Evaluating Women’s Sports Streaming Across India

From record-breaking WPL viewership to a 24/7 all-women’s sports channel, platforms and brands are racing to monetize India’s fastest-growing fan segment

Hey Streamers 👋,

A warm welcome to the 97th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

Women’s Sports Streaming in India: A New Era of Opportunity

The Cricket Catalyst: Women’s Premier League (WPL)

Streaming Platforms Bet Big: JioHotstar and Competitors

Revenue Potential: Ads, Sponsors and Subscriptions

Gauging the Interest: By the Numbers

Outlook: Leveling the Playing Field

And….Action!

Women’s Sports Streaming in India: A New Era of Opportunity

India’s sports streaming landscape is undergoing a paradigm shift as women’s sports emerge from the sidelines to take center stage. For years, cricket (especially men’s cricket) has dominated both viewership and revenue in Indian sports media. Now, with the advent of high-profile women’s leagues and dedicated channels, streaming platforms see immense potential in engaging new audiences and advertisers through women’s sports content. In this issue of Streaming Lab, we explore how platforms are capitalizing on the momentum – from the blockbuster Women’s Premier League cricket to a 24/7 women’s sports channel – and what it means for viewership and revenue in India.

The Cricket Catalyst: Women’s Premier League (WPL)

The launch of the Women’s Premier League (WPL) in 2023 was a watershed moment for women’s sports in India. Backed by a ₹951 crore (US$116 million) media rights deal with Viacom18, the inaugural WPL season immediately drew unprecedented viewership. In fact, the 2023 WPL final attracted over 10 million live viewers, the highest ever for any women’s sports event globally. Across its first 14 matches, the debut season amassed around 50 million viewers (TV + digital) – a figure that stunned even optimists.

Fast forward to the second WPL season (2024), and the audience only grew. Cumulative TV viewership doubled to reach 103 million in the first 15 games. By 2025 (third season), opening match viewership on television soared to 3 crore (30 million) viewers, with TV ratings up 150% and digital viewership up 70% over the prior year. According to India’s cricket board, the WPL’s reach has expanded to about 300 million fans – a level of interest once unimaginable for women’s sports. To put it in perspective, the WPL 2025 opener drew nearly three times the peak global viewership of the 2023 FIFA Women’s World Cup final. Such comparisons underscore how women’s cricket in India is shattering global benchmarks, firmly establishing itself as a marquee property.

The WPL’s debut season on JioCinema drew record viewership – the highest ever for a women’s sports tournament.

Beyond the raw viewership numbers, fan enthusiasm and on-ground engagement have skyrocketed. Stadiums that were half-empty for women’s matches a few years ago are now buzzing with tens of thousands of fans. In 2023, the league initially even offered free tickets to build interest, but by 2024, crowds were paying and cheering with fervor. Traditional powerhouse franchises like Mumbai Indians and Royal Challengers Bangalore brought their established fanbases, and fans responded by showing up in team jerseys, chanting players’ names and waving “I 💗 WPL” banners. In Bangalore, the RCB Women’s team sold out nearly every match in 2024 – evidence that the appetite for women’s cricket is both real and rapidly growing, not merely an IPL sideshow. As one BCCI executive noted, “the response to WPL has exceeded even our expectations – from viewership to sponsorship to fan turnout, everything has been extraordinary.”

Streaming Platforms Bet Big: JioHotstar and Competitors

The surging popularity of women’s sports has prompted India’s streamers to ramp up coverage and innovate on distribution. JioHotstar – the new powerhouse formed by the 2024 merger of Viacom18’s JioCinema and Disney’s Hotstar – now commands the lion’s share of sports rights, including women’s events. (JioHotstar’s parent, JioStar, controls 75–80% of India’s sports broadcast market.) With this consolidation, all key women’s cricket content is under one roof: WPL, ICC women’s World Cups, and India’s women’s international matches. JioHotstar has leveraged its massive reach (over 280 million users as of early 2025) to stream WPL free of charge, using an ad-supported model to maximize eyeballs. The strategy mirrors what JioCinema did with the IPL – making it free in multiple languages – to capture a nationwide audience and then monetize via advertising at scale. For WPL 2023, this approach paid off: average watch-time exceeded 50 minutes per user per match on JioCinema, indicating viewers were deeply engaged with the live coverage.

Viacom18’s sports executives have been vocal about their ambitions in this space. “Our vision is to nurture the WPL into the biggest women’s sporting league in the world, and this is a big leap in that direction,” said Anil Jayaraj, CEO of Viacom18 Sports, after the first season’s success [sportsmintmedia.com]. He lauded the 50+ brands that partnered in year one and noted that WPL is “already on its way to becoming the largest viewed women’s sport event globally”. This optimism is backed by the numbers, and by the diverse advertiser interest WPL has drawn (more on that below).

Other domestic OTT players are also contributing to increased visibility for women’s sports, albeit on a smaller scale. SonyLIV, for instance, has streamed major multi-sport events (like the Olympics and Asian Games) where Indian women athletes won laurels, helping turn stars like P.V. Sindhu or Mirabai Chanu into household names. Niche platform FanCode has picked up digital rights to various under-the-radar sports – from women’s junior world cups to domestic leagues – providing coverage that traditional TV might skip. These efforts, combined with growing social media buzz, mean fans can now watch women’s matches in hockey, football, badminton and more online, even if those sports still trail cricket in popularity.

Interestingly, global streaming giants Netflix and Amazon Prime Video have so far taken a cautious approach in India when it comes to live sports – especially women’s sports. Netflix has zeroed in on sports docu-series (such as a documentary on the 2020 Women’s T20 World Cup) rather than bidding for broadcast rights. Amazon, while streaming some sports internationally, hasn’t secured any major women’s sports rights in India to date. That said, the buzz around properties like the WPL hasn’t gone unnoticed – these platforms may well explore women-centric sports content for the Indian market in the future, whether through documentaries, athlete-focused stories, or perhaps select live events if the commercial logic strengthens.

Revenue Potential: Ads, Sponsors and Subscriptions

Is this surging viewership translating into revenue? Early signs are encouraging. Advertising and sponsorships around women’s sports have risen sharply alongside audience growth. In WPL’s case, over 50 brands came on board in 2023; by 2025, more than 70 brands across 45 categories were investing in the league. These aren’t just the usual cricket advertisers (beer, telecom, etc.) – they include new sectors like beauty, fashion, and fintech, attracted by WPL’s relatively affordable rates and its large female fan demographic. For example, cosmetics brands (Kay Beauty, LoveChild) and a jewellery brand (Tanishq) sponsored WPL teams – categories that rarely featured in the men’s IPL. Central sponsorship revenues for WPL doubled from about ₹50 crore in 2023 to an expected ₹100+ crore by 2025 (with team sponsorships contributing another ₹50–65 crore) [exchange4media.com] . Industry analysts estimate the WPL’s overall business value climbed ~7% in a year, hitting $160 million in 2024. Clearly, brands are seeing ROI in associating with women’s sports – tapping into a fresh narrative of women empowerment and an engaged fan community.

From a streaming platform perspective, ad-supported models are the main monetization route for now. JioHotstar, for one, offered the WPL free to all users (just as it did with IPL) to maximize reach, then monetized via ad slots and sponsorship integrations. This has driven huge scale – Jio’s merged platform reportedly hit 300 million+ users during IPL/WPL season, with usage spikes leading to record ad impressions. While exact ARPU from women’s sports isn’t disclosed, the incremental lift in engagement is valuable: many viewers of WPL are women and younger audiences who may not have been as active on the app before. Converting some of these into long-term subscribers for other content is a strategic objective. In fact, one could argue women’s sports content helps reduce churn by keeping the sports calendar busy year-round (WPL in March, then IPL, then other events) and appealing to family audiences. As Indian women’s sports gain consistency and notability, there’s also potential for subscription packages or pay-per-view for niche tournaments, though mass events like WPL will likely remain free-to-stream to build scale.

It’s worth noting that advertisers currently get bargain CPMs on women’s sports compared to men’s cricket – which is exactly why many savvy brands are jumping in now. “Lower advertising rates are very attractive,” says Vinit Karnik of GroupM, pointing out that brands see women’s leagues as a chance for sustained marketing at a fraction of IPL costs [brandequity.economictimes.indiatimes.com] This may change as ratings climb; but for now, it’s a win-win: leagues get sponsor money and promotion, brands get visibility and goodwill, and fans get more coverage as a result of this virtuous cycle. The revenue mix isn’t only ads, either – subscription impact is subtle but present. For example, some fans have subscribed to Disney+/JioHotstar purely to follow the Indian women’s cricket team overseas or ICC women’s events that aren’t free. And as the content library of women’s sports grows (think documentaries, player interviews, shoulder programming), OTT platforms have more material to attract subscribers interested in sports storytelling, not just live matches.

Gauging the Interest: By the Numbers

Let’s recap with some key metrics that illustrate India’s burgeoning interest in women’s sports streaming:

WPL Viewership Growth: 50 million viewers in first 14 matches of 2023 → 103 million (TV only) in first 15 matches of 2024. By 2025, 30 million watched the opening match live on TV, and total reach is ~300 million [exchange4media.com]. Engagement per user also high (50+ min per match on digital).

Women’s Cricket World Cups: The 2023 ICC Women’s T20 World Cup drew 254 million global viewers, up 57% from prior edition. Online searches for women’s cricket in India more than doubled (+103% YoY in late 2023), showing spiking interest even outside WPL.

Sponsorship Uptick: WPL 2024 was projected to generate ₹125 crore in sponsorship revenue (central + team). Team sponsorships grew 10–20% in 2025 vs 2024, with new brand categories entering. Over 70 brands partnered with WPL 2025 (up from 50 in 2023).

New Leagues: Women’s Hockey League 2024 drew ~15 million viewers; Women’s Kabaddi challenge matches (as part of Pro Kabaddi) and the women’s Indian Football league, though still nascent, have seen record social media engagement whenever national team stars are involved. These numbers, while modest compared to cricket, are leaps ahead of where they were a few years back.

AWSN Channel Launch: A dedicated women’s sports network backed by Hollywood star Whoopi Goldberg is now available to over 400 million Indian mobile users via JioTV/JioHotstar.

It plans 2,000+ hours of live women’s sports content through 2025 – a significant increase in exposure time for women’s competitions that previously had virtually no airtime in India.

Such data points paint a clear picture: interest in women’s sports is not a passing fad, but a growing wave. India, with its 650+ million sports fans, is uniquely positioned to lead this movement – and streaming platforms are the vehicle driving it.

Outlook: Leveling the Playing Field

From all indicators, women’s sports streaming in India is poised for sustained growth. We’re seeing the virtuous cycle in action: greater visibility leads to more fans, which attracts more sponsors, which in turn funds better coverage and events. Importantly, this isn’t just about feel-good equality; it’s proving to be smart business. The merged JioHotstar platform, with its near-monopoly on sports rights, certainly has the incentive to push women’s leagues – they fill the content pipeline and bring in new advertisers. We can expect more cross-promotion (e.g. men’s IPL stars promoting WPL, or vice versa), and perhaps special subscription bundles targeting women viewers or junior fans.

Challenges remain, of course. Converting occasional viewers of big events into year-round followers of women’s sports is a work in progress. Not every non-cricket sport will see WPL-level numbers overnight. Yet, the trajectory is undeniably upward. The cultural shift is visible – young girls now proudly wear jerseys bearing names of women cricketers and Olympians, and families watch women’s matches together at home. As one article noted, “fathers bringing daughters to matches, little girls holding signs” is increasingly common, something barely imaginable a decade ago.

For the streaming industry, the takeaway is simple: women’s sports in India represent a growth frontier. Whether through ad-driven streams of live matches, or sports documentaries and shoulder content that enrich the fan experience, there is a sizable audience waiting to be served. Platforms like JioHotstar have seized the first-mover advantage, while others like SonyLIV and FanCode play a supporting role. Global players are watching closely from the sidelines. The next few years will likely see even bigger investments – possibly higher production quality, more regional language feeds (to replicate the IPL’s success), and deeper integration of women athletes into mainstream sports marketing.

In summary, women’s sports streaming in India has gone from niche to next big thing. The revenue potential – via advertising, sponsorships, and future subscriptions – looks increasingly promising as viewership milestones keep getting shattered. And perhaps most importantly, this growth is changing perceptions. As Whoopi Goldberg aptly said during AWSN’s launch, “When She wins, We win.” The rising tide of women’s sports is lifting all boats – fans, brands, and streamers alike – heralding a new era where women’s achievements on the field get the spotlight and streaming screens they have long deserved.

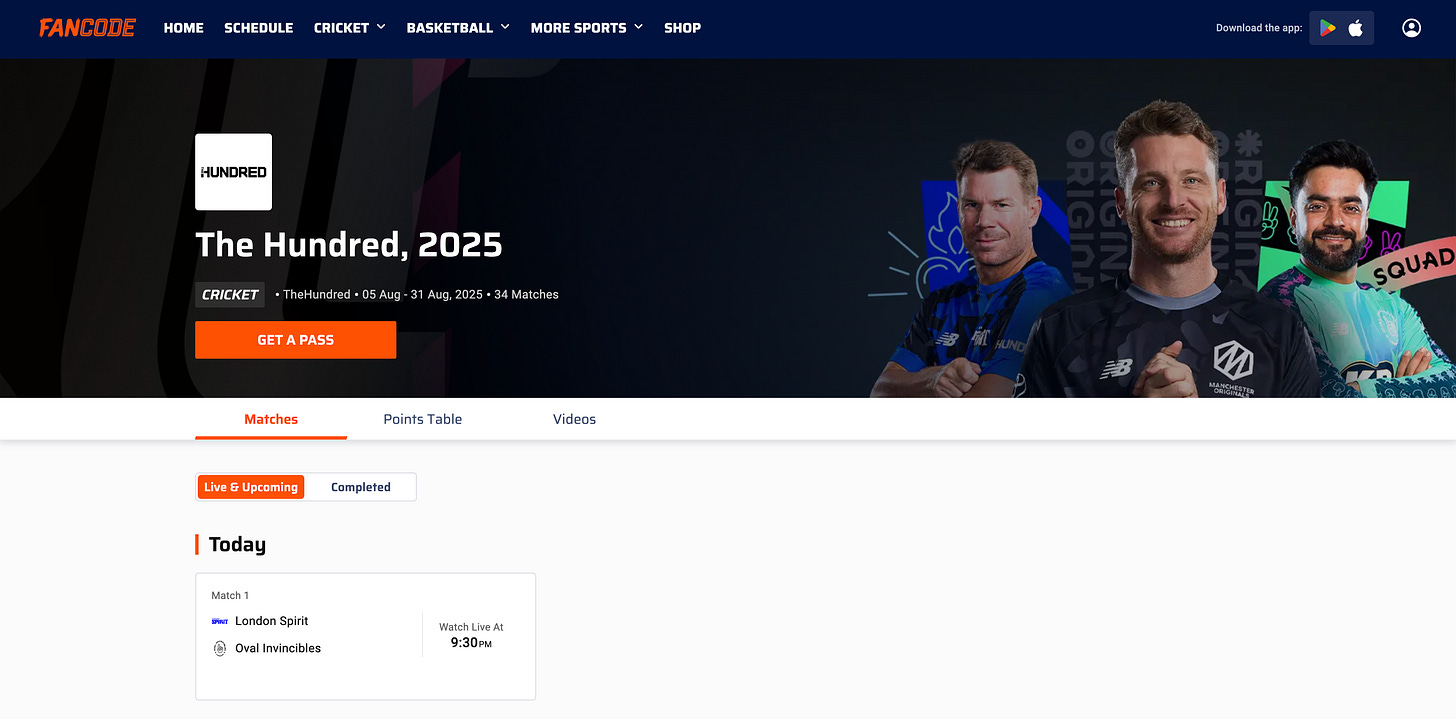

Live Cricket momentum continues on Fancode with “The Hundred” - The fifth season of ECB’s 100-ball carnival runs 5 – 31 August with the familiar eight city-franchises—Phoenix, Spirit, Originals, Superchargers, Invincibles, Brave, Rockets, and Welsh Fire—playing daily men’s-and-women’s double-headers (64 matches total). Each side gets four home and four away games; the top three enter a knockout culminating at Lord’s on 31 August! Enjoy.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.