How Amazon plans to win Streaming in India with MX Player?

The Streaming Lab #49

Hey streamers 👋

Welcome to the 49th edition of The Streaming Lab. Thanks for reading me.

A big thank you to our sponsor of the week: White Peaks Solutions, a media and Tech company that provides end to end OTT solutions.

If you read my newsletter, you know I write a lot about MBC Shahid: the leading streaming service in MENA. I track everything they do, the latest TV series available, their new FAST channels, and the Tech providers they partner with. MBC has chosen KWIKmotion’s Clipping feature to optimize their publishing process.

KWIKmotion, a product of White Peaks Solutions, is a complete video suite that provides a clipping tool unlike any other. It allows users to easily create clips of any length from their video content, making it easier to share and distribute on various platforms. Mofeed Alnowaisir, the Director of Digital at MBC is the best one to talk about it: “KWIKmotion offers precisely what MBC’s digital team requires.”

KWIKmotion also offers a variety of essential video tools including video editing, video compression, and video transcoding. You can get more details below and/or meet them at CABSAT next week

Whenever you’re ready, there are many ways I can help you:

Promote your company by sponsoring this newsletter [NEW]

Work with me 1:1 to diversify your streaming revenues

Join 35+ companies using the market report Streaming in MENA [2023 EDITION]

Read all the previous editions of The Streaming Lab

And… ACTION!

This week’s program

Amazon is in the process of acquiring one of India’s most successful streaming service MX Player. Why?

From video player to OTT leader

5 reasons why Amazon is buying MX Player

Do you really know the local streaming ecosystem in India?

From video player to OTT leader

As its name indicates, MX Player was launched as a video player in July 2011. MX Player was relaunched as an OTT platform in February 2019, with a mix of originals, Indian and international studios.

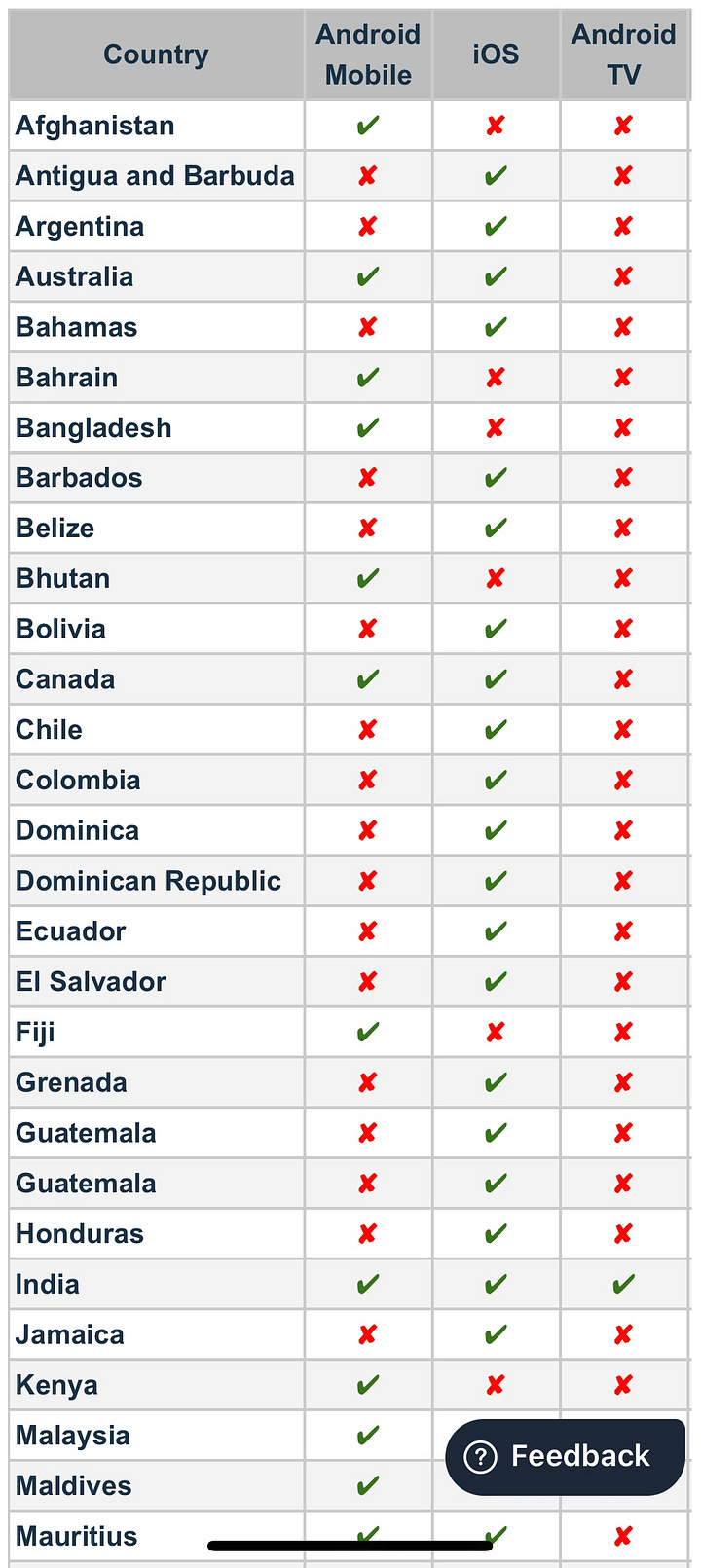

In March 2020, MX Player expanded outside of India in the US, UK, Australia, New Zealand, Pakistan, Bangladesh and Nepal. The service is now global in 20+ markets, and is available on Android, iOS, Web, Amazon Fire TV Stick, Android TV and OnePlus TV amongst others.

Here is the full list of the countries where MX Player is available:

Let’s now have a look at MX Player’s business models, audience and content strategy:

Business model

MX Player is an Hybrid service AVOD + SVOD, offering 3 main premium subscription plans:

MX Gold (India only - INR 499/year)

MX One (Limited countries - $16.99/year - $4.99/quarter)

MX Player Pro (Paid App version - $5.99)

Audience

MX Player has built the largest digital entertainment ecosystem in India with 1Bn+ App downloads on Android, targeting a large and diverse audience base in India (78 million Monthly active users) as well as globally.

Over 80 per cent of MX users are under the age of 34, keen on viewing free video content on mobile.

Content

MX Player offers 200,000 hours of Hollywood & Indian content, across 10 languages. The SVOD pack offers 70+ premium originals, also available in various Indian languages.

Here are some examples of content available: SBS Contents Hub, Radiant Media, Kumar Films, Paramount, Electric Entertainment, Sony Pictures Television, Hungama, Kala Chashma Entertainment, Sumeet Music, Pocket Films, All3Media, Sabbatical Entertainment, Real Reels Entertainment, Royal Raj Productions, Green On The Wall, Switch International, Echelon Studio, One Media ET, Vega Entertainment, Star Entertainment, Swami Films, Ramdhanu Entertainment Ventures, Millennium Video Vision, Chithralari Production, Rachel & Sam Media & Entertainment Private Limited, etc.

5 reasons why Amazon is buying MX Player

Reason #1: Become the number 1 streaming service in India

Disney+ Hotstar is today the market leader in paid OTT subscriptions with more than 50 million users, followed by Prime Video (28 million) and Netflix (6 million). With the acquisition of MX Player and its 78 million users, Amazon could become four times bigger in terms of consumer acquisition.

Reason #2: Tap into India’s Free Streaming user base

MX Player built its customer base among a young audience, watching video content on mobile phones without large subscription fees. With this acquisition, Amazon can access a new market with a potential of 184 million people.

Reason #3: Target regional audiences

54% of content produced for OTTs by 2024 will be in languages other than Hindi and English. Amazon already integrates OTTs targeting specific language audiences as separate paid services: ManoramaMAX (Malayalam), Hoichoi (Bengali), and NammaFlix (Kannada). The acquisition of MX Player should bring a large customer base looking for regional content.

Reason #4: Compete with the main streaming players

With Netflix and Disney+ Hotstar struggling with issues related to production of original content and losing of sports viewers respectively, Amazon can establish itself as the dominant leader in India’s OTT market. It’s also the only way to compete with JioCinema and its aggressive customer acquisition strategy.

Reason #5: The deal looks good

Times Internet Ltd acquired MX Player for an estimated sum of Rs 1,000 crore in 2018. Amazon could acquire MX Player around $45-50 million, which is between Rs 350-Rs 400 crore. It looks like a good deal to get the third most downloaded OTT App globally in 2022, and the most downloaded App in India.

Do you really know the local streaming ecosystem in India?

I’m sure you’ve heard about the main Indian streaming players: Disney+ Hotstar, Eros Now, JioCinema, ShemarooMe, SonyLIV, Sun NXT, YuppTV, Zee5, etc. But do you know them all? Can you differentiate them from each other? Or can you keep track of the newcomers in a market growing at a 20% annual rate?

That’s why I’m preparing a market report called STREAMING in INDIA, including 20+ data points:

Launch date

Business models

Subscription tiers and pricing

Desktop and mobile Web visits

Age and gender distribution

Content type, sections and genres

Content and platform languages

Devices available

Concurrent streams

Individual profiles

Register your interest for the upcoming market report STREAMING in INDIA here.

That’s all for today, who’s MX Player and why Amazon is buying it.

See you online next week. Until then, enjoy SILO on Apple TV+ (Yes I just love sci-fi ;) The pitch: In a ruined and toxic future, thousands live in a giant silo deep underground. After its sheriff breaks a cardinal rule and residents die mysteriously, engineer Juliette starts to uncover shocking secrets and the truth about the silo.