Diwali on the Big Screen: CTV’s Festive Breakout - Part 1

What marketers & streamers need to know about CTV’s rise this year

Hey Streamers 👋,

A warm welcome to the 104th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

CTV Is the New Prime Time During India’s Festive Season

Ad Budgets Shift from Mobile to the Big Screen

Creative Innovation on the Big Screen

And….Action!

CTV Is the New Prime Time During India’s Festive Season

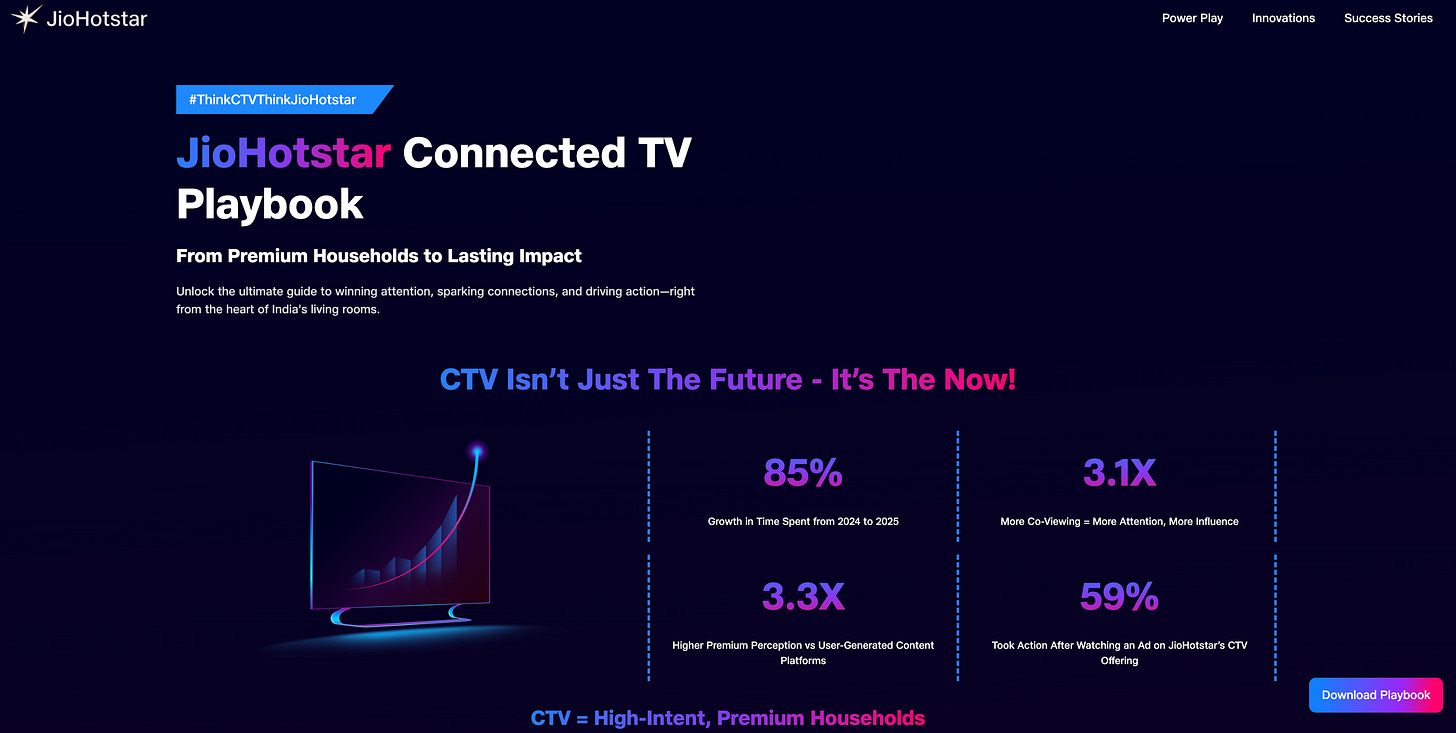

The Festive Fuel for CTV’s Rise

India’s festive season – from Onam through Navratri to Diwali – has long been prime time for advertisers, and this year Connected TV (CTV) is emerging as the star medium. As families gather for celebrations, many are tuning into smart TVs and streaming devices in the living room, making CTV “the new prime time.” Industry estimates show CTV advertising in India grew from around ₹450 crore in 2022 to ₹1,500 crore in 2024 – a more than 3× jump – and is projected to reach ₹3,500 crore in the next couple of years [financialexpress.com]. This growth is riding on the back of exploding CTV adoption: India hit roughly 50 million monthly active connected TV sets by end-2024 [brandequity.economictimes.indiatimes.com], up from just 10 million three years ago. That’s a 5× expansion in CTV households, fueled by affordable smart TVs, widespread broadband, and consumers’ shift to streaming content on the big screen.

This festive period is set to be CTV’s breakout moment. Ahead of the 2025 festivities, brands have upped their CTV investments by 30–35% over last year’s festive season, according to industry observers. Many advertisers are now earmarking 30–50% of their digital ad budgets specifically for CTV during the festive push [financialexpress.com], a striking reallocation that underscores CTV’s newfound importance. In fact, digital-first ad spend overall is soaring this time of year – by 20–25% YoY in 2025’s festive quarter [storyboard18.com] – and much of that incremental growth is flowing into connected TV and online video. Shweta Sharma of Hakuhodo Data Labs notes that video and OTT/CTV already account for ~30% of India’s digital ad expenditure and will climb higher this season [storyboard18.com] s. Connected platforms like JioHotstar, YouTube, SonyLIV, and aggregators like Tata Play Binge have become the new festive “living rooms” where brands jostle for consumer attention.

Why the surge in CTV during festivals? One reason is audience behavior. Families often co-view content on big screens in prime evening slots, especially around holidays. According to Dentsu’s Media & Entertainment Report 2023, 65% of Indian TV households have cut the cable cord in favor of Smart TVs, Fire Sticks, or internet set-top boxes [brandequity.economictimes.indiatimes.com], and families now spend an average of 3 hours daily on their smart TV. These living-room viewing sessions – often during dinner or family time – are incredibly valuable to advertisers. About 74% of Indian viewers engage in shared CTV watching during prime time, making it akin to the appointment viewing of traditional TV’s glory days. It’s no surprise, then, that marketers see festivals as the perfect stage for CTV: the audience is together, attentive, and in a spending mood.

Moreover, categories that thrive during festivals – e-commerce, electronics, auto, fintech, travel, and premium FMCG – align well with CTV’s audience profile. Connected TV viewers skew toward younger, affluent, and urban consumers, the kind of high-intent shoppers brands love to court during Diwali sales and year-end promotions. According to industry leaders, auto brands now channel 20–25% of their video ad budgets to CTV (for instance, electronics brand boAt and others consider CTV “central” to reaching affluent urban households [financialexpress.com]. Likewise, FMCG majors like Godrej Consumer allocate ~80–85% of their internet ad spend to CTV, and Parle Products has redirected 15–20% of its high-definition linear TV budget into CTV. These shifts illustrate how CTV has graduated from experimental to essential in media plans, especially when big cultural moments drive up viewership.

Even last year’s data foreshadowed this trend. The 2024 festive quarter saw CTV’s share of digital ad spend roughly double from about 4–5% to 6–8% [storyboard18.com] (some experts say it even reached low double-digits for certain advertisers). In 2025, projections range from CTV taking 8–15% of total digital spends [storyboard18.com], with key sectors possibly putting 20–25% of their video budgets into CTV. Clearly, brands now view CTV as a “premium showcase window” for festive campaigns, not just a niche add-on.

Ad Budgets Shift from Mobile to the Big Screen

This festive surge in CTV is coming partly at the expense of other screens. Mobile OTT viewing remains massive in India, and brands still invest heavily there for reach – but a notable rebalance is underway. Many advertisers are adopting a “70/30” strategy: ~70% of digital video budget on mobile for broad reach, and ~30% on CTV to hit premium audiences [afaqs.com]. “Advertisers recognise that the audience size on TV (CTV) is comparable to mobile, so they’re opting for a combination,” explains Vaibhav Choudhari of Carat India. The co-viewing, large-screen impact of CTV is drawing categories like automotive, consumer electronics, banking, and high-end FMCG to favor it for metro audiences. At the same time, mass-market brands (e.g. some FMCGs, budget financial products) still rely on mobile to cover India’s vast hinterland for volume reach.

Crucially, CTV isn’t cannibalizing only digital budgets – it’s also eating into linear TV spends. For the first time, many advertisers are openly trimming their traditional TV buys to free up funds for connected TV. Advertising on linear television actually dipped ~6% in ad volumes in 2024, with 12% fewer advertisers on board, per a FICCI-EY report [financialexpress.com]. Some of that pullback is due to economic factors, but much is a deliberate shift: marketers migrating money to CTV for its targeting and measurement advantages. EY-FICCI data shows CTV was just ~4.4% of total TV ad spends in 2024, but is on a fast track – projected to be 35% of TV ad budgets by 2026 and ~42% by 2027 if current growth holds. In absolute terms, that would mean CTV taking roughly a third of all “TV” advertising within the next 2–3 years, a stunning change in the media mix.

Advertisers describe three patterns in how budgets are shifting to CTV:

Direct migration from linear TV: Brands, especially those targeting affluent urban consumers, are cutting high-definition (HD) TV spends and moving that money into CTV platforms. For instance, Parle now allocates 10–15% of its combined TV+digital budget to CTV, pulling 15–20% from its HD linear TV pot and another 20–25% from digital video to fund it [brandequity.economictimes.indiatimes.com]. What might have gone entirely to a Star Plus or Zee TV in the past is now partially going to a connected device showing OTT content.

Incremental digital investment: Some advertisers are simply adding new budget on top for CTV, viewing it as a way to extend reach once linear and mobile plans are in place. This reflects the “CTV + TV = greater reach” approach: GroupM research shows integrating CTV with traditional TV lifts total reach by 4–7% in key markets. So these are new dollars chasing incremental eyeballs (often younger viewers who no longer watch linear TV).

Consolidation of scattered video spends: In the early days, marketers dabbled small amounts in various OTT apps; now, many are consolidating those fragmented spends into a focused CTV strategy. The idea is that instead of placing a bit of budget on 10 different mobile apps, it can be more effective to buy television-sized impressions via a programmatic CTV buy or a large-screen platform to ensure impact and easier measurement.

The net effect is that CTV ad spending in India is growing 3–4× faster than traditional TV ad spend [brandequity.economictimes.indiatimes.com]. Deliese Ross of Mudramax notes that at this pace, CTV could account for one-fourth of all TV advertising in India within a few years. And the trajectory may accelerate further as smart TV sales boom (40 million units expected in homes by 2025) and as the infrastructure for programmatic CTV buying matures. In essence, marketers are reorganizing their video plans around a new reality: the “first screen” for many consumers is now an internet-connected one. As one media agency head put it, “Our frameworks now combine traditional TV’s reach with digital’s precision targeting. CTV delivers the best of both – the living room impact of TV with the data and tracking of digital.” [brandequity.economictimes.indiatimes.com]

Creative Innovation on the Big Screen

With CTV taking center stage, advertisers are retooling their creatives and tech strategies to capitalize on the living room experience. This isn’t just repurposing a 30-second mobile ad; brands are developing CTV-first creatives that leverage the big screen, high-definition visuals, and interactivity:

Longer-format storytelling: Since CTV viewers tend to watch long-form content (YouTube noted over half of connected TV watch time in India is on videos 21+ minutes long), advertisers aren’t shy to run 30-second or even 60-second spots, akin to traditional TV commercials. The shared viewing context allows for more narrative, emotion, and festive flavor in ads. For example, many Diwali campaigns on streaming platforms resemble mini-films targeting family audiences, designed to be enjoyed on a TV with sound – very different from the short, muted mobile ads.

Interactive and shoppable ads: One big advantage of CTV is that it can blend digital interactivity with TV. QR codes on TV ads have become a popular tool – viewers can scan with their phone to directly shop or learn more. Kia India recently tried this by integrating QR codes into its YouTube CTV ads for the Seltos SUV, and saw a 3.6× lift in conversion rates compared to standard non-CTV campaigns [financialexpress.com]. Essentially, people watching the Kia ad on their smart TV could scan and book a test drive on the spot. Many brands are now adding “scan to shop” QR codes or short URLs on their CTV ads, recognizing that a viewer with a phone in hand on the couch can be prompted to take immediate action. Early results are promising – these shoppable CTV ads are driving measurable sales lift for consumer electronics and retail brands in festive campaigns.

New ad formats: Streaming platforms and devices are enabling formats unheard of in traditional TV. “Pause ads” (an ad that displays when a viewer pauses the video), dynamic overlays, and even click-to-WhatsApp banners on TV screens are emerging in India. For instance, an OTT app might show a static brand message or offer on the paused screen – a moment when the viewer is likely to be paying attention. These are less intrusive but high-impact touchpoints unique to CTV. Brands this season are experimenting with such formats to stand out amid the clutter.

Localized and personalized creative: Digital delivery means CTV ads can be tailored by audience segment or region. YouTube’s latest push in India even allows separate urban vs. rural targeting on CTV [financialexpress.com] , which is a game-changer for creative versioning. A festive campaign can show an “aspirational, premium” storyline to urban viewers and a more “affordability/value” driven creative to rural audiences, simultaneously. Advertisers are leveraging this by shooting multiple edits of the same ad to resonate with different demographics. Studies show localized languages and context can significantly boost ad recall and favorability, so CTV’s targeting is letting brands serve, say, a Tamil ad to a Chennai viewer and a Hindi ad to a Delhi viewer in the same media buy – something impossible on national TV.

CTV-first production investments: Recognizing that large 4K screens amplify every detail (for better or worse), some brands are investing more in production values for their CTV ads. Higher resolution assets, cinematic visuals, and surround sound mixes are being employed so that the ad “pops” on a living room TV. This festive season, a few streaming platforms even offered “CTV creative workshops” to advertisers, advising them on optimal UI safe zones (so that important text isn’t cut off on a TV frame) and how to include on-screen interactive elements. It’s a sign that the industry now sees CTV as its own creative canvas, not just an extension of digital.

Major streaming players are also racing to innovate on the ad tech side for CTV:

YouTube has rolled out CTV-specific products like the “Immersive Masthead” (a high-impact ad that takes over the YouTube app home screen on TVs) and introduced an India-first feature for granular geographic targeting (urban vs rural) on CTV. They even launched a Creator Partnerships Hub to help brands produce content and ads suited for YouTube on TV, underscoring how serious the platform is about its “India’s new TV” positioning. The result: YouTube’s own data shows 75 million Indians 18+ watched YouTube on connected TVs in April 2025 [financialexpress.com], and features like these aim to push that even higher by luring traditional TV advertisers.

JioHotstar (formerly JioCinema + Disney Hotstar) has become a powerhouse after the merger. With vast sports content (IPL cricket, ICC tournaments) and entertainment libraries now under one roof, JioHotstar is focusing on CTV scale and innovation. Notably, JioCinema’s free IPL 2023 streaming in 4K led to many households trying OTT on their big screens for the first time. Advertisers piggybacked on this with interactive ads. This year, JioHotstar has introduced things like multi-camera angles and real-time stats for sports on CTV, giving brands the opportunity to sponsor these features or integrate messaging in non-traditional ways. Additionally, Reliance’s integrated ecosystem means Jio can use its subscriber data to target CTV ads smartly (for instance, offering a Reliance Retail discount code on-screen to a JioFiber broadband user).

SonyLIV, while smaller, is leveraging its strengths in premium content (like sports, original series) to attract CTV viewers who prefer ad-supported high-quality content. SonyLIV partnered with tech firms to improve its ad tech and viewer data analytics. For example, a strategic tie-up with TCS in 2023 aimed to enhance SonyLIV’s personalization and ad delivery, indicating a push toward more CTV-friendly, data-driven advertising. We’re seeing SonyLIV pitch “CTV-first” packages to brands around its sports streams (like UEFA football or cricket), emphasizing the high dwell time of a connected TV viewer versus a casual mobile scroller.

Tata Play Binge, an aggregator that bundles 20+ OTT apps, is an interesting player in the CTV space. Essentially a bridge between DTH (traditional TV) and OTT, Tata Play Binge targets those using smart set-top boxes or smart TVs to access multiple services in one interface. While Binge itself is subscription-driven, it offers advertising opportunities in its UI and on certain free content streams. Tata claims its Binge users are “super streamers” who spend a lot of time on connected TV apps, thus an attractive segment. This festive season, Tata Play Binge has run a campaign “India is Now Bingeing” celebrating co-viewing habits – implicitly nudging advertisers that their platform is where the modern joint family flips through OTT content together (and where brands can insert themselves in that journey).

Taken together, these developments show an industry gearing up to treat CTV not as digital video “as usual,” but as a hybrid of TV’s storytelling and digital’s engagement. The creative bar is rising. One executive quipped that streaming ads used to be recycled TV ads or YouTube spots, but now the pendulum has swung – some TV commercials are being cut from CTV ads! In other words, the innovation cycle is now starting in digital and then extending to traditional, rather than vice versa.

Measurements & the CTV Advertising Outlook for this festive season coming up on the next newsletter! Until then, Happy Streaming.

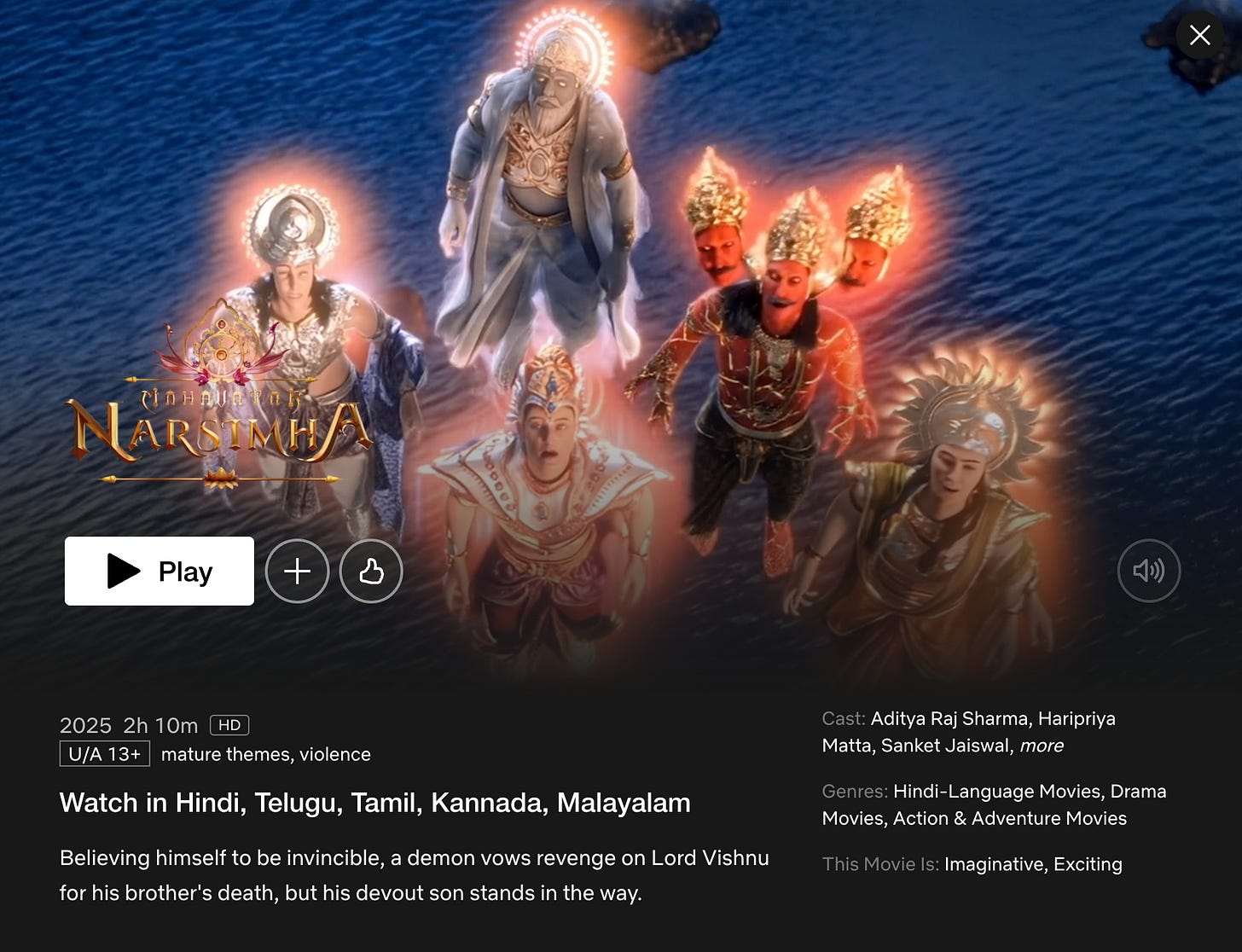

India’s highest grossing animated film just released on Netflix and promises to be a home run for their viewership as well - The mythological animated film Mahavatar Narsimha achieved significant box office success, crossing ₹300 crore in worldwide gross collection. Made on an estimated budget of around ₹40 crore (more than 7x return), it has become a huge hit and an unexpected success for Indian cinema, especially for an animated film!

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” / sports tech fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.