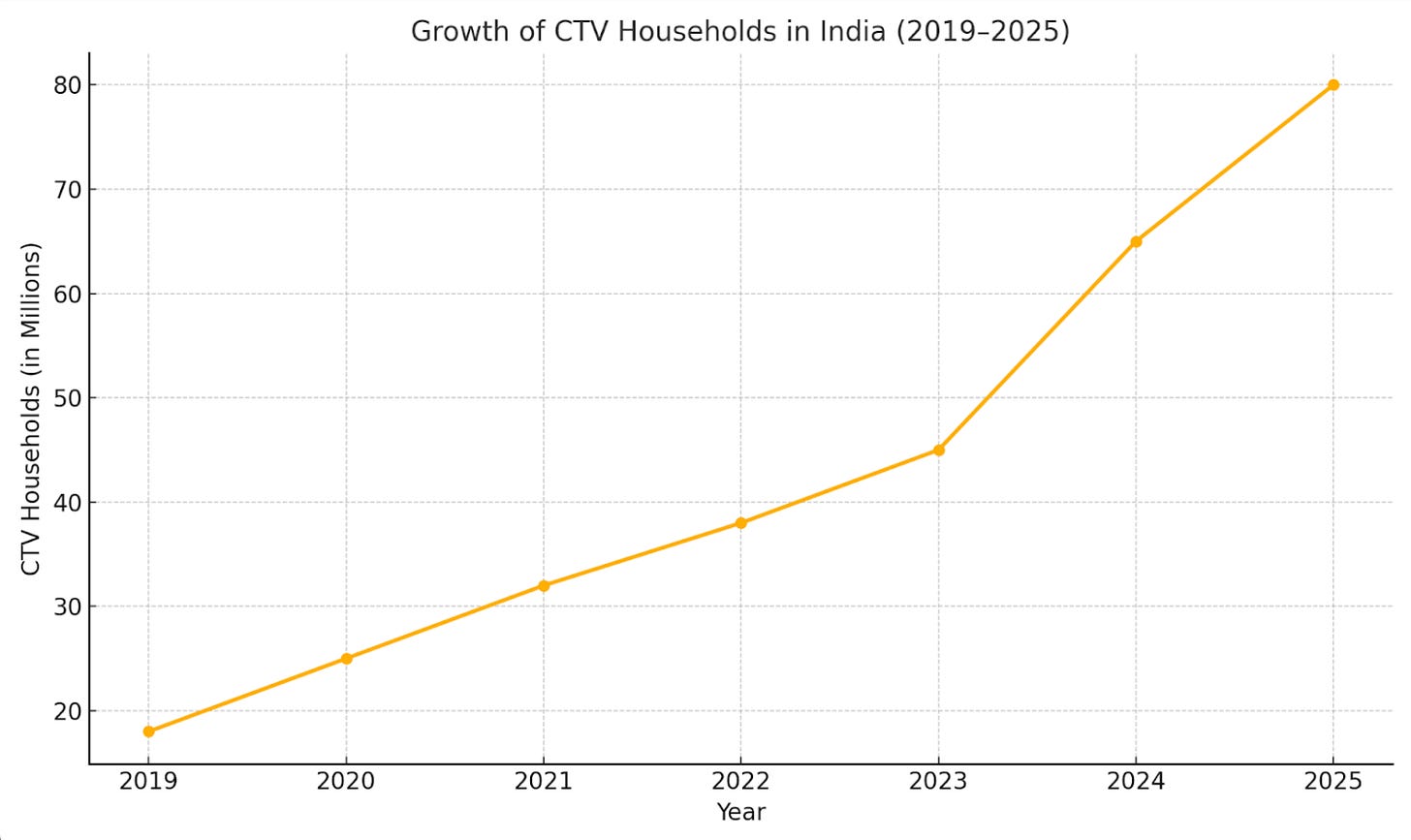

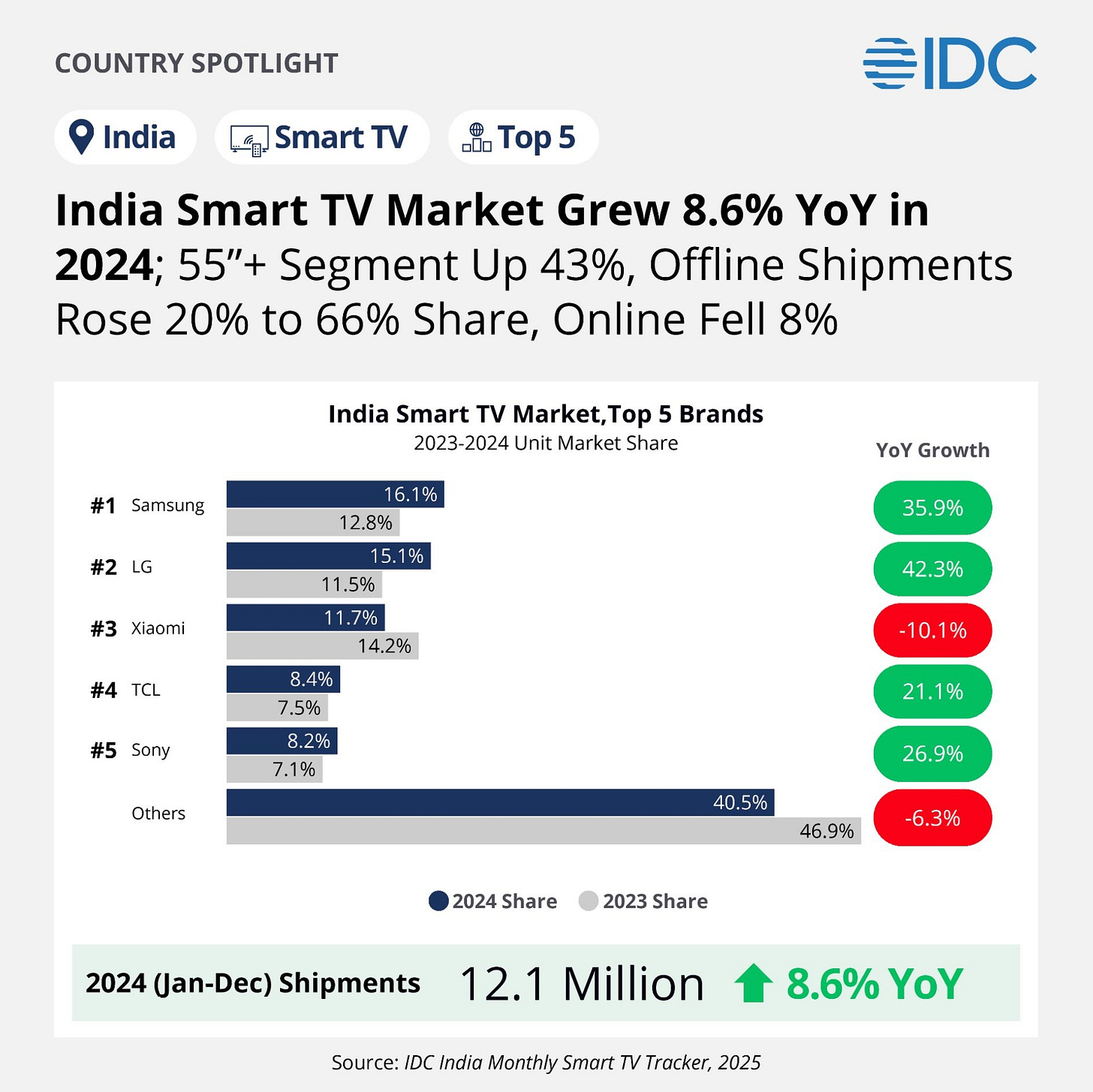

Consumer behavior is durably changed. The pandemic and subsequent tech boom put Smart TVs in millions of homes, and consumers have gotten used to the flexibility of streaming. With each passing month, more households figure out how to watch YouTube or Hotstar on their TV. By 2026, India could have 80–100 million CTV households, approaching the scale of linear TV households. This isn’t just a metro phenomenon – notably, five of India’s bottom ten states by per-capita income rank among the top ten in CTV growth, showing small-town India is joining the party.

Advertiser sentiment is bullish. 2024 was seen as a rebound year, but 2025 is all about scale and new benchmarks. “Digital isn’t the side channel anymore, it’s the first screen. Festive discovery, shopping, and entertainment are all digital-first now,” Thakkar of Frodoh observed [storyboard18.com]. When major FMCG and auto advertisers publicly talk about moving 20–30% of TV budgets to CTV, it sends a signal across the industry. Expect even traditionally conservative sectors (like some retail and pharma brands) to test CTV in the coming quarters as success stories pile up.

The ecosystem is maturing. With big players like JioHotstar, Google, and even device OEMs (TV manufacturers) in the mix, the infrastructure for CTV advertising is strengthening. Already smart TV OEMs act as gatekeepers to high-impact inventory – for instance, Samsung or Xiaomi TVs might have their own ad platforms for the home screen or global content. These developments will create more CTV avenues but also more standardization as global best practices are adopted. Every new measurement integration (Comscore, Nielsen, etc.) and anti-fraud measure improves buyer confidence.

Looking specifically at the festive context: CTV offers a way to combine scale with segmentation during a time when brands want both mass reach and precise targeting. A clothing brand can run a big hero ad for its Diwali collection on connected TV to reach fashion-conscious families, while concurrently retargeting those who showed interest with a mobile coupon.

This holistic approach, stitching together CTV and other digital channels, is becoming the norm. Indeed, many savvy marketers now plan CTV + social + e-commerce campaigns in tandem – for example, a festive recipe show on CTV sponsored by a cooking oil brand, coupled with influencer posts on Instagram and a “buy now” integration with an online grocer. Such 360-degree strategies treat the living room screen as the anchor for storytelling, with mobile and web amplifying it.

In concluding this analytical story: India’s living room is truly reconnected. After a decade where the personal screen (mobile) dominated growth, the shared screen is back in focus – not in the old linear broadcast way, but in a digital, on-demand, highly targetable way. This festive season is proving that CTV has arrived as a mainstay of media plans, commanding real budgets and delivering tangible results. Advertisers are learning to navigate its nuances – paying a bit more per impression, crafting new kinds of ads, demanding better measurement – and by doing so, they are reaping the benefits of an engaged audience that is watching, shopping, and celebrating from the couch.

As Diwali lights up millions of homes, don’t be surprised if the most impactful ad campaigns you see are lighting up the smart TV in the living room. CTV is no longer a niche; it’s where the big stories unfold – and this festive season has made that clearer than ever.

13th on SonyLIV : Some Lessons Aren’t Taught in Classrooms’ is a heartfelt series that captures the evolving bond between a mentor and his student while exposing the hollow chase of start-up culture. Rooted in realism, it’s powered by strong performances and a story that feels lived-in.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” / sports tech fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.