How can local OTTs compete against their international counterparts?

Creating a level playing field for the "Indian" streaming space

Hey Streamers 👋,

A warm welcome to the 45th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join 3,000+ others who receive it directly in their inbox every Wednesday.

Netflix and Amazon Dominate Commissioning by Streamers, Tilting the Content Market Away From U.S., Towards Local: Study

Netflix and Amazon have regained their leading positions in commissioning original content globally in Q1 2024, according to Ampere Analysis. This resurgence follows a period where studio-backed platforms gained traction but have since scaled back due to Hollywood strikes, rising costs, and Wall Street pressures. Netflix hit its highest number of new titles since Q3 2021, while Amazon set a new quarterly record. Together, they accounted for 53% of global commissions.

The report highlights a strategic shift, with both giants now ordering most of their content from outside the U.S. due to market saturation and a focus on local markets. Netflix has significantly increased its commissions in Western Europe and the Asia-Pacific, with India and South Korea being key markets. For instance, Netflix's Western European commissions nearly matched its North American titles, and in India, it focused on crime and thriller genres, anticipating the country to become its largest subscriber hub in the region.

Amazon is particularly concentrating on India, commissioning a record 37 titles in Q1 2024, aiming to compete with strong local players. Its approach includes increasing investments in international movie orders and leveraging its acquisition of MGM to enhance its original movie slate.

Germany and Thailand also saw substantial increases in content orders, with Germany leading in Western Europe and Thailand showing the largest individual rise in Asia.

Both companies are reducing their U.S. original movie commissions, focusing more on international productions. This global strategy is driven by the need to expand their subscriber bases in diverse markets and leverage local content's appeal.

In summary, Netflix and Amazon's focus on non-U.S. markets reflects a strategic shift to stimulate subscriber growth and diversify their content offerings, responding to market dynamics and local demand.

Today’s program:

Fostering Local Content to Compete with Global Giants

And….Action!

Fostering Local Content and Platforms to Compete with Global Giants

Preface

This newsletter is not an attempt to posture an "us" vs. "them" showcase but to kick-start a constructive dialogue to protect and nurture the interests of the Indian viewer, streaming subscriber and streaming industries.

Our goal is to ensure that local talent, employment, and the media/entertainment economies in India are sustained and can grow and compete well with global giants. The interests of the Indian consumer are at the beating heart of this debate.

In recent years, India has witnessed an explosion in the OTT market, driven largely by affordable data plans and widespread smartphone usage. Despite the dominance of global players like Netflix and Amazon Prime Video for SVOD content, the local OTT ecosystem holds immense potential, needing strategic support and innovation to level the playing field. The thoughts and suggestions that follow explore how local content owners and platforms can rise to compete effectively against these giants, ensuring a diverse and competitive market landscape.

The Need for International OTTs to Invest in Local Content

International OTT platforms have significantly impacted the Indian market, yet there remains a strong need for these giants to invest more deeply in local content. One can argue that the growth of local content production by these companies has been on an upwards trajectory, however folks who we speak to in the industry argue that a lot more can be done especially when it comes to under-represented content such as kids, documentaries, Bhojpuri / Bengali / Gujarati / Punjabi content and so on. This investment is not only crucial for fostering cultural diversity but also for capturing the unique narratives that resonate with Indian audiences. In addition, the $$ that flow into the local / under-represented media industries / verticals will also help create more jobs and help additional content production leading to more options for local OTTs to access revenue opportunities for themselves as well.

Supporting Local OTT Platforms

The Need for Patient Capital

One of the primary challenges local OTT platforms face is the lack of patient capital. Unlike global giants backed by extensive financial resources, Indian OTT platforms often struggle with funding constraints that limit their growth and innovation capabilities. To address this, there is a crucial need for both government support and private investments focused on long-term growth rather than immediate returns.

Government Support: The Indian government can play a pivotal role by offering financial incentives, tax breaks, and grants to local OTT platforms. Additionally, establishing dedicated funds for the media and entertainment sector can provide the much-needed patient capital.

Private Investments: Encouraging venture capitalists and private equity firms to invest in local content platforms can help them scale operations, innovate, and compete more effectively. Investments should focus on technological advancements, content creation, and market expansion.

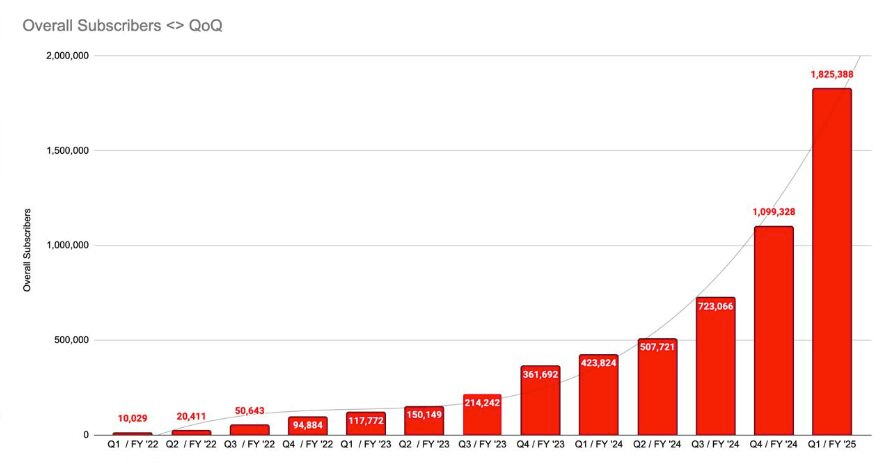

Sample VC Investments in Indian OTT Platforms:

Stage OTT: This hyperlocal content platform raised funds from Blume Ventures and others to expand its regional content library and enhance its technology stack (Bain) (LiveMint) .

Sharechat: A short-form video app that has attracted significant investments from Tiger Global, Twitter, and Lightspeed Venture Partners to boost its content offerings and user engagement (Bain) .

DailyHunt / Josh: This platform secured funding from Google, Microsoft, and AlphaWave, focusing on expanding its short-form video content and enhancing its AI capabilities for better user experiences (Bain) .

India Entry Premium for International & the Top Indian OTT Platforms

International OTT platforms along with leaders like Reliance Jio (JioCinema) should also contribute to the growth of the local ecosystem by paying an "India entry" premium. This premium would be directed into a "Creator Economy Fund" administered through a public-private partnership between the government and the top 10 media companies in India, each holding equal voting rights.

Purpose of the Creator Economy Fund:

Support Startups: The fund would provide financial support to startups in the creator economy, fostering innovation and new business models.

Funding Streaming Startups: It would help emerging streaming platforms scale up and compete with established players by providing necessary financial resources.

Boost Media Companies: Media companies focusing on India can utilize the fund to enhance their content libraries, invest in new technologies, and expand their market reach.

This fund would ensure that the economic benefits of international OTT operations in India also contribute to the development of the local media and entertainment ecosystem, fostering a more balanced and competitive market.

Supporting Data Points:

The Indian OTT market is expected to reach $5 billion by 2024, fueled by affordable data plans and widespread smartphone use.

The number of OTT subscribers in India is projected to reach 500 million by 2024, with mobile devices being the primary access point.

OTT platforms are expected to invest over $2 billion in original content production by 2024.

Embracing Hyperlocal Content and Platforms

Local platforms like Stage OTT have shown that hyperlocal content can capture significant audience interest. Stage OTT, for example, focuses on dialect-based content, catering to non-urban audiences in states like Uttar Pradesh, Bihar, Haryana, and Rajasthan. This model can be replicated and expanded across various regions in India to create a rich tapestry of localized content that resonates with diverse audiences.

Best Practices from Stage OTT:

Dialect-Specific Content: Creating content in local dialects to cater to regional audiences.

Community Engagement: Building strong community ties through local stories and cultural narratives.

Innovative Monetization: Integrating e-commerce and other revenue streams within the platform.

Exciting Distribution: Ingenious plans working with local “kirana” stores and “paan - beedi” (hyper local shops selling paan - Indian mouth sweetener, freshener, and digestive made from betel leaves) incentivizing them to sell Stage OTT subscriptions to the masses.

Data Points:

Stage OTT offers its subscription at INR 399 annually, making it affordable for a wide range of users.

Platforms like OTTPlay (INR 360 annually) and Eros Now (INR 399 annually) provide budget-friendly options compared to global giants like Netflix (INR 5988 annually).

Leveraging AI for Content Localization

To compete with the content libraries of Netflix and Amazon Prime Video, Indian platforms must harness AI technologies for content localization. AI can be used for dubbing, subtitling, and content personalization, making regional content accessible to a broader national audience.

AI Tools in Action:

Dubverse: An AI tool that helps in dubbing content into multiple Indian languages, enhancing reach and engagement.

Frammer: This tool offers automatic transcription, captioning, and content editing, making the process efficient and cost-effective.

Enhancing Regional Platforms with National Appeal

Platforms like SunNXT, Malayala Manorama, ShemarooMe, and HoiChoi have strong regional followings. By leveraging AI to provide Hindi and English subtitles and also other audio language dubs, these platforms can attract a national audience, thereby increasing their subscriber base and improving their competitive edge.

Strategic Steps:

Subtitles and Dubbing: Implementing AI-driven subtitles and dubbing to make content accessible across language barriers.

Content Diversity: Expanding content libraries to include a mix of regional and national content.

Cross-Promotion: Collaborating with other platforms and media outlets for broader visibility and reach.

Data Points:

Sun NXT (INR 799 annually), ManoramaMAX (INR 899 annually), and HoiChoi (INR 999 annually) offer competitive pricing, appealing to a diverse audience base.

Creating a Better Playing Field

While Reliance Jio stands as a formidable local competitor (well its a monopoly if the Disney+ Hotstar merger goes through the Competition Commission of India approvals), the Indian OTT landscape needs more players to step up. Government policies and industry collaborations can help create a supportive ecosystem for local platforms to thrive.

Policy Recommendations:

Regulatory Support: Developing regulations that protect local content creators and platforms from being overshadowed by global giants.

Infrastructure Development: Investing in digital infrastructure to improve streaming quality and accessibility in rural and semi-urban areas.

Content rules: Implementing content quotas that require a certain percentage of local content on all streaming platforms operating in India.

Brand-Supported Content Creation Strategy

Involving brands in OTT content creation can help reduce costs, increase the velocity of content creation, and enhance viewer engagement. Here are some best practices and strategies for implementing brand-supported content creation:

Brand Partnerships: Collaborate with brands to co-create content that aligns with their marketing goals while providing value to the audience. Brands can fund content production in exchange for integration and exposure.

Interactive Content: Develop interactive content that allows viewers to engage with the brand within the OTT environment. This can include shoppable ads, where viewers can purchase products directly from the content.

Influencer Collaborations: Leverage influencers and micro-influencers to create content that resonates with their followers. Influencers can bring authenticity and a built-in audience to the platform.

Indian Examples:

The Viral Fever (TVF): Pioneered brand-supported content creation with its web series "Permanent Roommates," funded by Ola. This collaboration set a precedent for integrating brands into engaging, narrative-driven content.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

A gripping newsroom drama with two seasons on Zee5 is worth a watch for some great performances by Jaideep Ahlawat, Sonali Berndre and Shriya Pilgaonkar - two news channels have opposing principles which leads to a fierce rivalry and more.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on the Indian and Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.

Download our market reports STREAMING in MENA and STREAMING in INDIA.