ETV's unique strategies to 'win' the regional OTT game

Also unpacking ETV Win vs. Aha OTT: A Competitive Snapshot

Hey Streamers 👋,

A warm welcome to the 56th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join 3,000+ others who receive it directly in their inbox every Wednesday.

You wake up and take notice when one of India’s premier English language financial news destinations runs this headline. In spite of 60+ OTTs, Jio-Disney+ Hotstar merger and a burgeoning regional creator economy, global giants are making a beeline for India with Apple TV+ announcing an Airtel (India’s second largest telco after Jio) distribution tie up. Currently HBO content is distributed via JioCinema and therefore HBO MAX will delay their D2C entry in India, which in many ways is a smart move.

Agenda

Unpacking ETV Win’s Unique Role in India’s OTT Landscape

ETV Win vs. Aha OTT: A Competitive Snapshot

And….Action!

Unpacking ETV Win’s Unique Role in India’s OTT Landscape

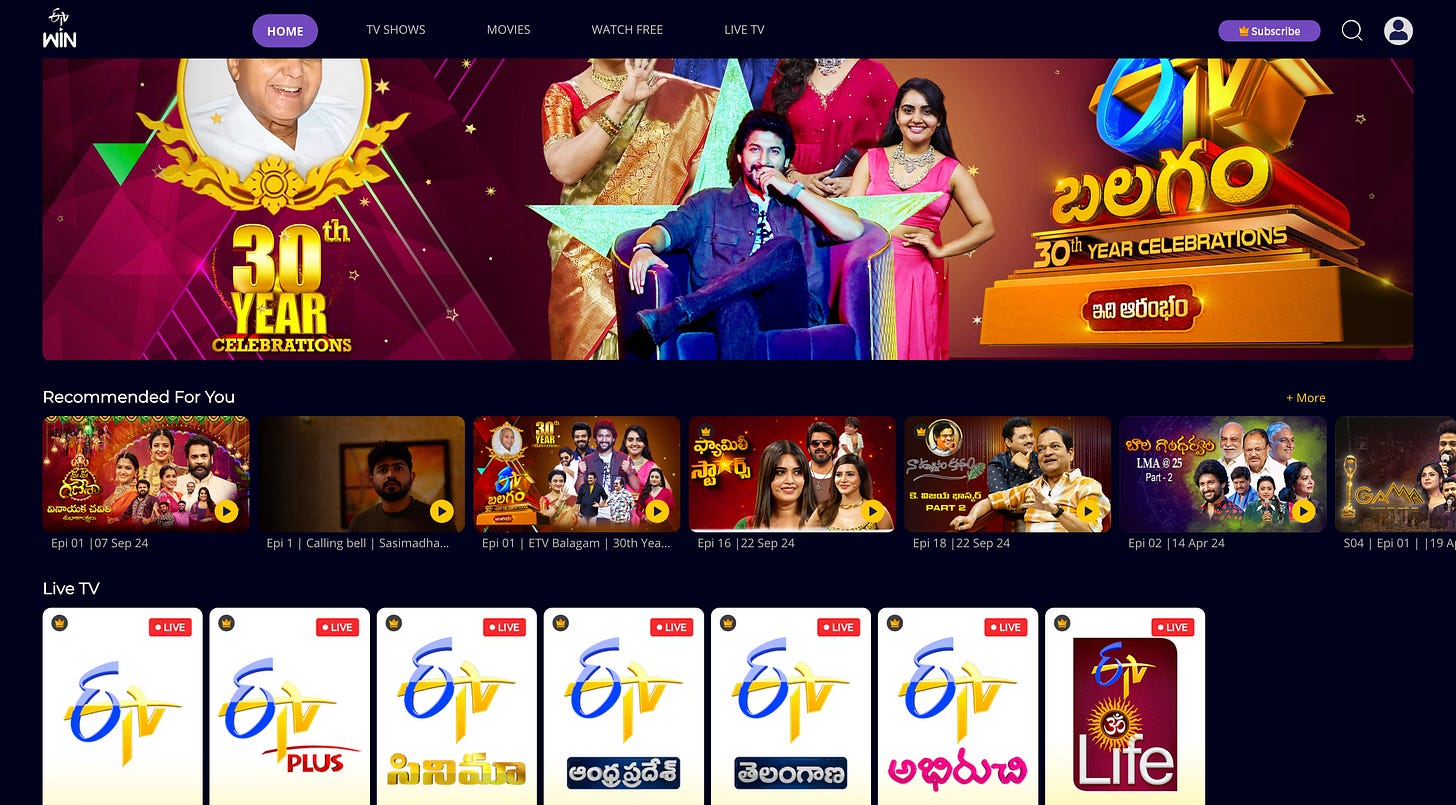

At Streaming in India, our mission has always been to shine a spotlight on the diverse and evolving stories within India’s streaming industry. While mainstream platforms dominate much of the conversation, our focus extends to OTT services that may not always grab the headlines but play a vital role in shaping the landscape. Today, we turn our attention to ETV Win, a Telugu-language streaming service born out of the iconic ETV Network, whose strategic moves and deep cultural connections make it a standout player in regional streaming.

ETV Win: A Pillar of Telugu Streaming

ETV Win, owned and operated by Eenadu Television Private Limited, emerged as a natural extension of the ETV Network's long-standing media legacy. The platform serves as a comprehensive OTT offering that taps into Telugu cinema, television, and original web content, catering to a vast audience that craves regional entertainment. What makes ETV Win truly unique is its understanding of the cultural nuances and preferences of Telugu-speaking audiences, a factor that many larger platforms tend to overlook.

With the Telugu film industry, or Tollywood, at the forefront of Indian cinema, ETV Win has positioned itself as a go-to platform for everything from timeless blockbusters to newly launched original series. Its extensive content library also includes a blend of daily soaps, reality shows, and infotainment, making it a one-stop hub for Telugu content.

1. Exclusive Content and Originals: The Key Differentiator

One of the standout features of ETV Win is its robust selection of exclusive content. With one of the largest collections of Telugu-language films, the platform offers a variety of genres that appeal to a wide demographic. But it doesn’t stop there. ETV Win is aggressively expanding its portfolio of original web series, aimed at tapping into the growing appetite for new, refreshing content.

In a market where platforms often compete on the same content, ETV Win’s focus on before-TV content adds a unique edge. By offering early access to TV shows before they are broadcast on traditional channels, ETV Win successfully creates a sense of exclusivity that helps maintain a strong subscriber base. This content strategy is particularly relevant in an era where audiences increasingly prioritize on-demand access and flexibility.

ETV Win’s Original Content Push:

In 2023, ETV Win significantly ramped up its original content production. From suspense thrillers to family dramas, the platform aims to provide a diverse range of genres that appeal not only to the masses but also to niche audiences. What’s commendable here is the platform's ability to tailor its original content to the sensibilities of Telugu viewers, offering stories that reflect regional values, humor, and culture. With its original content, ETV Win positions itself as a trendsetter in the Telugu OTT space, catering to a wide demographic with different tastes.

2. Distribution Strategy: Premium Live TV and Beyond

ETV Win’s approach to content distribution is another element that sets it apart. Rather than relying heavily on third-party platforms like YouTube to stream its live TV channels, the platform has chosen to keep its live content exclusive to paying subscribers. This strategy reinforces the platform’s premium positioning while ensuring that subscribers feel they are receiving value for their investment.

By offering 24x7 live channels exclusively through subscription packages, ETV Win creates a distinct separation between free content and premium offerings. Live TV shows such as ETV Plus (comedy) and ETV Cinema (movies) are part of the platform’s premium package, accessible only to paying members. This model has allowed the platform to protect its premium content while monetizing it effectively, particularly in international markets such as the United States through YuppTV.

YouTube Integration with a Twist:

ETV Win hasn't entirely ignored the power of YouTube. Instead, it strategically utilizes the platform to share highlights and snippets of key moments from live shows, while withholding the full live experience for paying subscribers. This has allowed the platform to retain a strong YouTube presence without undermining its subscription business—a delicate balance that many streaming platforms struggle to achieve. This smart distribution strategy ensures that free users are engaged while incentivizing them to convert to paying subscribers for the full experience.

3. Hybrid Revenue Model: A Future with FAST Channels?

ETV Win has not built its business model on a hybrid revenue structure, with both subscription-based premium content and ad-supported free content. As part of its evolution, the platform is well-positioned to explore Free Ad-Supported Television (FAST) channels, which could further enhance revenue streams. FAST channels would allow certain segments of the platform’s content to be freely accessible but monetized through server-side ad insertion (SSAI), thereby tapping into broader audience bases while still reserving premium content behind a paywall.

A potential move toward FAST channels could help ETV Win diversify its revenue model and capture a more price-sensitive segment of the audience. The ability to experiment with a mix of free and paid content ensures that the platform remains agile and adaptable to changing audience preferences.

4. The Ramoji Factor: Leveraging Legacy to Fuel the Future

Much of ETV Win’s success can be attributed to the Ramoji Group, the parent company behind the platform, which also owns Ramoji Film City—one of the largest film production complexes in the world. Leveraging the group’s extensive media assets, ETV Win is able to produce high-quality content in-house, drawing from the experience of its sister companies.

ETV Win’s close connection to the Telugu cinema ecosystem has enabled it to become a key player in the OTT space, giving it access to some of the region’s most iconic movies and industry talent. By producing in-house content through Usha Kiran Movies and Ramoji Film City, the platform can maintain high production values while offering exclusive Telugu content that resonates with its core audience.

5. Customer Engagement: A Personal Touch

In an age where customer engagement is largely digitized, ETV Win’s decision to offer a direct phone line for subscribers is a refreshing departure from industry norms. Available every day from 7 AM to 10 PM IST, this service allows users to speak directly with representatives to address technical issues, provide feedback, or inquire about content. This level of personal engagement not only sets ETV Win apart but also reinforces its commitment to providing a user-first experience.

It will be interesting to explore what kind of conversations are taking place via this hotline—whether they are predominantly complaints or constructive feedback—and how ETV Win plans to use this channel to further enhance its service.

ETV Win vs. Aha OTT: A Competitive Snapshot

As we explore India’s vibrant OTT landscape, two regional powerhouses, ETV Win and Aha OTT, stand out in the Telugu content space. Both platforms have carved unique positions, offering compelling entertainment to millions, yet their strategies and strengths differ significantly. Let’s take a closer look at how these two Telugu OTT platforms compare.

ETV Win: Leveraging the Power of a Media Giant

ETV Win has the distinct advantage of being backed by the ETV Network, one of India’s largest television conglomerates with decades of experience in Telugu media. This connection allows ETV Win to leverage a vast library of popular TV shows, movies, and exclusive before-TV content, giving it a level of depth that few competitors can match.

Strengths of ETV Win:

Content Library: ETV Win boasts one of the largest collections of Telugu movies, shows, and serials, alongside an increasing number of original web series.

TV Integration: With ETV Win’s before-TV content, viewers can access their favorite serials and shows ahead of their television broadcast, creating a sense of exclusivity.

Live TV: The platform provides 24x7 live streaming of ETV Network’s channels, including ETV Plus and ETV Cinema, which are kept behind a paywall, enhancing their premium value.

While ETV Win may not be as flashy as Aha, its long-standing connection to the ETV television network gives it a reliable and loyal subscriber base, particularly in rural and semi-urban areas. It’s a platform deeply rooted in tradition, and its strength lies in its ability to integrate television content seamlessly into the OTT space.

Aha OTT: Glamour, Star Power, and Rapid Growth

On the other side of the spectrum, Aha OTT is the more glamorous player, built around its star power and rapid expansion in the Telugu and Tamil entertainment markets. Launched in 2020, Aha quickly gained attention with endorsements from Telugu cinema superstar Allu Arjun, who has been a significant force in building the brand’s appeal.

Strengths of Aha OTT:

Star Power: Aha’s association with top Telugu cinema figures, including its brand ambassador Allu Arjun, gives it immediate visibility and a strong connection with younger, urban audiences.

Subscriber Growth: Within a year of launch, Aha hit one million subscribers, and by July 2021, it surpassed 1.5 million paid subscribers and 40 million users—an impressive feat that reflects its aggressive marketing and content expansion.

Original Content and Kids Programming: Aha has invested heavily in producing original series and shows for its platform, including its Aha Kids sub-brand, focusing on children's content, and aha 2.0, which brought in a new cloud-native platform for better user experience.

Aha has a clear edge in terms of brand visibility and subscriber growth. Its association with major Tollywood personalities and its focus on producing original, contemporary content make it the go-to platform for younger viewers who seek fresh and high-production-value content.

Key Differences: Star Power vs. Legacy Network

The contrast between ETV Win and Aha lies in their respective approaches to content and audience engagement. Aha has built its brand on star power and original content, appealing primarily to younger, urban audiences who are keen on fresh narratives and high-quality production. With its emphasis on exclusivity and celebrity endorsements, Aha delivers a modern OTT experience.

In contrast, ETV Win leverages its stronghold in traditional television content, appealing to viewers who value reliability and a vast library of existing shows and films. ETV Win’s strength comes from its integration with the ETV Network, which provides steady access to live TV and before-TV content, making it a staple for more traditional Telugu-speaking audiences across India and abroad.

Challenges and Opportunities Ahead

While Aha’s rapid growth is remarkable, it faces potential challenges with market consolidation. Rumors of a possible acquisition by Reliance Jio could lead to concerns over monopolization within the regional OTT space, which may face scrutiny from the Competition Commission of India. Consolidation could limit competition, leaving platforms like Aha with tough decisions about maintaining their distinct identity.

On the other hand, ETV Win, with its deep-rooted television network and subscriber loyalty, may not have the same growth trajectory as Aha, but its stable foundation allows it to focus on content diversification and enhancing user experiences. ETV Win’s future lies in how well it can blend its legacy TV content with newer OTT formats, including FAST channels and more premium offerings.

Conclusion: The Battle for Telugu OTT Supremacy

Both platforms bring distinct strengths to the table. Aha OTT has positioned itself as the platform of choice for those seeking cutting-edge, star-studded entertainment, while ETV Win remains a reliable, trusted source for traditional television content with a strong connection to the Telugu-speaking community.

As these platforms continue to evolve, the competition between Aha OTT and ETV Win will likely shape the future of regional OTT in India, particularly in the Telugu-speaking market. For now, the choice for viewers may come down to whether they seek the glamour and exclusivity of Aha or the deep, reliable content library of ETV Win.

Netflix serves a dose of equal parts nostalgia, wrestling super stars and drama as we go behind the scenes of the excitement and a story line so bizarre that it will blow you away. Across 6 episodes, this docu series chronicles insights drawn from over 200 hours of interviews and conversations with McMahon (before his resignation), his family, business partners, wrestling legends, and journalists who exposed sexual misconduct allegations (amongst other things) etc. If you watched (like me growing up in India including playing the trump card games!) OR still watch WWE /F, this is a must watch.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on AI, the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.

Download our market reports STREAMING in MENA and STREAMING in INDIA.