MX Player's Evolution Amidst the Times Group Split

Exploring Times Group's Split: Samir vs. Vineet Jain

Hey Streamers 👋,

A warm welcome to the 29th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends and more in one of the fastest growing video markets! Appreciate your support and in case there are topics that we might have missed out so far, we are open for suggestions and feedback. If you are not already a subscriber, please sign up and join 2,600+ others who receive it directly in their inbox every Wednesday.

Today’s program:

India’s Times Group

The Split

Impact on Streaming properties

And….Action!

India’s Times Group

The Times Group is one of India's largest media conglomerates with its flagship Bennett, Coleman and Company Limited (BCCL) being the largest publishing company in India and South-Asia.

Starting off with The Times of India (TOI) - which is now the largest English publication in the world, BCCL and its subsidiaries (called The Times of India Group), are present in every existing media platform including newspapers, magazines, books, TV, radio, internet, event management, Outdoor Display, music, movies and more.

With a turnover exceeding a billion dollars, the group has the support of over 25,000 advertisers, 11,000 employees and an audience spanning across all continents.

The origins of TOI, the world's largest circulated English broadsheet newspaper, go way back to 1838. At present, it is the nation's first English newspaper of choice with 55 editions which cater to millions of readers across the country. TOI has consistently changed with the needs and demands of changing generations, with the Delhi and Mumbai editions at the forefront.

The subsidiary of 181-year-old Bennett Coleman and Company Limited (popularly known as Times Group) operates more than three dozen properties, including newspaper Times of India, online outlet Indiatimes, advertisement business Colombia, venture arm Tventures and streaming services Gaana and MX Player

The Split

Samir (sitting, right) and Vineet Jain (sitting, left), the promoters of Bennett, Coleman & Co (better known as the Times Group) and also real brothers, reached a settlement to split the media conglomerate’s assets between them around May of last year.

The deal gets Samir Jain (elder brother) the entire print businesses of the conglomerate, including the Times of India, Economic Times and language papers like Navbharat Times and Vijay Karnataka along with their online editions.

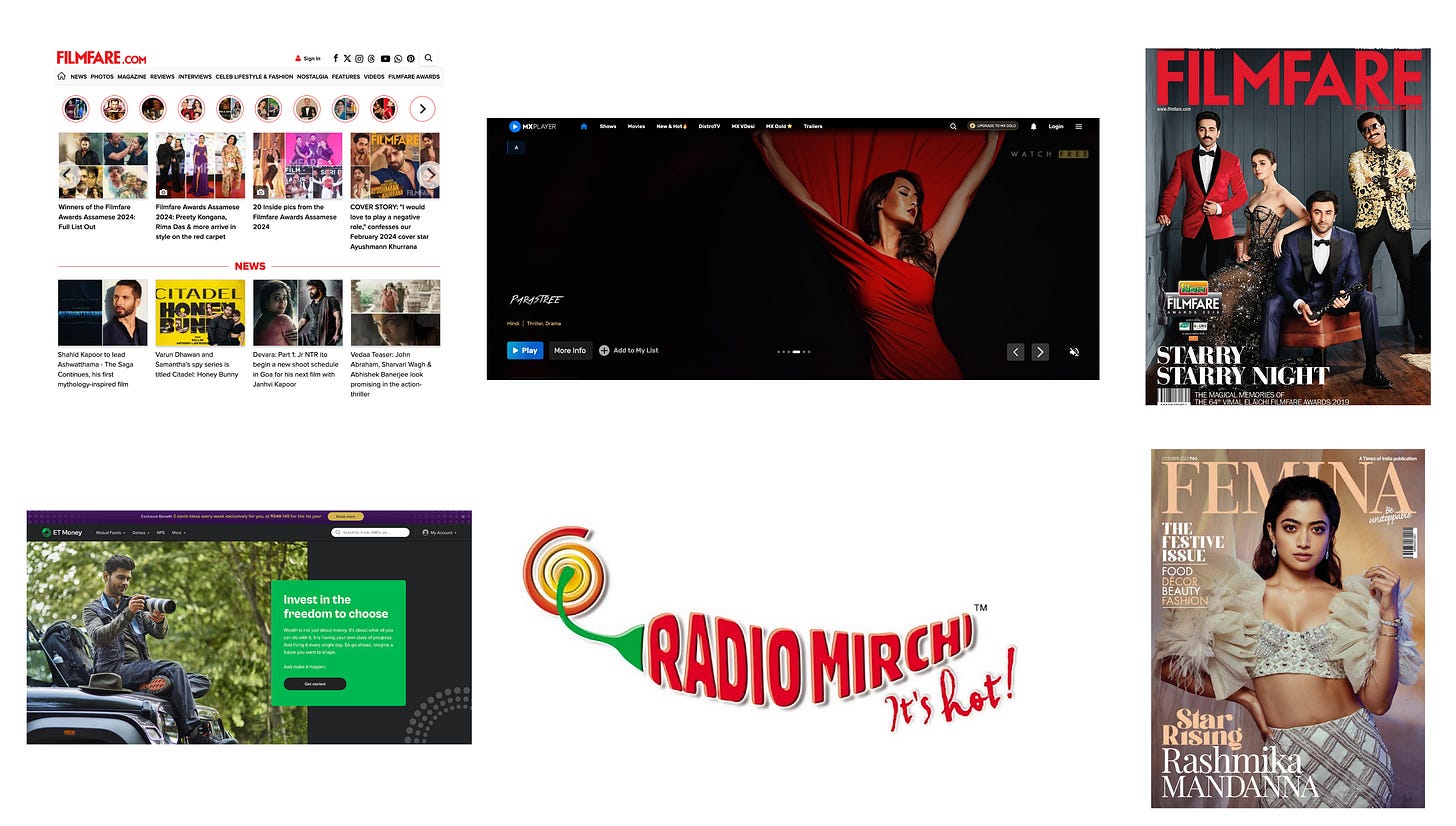

Younger brother Vineet Jain now occupies broadcast, Radio Mirchi, Entertainment (ENIL), and other businesses such as Filmfare, Femina, the event IPs along with their respective online editions (clubbed under Times Internet Ltd.) + MX Player, ET Money and the broadcast channels (Times Now (news),

Plus Times Network of broadcast channels and their corresponding digital destinations:

Sources add that since the print businesses of the group are far bigger in terms of revenue, Vineet is likely to receive a cash payout of at least Rs 3,500 crore ($427 million) from his elder brother to balance out the partition. This amount may go up to Rs 5,000 crore ($610 million) depending on various factors.

Impact on Streaming business

In the ever-evolving landscape of India's streaming ecosystem, MX Player (now owned by Vineet Jain), a Times Internet Ltd. acquisition, finds itself at crucial crossroads. Recent developments indicate that negotiations for its acquisition by Amazon have encountered obstacles, posing financial challenges for the platform's future endeavors.

To navigate these hurdles and maintain its position in India's competitive advertising video-on-demand market, MX Player is reshaping its strategy. Rather than solely relying on original content creation, MX Player is embarking on collaborations with other platforms for content syndication. One notable partnership is with DistroTV, which grants users access to a vast array of global and Indian channels, aligning with MX Player's shift towards offering diverse content offerings.

MX Player's journey began as a media player and transitioned into an ad-supported video streaming application under Times Internet's ownership in 2018. Despite securing significant funding, including a substantial investment from Tencent in 2019, MX Player has encountered challenges in sustaining expansion efforts.

Times Internet's divestment of certain businesses, such as MX Takatak and Dineout, reflects strategic restructuring amidst MX Player's financial constraints. Notably, MX Player's acquisition by Times Internet in 2018 for an estimated sum of $140 million underscores its potential value in the market.

However, negotiations with Amazon reportedly faltered, with the offer falling significantly below MX Player's purchasing cost. Despite MX Player's status as one of the most downloaded apps in India and globally in 2022, according to the State of Mobile 2023 report by Data.ai, the platform faces pressing financial concerns.

In light of these challenges, MX Player's shift towards content syndication partnerships signifies a proactive approach to sustain its presence and cater to evolving viewer preferences. As it navigates this pivotal phase, MX Player remains a key player to watch in India's dynamic streaming landscape, poised to adapt and innovate in the face of industry dynamics and financial exigencies - Vineet Jain’s biggest challenge, but also opportunity.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

The OTT content of the week is Maamla Legal Hai on Netflix - "Maamla Legal Hai" emerges as a delightful addition to Netflix's lineup, offering a refreshing departure from the typical crime dramas that dominate the OTT space. Directed by Rahul Pandey, and written by Kunal Aneja and Saurabh Khanna, the series picks on the salient points of real-life cases (‘satya durghatnaon pe aadharit’), some funny, some plain bizarre, with a couple of poignant elements thrown in, all things that make us human. Hilariously legal

+ IPL ‘24 has started with a bang! JioCinema broke their record of the last season as they registered 590 million video views on the first day of the Indian Premier League (IPL) 2024 season. Over 111 million viewers logged in to watch Chennai Super Kings (CSK) take on Royal Challengers Bengaluru (RCB) at the MA Chidambaram Stadium in Chennai on Friday.

According to the numbers released by the JioCinema, the official streaming partner of the IPL, the first day viewership of this season was 51 percent more compared to the day one viewership of IPL 2023. A total of 6.6 billion minutes of watch time were also recorded during the match that was won by the CSK.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Download our market reports STREAMING in MENA and STREAMING in INDIA.

I also work with streaming services, content creators, rights holders, platform providers or media consultants and help them upgrade their tech & turbo charge their revenues. Contact me here.

MX Player has always syndicated third party content, so this is not a new strategy. They have syndicated content from SonyLiv, ALTBalaji, ShemarooMe, Hungama, etc. They also had a co-production deal with ALTBalaji.

Given the large distribution, MX Player had a great opportunity to launch Amazon type paid channels. That would have worked well for regional OTT players.