To understand the future, look at the past

The Streaming Lab - MENA #001

Hey 👋 - Yann here.

This is the 1st issue of The Streaming Lab - MENA.

Every Saturday, I send out 1 tip to better understand the OTT market in Middle East & North Africa.

Enjoy the show.

My tip today: to understand the future of OTT in MENA, you need to look at what happened in the past 10 years.

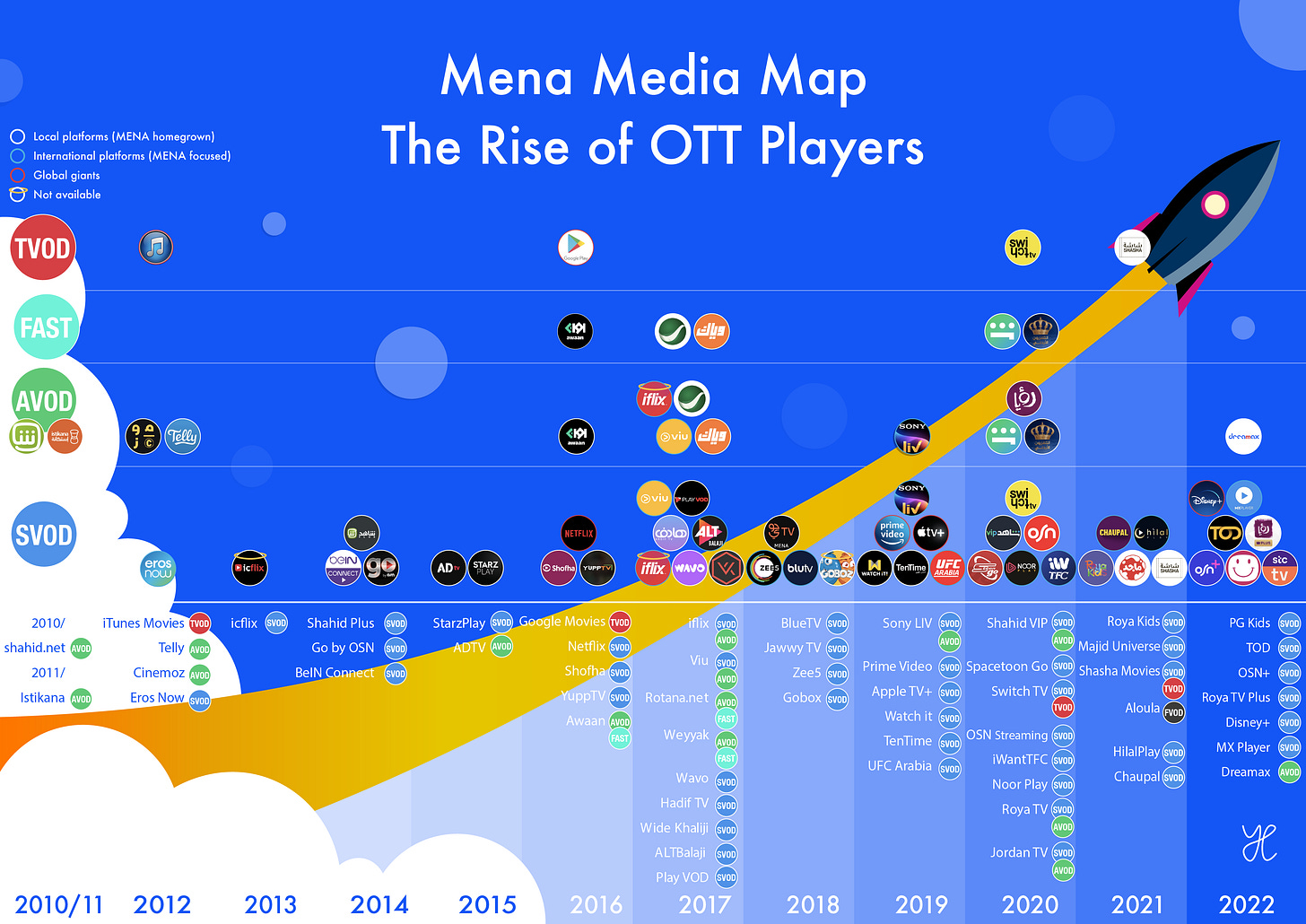

50+ pure OTT players launched in the region: local players, global giants and international platforms.

I designed my first « Mena Media Map: The Rise of OTT players » to get a visual representation of the new players through the years.

And I identified 3 main trends ↓

Download the pdf version here.

Local OTT players have a powerful defense (eco)system

The homegrown platforms didn’t wait for Netflix and the international streamers before strengthening their content, product and distribution strategies:

They established key partnerships with Hollywood studios and major international providers. And most of them invested in Arabic content from local creators and original co-productions from levant, Egypt, Maghreb and Gulf.

They designed their platforms for an Arabic audience, including translating but also mirroring. For example, Shahid SVOD service is available in English, French and Arabic with a mirror-friendly UX.

Delivering content over the internet helped them reach millions of viewers. But they also signed regional telecom billing partnerships with Etisalat, Ooredoo, STC or Zain to increase their reach, especially in countries where credit card penetration is low.

SVOD is still king, but for how long?

We can easily see on the roadmap the majority of OTT players focus on the subscription model. But the over-representation of SVOD could lead to a “subscription fatigue” and have 2 direct consequences:

Super aggregation could be the only way to save SVOD, coming from different actors:

Pay-TV & Telcos: OSN, STC, Etisalat or Ooredoo

Streaming service: Shahid, StarzPlay or OSN+

Smart TVs: Sony, LG or Samsung

The comeback of Advertising models, sooner than expected: AVOD (Advertising-based Video on Demand) and FAST (Free Ad-supported Streaming Television).

On Demand will not cannibalize Linear TV, but strengthen it

We can now find Linear TV (live and channels) within the SVOD ecosystem, on Shahid VIP, Jawwy TV, StarzPlay and Switch TV. But also mixed with AVOD content on Weyyak, Rotana[dot]net or Awaan.

We will find more cohabitation examples between On Demand and Linear content in the coming months, mainly driven by Shahid and StarzPlay, already on the hunt for Live Sports. Both models will benefit from this natural alliance.

The new nomenclature, recently described here by Alan Wolk, is a first answer to services mixing On Demand and Streaming Televisions. The starting point is still the business models, but the way end users see them: Free (FAST) or Subscription (SVOD).

We’ll keep calling them FAST and SVOD for now, until we find better acronyms. Linear and On Demand become then delivery methods that can be found within each models.

That’s all for today. 1 tip to better understand the OTT market in Middle East & North Africa.

See you online next week. Until then, enjoy the season 4 of Stranger Things on Netflix.

- Yann

Whenever you’re ready, there are 3 ways I can help you with:

If you want to learn more about OTT in MENA, I’d recommend starting with my market report:

→ The local OTT ecosystem in MENA: Learn everything about the local streaming services in the region. Get full access here.

License premium FAST & On Demand content on TVToday.

Hire top streaming experts for short-term assignments on OTTpro.