Over The Top or At The Top?

The Streaming Lab - MENA #007

Hey 👋 - Yann here.

This is the 7th issue of The Streaming Lab - MENA

Each Saturday, I analyse 1 topic to better understand the OTT market in Middle East & North Africa.

Enjoy the show.

This week, I’m looking at the best ways to compare the OTT players thanks to public data. And I identified 6 points of comparison:

The great subscriber war

Top ranked apps: iOS vs. Android

Who is the most "popular" player?

From Global to Local or Local to Global?

Content is still king

Distribution is King Kong

The great subscriber war

What are the real numbers of SVOD subscribers in MENA?

Let’s start with 2 reports from market research: Dataxis vs Digital TV Research (end of 2021 subscribers)

Shahid VIP: 2.2M vs 1M

Netflix: 2.1M vs 6.8M

StarzPlay: 2M vs 1.9M

OSN+: 0.4M vs 0.5M

It’s easy to get confused so let’s find more sources thanks to CEOs interviews in 2022:

Shahid: “We are now at 2,25M”

Netflix: [No interview about MENA]

StarzPlay: “The platform ended the year with 1.97M subscribers”

OSN+: “We have more subscribers today on our streaming service than we ever had on our DTH service”

What are the real numbers of SVOD subscribers in MENA? I don’t have the answer. The only thing I know is that Netflix reported a global loss of 200,000 subscribers during the first quarter of 2022, a first in over a decade. Keep listening, Netflix will post its second quarter financial results in a few days, on July 19, 2022.

I believe the number of subscribers is a key performance indicator that matters for global listed companies, and they will burn a lot of money for it. The privately owned local players will be looking for a combination of subscribers and ARPU with a different objective: grow, but in the right direction.

Sources:

Digital TV Research (February 2022): https://www.broadcastprome.com/news/svod-revenue-in-mena-to-reach-4bn-by-2027-digital-tv-research/

Dataxis (March 2022): https://dataxis.com/researches-highlights/536173/can-newcomers-topple-shahid-vip-netflix-and-starz-play-in-mena/

Top ranked apps: iOS vs. Android

Another way to compare the streaming services in the region is to have a look at the Top ranked apps.

Like Search Engine Optimization (SEO), Top ranked apps from iOS (Apple) & Android (Google) are based on several parameters. The exact ranking algorithms are not publicly available, but we know the factors that can highly influence the rankings:

Quantity of new users added

App usage: session frequency and total time spent inside the App

Velocity of downloads and engagements

Here are the Top 10 iOS & Android streaming Apps from 15 MENA countries:

Download the pdf version HERE.

My insights:

20 iOS streaming apps made it to the Top 10 (22 for Android)

More than 50% of iOS apps are local services from MENA (60% for Android)

Only 3 services are always part of the iOS Top 10 in 15 countries: Netflix, Shahid and Disney+ (4 for Android with Netflix, Viu, Shahid and Disney+)

Several international players are successfully targeting the region: Crunchyroll (US), Viki (US), Iqiyi (China), Viu (Hong Kong), Noor Play (Turkey), Zee 5 (India), SonyLIV (India) and MX Player One (India)

Sources:

https://appfigures.com

Who is the most “popular” player?

Popularity can look like a subjective concept, but it is not. Thanks to Google Trends, we can now measure the search queries from Google Search across various regions and languages.

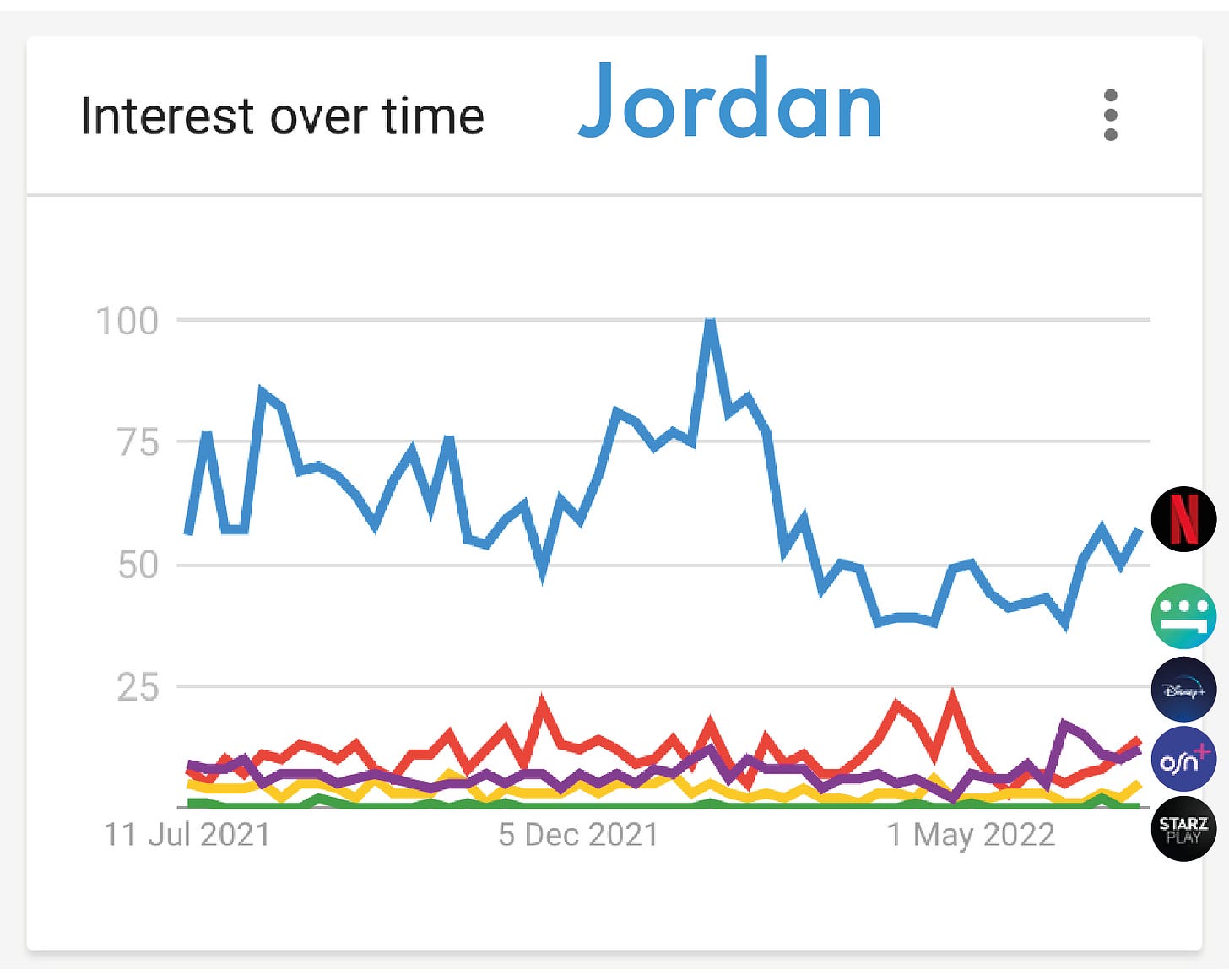

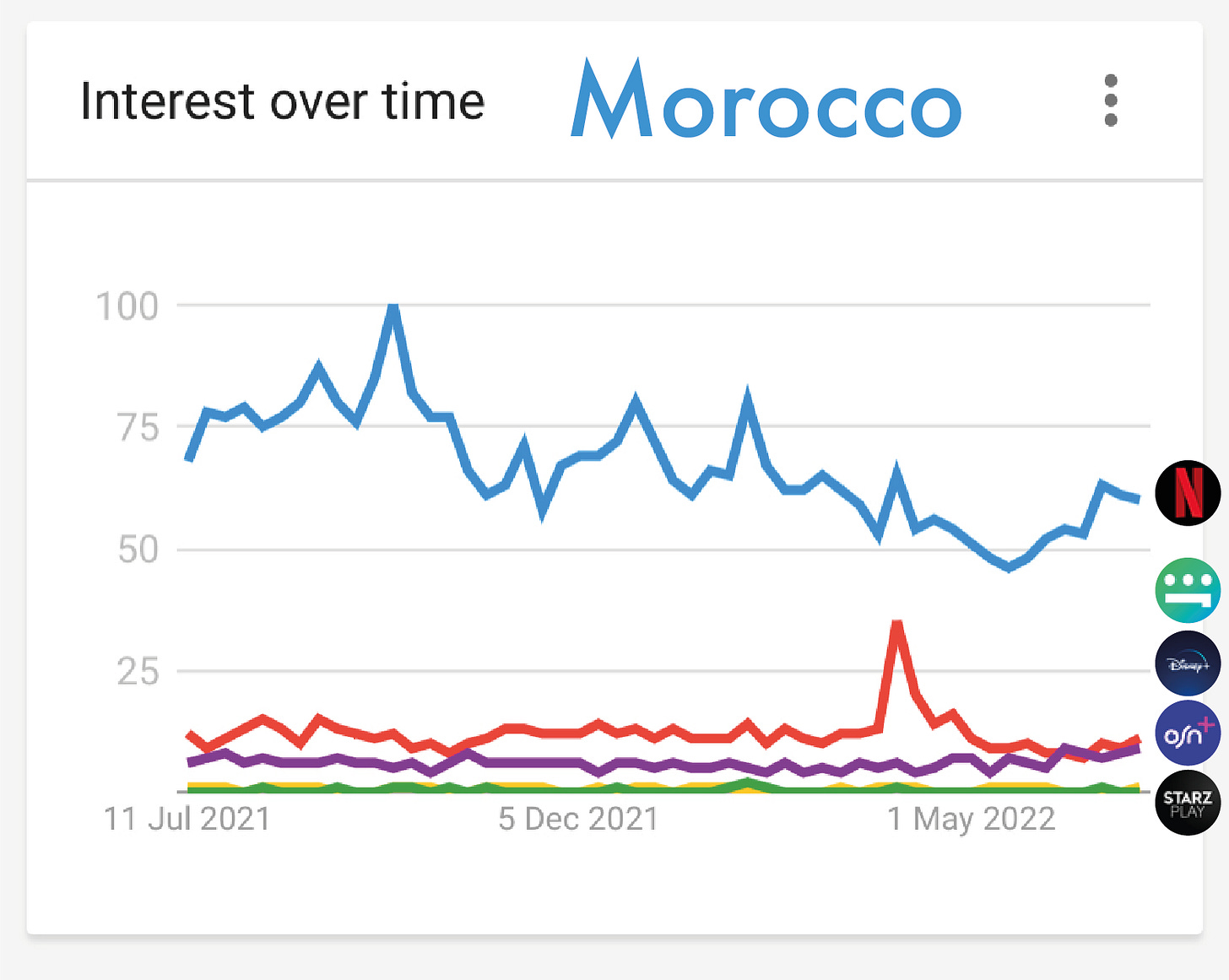

Let’s play with the “interest over time” from 5 top streaming services: “Netflix”, “Disney+”, “Shahid”, “OSN+” and “StarzPlay” in 4 countries: UAE, Egypt, Morocco and Jordan:

My insights:

The volume of search queries for “Netflix” is high is all countries, but it is also declining compared to the other streamers

The popularity of “Shahid” is very close to “Disney+” in Egypt, Morocco and Jordan

“Disney+” popularity increased recently during the launch of the service in UAE, Egypt and Jordan (June 8th, 2022)

Most of the search queries increase is driven by new releases

My sources: https://trends.google.com/trends/

From Global to Local or Local to Global?

In other words, who are the streamers with the most efficient localisation strategy? At this game, local players are one step ahead:

They know their target audience and preferred languages

They understand the economic challenges behind each countries and match their subscription costs with purchasing powers

They implement Telecom partnerships to increase their reach

They design their OTT platforms for an Arabic audience with mirror-friendly UX

They license content from local creators and regional production houses

Global giant and international services started localizing their services but still have a lot to do to catch up with local players.

Content is still king

Content is at the core of every streaming services. Analyzing their content strategies is a natural way to compare them.

Recently, I looked at the most watched TV Series in UAE from 5 top OTT players: Netflix, StarzPlay, Shahid, OSN+ and Jawwy TV.

My insights:

Most watched content on those platforms come from 8 countries: US, UK, Egypt, Lebanon, Saudi Arabia, Turkey, Korea and India

Netflix Top 10 includes TV Series from Europe, Asia and North America with the 4th season of The Umbrella Academy

80% of StarzPlay most watched TV Shows are premium American Comedy, Crime and Dramas: The Office, CSI: Las Vegas or Billions

Shahid is the only platform with Top TV Series coming exclusively from Middle East: Beirut 303 from Lebanon, Eyal Nouf from Saudi Arabia or The Eight from Egypt

Most watched TV Shows on OSN+ are all from the US, including the 4th season of the Sci-Fi dystopian Television series Westworld

Two TV Shows from Egypt and Saudi Arabia made it to Jawwy TV Top 10: Shabab Al Bomb and Awdat Al-Abb Ad-Dhaal. The other ones are mainly American Action, Crime and Comedy TV Series

Sources:

https://top10.netflix.com

Top 10 carousels from StarzPlay, Shahid, OSN+ and Jawwy TV in UAE

Distribution is King Kong

Distribution is key for the streamers to expand their reach and get more subscribers. An effective distribution strategy in Middle East & North Africa is to partner with regional Telecom operators: STC, Etisalat, Ooredoo, etc.

Homegrown services - StarzPlay, Shahid and OSN+ - invested a lot of time and resources to implement different levels of partnerships with local Telecom companies: billing, soft or hard bundles. Global giants and international services will also have to catchup at some point if they want to maximize their reach.

Super-aggregation is another way for streaming services to increase their reach and offer additional content. It will come from different actors in the region: Pay-TV, Telcos, streaming services and smart TVs.

That’s all for today, 1 tip to compare OTT players in Middle East & North Africa.

See you online next week. Until then, enjoy A Long Way Round on Apple TV+.

May this blessed Eid bring you and your family peace, happiness and good health.

- Yann

Whenever you’re ready, there are 3 ways I can help you with:

If you want to learn more about OTT in MENA, I’d recommend starting with my market report:

→ The local OTT ecosystem in MENA: Learn everything about the local streaming services in the region. Get full access here.

License premium FAST & On Demand content on TVToday.

Hire top streaming experts for short-term assignments on OTTpro.