The Regional OTT Playbook 2025 (Part 1)

Data-backed rise of Hoichoi, Aha, SunNXT, ManoramaMAX - what’s working now

Hey Streamers 👋,

A warm welcome to the 102nd edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

Regional Indian OTT Streaming Landscape in 2025 [Part 1]

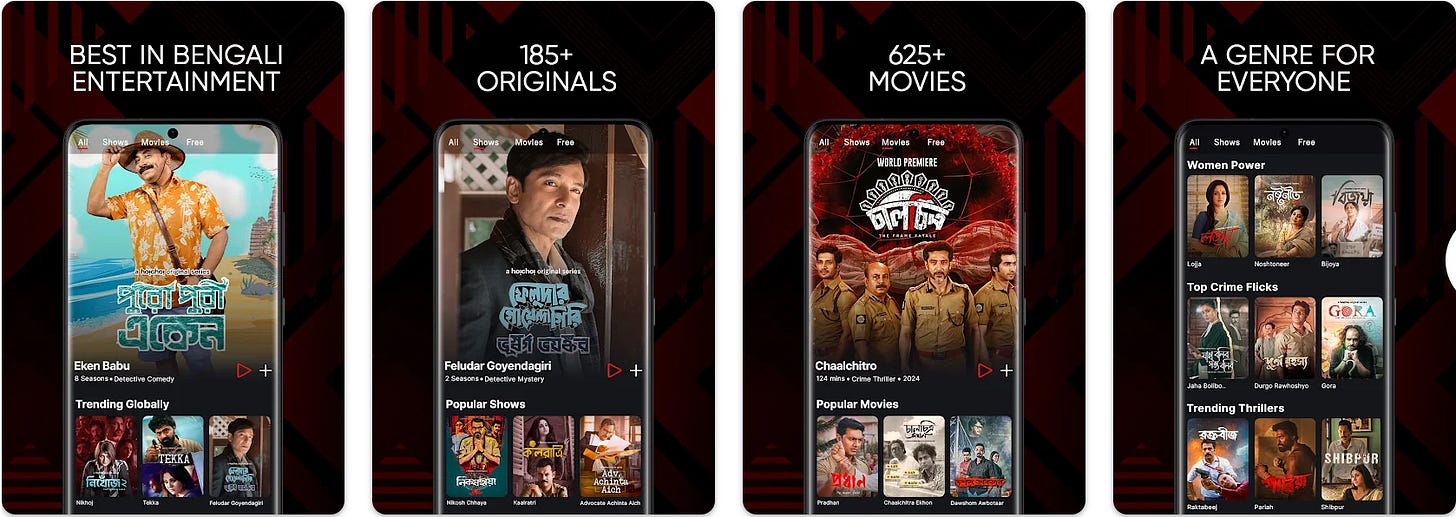

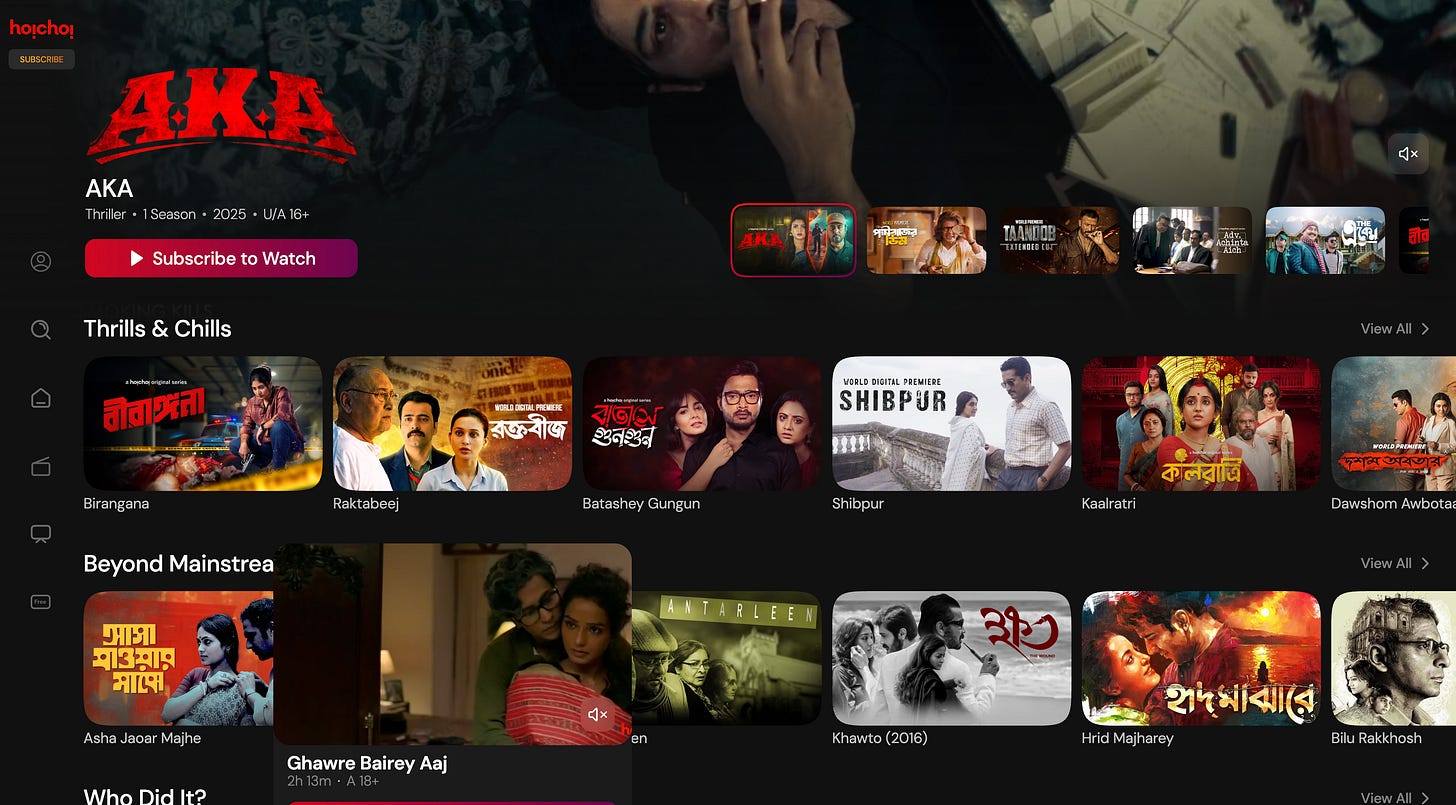

Bengali – Hoichoi

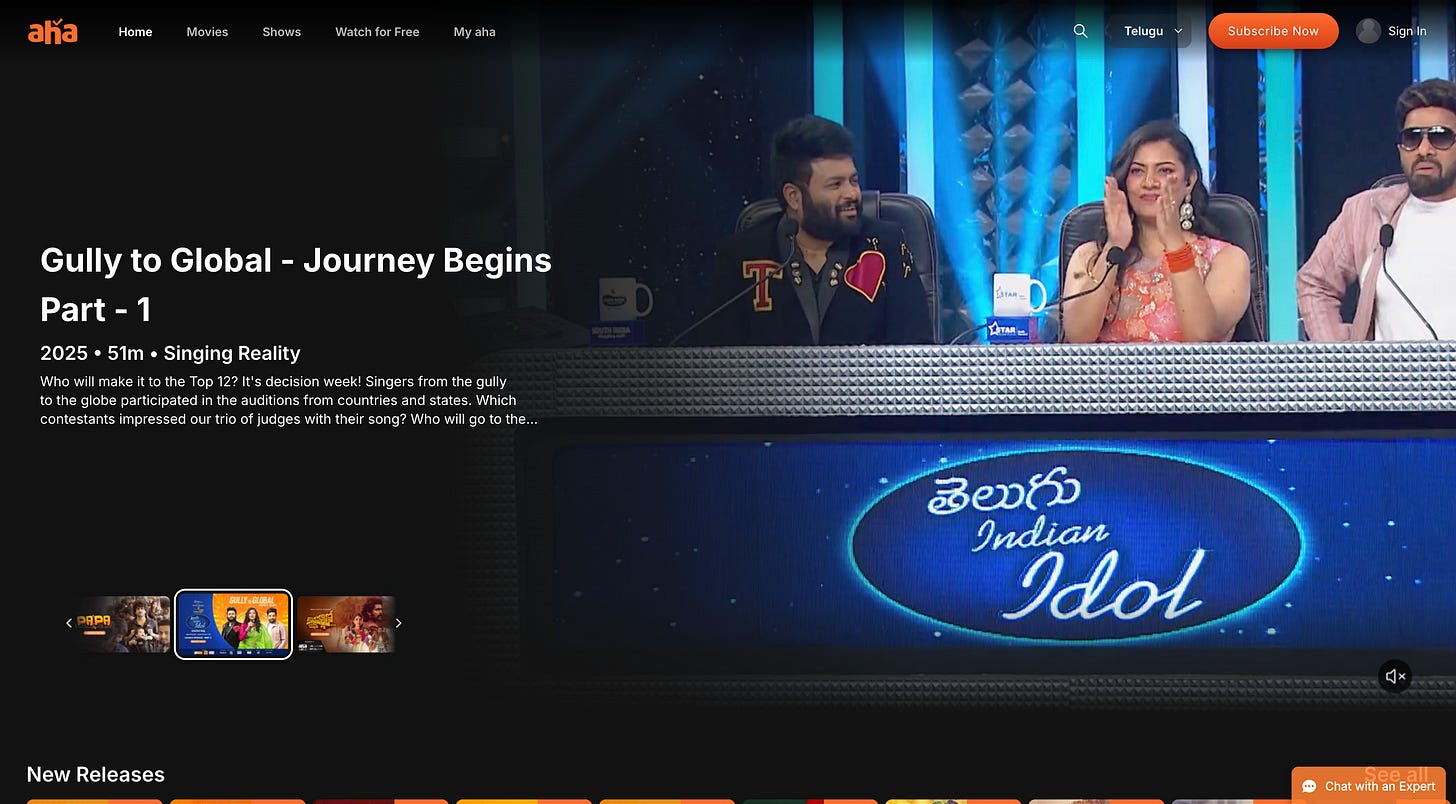

Telugu & Tamil – Aha

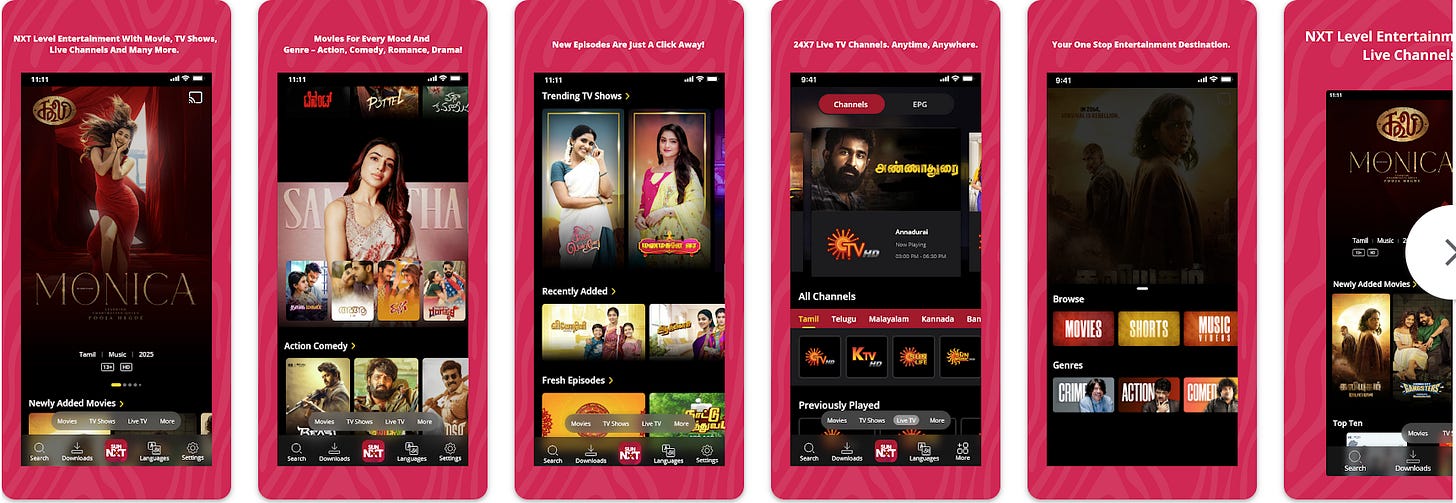

South Indian Broadcaster OTT – SunNXT

Malayalam – ManoramaMAX

And….Action!

Regional Indian OTT Streaming Landscape in 2025 [Part 1]

Regional OTT platforms have firmly established themselves by 2025, carving out thriving niches alongside global players. In fact, regional-language content now accounts for over half of all OTT viewership in India [fortuneindia.com]. Whether it’s a Bengali thriller or a Punjabi comedy, localized stories coupled with smart business models are turning “small-town” content into big business. These platforms operate with leaner economics, targeted content, and strategic partnerships, allowing them to compete without trying to be the next Netflix. Below is a look at the key regional OTT players in major Indian languages, their strategies in 2024–25, and common trends shaping this landscape.

Bengali – Hoichoi

Hoichoi (launched 2017) has become the premier Bengali OTT service, boasting approximately 13 million subscribers across 100+ countries. It has achieved this reach by focusing singularly on Bengali content and diaspora audiences. The platform offers a vast library of 600+ movies and 160+ original series, including popular detective thrillers and social dramas that enjoy completion rates as high as 80%. Co-founded by SVF (a major Bengali studio), Hoichoi leverages a steady pipeline of Bengali films and originals – even launching its own film production arm Hoichoi Studios to produce theatrical films that later stream on the platform.

Hoichoi’s strategy emphasizes depth in one language: it has produced over 160 original shows in Bengali and secured premium Bengali movie rights, creating a content moat. At the same time, it’s diversifying reach by dubbing its hit shows in Hindi to attract non-Bengali viewers and via syndication deals – for instance, partnering with JioHotstar to carry Hoichoi content to new audiences (with plans for Tamil, Telugu, and Malayalam subtitled offerings). Importantly, Hoichoi has a significant global footprint – around 40% of its revenue comes from international markets (U.S., UK, Middle East, etc.), where expatriate Bengalis are willing to pay for content in their mother tongue. This has driven up international revenues ~40% year-on-year, and the platform notes an 82% monthly retention rate among overseas subscribers, indicating strong loyalty.

Monetization is largely SVOD (subscription). Hoichoi eschews traditional advertising, which keeps the viewing experience ad-free. Instead, it monetizes via product placements and branded content integrations – a strategy that resulted in a 200% YoY jump in advertising revenues without running standard ads. The company has also partnered with telecom and device OEMs (e.g. Vodafone, Samsung) for bundled offers. Thanks to a sustainable, limited-burn approach, Hoichoi is nearing cash-flow breakeven and has even modestly raised subscription prices to fund its growing slate of originals while staying cash-neutral. The subscriber base itself is evolving: while Hoichoi initially targeted 30-something urban viewers, its fastest-growing segment is the 50+ age group, and its audience gender mix (60:40 male:female) is far more balanced than the OTT industry average. Overall, Hoichoi’s 2024–25 gameplan centers on doubling down on Bengali content dominance, expanding distribution (tier-2 city marketing and telco tie-ups in Bengal), and tapping diaspora pockets in Southeast Asia and the Middle East to keep growth momentum.

Telugu & Tamil – Aha

Aha, launched in 2020, has quickly become a regional powerhouse for Telugu (and Tamil) streaming. Backed by film producer Allu Aravind’s Geetha Arts, Aha leveraged an existing studio ecosystem to fill a gap in the market: a dedicated platform for Telugu content. It later expanded to Tamil in 2022, effectively targeting two of the largest South Indian language markets via one service. By early 2024, Aha had grown to around 2.5–2.7 million paid subscribers, up from 1.5M in mid-2021. Its app had been downloaded over 40 million times in core markets, and notably, Aha reports about 12 million monthly active users including a large base of free users consuming its AVOD content. This hints at Aha’s distinct model: unlike most regional OTTs, Aha runs a hybrid AVOD+SVOD strategy, offering a sizable free catalog supported by ads alongside its premium subscription content. In fact, about 70% of Aha’s content is free (ad-supported) – mainly older movies and shows – while the top 30% “premium” content is paywalled for subscribers. This acts as a funnel: the free tier hooks viewers, who then upgrade to watch the latest blockbuster or an exclusive original series.

Content is Aha’s forte, spanning 750+ films and 40+ original shows as of late 2023. It differentiates itself by not only providing the usual mix of movies and web series, but also investing heavily in regional non-fiction formats. Aha has been a pioneer in Telugu reality and talk shows on OTT – e.g. it launched Telugu Indian Idol (a singing competition) and the celebrity talk show Unstoppable with actor Nandamuri Balakrishna. These shows became massive crowd-pullers and “subscription drivers” for the platform. For instance, Unstoppable Season 2 brought a 60% increase in new subscribers over Season 1, and together Seasons 1–2 clocked 35.7 million unique viewers. Similarly, Telugu Indian Idol drew in significant viewership and even attracted multiple brand sponsors despite being on an OTT (not TV) – showing that Aha could generate event-level buzz in a regional market. By focusing on local reality formats and star-led shows that national OTTs hadn’t ventured into, Aha tapped an underserved appetite and boosted its subscriber acquisition.

On the scripted side, Aha’s original web series like Kotha Poradu (rural drama) or Locked (thriller) and direct-to-OTT movies (Color Photo, etc.) have resonated well. 70% of Aha’s content budget is dedicated to originals (Telugu and Tamil), underlining its belief that unique local content is key to retention. The service keeps pricing affordable for mass appeal – annual plans around ₹399-699 and quarterly mobile-only packs under ₹150 – far cheaper than global OTT subscriptions. This low ARPU is offset by scale and high engagement in its target states. To extend its reach further, Aha has pursued aggressive bundling and partnerships: for example, it joined the Airtel Xstream aggregator in late 2023, instantly getting exposure to Airtel’s 5+ million bundle subscribers. (Airtel’s OTT pack now carries Aha’s Telugu and Tamil catalogs alongside bigger platforms, expanding Aha beyond its direct subscriber base.) Likewise, Aha is offered on OTTplay Premium and other super-aggregators, and it frequently partners with cable and fiber broadband operators in South India for bundled deals.

All these moves have made Aha one of the few regional OTTs to achieve scale and a sustainable model. As of 2024, it claims to be profitable in its original Telugu market and is aiming to replicate that success in Tamil. The focus for 2025 is on continued content innovation (they unveiled an ambitious 2025 slate with new originals, spanning genres from fantasy to rom-com) and on user experience improvements (Aha 2.0 app revamp) to keep users engaged. In summary, Aha’s twin-market strategy backed by local reality content and a freemium model has cemented it as a leader in the South Indian regional streaming game.

South Indian Broadcaster OTT – SunNXT

SunNXT is unique in the regional OTT pack as it’s an extension of a traditional TV network (Sun TV Network, Chennai). Launched in 2017, SunNXT was an early mover, designed to digitize Sun TV’s vast trove of content. It serves four major South Indian languages – Tamil, Telugu, Kannada, Malayalam – by hosting Sun TV’s popular serials, game shows, music and a deep library of South Indian films. In fact, SunNXT carries 4,000+ movies and 30+ live TV channels (Sun’s network channels) under one roof. This all-in-one approach quickly attracted a massive user base; the platform saw over 20 million users (installs or subscribers) sign up within a few years of launch, thanks largely to bundling deals. SunNXT’s growth was heavily driven by B2B partnerships – for example, SunNXT has been offered free or at discount to subscribers of Jio, Airtel, Vodafone Idea’s apps, and even DTH operators, as part of Sun TV’s strategy to widen distribution. These deals have helped SunNXT cross 2 crore+ (20 million) users by combining its direct subscribers with bundled-access users.

The content strategy for SunNXT has been more about breadth and catch-up TV than high-end originals. Subscribers (paid users) get ad-free access to SunNXT’s entire catalog, including live TV streams and catch-up episodes of shows that air on Sun’s channels (often available immediately after TV broadcast). This “tap into TV audience” strategy turned SunNXT into a must-have for soap opera fans who could watch missed episodes or even live television on mobile. In addition, SunNXT has a rich film library – especially Tamil hits, given Sun’s film distribution arm (Sun Pictures) which produces big Tamil films. The platform does have some originals and exclusive premieres, but on a much smaller scale than Hoichoi or Aha. Instead, SunNXT’s differentiator is leveraging its parent network’s strengths: for instance, Sun TV produces made-for-TV movies and then directly secures their digital rights for SunNXT, saving costs on content acquisition. This vertical integration (TV + movies + OTT) gives SunNXT a steady flow of content without huge extra investment.

Monetization is via subscription, with monthly, quarterly, annual plans (pricing roughly ₹50–₹480 depending on plan). There is no separate free tier of SunNXT, but interestingly, SunNXT has allowed some of its content to be accessed on partner platforms without a SunNXT subscription – e.g., certain movies or shows appear in JioHotstar’s free library or Airtel’s app as part of content-sharing deals. Within SunNXT’s own app, a few things like movie trailers, comedy clips, and music videos are free to watch for marketing purposes. By 2024, SunNXT remains dominant in the South Indian OTT segment in terms of pure user numbers (given the millions who have access via bundles). It’s especially strong in Tamil Nadu where the Sun TV brand loyalty is unparalleled. However, industry observers point out that SunNXT has room to improve in technology and engagement – its app experience has lagged behind competitors (drawing criticism for a clunky UI), and the lack of sports or edgy originals means it could lose younger audiences. Sun appears cognizant of this and has hinted at an app revamp and more investment in SunNXT-exclusive content going forward. Notably, SunNXT quietly added some Bengali and Marathi content as well (since Sun launched Sun Bangla channel in 2019 and Sun Marathi in 2023), indicating an interest in broader regional reach. In summary, SunNXT in 2025 stands as a formidable OTT with a broad regional library, sustained by its broadcast might – but its challenge ahead is to innovate beyond being just a catch-up TV archive and keep pace on user experience.

Malayalam – ManoramaMAX

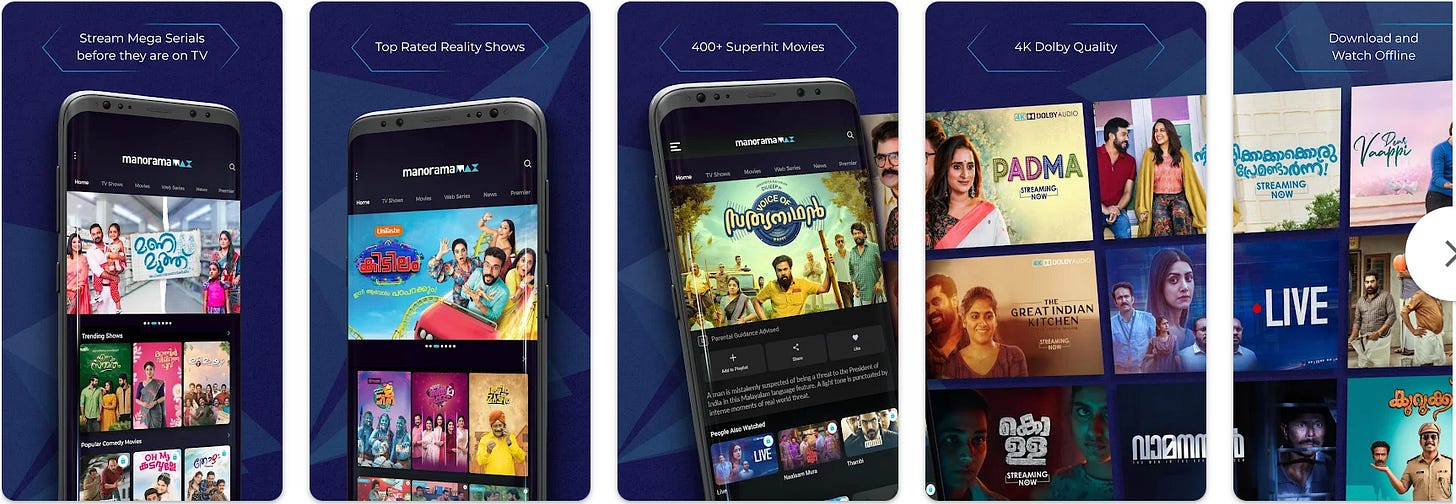

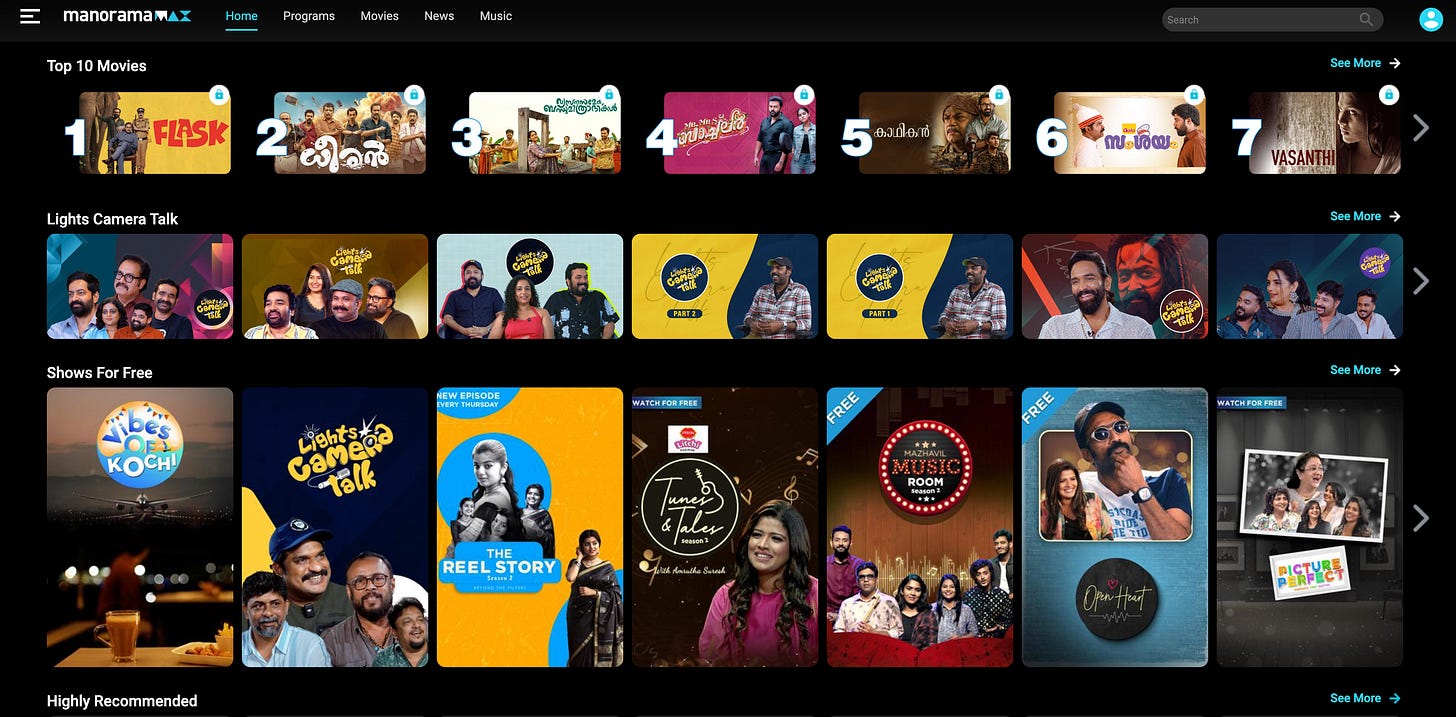

ManoramaMAX has emerged as a success story in the Malayalam OTT space by taking a slightly different approach. Launched in 2019 by the Malayala Manorama media group, it was the first exclusive Malayalam-language OTT platform. What sets it apart is the integration of news and entertainment in one service – reflecting the parent company’s strengths (Malayala Manorama is a top newspaper and runs TV channels). ManoramaMAX offers a diverse mix: live TV streams of Mazhavil Manorama (a leading Malayalam GEC channel) and Manorama News channel, on-demand serials and reality shows (essentially catch-up TV for Manorama’s broadcasts), a library of 400+ Malayalam films, and a growing slate of original web series and shows. It’s effectively a one-stop app for Malayali viewers, blending daily soaps, news updates, movies, and original digital content.

One of ManoramaMAX’s key strategies is early window content for subscribers. If you subscribe to the premium tier, you can watch new episodes of TV serials before they air on television (same-day early access), and see monthly movie premieres on the app before they’re broadcast on TV. This “digital-first, TV-next” approach not only incentivizes fans of Manorama’s shows to subscribe, but also helps the company’s advertising business – by driving buzz to the TV premieres later. (Notably, ManoramaMAX has been recognized with Best Regional OTT Platform awards four years in a row, suggesting it’s kept viewers happy with this model.) On the originals front, ManoramaMAX has produced Malayalam web series and specials that align with local sensibilities, though its original content volume is modest compared to bigger players. It leverages the trust and brand of Manorama: the platform pitches itself as “the Malayali’s home OTT”, even highlighting that a significant chunk of its online traffic comes from the Malayali diaspora in the Gulf (UAE, etc.) who rely on Manorama for staying connected to Kerala. This diaspora focus is important – Kerala has a large expatriate community, and ManoramaMAX, through ManoramaOnline and the OTT, reaches Malayalis worldwide, offering them everything from the latest news to nostalgia sitcoms in one app.

In terms of monetization, ManoramaMAX is subscription-based with an affordable pricing (~₹899/year in India). There may be limited free content (perhaps news clips or select shows) to draw users in, but by and large premium content (the early premieres, full movie catalog, originals) sits behind a paywall. The platform likely benefits from cross-selling to loyal readers and TV viewers – for example, bundling offers for newspaper subscribers, or promotions on the TV channel to download the app. The cross-media synergy is a cornerstone: Malayala Manorama can offer advertisers combined packages across print, TV, and OTT, which means ManoramaMAX doesn’t have to rely purely on subscription revenue. In 2024, ManoramaMAX even clinched the IAMAI award for Best Regional OTT in India, underscoring its role as a “beacon of hope” for niche regional platforms. With Kerala’s government launching its own CSpace OTT (first state-run OTT for classic films), ManoramaMAX may face some home-turf competition, but its head-start and the trust in its brand give it a solid foundation. Going forward, expect ManoramaMAX to continue focusing on its loyal Malayali user base, adding more exclusive movies (perhaps Malayalam film festival hits) and leveraging its unique news-entertainment combo to retain engagement.

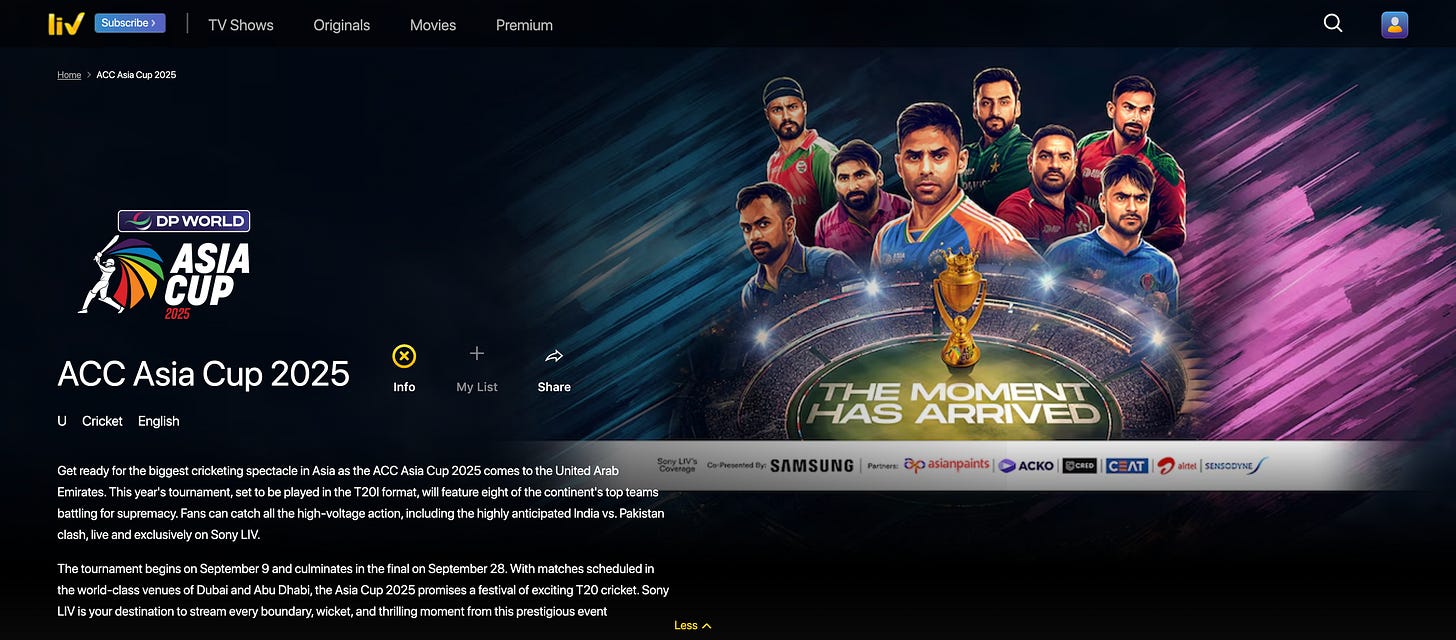

All roads lead to the Dubai International Stadium, aka the Dubai Sports City Cricket Stadium as the Asia Cup Cricket carnival began yesterday with the marquee clash of India v Pakistan scheduled for this Sunday, the 14th of September. Catch the action live on SonyLIV in India!

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” / sports tech fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.