The Next Tech Stack for Streaming: MediaTech Meets AI in India’s $30B M&E Market

Analyzing a few pages out of the EY-FICCI Future of Indian Media and Entertainment 2024 report

Hey Streamers 👋,

A warm welcome to the 79th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

The Indian Eyeball Economy Enters Its Most Defining Tech-First Chapter Yet

MediaTech for the Now: Bridging Screens, Behaviors & Business Models

Putting the AI in medIA: India’s Generative Moment Is Here with Automation & Personalization

Our Take

And….Action!

The Indian Eyeball Economy Enters Its Most Defining Tech-First Chapter Yet

The Indian Media & Entertainment (M&E) sector has just hit an inflection point.

For the first time in over two decades, digital media has overtaken television to become the largest segment in India’s M&E industry, contributing 32% of total revenues. According to the just-released EY-FICCI Future of Indian Media and Entertainment 2024 report, the sector grew to INR 2.5 trillion (US$29.4 billion) last year, with new media (digital + online gaming) now accounting for 41% of all M&E revenues. By 2027, the sector is expected to touch INR 3.1 trillion (US$36.1 billion), growing at a healthy 7% CAGR.

In other words: this is not just a transition. It’s a tech-led transformation.

But instead of summarizing the entire 286-page deck (which is brilliant, by the way), this week, we’re zooming in on two technology categories we at Streaming in India believe are reshaping the foundations of the eyeball economy:

MediaTech for the Now

Putting the AI in medIA

These two sections capture the most exciting confluence of content, AI, personalization, monetization and platform innovation that we’ve seen in Indian M&E to date.

Let’s unpack both, category by category.

I. MediaTech for the Now: Bridging Screens, Behaviors & Business Models

1. Multi-Format, Multi-Market Content Monetization

India now has 750 million+ active screens, but audiences are more fragmented than ever.

The opportunity? Build IP businesses that monetize every eyeball.

From blockchain-led rights management to CTV + FAST channels, the report urges IP owners to integrate lifecycle monetization strategies. Think: licensing, brand extensions, gamified commerce.

2. TVOD & One-Time Payments Are Back

Transactional Video on Demand (TVOD) is showing green shoots again, with Indian audiences willing to pay for exclusive content “sachets.”

Building AI-driven TVOD platforms, with personalized pricing models and loyalty integrations, will be key to converting intent into paid behavior.

3. Bundling and Cross-Sell Tech

The next wave of retention will come from bundling: music + OTT, news + gaming, and commerce + creator tools.

Expect linkages with ONDC, cross-platform analytics engines, and new “bundling intelligence” stacks that create content + commerce hybrids.

4. Gamification & Real-Time Personalization

With average screen time exceeding 6 hours/day, user attention is the new currency.

Tools like real-time recommendation engines, AR/VR layers, and gamification frameworks (challenges, leaderboards, rewards) will be table stakes to win loyalty.

5. Attention ≠ Retention Without Tech

From dynamic pricing engines to predictive churn models, the MediaTech imperative is simple: keep them coming back.

II. Putting the AI in medIA: India’s Generative Moment Is Here with Automation & Personalization

2024 was the year AI pilots kicked off. 2025 will be the year they go production-scale.

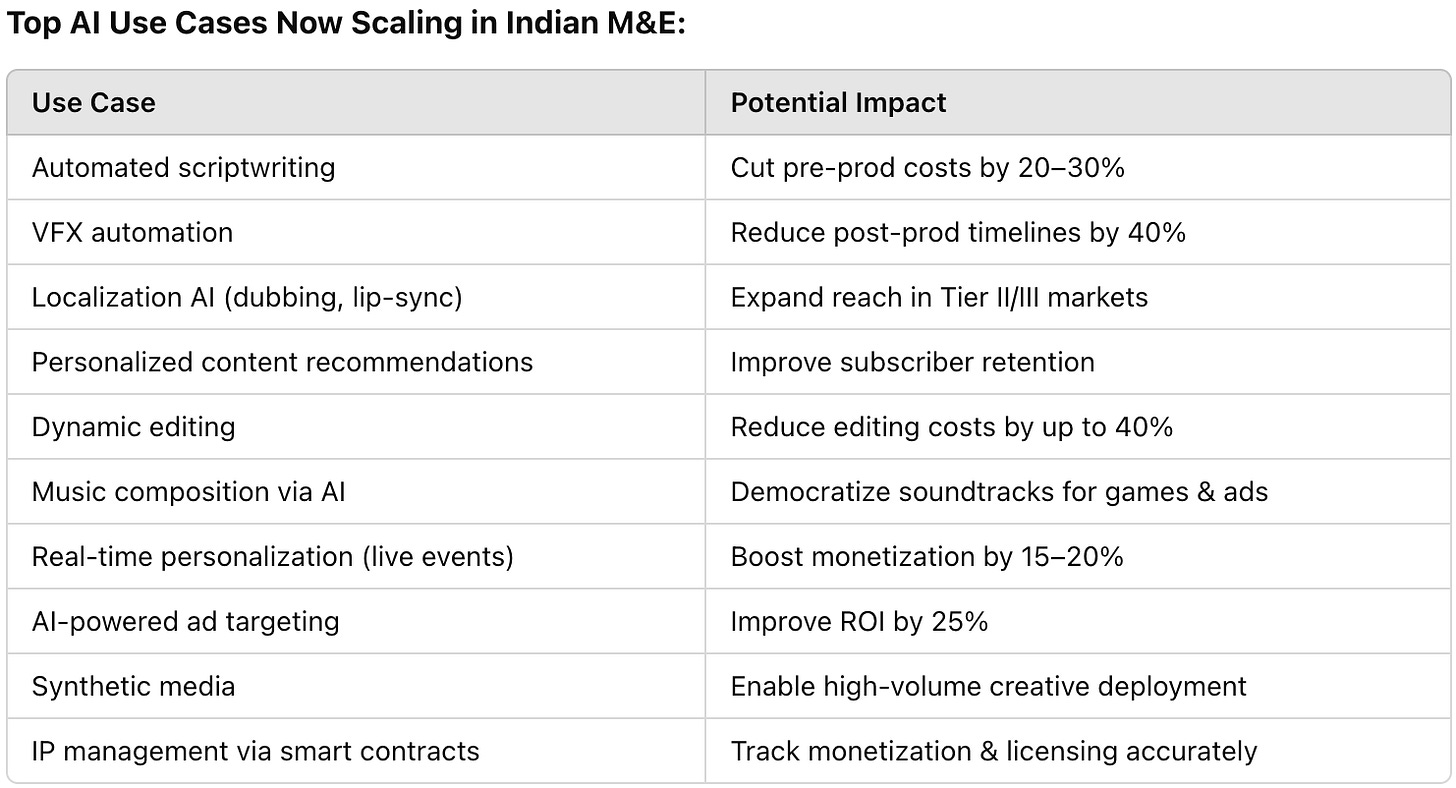

1. Automated Storytelling & Scriptwriting

Tools like Soros and Runway Gen-2 are now helping creators storyboard, identify plot gaps, and even automate VFX.

EY estimates that by 2026, automated scriptwriting will be standard, especially for smaller studios and regional players — reducing pre-production costs by up to 30%.

2. Localization Gets a GenAI Makeover

Platforms like Rephrase.ai and VisualDub are enabling AI-driven dubbing, voice cloning, and lip-syncing — reducing localization costs by 25–35%.

This is unlocking Tier 2 & Tier 3 markets, especially for OTTs trying to go regional fast.

3. Personalization at Scale

AI is driving hyper-personalized curation across platforms. Tools like Gracenote AI, DorPlay, and in-house tech by Spotify, Prime Video, etc. are reshaping metadata-based recommendations.

EY notes this could boost subscription revenues by 20–30%.

4. Dynamic Post-Production Tools

AI-led editing, color correction, and background replacements (via tools like Firefly) are now reducing production timelines by 40%.

Indian YouTubers, independent filmmakers, and ad agencies are already seeing cost and time advantages.

5. AI in Advertising & AdTech

AI-generated synthetic media and ad targeting tools (like Kargo AI) are now unlocking better ROAS.

Personalized, dynamically created ads can reduce campaign deployment times by 50% and enhance ROI by up to 25%.

6. AI for Operations, Not Just Creativity

Beyond content, AI is being used for automated rights management, media mix modeling, cue sheet generation, and even contract drafting.

56% of surveyed Indian M&E companies are actively exploring GenAI investments.

7. The Flip Side: Security, Ethics & IP Risks

EY also cautions on the downsides: GenAI’s rapid growth is outpacing governance.

From the Samsung data leak via ChatGPT to deepfake concerns, the call is clear: adopt Responsible AI frameworks that embed transparency, fairness, and safety into your creative pipelines.

💡 Our Take

India's eyeball economy is no longer just about volume — it's about value per viewer.

The shift from linear TV to digital-first content has now entered its next phase: a MediaTech + GenAI fusion where personalization, automation, localization, and monetization go hand in hand.

We believe that Indian startups building tools, infrastructure, and platforms for:

Personalized CTV and FAST

AI-driven Adtech & Monetization

Regional content IP + AI-enabled workflows

Creator SaaS + short-form editing

Immersive formats & gamified engagement / gaming

...will be the real disruptors of this decade.

We’re actively scouting, helping with GTM, fund raising and investing in these spaces + if you’re building something in this space — or want to collaborate — we’d love to hear from you.

—

🧠 Let’s build the next era of the Indian Eyeball Economy — with tech, talent, and timing on our side.

Excited to see Nana Patekar return to Hindi cinema in Vanvaas on ZEE5. The film portrays Pratap Singhania, an elderly man battling early-onset dementia, who faces a profound betrayal when his sons abandon him during a supposed family trip to Varanasi. This poignant narrative delves into themes of family, betrayal, and redemption, promising a compelling watch.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your advertising requirements.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me