JioCinema and Disney+ Hotstar about to create a Monopoly?

With great power comes great responsibility, Mr. Competition Commission of India.

Hey Streamers 👋,

A warm welcome to the 51st edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join 3,000+ others who receive it directly in their inbox every Wednesday.

India's Streaming Landscape Expands to 547 Million Users, but Paid Subscriptions Remain Flat

The latest Ormax Media report provides a comprehensive view of the evolving digital content consumption trends in India, highlighting a significant milestone in the country's streaming landscape. According to the Ormax OTT Audience Report: 2024, India's streaming universe has grown to an impressive 547 million users, reflecting a 14% increase from last year. However, this growth is driven entirely by the ad-supported video-on-demand (AVOD) segment, which saw a robust 21% rise, while subscription video-on-demand (SVOD) subscriptions have slightly declined.

The study, based on a diverse sample of 12,000 respondents from both urban and rural areas, reveals that OTT penetration in India now stands at 38%, up from 34% in 2023.

Yet, despite this overall expansion, the number of active paid streaming subscriptions remains static at approximately 99.6 million. Additionally, the average number of platforms per paying subscriber has decreased from 2.8 to 2.5.

This shift underscores a growing preference among Indian audiences for free content, particularly on platforms like YouTube and social media. As Keerat Grewal, head of business development at Ormax Media, notes, the AVOD segment is playing a pivotal role in bringing new viewers into the streaming ecosystem. The cost-sensitive nature of the Indian market, coupled with the abundant availability of free content, continues to pose challenges for the growth of paid subscriptions.

Shailesh Kapoor, CEO of Ormax Media, had previously highlighted the complex dynamics of the Indian streaming market, where the concept of paying for content is still evolving. With television remaining a low-cost alternative and the additional burden of data costs, many Indian consumers find it difficult to justify spending on paid streaming services when free alternatives are readily available.

[With Inputs taken from Variety]

The Battle of the Titans: JioCinema’s Big Merger and the Rising Regulatory Tide

Regulatory Concerns: The CCI’s Battle for Fair Competition

The Road Ahead: Strategic Implications and Market Impact

My Views

And….Action!

The Battle of Titans: JioCinema’s Big Merger and the Rising Regulatory Tide

As India’s streaming landscape continues to evolve, a major development is on the horizon: the impending merger between Disney Star and JioCinema. This merger, if approved, promises to reshape the OTT ecosystem, combining the strengths of two entertainment giants. However, the road to this merger is anything but smooth, with regulatory bodies like the Competition Commission of India (CCI) raising significant concerns.

The Strategic Merger: JioCinema’s Play for Dominance

The Grand Vision

In the rapidly evolving landscape of India's streaming industry, Reliance Industries Limited (RIL) is reportedly gearing up for a significant transformation. According to a report by The Economic Times, RIL is contemplating consolidating its streaming operations into a single powerhouse platform—JioCinema—following the anticipated merger with Star India’s Disney+ Hotstar.

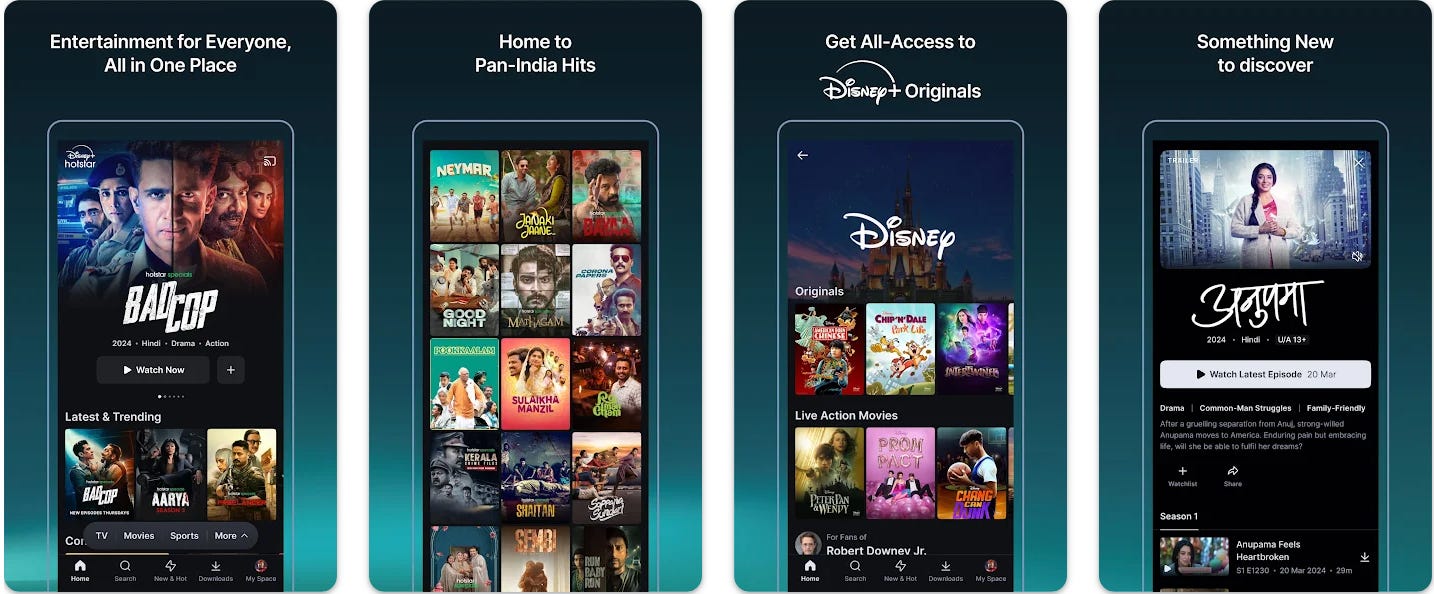

Currently, Disney+ Hotstar dominates the market with a massive user base and over 500 million downloads on Google Play Store. In contrast, JioCinema, owned by Viacom18 (which is controlled by RIL), has over 100 million downloads. Despite this disparity, RIL is eyeing a strategic move to merge Disney+ Hotstar’s vast content library with JioCinema, aiming to create a unified, more formidable platform that can rival industry giants like YouTube, Netflix, and Amazon Prime Video.

This potential shift comes on the heels of an earlier agreement between RIL and Walt Disney to merge Star India and Viacom18, a deal that is poised to create a media behemoth valued at approximately $8.5 billion. The merger would bring together over 100 TV channels and two streaming platforms under one roof, but RIL appears to favor streamlining its digital presence to enhance efficiency and reduce operational costs.

While the merger awaits approval from regulatory bodies such as the Competition Commission of India (CCI) and the National Company Law Tribunal (NCLT), RIL has indicated a willingness to make concessions, including the possible closure of certain TV channels in Hindi and regional markets, to address concerns about market dominance.

The numbers tell an intriguing story. RIL’s 2023 annual report revealed that JioCinema attracted an average of 225 million monthly users, while Disney+ Hotstar boasted 333 million active users in the last quarter of 2023.

However, Disney+ Hotstar has seen a decline in paid subscribers, dropping from a peak of 61 million to 35.5 million as of June, largely due to the loss of key content like the Indian Premier League (IPL) and HBO shows.

On the other hand, JioCinema has experienced a surge in growth, particularly after securing the digital rights to the IPL, leading to record-breaking viewership. RIL Chairman Mukesh Ambani has hailed this success as a testament to JioCinema’s potential to rapidly attract large audiences.

Absorbing the Best of Both Worlds

Should RIL proceed with merging Disney+ Hotstar’s content with JioCinema, the latter could emerge as the largest streaming platform in India, offering an unprecedented 125,000 hours of entertainment, sports, and Hollywood content. The enhanced platform would also boast key sports rights, including the IPL, alongside content from major studios such as Disney, HBO, NBCUniversal, and Paramount Global.

This isn’t RIL’s first foray into streamlining its digital offerings. The company has previously merged platforms like Voot into JioCinema, and recently, JioCinema was transferred to Viacom18 following a court-approved deal involving a ₹15,145 crore investment from RIL and Bodhi Tree Systems into Viacom18.

As the streaming wars heat up, RIL’s strategy to consolidate its streaming services could reshape the digital entertainment landscape in India, positioning JioCinema as a formidable contender on the global stage.

Regulatory Concerns: The CCI’s Battle for Fair Competition

The Cricket Conundrum

The merger, while promising from a business standpoint, has raised alarms with the Competition Commission of India (CCI). The CCI’s primary concern lies in the potential dominance of the merged entity over cricket broadcasting rights—a highly lucrative market in India. With both TV and digital rights to top cricket leagues, including the IPL, the merger could give RIL and Disney an overwhelming share of the advertising market, potentially squeezing out competitors and raising prices for advertisers.

The Market Power Dilemma

The CCI has expressed concerns that the merger could lead to a near-monopoly in the streaming and TV segments, particularly in sports broadcasting. With cricket being a national obsession, control over its broadcast could give the merged entity significant pricing power, leading to higher costs for advertisers and potentially reducing competition in the market.

Potential Setbacks and Compromises

In light of these concerns, the CCI has issued a notice to RIL and Disney, warning of the potential anti-competitive effects of the merger. The companies have been given 30 days to respond, and while they have offered to shut down some TV channels to address the CCI’s concerns, they remain firm on retaining their cricket rights. This standoff could delay the approval process and complicate the merger further.

The Road Ahead: Strategic Implications and Market Impact

A New Media Giant in the Making

If the merger goes through, the combined entity will not only dominate the streaming landscape but also reshape the broader media industry in India. With control over a vast array of content and sports rights, JioCinema could become the go-to platform for millions of Indian viewers, pushing the boundaries of what a single streaming service can offer.

The Competitive Landscape

The potential dominance of the merged entity has implications for the entire OTT ecosystem in India. Competitors like Netflix, Amazon Prime, and smaller regional players may face unprecedented challenges as they compete against a platform backed by the immense resources of Reliance and Disney.

Regulatory Hurdles and Market Dynamics

However, the merger’s success is far from guaranteed. The CCI’s concerns highlight the delicate balance between fostering competition and enabling business growth. How RIL and Disney navigate these regulatory challenges will determine the future of this mega-merger and its impact on the Indian media landscape.

My Views: A Step Back for India's Streaming Diversity

As we closely watch the impending merger between Jio and Star India, it’s hard to ignore the potential consequences for the Indian streaming landscape. While on paper, combining the strengths of Disney+ Hotstar and JioCinema might seem like a strategy to create a media powerhouse capable of competing with global giants like Netflix and Amazon Prime Video, there are serious concerns that need to be addressed.

India thrives on diversity—be it in culture, languages, or even in the digital content we consume. The merging of Jio and Star India threatens to create a "one-man-wins-all" scenario, where a single entity could dominate the streaming market. This consolidation could stifle competition, leaving Indian consumers with fewer choices and potentially poorer experiences.

One major concern is the overwhelming cost control, pricing power, and negotiation leverage that the merged entity would hold. In a market as diverse as India, this level of control could lead to higher subscription prices, reduced content diversity, and a significant impact on independent and smaller content creators who might struggle to compete with a behemoth like Jio-Star.

Moreover, there’s the issue of technology. JioCinema, which has been touted as the platform to unify all content post-merger, currently holds a disappointing rating of 2.6 on the Google Play Store. This raises red flags about the platform’s ability to deliver a seamless and high-quality streaming experience. If the technology behind this unified platform isn't up to speed, Indian customers could be left with a subpar service, with little to no alternative apps to switch to.

This potential merger, therefore, raises a critical question: Are we willing to sacrifice competition, choice, and quality in the name of creating a single dominant player in the streaming space? For a market as vibrant and diverse as India, the answer should be a resounding no. A monopoly, even in the digital world, is rarely in the best interest of consumers. It’s essential that regulators take a hard look at the implications of this merger and prioritize the long-term interests of Indian consumers over short-term corporate gains.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

Two months after the events of Haseen Dillruba, Rani is living in Agra, running a beauty parlor, while Rishu, now using the alias Ravi, works as a delivery boy with a prosthetic hand. Though living separately to avoid detection, they stay in touch by phone and plan to escape to Thailand in two months. Abhimanyu, Rani's landlady's physician, has shown romantic interest in her, which she doesn't reciprocate, while Rishu's landlady, Poonam, has made explicit advances towards him, which he also rejects. Great romantic thriller and fantastic performances by the lead cast!

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on the Indian and Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.

Download our market reports STREAMING in MENA and STREAMING in INDIA.