Fallouts, Mergers, Ads, AI & More

Vanita Kohli-Khandekar, India's foremost media journalist on The Streaming Lab

Hey Streamers 👋,

Welcome to the 22nd edition of “Streaming in India”, your weekly news digest about streaming players, OTT trends and more in one of the fastest growing video markets. If you are not already a subscriber, please sign up and join 2,300+ others who receive it directly in their inbox every Wednesday.

Today, we have a very special guest at The Streaming Lab. It gives us great pleasure in introducing our friend and media expert, Vanita Kohli-Khandekar to the Streaming in India audience!

Vanita has been tracking the Indian media and entertainment business for two decades. Currently she is a columnist and writer for one of India’s leading financial dailies, Business Standard and writes for Singapore-based Content Asia. A Cambridge University press fellow (2000), Vanita has taught at some of the top media schools in India. The fifth edition of her book, The Indian Media Business: Pandemic and After (Sage) was released in October 2021. Her second book, The Making of Star India (Penguin-Random House) is being developed into a web-series.

Today’s program:

Zee - Sony Merger Fallout: The $10 billion Zee - Sony merger recently fell through. How do you see this impacting the broader industry?

Reliance - Disney Star Merger: How might this impact regional OTT players and the overall streaming industry?

Comparing Indian TV and Streaming: With the current industry landscape in mind, do you foresee the Indian streaming industry evolving similarly to Indian television? Are there lessons that streaming services can learn from TV?

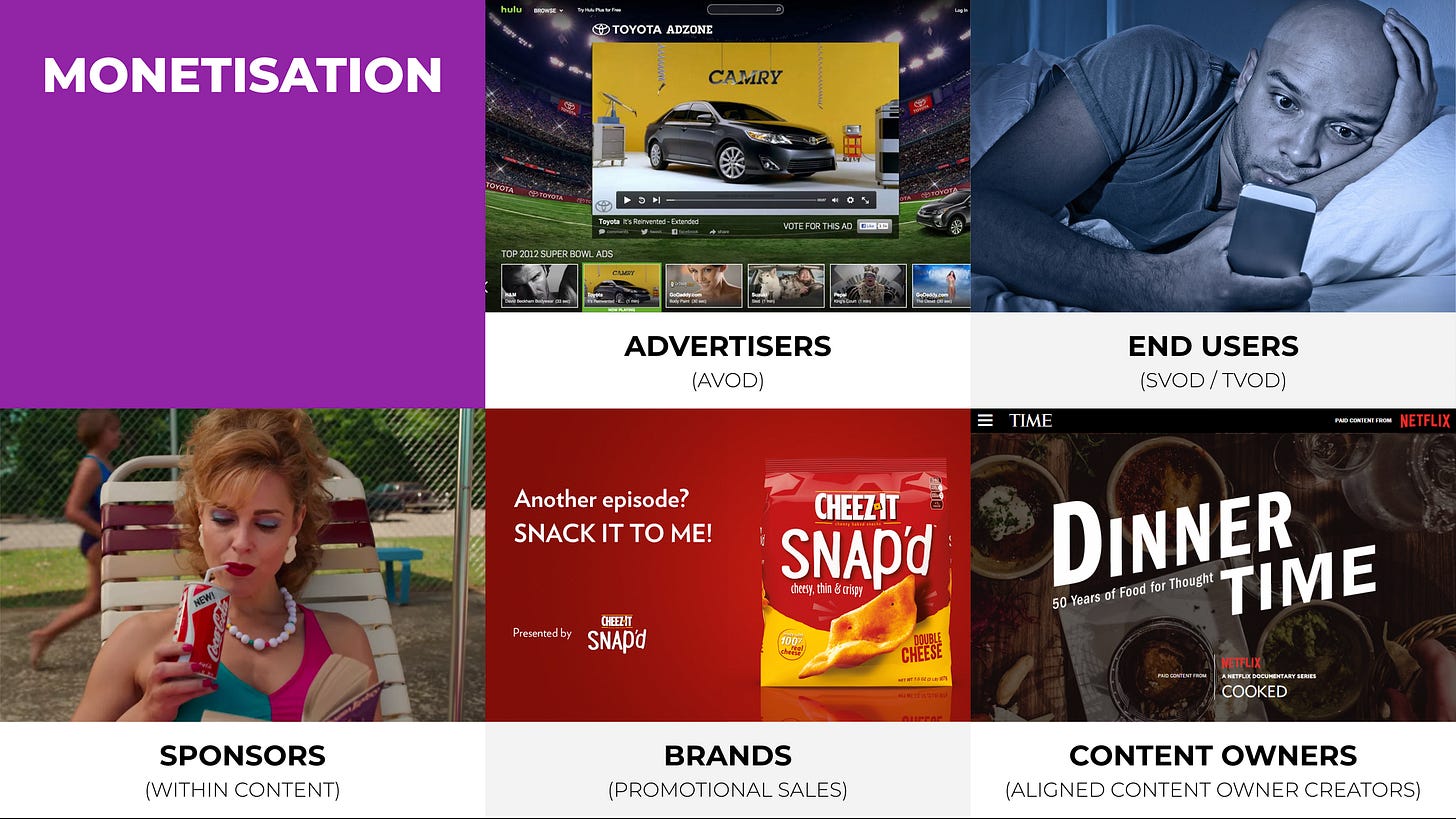

Ad-Supported Streaming Models: Most industry experts suggest a return to ad-supported streaming models. Do you believe this shift is inevitable, considering concerns about the sustainability of subscription-based models for streaming growth?

AI: What are your views on the role of AI in the Indian media and entertainment industry? Do you foresee AI significantly affecting job dynamics?

And….Action!

Zee - Sony Merger Fallout:

The $10 billion Zee - Sony merger recently fell through. How do you see this impacting the broader industry?

Vanita:

The issue traditional media companies face globally is not that they are losing audiences - in many cases they are gaining them right back online. But that audience simply doesn't bring in the same revenue that it did offline. So while entire revenue streams go kaput they are not reborn online.

The audience is coming through large aggregators and platforms essentially Google/Meta, Amazon, Apple et al. Google, with revenues of $278 billion in the financial year ending September 2023, uses search and YouTube as the glue to keep audiences. The $127 billion Meta uses socialising to keep them coming to WhatsApp, Facebook or Instagram, the brands it owns. For the $554 billion Amazon, its video business is simply one of the carrots it uses to get people to buy more things on Amazon.

There is a club of $100 billion plus businesses, the tech-media majors, that now dominate every segment -music, film, TV, publishing - of what we knew as the media and entertainment business.

Where do legacy media companies fit? How do they compete?

Fox’s Rupert Murdoch was among the first to realise that there was no way he could take on a Netflix, let alone Google or Meta. In 2018 he sold his entertainment business to Disney for just over $71 billion. This triggered a wave of consolidation that continues. Remember that Disney, Paramount or even Sony are dictated by the American (and Japanese) stock markets that create far more value that the Indian one.

The choice then is clear – cut your losses and run or merge, scale up and fight.

That is what this merger was attempting to do. Its collapse so close to consummation has two implications.

It is bad news for India's roughly $25 billion media and entertainment business. And it sends all the wrong signals to anyone looking to invest in this market. It changes the India narrative on the sector.

The merged company would have had 24 per cent of the TV audience in India, a tad more than current leader Disney-Star’s 22 per cent. Unlike Sony, Zee has a strong presence across Hindi, Marathi, Tamil, Telugu, and other Indian languages. It also has a global footprint with 35 channels in 170 countries. It lacks sports and kids programming that Sony and its 27 channels have. Both have a strong film business and OTT platforms. Of the two, Zee has a stronger broadcasting business while Sony has a more robust digital one. At 33 million subscribers (direct and indirect) SonyLIV is the second largest pay streaming service after Disney+Hotstar (38 million) in India. It brings in roughly a third of Culver Max’s India topline.

Without the heft that being together gives Sony and Zee, either they become easy targets for a takeover or dissipate into irrelevance.

Reliance - Disney Star Merger:

How might this impact regional OTT players and the overall streaming industry?

Vanita:

The coming together of Disney-Star and Reliance Industries will create a behemoth that will be difficult if not impossible to battle.

Take the broadcast, digital and studio assets of Disney-Star - Star Plus and 70 other channels, the largest pay-streaming app Disney+Hotstar, movies such as Neerja and Brahmastra. Combine them with the 58 news and entertainment, digital brands and films from Reliance's Network18 - Colors, Moneycontrol, Drishyam 2, OMG2. You have a media conglomerate that would have a 32 per cent share of all TV viewership in India.

If all the streaming apps this duo owns - Voot, JioCinema and Disney+Hotstar - are merged into one it will be at 316 million unique visitors.

That is very close to the India reach of the world’s largest streaming app – Google’s YouTube.

Therefore, its impact will not be limited to regional OTT players. Disney-Reliance combined would make for a very large national OTT with a footprint in most major languages.

Comparing Indian TV & Streaming:

With the current industry landscape in mind, do you foresee the Indian streaming industry evolving similarly to Indian television? Are there lessons that streaming services can learn from TV?

Vanita:

On programming quality, production value, streaming is very much like film but on format, texture, monetisation it is closer to TV.

What it could really learn from television is fiscal discipline. It is learning that lesson albeit after spending crazy amounts on programming that was being offloaded at one go.

Ad Supported Streaming Models:

Most industry experts suggest a return to ad-supported streaming models. Do you believe this shift is inevitable, considering concerns about the sustainability of subscription-based models for streaming growth?

Vanita:

Both pay and ad supported models have a place in all markets. Pay will work at the top tier while the middle and bottom will be ad supported.

You can already see that happening as smart TVs take off streaming audiences are behaving exactly like they did with TV - they watch shows by appointment and come back regularly for their favourites.

This will help streaming push for more stable, larger audiences and therefore better CPMs. Am doing a large piece on work on this which will be published soon.

AI:

What are your views on the role of AI in the Indian media and entertainment industry? Do you foresee AI significantly affecting job dynamics?

Vanita:

Zee’s proprietary artificial intelligence (AI) tool, ScriptGPT which took 8-12 months to develop, is a product of Zee’s Technology and Innovation Centre in Bengaluru. Script GPT has been built by us using OpenAI and 1.3 million variables which include character archetypes, plot twists. It has been in regular use for the last four months on two of its popular shows. The tool helps figure out the impact on ratings of various tweaks in the script of an episode. Eros Investments is trying to develop a fully bound script using AI in conjunction with the Indian Institute of Technology, Mumbai.

Across the board Indian media and entertainment companies have taken to AI with gusto. According to EY, AI could add over Rs 45,000 crore in revenues to the Rs 2 trillion sector over five years. This figure is arrived at by looking at the opportunities for cutting costs, in some cases by 80-90 per cent. To this you add the increased chances for monetisation. For instance the ability to dub and subtitle in dozens of languages, quickly, means expanding the market for every show, film or piece of music.

While entertainment companies are using AI enthusiastically, news publishers and broadcasters are circumspect.

There are about half a dozen AI anchors being used by India's rambunctious 24 hour news channels in a bid to cut costs.

However a bulk of the usage of AI at Times Internet, Network18, Inshorts and many other news firms is about translating from one language to another, from text to audio, making summaries, giving headlines, streamlining workflows, video editing and writing tweets.

News publishers are extremely uncomfortable with the idea of using AI in core editorial functions. One, because how could AI possibly generate first-hand on ground news.

The other more important worry is the potential for misinformation. A hallucinating AI that generates false or completely cooked up news could lead to riots or conflict.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

One of my current favourite shows on OTT is Shark Tank India Season 3!

Watch India’s most exciting startups and entrepreneurs pitch their amazing ideas, products and services to a dynamic line up of judges.

Apart from the 6 existing Sharks - Aman Gupta, Amit Jain, Anupam Mittal, Namita Thapar, Vineeta Singh, Peyush Bansal, 6 new Sharks – Ritesh Agarwal, Deepinder Goyal, Azhar Iqubal, Radhika Gupta, Varun Dua and Ronnie Screwvala are introduced.

I love the energy, the way the sharks evaluate deals and most importantly the tenacity, grit and pitches of the entrepreneurs. Worth a watch!

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Download my market reports STREAMING in MENA and STREAMING in INDIA.

I also work with streaming services, content creators, platform providers or media consultants and help them upgrade their tech & diversify their revenues. Contact me here.