How Netflix Is Riding the Bundle Wave to Reach the Next 100 Million

Tracking the Netflix bundling strategy in India just as their Shahid partnership breaks the internet in the Middle East

Hey Streamers 👋,

A warm welcome to the 96th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

Netflix’s Bundling Strategy in India: Tying Up with Telcos for Growth

Netflix Bundles in India: Jio, Airtel, Vi and More

Why Netflix Is Embracing Bundling in India

The Downsides and Challenges of Bundling

And….Action!

Netflix’s Bundling Strategy in India: Tying Up with Telcos for Growth

Today’s newsletter takes inspiration from the news that is breaking the internet in the Middle East - Netflix made headlines by joining forces with MBC Group’s Shahid streaming service in the Middle East, offering a joint “Shahid+Netflix” subscription on the new MBC+ bundle! Such partnerships promise convenience (one bill, one app) and savings for consumers (MBC claims over 20% savings versus separate subscriptions).

Netflix has long been known for its standalone streaming service, and in India the company has increasingly taken a bundled approach in the recent past. Facing a price-sensitive market and stiff competition, Netflix has begun partnering with telecom operators, broadband providers, and aggregators to offer its service as part of larger packages. This strategy – already common for rivals like JioHotstar or Amazon Prime Video – marks a significant shift for Netflix in India. It mirrors a broader global trend: from the Middle East to the US, streaming platforms are teaming up with other services to reach more users. But what exactly does Netflix’s bundling play look like in India, and what are the pros and cons of this approach?

In this edition, we’ll evaluate Netflix’s bundling strategy in India – which telecom and platform deals are in place, and how they might benefit or complicate Netflix’s growth in the country. We’ll also touch on emerging opportunities (like new bundle channels or payment partnerships) and weigh the advantages versus pitfalls of riding the bundle bandwagon in the Indian streaming market.

Netflix Bundles in India: Jio, Airtel, Vi and More

Until recently, Netflix India subscriptions were sold mostly direct-to-consumer, but that is rapidly changing. Today, all three major Indian telcos – Reliance Jio, Bharti Airtel, and Vodafone Idea (Vi) – bundle Netflix into certain plans, alongside a growing number of broadband and TV platform deals. Here’s an overview of where Netflix is packaged in India:

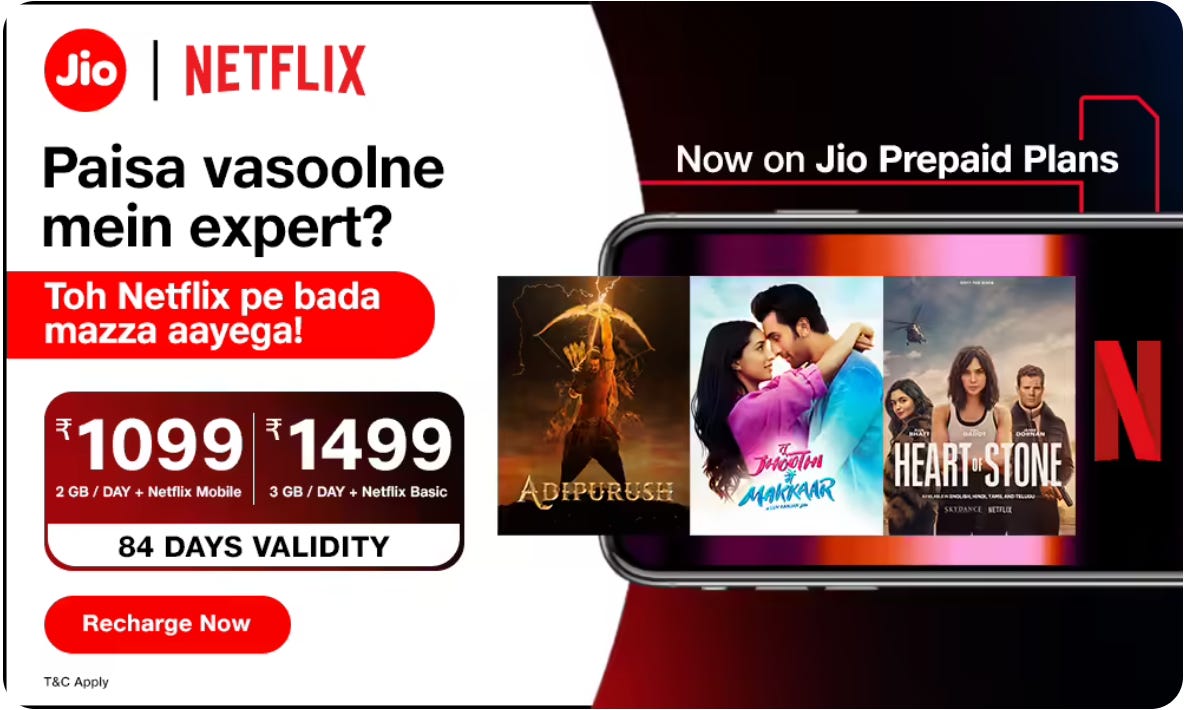

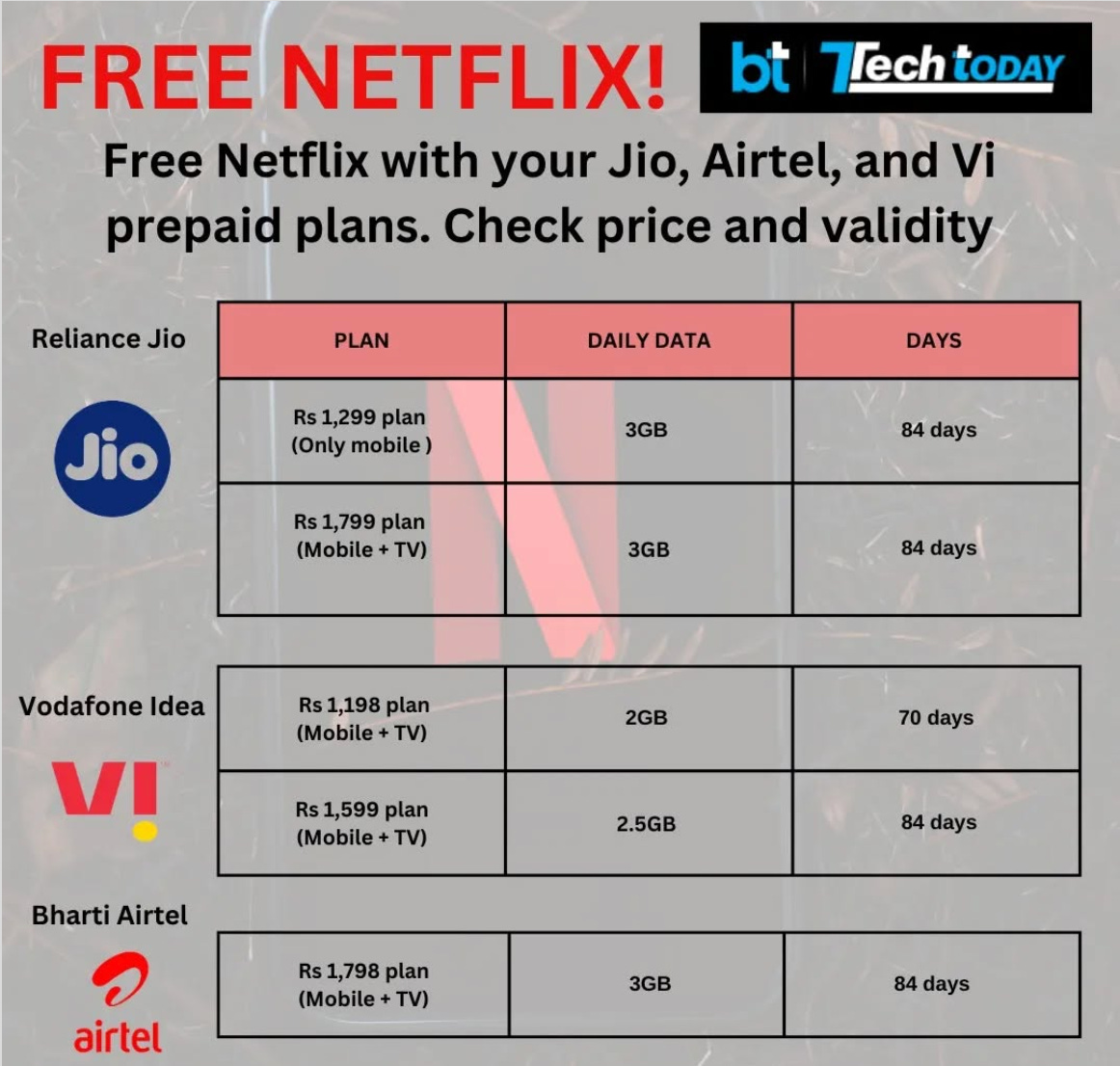

Reliance Jio (Mobile) – In August 2023, Reliance Jio announced a “first-of-its-kind” prepaid mobile deal with Netflix. Jio launched two 84-day prepaid recharge packs that include Netflix: a ₹1,099 plan with Netflix Mobile (one-screen mobile-only access) and a ₹1,499 plan with Netflix Basic for larger screens. These plans also came with generous 5G data (2GB/day on ₹1,099; 3GB/day on ₹1,499) and unlimited calls. It was the first time Netflix partnered with an Indian telecom for prepaid service – previously, Netflix was offered only on Jio’s postpaid and fiber plans. By extending to prepaid (which dominates India’s mobile market), Netflix instantly gained potential access to Jio’s ~450 million user base. Jio’s move also one-upped rivals, who at the time bundled Disney+ Hotstar with their plans. The strategy seems to be evolving: by 2024 Jio revised its Netflix prepaid offers, introducing higher-data packs at ₹1,299 and ₹1,799 (84-day validity) that include Netflix Basic. In other words, Jio is leveraging Netflix to entice heavy data users and add value to pricier recharges.

Bharti Airtel (Mobile) – Airtel initially dabbled in Netflix bundling via short trial offers on postpaid plans (notably a 3-month Netflix gift on select plans back in 2018-19). But in 2024, Airtel jumped in more fully. It launched an “All-in-One” OTT bundle pack for prepaid users, which for ₹279/month includes Netflix Basic, along with subscriptions to other platforms like Amazon Prime Video (mobile), Disney+ Hotstar, Zee5 and more (This pack essentially turns an Airtel recharge into a mini streaming bundle.) For higher-data needs, Airtel’s top-tier traditional plans also embraced Netflix – e.g. a ₹1,798 prepaid plan with 84 days validity mirrors Jio’s offering, packing 3GB/day data plus Netflix Basic and other perks. On the postpaid front, Airtel’s premium Airtel Black plans (combined mobile+broadband+DTH bundles) have started to include Netflix as well. In short, Airtel now sees Netflix as a sweetener to attract premium customers, just as it has long offered Amazon Prime or Hotstar on some plans.

Vodafone Idea (Vi) – Despite its financial struggles, Vi too has turned to Netflix to bolster its appeal. In mid-2024 Vi announced it is “the only operator to offer Netflix Basic under ₹1000” in a prepaid bundle. Vi introduced two Unlimited prepaid packs (roughly ₹1,099 and a slightly cheaper option) that come with unlimited calls, data, and Netflix Basic for 84 days. These give Vi users Netflix access on mobile or TV, similar to the Jio/Airtel offerings. Previously, Vi’s focus was bundling cheaper services (it had deals for Zee5 or SunNXT, and offered Amazon Prime on some postpaid plans). Now, with Netflix in the mix, Vi hopes to lure high-ARPU users despite lacking 5G service. The telco has said it will expand Netflix bundling to postpaid plans as well – likely to its REDX premium tier. For Vi, partnering with the world’s top streaming brand is a bid to stay relevant and retain subscribers, especially as Jio and Airtel race ahead in network upgrades.

Broadband and TV Bundles – Netflix is also being woven into home broadband and TV subscription bundles:

> JioFiber/AirFiber: Reliance’s fiber broadband service initially included Netflix only on its very high-end plans (₹1,499+). But in May 2024, Jio launched a new ₹888 per month postpaid broadband plan that packs 15 OTT apps — notably Netflix Basic, Amazon Prime (Lite), Disney+ Hotstar, JioCinema Premium, SonyLIV, Zee5 and others. This was a significant move: bringing Netflix and other premium services to an entry-level 30 Mbps plan. JioFiber users on this plan get unlimited data plus the full array of streaming apps as a value bundle. The ₹888 plan essentially democratizes the “streaming combo” that was once reserved for higher-paying customers, signalling Jio’s intent to drive broadband uptake with entertainment. (It also mirrors Jio’s mobile strategy of using content to sell data packs.)

> Airtel Xstream Fiber: Bharti Airtel’s broadband has similarly embraced OTT bundling. In 2023 Airtel started offering Netflix on select high-speed plans (for example, its ₹3,999 1 Gbps plan includes Netflix, Amazon Prime and Disney+ Hotstar by default). By mid-2025, Airtel went further, revamping its 100 Mbps plans to include Netflix even at lower price points. A new ₹999 fiber plan offers unlimited 100 Mbps internet plus Netflix (Standard with ads), Apple TV+, Amazon Prime Video, Disney+ Hotstar and 20+ other services via the Airtel Xstream app. The ₹1,199 plan even adds IPTV with 350+ live TV channels on top of those OTT subscriptions. Essentially, Airtel is bundling an entire entertainment suite – streaming apps and live TV – with broadband to create a one-stop package. Netflix’s inclusion here shows it’s now a standard part of the Indian “triple-play” offering (internet + TV + OTT). Customers benefit from convenience (one bill, integrated viewing via Airtel’s STB or app), while Airtel hopes the content library justifies higher broadband ARPU.

> Tata Play Binge (DTH + OTT): Even traditional DTH players have brought Netflix on board. Tata Play (formerly Tata Sky) launched Binge Combo packs in 2022 that combine linear TV channels with OTT app subscriptions, including Netflix. Users can customize packs with various channel bouquets and apps. For instance, Tata Play’s Netflix Combos start around ₹399–₹449 per month for a basic TV+OTT package. Higher tiers include Netflix (Basic or Standard plans) along with Amazon Prime, Zee5, SonyLIV and more. The appeal is similar: a bundled discount and single interface (the Tata Play Binge box or app) for all content. While these combos require the user to have a Tata Play DTH connection, they blur the line between cable and streaming. Netflix’s presence on Tata Play Binge signaled an early willingness (back in 2022) to be part of aggregated offerings in India. It acknowledged that many Indian viewers still use set-top boxes and might prefer to pay one company for “TV + Netflix” together.

Emerging tie-ups: Beyond telcos and broadband, Netflix hasn’t extensively partnered in other domains yet – but we see hints. For example, some credit cards and digital wallets in India offer rebates or perks on OTT subscriptions (mostly for services like Amazon Prime or Hotstar – Netflix has been a notable holdout in such promotions). The idea of getting a “free Netflix” with your credit card spend is still novel in India; most banks instead bundle more affordable services (as per a Mint report, cards often give free Amazon Prime or TimesPrime membership, but not Netflix). Netflix’s stance of not discounting its product means it hasn’t done the kind of tie-ups Spotify or others have with, say, Times Prime or Flipkart deals. However, as competition grows, we may see creative offers – e.g. a premium credit card covering your Netflix bill as a loyalty reward, or e-commerce memberships adding Netflix as a perk for higher-tier customers.

Why Netflix Is Embracing Bundling in India

Netflix’s pivot to bundling isn’t happening in a vacuum – it’s a response to the realities of the Indian market and Netflix’s own journey here. After a lukewarm start, Netflix has spent the past couple of years fundamentally retooling its India strategy. In fact, Netflix’s leadership outlined a three-pronged approach: improve content, cut prices, and partner with telcos. Let’s unpack why bundling with partners makes sense for Netflix at this stage:

Reaching Price-Sensitive Consumers: India has hundreds of millions of potential streaming viewers, but most are unwilling (or unable) to pay international-level prices. Netflix learned this the hard way – its initial high pricing meant subscriber growth lagged. In late 2021, Netflix slashed its subscription fees by 18–60%, making the Mobile plan ₹149 (down from ₹199) and Basic ₹199 (formerly ₹499). That helped, but bundling takes affordability a step further. By folding Netflix into a package that users are already paying for (a phone bill or broadband), the perceived cost of Netflix drops. For example, a Jio user paying ₹1,499 for 84 days of service with Netflix might justify it as “getting Netflix effectively for free” during that period. Bundling can thus rope in customers who may never shell out ₹199/month separately for Netflix, but will gladly take it as a value-add with a service they do prioritize (data and voice). In a way, it sidesteps India’s low willingness-to-pay barrier by hiding the cost in a larger bundle.

Leveraging Distribution Networks: Partnering with big telcos gives Netflix an incredible distribution boost. Jio touts over 400 million prepaid subscribers; Airtel and Vi add hundreds of millions more. These companies have retail reach into every town and village, via recharge shops and sales agents. By tying up with them, Netflix piggybacks on that network. Notably, Netflix can acquire users without each user signing up individually with a credit card on the Netflix app – a huge benefit in a country where digital payments and recurring subscriptions are still nascent for many. The telco essentially becomes the channel to sell Netflix. As Inc42 put it, Netflix can “bank on Jio’s network of dealers” and billing infrastructure to get revenue from users who wouldn’t otherwise convert [inc42.com]. This distribution angle is vital in semi-urban and rural markets. Bundling with broadband operators similarly helps Netflix tap into households that are coming online for the first time via fiber.

Improving Adoption and Engagement: There’s evidence that these efforts are paying off in subscriber growth. While Netflix doesn’t break out country numbers, industry estimates peg Netflix India at around 10–12 million subscribers as of mid-2024, more than double what it was a few years ago. During Q2 2024, India was Netflix’s #2 market globally for net new subscriber additions – a remarkable surge. Netflix leadership credited a better content lineup and the improved “product-market fit” from pricing and partnerships for this success. In other words, by tailoring plans to local needs (like mobile-only options and bundled plans), Netflix saw uptake soar. A Netflix spokesperson also highlighted that the Jio partnership would bring Netflix’s lineup of Indian and global content to many more customers than before. Early signs suggest that bundling is introducing new audiences to Netflix – people who perhaps were loyal to YouTube or Hotstar, now sampling Netflix because it came with their phone plan. If even a fraction of Jio’s 450 million users activate the Netflix benefit, that’s a massive funnel of potential long-term customers.

Competitive Differentiation: In India’s streaming wars, being part of a bundle can influence consumer choice of primary service provider. Jio’s inclusion of Netflix in prepaid, for instance, was a direct competitive strike at Airtel and Vi, which at the time were bundling rival Hotstar but not Netflix. Suddenly, Jio could advertise “we have Netflix, others don’t.” Not to be outdone, Airtel and Vi then rushed to ink their own Netflix deals by 2024. This one-upmanship shows that premium content is a battleground for telcos. From Netflix’s perspective, this dynamic is beneficial: it creates a bidding war of sorts for its service. Each operator wants to boast the best entertainment bundle. Netflix can potentially negotiate favorable terms (minimum guarantees or promotional payments) from partners eager to have “Netflix inside.” The end result: Netflix gains more distribution and marketing exposure, essentially funded by telco marketing budgets.

Increasing Stickiness and Reducing Churn: Bundled subscribers might be more inclined to stick with Netflix. If your Netflix access is tied to your postpaid plan or broadband subscription, you are less likely to cancel Netflix on a whim – you’d have to change your entire plan. This built-in stickiness can bolster Netflix’s retention. It’s similar to how cable TV used to lock in customers with bundles. In a market where users hop between prepaid recharges or churn for better data offers, having Netflix as part of a plan encourages users to stay on that plan for the full validity to enjoy their favorite shows. Moreover, the psychological effect of “free Netflix” could spur higher usage – a user might explore Netflix content simply because it’s there at no extra cost, potentially converting them into a long-term fan who will resubscribe or upgrade in the future.

In short, bundling aligns well with Netflix’s India growth imperative: get many more users to sample and stick with the service, even if it means accepting lower revenue per user initially. It complements the price cuts and local content push that Netflix has undertaken to make itself more relevant to Indian audiences. As Netflix co-CEO Ted Sarandos noted, the company’s improved performance in India came from “bringing the two most important levers (price and content)” to broaden the audience [livemint.com] – we can safely add “distribution” as a third lever, with telco bundles doing a lot of heavy lifting on that front.

The Downsides and Challenges of Bundling

It’s not all smooth sailing, however. There are some inherent trade-offs and risks in Netflix’s bundling strategy that are worth noting:

Diluted ARPU and Revenue Share: The most obvious downside of bundles is that Netflix likely earns less revenue per user compared to a standalone subscriber. Telecom deals often involve discounted wholesale rates. Netflix might be getting only a fraction of the ₹199/month it normally charges for Basic when that plan is sold via Jio or Airtel’s bundle (the exact terms aren’t public, but it’s reasonable to assume the telco negotiated a volume discount). While this boosts user numbers, it can drag down Netflix’s average revenue per member in India. If not managed carefully, there’s a risk that Netflix’s subscriber count rises but revenue doesn’t keep pace proportionally. Moreover, telcos might push for even better terms as time goes on or if subscriber targets aren’t met, squeezing Netflix’s margins. In extreme cases, bundling can become a race to the bottom – with so many services bundled, how much value is each one truly capturing? Netflix has to ensure the bundle math makes sense: lots of low-paying users via partners versus fewer high-paying direct users. Thus far, Netflix seems willing to trade ARPU for scale in India, but investors will watch if these bundled subscribers eventually turn profitable.

Losing Direct Customer Relationship: One of Netflix’s strengths has been its direct relationship with subscribers – it controls the interface, the data, the billing, etc. Bundled subscribers, however, are essentially customers of the telco, not Netflix (in terms of who they interact with for account and payment). This has a few implications:

Netflix might get less granular data on user behavior or demographics than it would from direct sign-ups, depending on data-sharing agreements. The telco sits in between, and may not pass all user info to Netflix. For a company that thrives on analytics (what you watch, when you watch, etc.), any data gap could hurt content recommendations or personalization.

Limited upselling opportunities: If a user is on a free Basic plan via a bundle, can Netflix easily upsell them to Standard or Premium? Possibly not – the user isn’t entering payment details with Netflix. The telco would have to offer a higher bundle or the user would have to independently upgrade on Netflix (which many won’t bother to if they’re content with the bundled plan). This friction means Netflix can’t smoothly convert a bundle user to a higher tier or cross-sell other services (e.g., Netflix merchandise or games) as easily as with a direct user.

Netflix also cedes some brand control. If, say, there’s a problem with the bundled activation (“Why isn’t my Netflix working?!”), users might blame Netflix when the issue could be on the telco’s side or confusion in redemption. Customer support might be handled by the telco’s call center, not Netflix, leading to a less consistent service experience. Essentially, Netflix outsources a chunk of customer service to partners, which can be a double-edged sword if partners don’t handle it well.

Dependency and Bargaining Power: Relying on big partners can make Netflix’s growth dependent on their strategies. For example, if Jio decides tomorrow to pivot its strategy – perhaps emphasizing its own JioHotstar more and dropping Netflix from a bundle – Netflix could suddenly lose a major pipeline for new users. We saw a parallel in music streaming: Airtel’s Wynk Music thrived when bundled, but when Airtel changed course, Wynk’s user base evaporated. While Netflix isn’t owned by the telcos (unlike Wynk), it is still subject to their marketing whims. The telco could choose to promote a different streaming partner more aggressively or use Netflix as a negotiating chip. Also, when renewal time comes for these deals, Netflix might face hard bargain negotiations: the telco knows Netflix now counts on them for X million users, so they might demand better pricing or terms. If Netflix refuses, the deal could lapse, and those users might not convert to independent subscribers (since they were accustomed to “free” Netflix). This gives the distributors a degree of leverage over Netflix’s future subscriber base in India – a situation quite different from Netflix’s autonomous position in markets where bundles are minimal.

Cannibalization of Direct Subscribers: There’s a risk that bundling could cannibalize some of Netflix’s existing direct subscriber segment. For instance, if a consumer was paying Netflix ₹199/month directly but then realizes they can get the same Netflix plan effectively at no extra cost by switching to a certain mobile plan, they might do so and stop their direct subscription. In that case, Netflix loses a full-paying user and replaces them with a discounted bundle user. Granted, this likely affects higher-income users (who are more likely to be Netflix subscribers and also have postpaid plans or high-end broadband). It’s a fine balance – Netflix wants new users via bundles, not to simply shift current users into cheaper deals. So far, India’s overall growth suggests bundles are net additive, but the possibility of cannibalization grows as bundles become ubiquitous. If every telecom and ISP is giving away Netflix, why would anyone subscribe individually? Netflix has to keep its direct value proposition strong (such as offering Premium 4K plans or an ad-tier outside bundles) to maintain a segment of standalone subscribers who deliver full ARPU.

Perception Challenges – “Free” vs Paid: Another subtle issue is one of perceived value. When consumers get something included for free (or very cheaply), they may undervalue it. There’s a concern that bundled users treat Netflix as a nice freebie but not something they’d actively pay for if it wasn’t included. This could affect engagement quality – e.g. they might not become loyal fans or advocates for Netflix content in the same way a paying subscriber might. Also, if for some reason the bundle goes away, those users might not be willing to become paying Netflix customers, because psychologically they’ve always gotten it without a separate bill. In essence, Netflix could be training a segment of users to expect entertainment as a packaged commodity rather than a premium service. Over time, this might pressure Netflix to keep being part of bundles (with discounts) to retain those users, limiting its pricing power in the market.

Integration and Experience Issues: Executing bundles well is not trivial. Users have to be able to easily activate and use Netflix as part of their provider’s ecosystem. Any hiccups – say, confusion in how to sign in with the bundled account, or suboptimal streaming quality if accessed through a third-party app – can hurt Netflix’s reputation. For example, some Tata Play Binge users initially faced cumbersome steps to link their Netflix account. Netflix on telco apps may not support all features (like profiles or downloads) as seamlessly. Ensuring a smooth, native-feeling experience for bundled users requires technical integration and cooperation with partners. This is an ongoing challenge to maintain consistency of the Netflix experience across many platforms (telco apps, set-top boxes, etc.). Netflix has to work closely with partners so that, for instance, the latest app version and content library updates reflect promptly on those platforms. Any mismatch could lead to user frustration (“Why is the Netflix app on my Xstream box not showing the new episode?”). Thus, operationally, bundles add complexity.

Despite these challenges, Netflix likely views them as manageable trade-offs given the prize of Indian market leadership. Indeed, Netflix’s co-CEO famously set a goal of reaching “the next 100 million users from India” (a very ambitious target) – something that almost certainly requires creative bundles and partnerships. However, Netflix will need to constantly monitor and fine-tune these partnerships: negotiating fair revenue shares, retaining the ability to connect with users, and making sure the bundled Netflix experience is as good as the standalone one.

Bottom Line: Netflix bundling in India represents a blending of the old and new – the old cable/telco model of aggregated content with the new world of on-demand streaming. It has proven to be a powerful catalyst for Netflix’s Indian ambitions, unlocking new user segments and cementing Netflix as a key part of the digital entertainment bundle. The strategy comes with caveats around revenue and control, but if managed well, it positions Netflix as a service that’s deeply embedded in India’s digital fabric, rather than a standalone luxury. And for Indian consumers, it means streaming your favorite Netflix series might increasingly be as simple as recharging your phone or paying your internet bill – no separate login or payment required. In a market as vast and diverse as India, that convenience could be the decisive factor that turns Netflix from a niche urban indulgence into a mass-market habit. As the streaming landscape evolves, one thing is clear: the bundle is here to stay, and Netflix is making sure it’s not left out of the package deal.

One of the better crime thrillers on Netflix currently, Mandala Murders is a daring and visually rich watch with Vaani Kapoor leading the starcast. The show focuses on a web of gruesome murders connected to a mysterious cult, the "Aayastis". What sets Mandala Murders apart is its deep mythological world-building and strong cinematic style.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.