India's Streaming Revolution: Brightcove's Legacy, Dor's CTV Disruption, and Prasar Bharati's Leap

And Waves OTT hits 100K+ downloads with scope for personalization

Hey Streamers 👋,

A warm welcome to the 64th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

As the news of Brightcove's acquisition by Bending Spoons hit last week, a flood of memories came rushing back.

In 2017, I had the incredible opportunity to be the first employee for Brightcove India, tasked with kickstarting its operations in one of the fastest-growing streaming markets. It was still the early days of OTT in India, but Brightcove was already leading the charge globally as a pioneer in the Online Video Platform (OVP) space.

One of my proudest moments during this journey was the Brightcove CXO Roundtable in Goa (A Brightcove India launch event). We brought together India's top media and entertainment leaders to discuss the immense opportunities, challenges, and innovation potential in the streaming video space. This event reflected what Brightcove truly stood for: thought leadership, collaboration, and pushing boundaries.

Under the leadership of David Mendels (then CEO) and with unwavering support from HQ in Boston and our Singapore outpost, we built something extraordinary in India (faster growing region's for the company with 45 customers at it's peak). While operating in a market as dynamic and unique as ours felt like being on an island at times, the camaraderie, passion, and dedication to the customer within Brightcove made it a company that wasn’t just about business—it was about building relationships.

To this day, Brightcove remains a career-defining chapter for me. It taught me the pressures and thrills of working for a NASDAQ-listed company, the value of customer-centric innovation, and how to bring SaaS solutions to industries spanning media, sports, education, e-commerce, and beyond.

The sale of an award winning / blue chip online video platform, Brightcove to Bending Spoons (they own Streamyard, Wetransfer, Evernote amongst other popular software platforms) for a undervalued $233 million reflects the state of the streaming tech space - tough years back to back post Covid with not much to show in terms of technology innovation.

Agenda

India's First Subscription-Based TV Service: Dor

Prasar Bharati's Foray Into Streaming: A great start with scope for personalization

And….Action!

India's First Subscription-Based TV Service: Dor

A New Era for Connected TVs in India

The connected TV (CTV) market in India is on the brink of a significant transformation. Streambox Media, backed by Micromax Informatics, along with investors like Nikhil Kamath and Stride Ventures, has unveiled Dor, India's first subscription-based TV service. With the number of CTV households expected to double from 50 million to 100 million in the next five years, Dor aims to redefine how Indians experience TV content by addressing critical pain points like high upfront costs and fragmented services.

1. What is Dor?

Dor combines hardware and a subscription service in a single, seamless offering. It introduces a 43-inch 4K QLED TV powered by the proprietary Dor OS, preloaded with 24 OTT apps and 300+ live channels. Some key highlights include:

Unified subscription model: One sign-on for services like Prime Video, Jio Cinema, Disney+ Hotstar, and many more.

AI-powered search and personalization: Hyper-personalized recommendations driven by knowledge graphs.

Solar-powered remote: Sustainability meets functionality with cutting-edge hardware design.

2. Streambox Media’s Vision: Bridging the Gaps in India’s CTV Market

The Indian CTV ecosystem is riddled with challenges like high upfront hardware costs, siloed subscriptions, and complex user experiences. Dor addresses these gaps with:

Affordable pricing: An upfront activation fee of ₹10,799, followed by a ₹799 monthly subscription.

Scalable distribution: Initially available on Flipkart, Dor plans to expand to offline channels and introduce larger TV variants (55-inch and 65-inch) by early 2025.

Consumer-first approach: Features like intuitive navigation and four years of warranty underscore their commitment to creating long-term value.

3. Strategic Backing: Investors Fueling the Growth of Dor

The venture's backing reflects growing confidence in its innovative business model:

Micromax Informatics holds a majority stake, signaling a strategic pivot from smartphones to smart TVs.

Nikhil Kamath (Zerodha) and Stride Ventures have acquired significant minority stakes, bringing financial muscle and operational expertise.

Founder Anuj Gandhi, a veteran in media, has leveraged his extensive industry experience to craft this solution.

While the exact valuation and stake details remain undisclosed, the entry of such notable investors underscores the belief in Dor’s potential to disrupt India’s burgeoning CTV market (read the eyeball economy).

4. Competitive Edge: How Does Dor Stand Out?

India’s CTV landscape is fragmented, with consumers forced to navigate between multiple apps, subscriptions, and ecosystems. Dor offers a distinct proposition:

Simplified user experience: AI-enhanced search helps users discover content effortlessly across genres, platforms, and languages.

Bundled pricing: Unlike traditional TVs or streaming sticks, Dor eliminates the need for multiple subscriptions by integrating services into a single plan.

Targeting underserved segments: With accessible pricing and preloaded content, Dor is poised to capture users in Tier 2 and Tier 3 cities, where CTV penetration remains low.

5. Future Opportunities and Challenges

Opportunities

CTV Advertising Potential: With the rise in affluent audiences watching premium content on CTV, Dor is well-positioned to partner with advertisers for targeted campaigns.

Local Content Integration: The inclusion of regional platforms like Aha and Hoichoi provides an edge in connecting with India's diverse audience.

Market Expansion: By entering offline retail and launching larger screen sizes, Dor could tap into a broader demographic, including joint families and high-income households.

Challenges

Content Licensing Costs: Scaling the content library while maintaining profitability could be a hurdle.

Consumer Adoption: Convincing users to switch from existing setups to Dor’s ecosystem will require significant marketing and education efforts.

Competition from Telcos & Tech Giants: Players like Amazon Fire TV and LG Channels are aggressively expanding their CTV offerings, posing a threat to Dor’s market share. And lets not forget the 1000 pound gorilla, Jio which could easily disrupt Dor since they control the data.

6. Is Dor the Disruption India Needs?

Dor is more than just a TV—it’s a comprehensive ecosystem aiming to revolutionize how Indians consume content. Its subscription-based model, combined with intuitive technology and affordable pricing, could redefine the CTV market. However, execution will be key. As Dor prepares to scale, its success will hinge on its ability to educate consumers, foster strategic partnerships, and continuously innovate.

The Indian CTV market has long been ripe for disruption, and Dor might just be the catalyst for change.

Prasar Bharati's Foray Into Streaming: A great start with scope for personalization

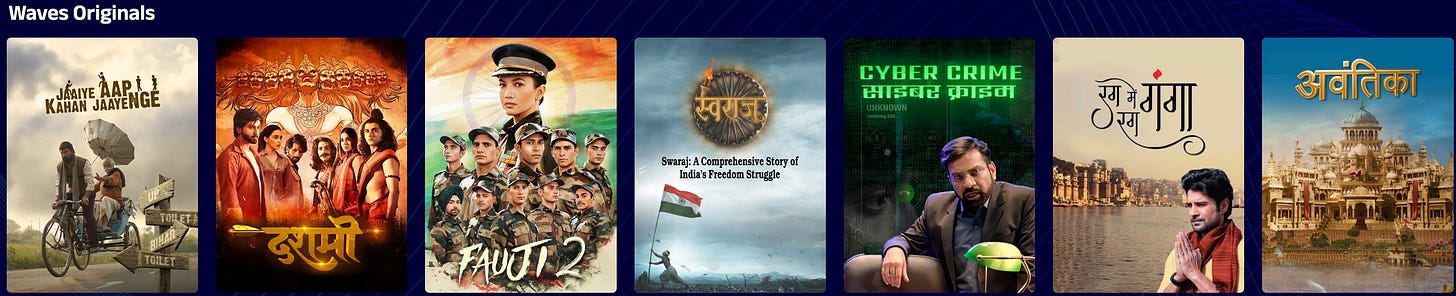

Prasar Bharati, India’s Public broadcaster has unveiled its streaming platform at the International Film Festival of India (IFFI) - the move signifies a bold step into the competitive OTT space. It has raced to 100,000+ downloads on Android alone which is an encouraging sign for the platform.

Great debut by Prasar Bharati - slick UI / UX, a wide variety of content in several leading Indian languages, repository of unique Indian cultural programs and a family friendly streaming application which can set interesting benchmarks in the hyper competitive OTT landscape in India.

Development Partners: Built by RailTel with AWS as the CDN and cloud service provider, the platform has scalable infrastructure.

The content on the app is not geo-blocked and I could log in to the web site using my Indian cell phone number to enjoy most of the content - the initial reports spoke about a ‘free’ app, however they have initiated a “freemium” model soon after launch for premium movies and shows.

Core Features and Differentiators

1. Content Strategy

Comprehensive Archives: Hosts legacy content from Doordarshan and All India Radio, offering a nostalgic and cultural repository.

Family-Friendly Content: Aimed at providing “clean” programming suitable for all age groups.

Exclusive Originals: Commissioned and licensed content promises fresh offerings beyond archival material.

Live TV and Sports: Streams live television and sports, ensuring real-time engagement for viewers.

3. Beyond Streaming: Games, Shopping, and Apps

Integrated Gaming: A unique app-within-an-app feature for children’s games.

ONDC Integration: Enables online shopping of goods and services, blending e-commerce with entertainment.

Third-Party Apps: Ties up with platforms like Eros Now and Lionsgate for in-app subscriptions and revenue-sharing models.

My Views

Prasar Bharati's Waves OTT is a promising step in the evolution of Indian public broadcasting, blending its rich archives with modern content to cater to India's diverse audience. From documentaries and government archives to live channels, movies, and even e-magazines, the platform offers something for everyone. However, crafting a unified content strategy for such a diverse nation is no small feat. Waves needs to prioritize original content creation and implement personalization algorithms to enhance viewer engagement and retention. While it’s an impressive start with competitive streaming experience and start times, future success will depend on user feedback and agile content diversification. A strong foundation has been laid—now it’s time to build on it!

I thought it would be difficult to find a “nature” / wildlife based documentary that can match the excitement and visual spectacles associated with David Attenborough, however “Our Oceans” on Netflix is an absolute masterpiece by Jonathan Smith as a producer, with James Honeyborne, Barack Obama, and Michelle Obama executive producing. Never seen before footage and Mr. Obama’s magical narration make this a must watch.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.