Is Netflix shaping the OTT ecosystem in Middle East?

The Streaming Lab - MENA #009

Hey 👋 - Yann here.

This is the 9th issue of The Streaming Lab - MENA.

Each Saturday, I analyse 1 topic to better understand the OTT market in the Middle East & North Africa.

Enjoy the show.

This week, we‘ll see how Netflix’s focus on Advertising and paid sharing is going to impact the streaming ecosystem in MENA.

I’m expecting 4 main influences:

A new focus on subscriber engagement

Ad-supported SVOD to become the new SVOD

Wake-up call: password sharing is an issue

« It’s definitely the end of Linear TV over the next 5-10 years »

A new focus on subscriber engagement

Netflix started losing subscribers for the first time in Q1 this year (200k globally). The second quarter was better than expected with « only » 970k memberships lost.

What happened in the MENA region?

Difficult to say as Netflix includes MENA with Europe and Africa in the EMEA region.

Netflix paid memberships decreased in EMEA from 73.73m to 72.97m (-770k), most probably in Europe where competition is strong with a lot of SVOD services and the newcomers FAST providers.

What’s the impact on MENA?

By contrast with the US where almost two-third of the households have a Netflix subscription, there is still room for growth in Middle East & North Africa for all the ecosystem.

I’m convinced the number of subscribers is not the only relevant indicator we should follow in the region. Another key performance indicator should be the number of hours viewed or let’s say the subscriber engagement.

And looking at the consumption results of Stranger Things on Netflix (1.3 billion hours viewed globally in the first four weeks), the other local and international streaming services will have to find innovative solutions to keep their subscribers engaged.

Subscriber engagement will be the best way to limit churn for pure SVOD players and to generate higher Advertising revenues for AVOD platforms.

Ad-supported SVOD to become the new SVOD

Netflix recently teamed up with Microsoft on Advertising. The global streamer will offer in early 2023 another plan sitting next to the existing Basic, Standard and Premium options. It will be cheaper but will include in-stream Ads.

We can’t call this model AVOD as members will still have to pay for a subscription. Let’s call it « Ad-supported SVOD ».

What’s the impact on MENA?

The first impact will be to inspire the competition and drive some regional streaming services to test this new Ad-supported SVOD model.

For now, there is no similar model in Middle East, only pure AVOD services (ADtv Now, Weyyak, Awaan, Rotana and soon Dreamax) and hybrid platforms AVOD/SVOD (Shahid, Istikana, Mahatat, Viu, SonyLiv, Roya TV, etc.)

The second impact will be on the regional Advertising market. Streaming TV Advertising in MENA is not as mature as the US or Europe, but with Netflix entering this space, the availability of premium inventory should grow faster than expected.

This will eventually help local brands understand the opportunity and drive them to switch part of their budgets from TV, digital and social to CTV (Connected TV).

Wake-up call: password sharing is an issue

Netflix disclosed recently that more than 100m+ households are using the service but don’t pay for it, at least directly. It took them 15 years to realize account sharing is an issue and can damage their ability to invest in and improve their service.

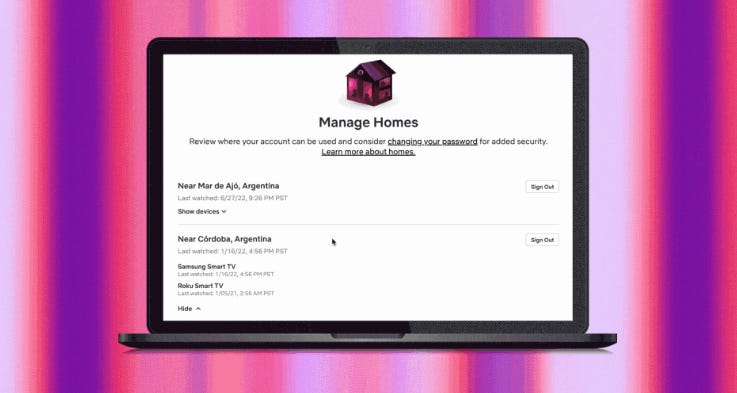

Netflix will launch next month the new feature “add a home” in Argentina, the Dominican Republic, El Salvador, Guatemala, and Honduras:

Each Netflix account will come with « one home »

Users can buy additional homes at $2.99 per month per home

Members on the Basic plan can add one extra home, Standard up to two extra and Premium up to three extra

What’s the impact on MENA?

The fact that Netflix is taking this issue seriously will push the local platforms to get a clear view of the numbers of households enjoying their services for free.

At some point they will have to decide what to do: implement repressive measures or accept it officially and try to limit the loss of revenue like Netflix.

In all cases, there will be a cost for the streaming services, the consumers or both.

“It’s definitely the end of Linear TV over the next 5-10 years”

Netflix CEO Reed Hastings said it a few days ago during the video interview commenting the financial results of the second quarter 2022.

By “Linear TV”, he was probably meaning Television consumption on traditional Linear networks. Because Linear is booming under the FAST & SVOD streaming business models!

According to Alan Wolk, Netflix will also roll out Linear channels for their library content for two main reasons:

Library channels can hold a heavier Ad load

“Why make someone choose a new episode of The Simpsons every time when you can just give them a Simpsons channel?”

“All of the SVOD services will go this route with their library content as an option in addition to On Demand. Makes little sense not to”

What’s the impact on MENA?

In 5 to 10 years, traditional Linear networks will still be there in Middle East & North Africa. But most probably with a smaller audience and lower Ad budgets.

International FAST providers (Free Ad-supported Streaming Television) will finally be available in the region: Pluto TV, Samsung TV Plus, Roku Channel’s Live TV, Peacock Channels, Prime Channels, Redbox Watch Free, Xumo, etc.

And the Advertising market will be transformed, with CTV then considered as a better-than-linear-TV advertisement model, more seamless and relevant for consumers, and more effective for Advertising partners.

Let’s just hope the local streaming players will be the ones building this CTV Advertising ecosystem and leveraging it before the international platforms.

That’s all for today, 1 tip to better understand the impact of Netflix on Middle East & North Africa.

See you online next week.

Until then, enjoy Resident Evil on Netflix. 🧟

- Yann

henever you’re ready, there are 3 ways I can help you with:

If you want to learn more about OTT in MENA, I’d recommend starting with my market report:

→ The local OTT ecosystem in MENA: Learn everything about the local streaming services in the region. Get full access here.

License premium FAST & On Demand content on TVToday.

Hire top streaming experts for short-term assignments on OTTpro.