From Naruto to Hanuman: The Animated Genres Driving the Next OTT Boom

Global anime hits and homegrown Indian animation are redefining what, and how millions of Indians stream

Hey Streamers 👋,

A warm welcome to the 98th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

From Anime to Animation: Emerging Genres Winning India’s Streaming Audience

Anime’s Surging Popularity on Indian Streaming

Local Animated Originals Gain Traction

Major Streaming Platforms in India’s Animation Scene

Audience Demand and Outlook

And….Action!

From Anime to Animation: Emerging Genres Winning India’s Streaming Audience

India’s streaming landscape is experiencing a content revolution as animation and anime gain mainstream traction. Once considered niche, Japanese anime and other animated genres are now winning over Indian OTT audiences in huge numbers. Improved internet access, affordable subscriptions, and rich content libraries have made it easier than ever for Indians to enjoy animated content – from beloved childhood cartoons to cutting-edge anime series – on-demand. Streaming platforms are responding with expanded catalogs and originals in this space, recognizing that animation is no longer just for kids but a major draw for Gen Z and millennial viewers as well. The result is a vibrant new chapter for streaming in India, where anime and locally-produced animation are emerging as blockbuster genres alongside traditional live-action fare.

Anime’s Surging Popularity on Indian Streaming

Classic anime characters now light up streaming screens in India. Anime (Japanese animation) has exploded in popularity on Indian OTT platforms, transitioning from a niche subculture into a mainstream phenomenon. Surveys and streaming data indicate a surge in Indian anime viewership, with one study finding that India now ranks second only to China in overall anime audience size. In fact, an estimated 73% of Indians had watched some anime content by 2020, reflecting a massive appetite that has grown in recent years [timesofindia.indiatimes.com]. This trend is fueled by streaming accessibility and localization – many popular series are now available with Hindi, Tamil and Telugu dubs, lowering language barriers for fans outside the English-speaking urban centers. As a result, titles like Naruto, Dragon Ball Z, Attack on Titan, Demon Slayer and more have built big fanbases in India, with younger audiences binge-watching these series daily.

Social media buzz, fan conventions, and even Bollywood celebrity endorsements (e.g. actors lending their voices to Hindi dubs) have further propelled anime into the mainstream. The fandom is vocal and growing: more than 31% of global consumers now watch at least one anime series weekly, and Netflix reports that over half of its 300+ million subscribers (roughly 150 million people) watch anime content [timesofindia.indiatimes.com] . In India, this worldwide anime wave is clearly visible – streaming has made anime readily accessible, and Indian viewers are tuning in by the millions.

Local Animated Originals Gain Traction

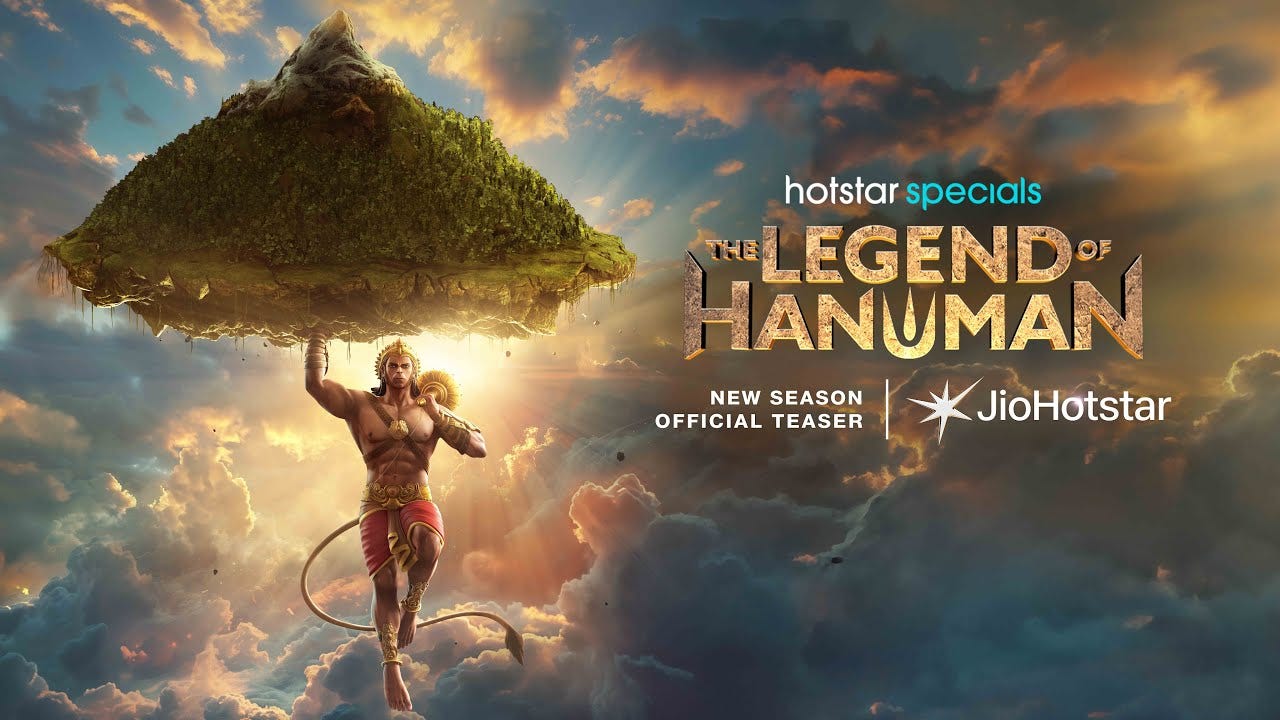

Anime isn’t the only animation genre on the rise – Indian-made animated series are also finding success on streaming platforms. In particular, mythological and fantasy animations based on Indian stories have struck a chord with broad audiences. A prime example is The Legend of Hanuman, a high-quality 3D animated series released as a Hotstar Original. Season after season, Hanuman has topped the OTT viewership charts in India, even outperforming many live-action shows [animationxpress.com] .

Recent data from Ormax Media (which tracks streaming viewership) showed The Legend of Hanuman Season 6 drew 5.8 million viewers within its first 3 days on Disney+ Hotstar – ranking as the #1 most-watched show across all Indian streaming platforms that week. Earlier seasons similarly dominated the charts, with Season 4 garnering 6.1 million views in its first week.

Another hit, Baahubali: Before the Beginning – Crown of Blood (an animated spinoff of the Baahubali film franchise), also climbed to the top of Hotstar’s rankings and amassed 11 million viewers in its first 3 weeks. These successes are groundbreaking – it’s unprecedented for two animated series to grab the top slots in India’s streaming top 10, surpassing all live-action content. It signals that Indian audiences are increasingly open to animation aimed at older age groups, not just children. As Baahubali creator S.S. Rajamouli (who co-produced Crown of Blood) put it, the goal is to “reshape Indian animation for a broader audience beyond kids.” economictimes.indiatimes.com.

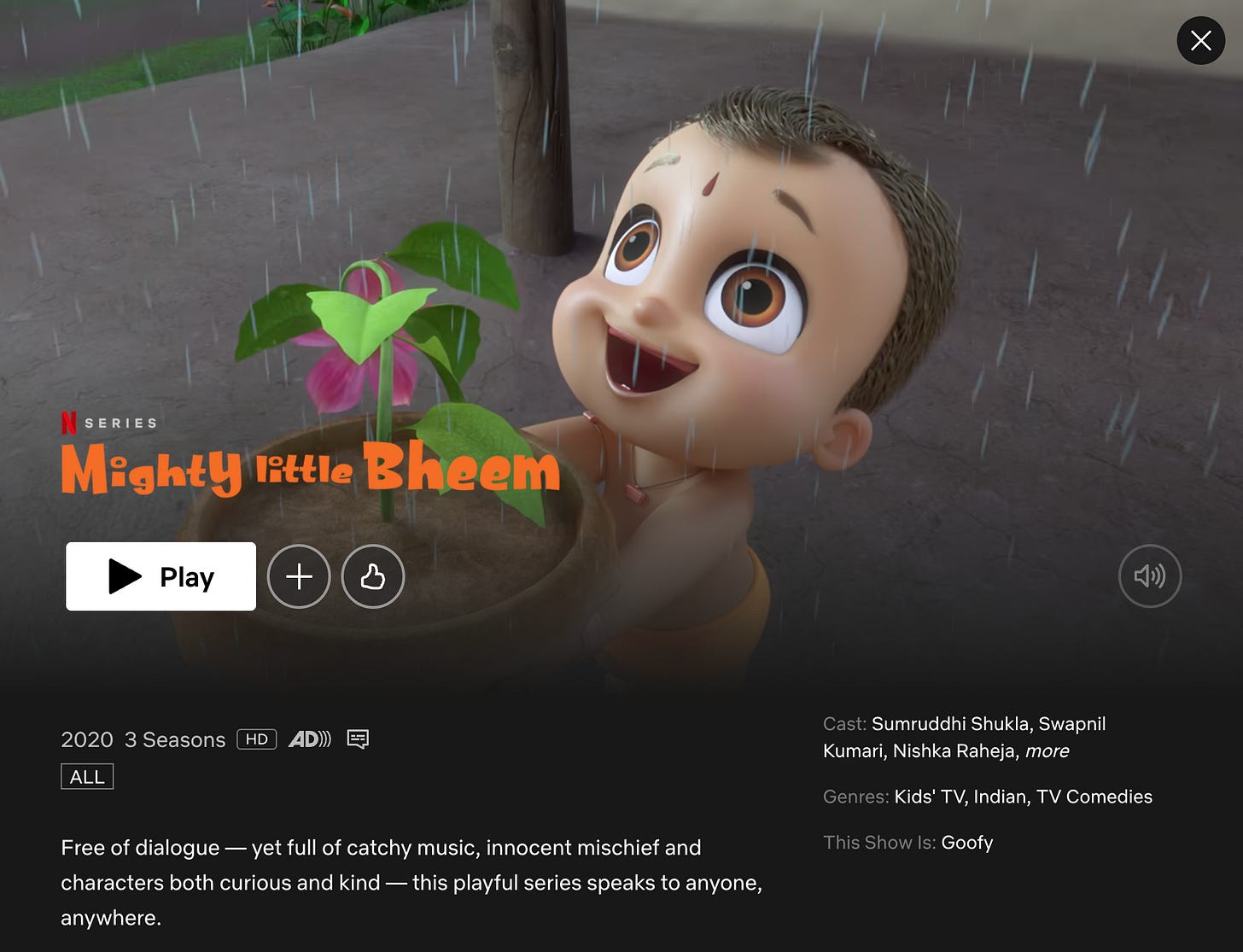

The approach is working: by blending familiar Indian characters and epics with high production values, these shows have attracted family and youth audiences at scale. Global streamers are taking note too – Netflix’s first Indian animation original for children, Mighty Little Bheem, became a global hit viewed by over 27 million households worldwide, demonstrating the international potential of Indian animated IP. All told, whether it’s Japanese anime or homegrown Indian cartoons, animated content has proven its ability to win over India’s streaming audience when it combines strong storytelling with cultural resonance.

Major Streaming Platforms in India’s Animation Scene

Multiple OTT players in India are now competing to serve this booming demand for anime and animation.

India’s animation and anime streaming market is now a fiercely competitive arena, with major OTT players adapting their strategies to capture a growing and diverse audience. JioHotstar continues to dominate family and kids’ animation through its vast library of Disney and Pixar films, Marvel/Star Wars animated series, and household anime names like Doraemon, Shin-chan, and Pokémon, all localized into Indian languages. Its original Indian animation hit The Legend of Hanuman further strengthens its local appeal. With freemium access and premium plans starting at ₹499 / year [mobile only], JioHotstar remains a mass-market leader, leveraging both global franchises and local productions. Amazon Prime Video takes a bundled approach, offering a wide mix of kids’ and adult animation, alongside an affordable Crunchyroll add-on at ₹79/month for anime enthusiasts. Standouts here include Demon Slayer, Goblin Slayer, and Iruma-kun, in addition to original titles like Baahubali: The Lost Legends. Netflix, meanwhile, pushes aggressively into anime, carrying global hits (Naruto, Death Note, Cyberpunk: Edgerunners) and producing local gems like Mighty Little Bheem, catering to both mobile-first viewers at ₹149/month and premium family audiences.

Specialist player Crunchyroll has rapidly emerged as India’s anime powerhouse, becoming the country’s second-largest user market within months of launch. With 800+ titles, over 80 dubbed in Hindi, Tamil, or Telugu, and pricing starting at just ₹79/month, Crunchyroll’s local-language strategy is resonating — 65% of its India viewership comes from dubbed content. Its deep catalog, simulcast availability, and fan-focused outreach (Comic Con sponsorships, celebrity ads) make it the go-to for dedicated anime fans, featuring titles like One Piece, Solo Leveling, and Naruto Shippuden.

JioHotstar’s Anime Hub, launched in partnership with Muse Asia, is another sign of anime’s mainstreaming. With 60 titles like Spy x Family, Tokyo Revengers, and Sword Art Online, and aggressive pricing for early adopters, Jio is targeting its massive base of price-sensitive users. While its catalog is smaller than Crunchyroll’s, Reliance’s resources could enable further expansion and even original productions in the future.

The broader ecosystem includes Sony LIV (historically tied to Animax), Zee5, and AVOD services like YouTube and MX Player, which offer free access to Hindi-dubbed anime and kids’ cartoons. Official YouTube channels (e.g., Muse Asia, Toei) and ad-supported experiments from MX Player show that anime can draw significant AVOD traffic, especially among cost-conscious viewers. Together, these players are shaping a layered market: premium SVOD platforms attract paying fans with depth and exclusivity, while free services serve as on-ramps for new audiences. The more prolific animation hubs are Netflix for its global anime and original Indian animation, Crunchyroll for breadth and hardcore anime appeal, and JioHotstar for aggressively priced mainstream anime offerings — a mix that reflects both India’s price sensitivity and its fast-growing appetite for animated storytelling.

Audience Demand and Outlook

All indicators suggest that India’s appetite for anime and animation will continue on its sharp upward trajectory. The audience demand is already substantial – for instance, one industry survey found 83% of Indian respondents preferred anime over other forms of animation when given a choice [timesofindia.indiatimes.com] . This aligns with global data showing anime to be one of the fastest-growing content genres (118% demand growth worldwide from 2020–2022) [restofworld.org]. The big streaming platforms are taking note of this demand: Netflix’s content strategy now prominently features anime (with numerous new titles announced at Anime Expo 2025), Amazon is integrating anime channels, and JioHotstar is leveraging its anime-filled kids lineup – all of which validate that anime/animation is driving engagement.

In terms of subscriber numbers, the platforms that effectively supply animated content have seen gains. Netflix, for example, credited its anime investments as a factor in its India growth – it ended 2024 with ~16% share (up from 13%) [medianews4u.com]. Meanwhile, Amazon Prime Video’s ~20 million Indian users remain solid, and Amazon’s push into anime could help with retention of younger subscribers who might otherwise churn to specialized services.

The entry of Crunchyroll and others adds healthy competition, but also grows the pie by converting former pirates and expanding the fan community. Industry analysts project the Indian anime market to grow at ~13% CAGR through 2028, on track to exceed $5 billion by 2032 [restofworld.org]. Importantly, there is still a huge untapped audience: India has over 500 million internet users and OTT viewers, but only a fraction are currently tuning into anime regularly. As connectivity spreads and content becomes even more localized (e.g. upcoming Indian-themed anime productions by Crunchyroll and others), we can expect animation’s reach to broaden to smaller towns and regional-language audiences.

The cultural acceptance of animation as a valid entertainment choice for adults is also rising in India – a significant shift from a decade ago. With fan conventions thriving and merchandise sales for anime skyrocketing in the 15–30 age group, the ecosystem around streaming content is flourishing too. In summary, from Naruto to Hanuman, and from subscription giants to ad-supported upstarts, animation is no longer on the fringes of India’s streaming sector – it’s a central growth driver.

Streaming platforms that embrace these emerging genres and curate them smartly are winning India’s audience today, and stand to reap huge rewards as this animated content boom enters its next phase. The competition will be intense, but one thing is clear: India’s streaming viewers are happily along for the ride, eyes glued to the colorful worlds of anime and animation like never before.

Mighty Little Bheem is an animated children series, Netflix's first animated series from India . It follows an innocent but super-strong toddler, Little Bheem, on his mischievous adventures in a small Indian town. The toddler is a baby version of the mythological-inspired 9-year-old character from the popular Indian series action comedy animated series Chhota Bheem which has aired on Turner Broadcasting's Pogo TV channel from 2008! Enjoy.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” / sports tech fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.