Who is doing Kids Content right?

With a Brief Look at the Kids' Content Strategy of the major 'Indian' streamers

Hey Streamers 👋,

A warm welcome to the 43rd edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends and more in one of the fastest growing video markets! If you are not already a subscriber, please sign up and join 3,000+ others who receive it directly in their inbox every Wednesday.

A summary of some great points of view shared by Shailesh Kapoor, head of Indian media consulting firm Ormax.

Consolidation and Profitability Challenges in India's Streaming Sector

Market Penetration and Growth

Streaming Penetration: Paid content reaches only 10-14% of India's 1.4 billion population.

Growth Slowed Post-Pandemic: Initial growth was driven by the top 10-15 cities, but these markets have now saturated. Future growth depends on attracting subscribers from smaller towns and rural areas, which is progressing slowly.

Cost Barriers

Double Cost Structure: Indians face both data and subscription costs for streaming, unlike the traditionally low-cost TV options. Many consumers are reluctant to pay for content available for free on TV and YouTube.

Industry Consolidation

General Landscape Influence: Consolidation trends are influenced more by the overall media landscape, including television, rather than being streaming-specific.

Failed Mergers: The Sony-Zee merger discussions, driven primarily by their television businesses, highlight the broader media consolidation.

Reliance-Disney Deal: The upcoming Reliance-Disney deal is anticipated to serve as a significant industry case study.

Market Paradox

Consolidation and Regional Strength: While the market appears to consolidate around a few major players, regional players remain strong and significant.

Unique Business Models

Amazon Prime's Integrated Model: Combining shopping and video services, Amazon Prime offers a potentially more viable business model.

Content Library Acquisitions: Amazon's acquisition of MX Player assets is a recent example, similar to Sony's acquisition of SAB TV in 2005.

Importance of Theatrical Films

Subscriber Boost: Theatrical films significantly boost subscriptions and platform preference. Despite the growing popularity of web series, theatrical releases remain a major draw, especially in southern India.

Sports Content

Advertising Revenue Potential: Sports content holds substantial advertising revenue potential, although high rights costs pose challenges.

Free Sports Streaming: JioCinema's decision to stream IPL cricket for free has altered sports content monetization strategies, maintaining Disney+ Hotstar's relevance despite losing IPL rights.

Key Players

Netflix: Notable growth with subscriber numbers increasing from 7-8 million to over 11 million in two years. Success attributed to a more affordable mobile plan and improved content quality.

Amazon and JioCinema: Identified as promising players, with JioCinema launching disruptive pricing at INR29 (35 cents) per month.

Conclusion

India's streaming sector faces profitability challenges and is witnessing consolidation trends influenced by the broader media landscape. Key growth drivers include:

1. Expanding penetration into smaller towns and rural areas

Leveraging unique business models.

Capitalizing on the importance of theatrical films and sports content.

Major players like Netflix, Amazon, and JioCinema are strategically positioned to navigate these challenges and opportunities in the evolving market.

Today’s program:

Kids Content in Indian OTT: Immense Opportunity

Green Gold Animation: India’s best known kids content producer

Major Indian OTTs’ Kids Content Strategy

And….Action!

Kids Content in Indian OTT: Immense Opportunity

Current Status: Online

If you’re a regular consumer of Netflix or other OTT platforms, chances are you've indulged in an anime series or two. This isn't an anomaly; kids and young adult-targeted shows are being consumed more heavily than ever. From anime and live adaptations to cartoons, the kids' entertainment market is booming.

Shifting Trends in Kids' Entertainment

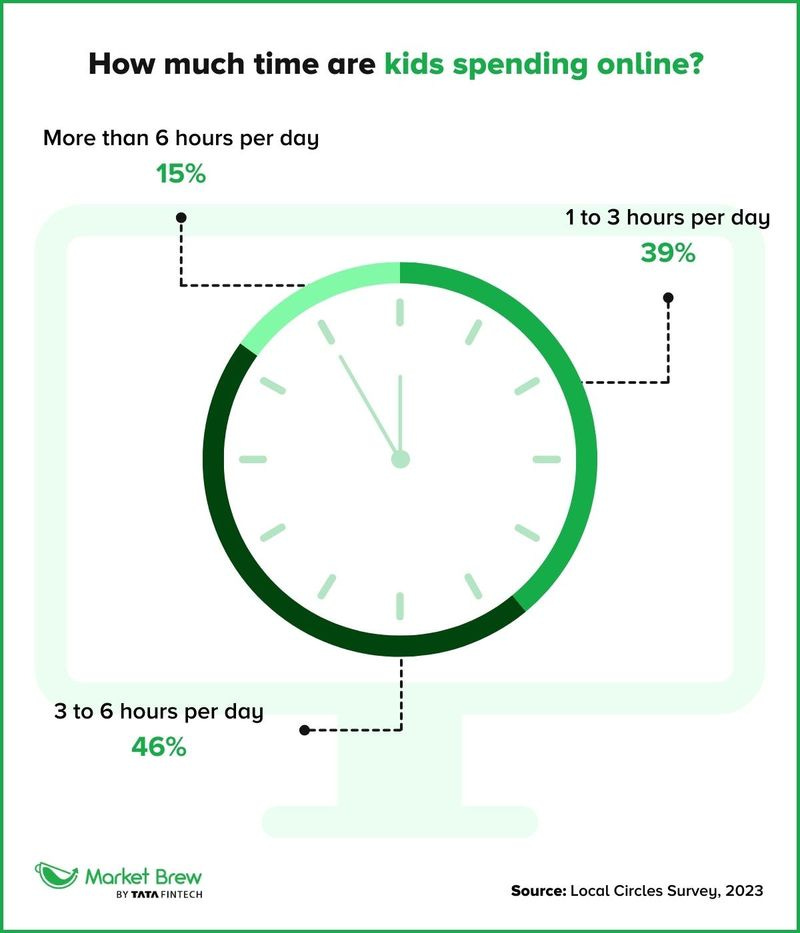

A decade ago, playgrounds were filled with playing children. Today, the scenario has shifted significantly. Most kids are now found in their rooms, engrossed in phones or tablets. According to a nationwide survey by LocalCircles, 61% of children spend at least 3 hours online daily. As kids migrate online, the demand for kid-focused content is rising.

Indian Content for Kids: Current Landscape

Ask any 9-15-year-old in urban India on what they're watching, and you'll likely hear about Hollywood franchises, Japanese anime, or shows on Netflix or Disney. Indian content tailored for children is scant. Shailesh Kapoor, CEO of Ormax Media, notes that children’s films contribute less than 0.2% to the Indian box office. This lack of investment has kept the sector stagnant, but the tide is turning.

The Pandemic Shift

The 2020 pandemic was a turning point. With children confined to their homes, TV viewership soared. Discovery Kids saw a 35% growth in 2020, while Nickelodeon had 50 million weekly viewers. Recognizing this trend, media companies began prioritizing kids' content.

ZEE5 launched Zee5 Kids with 4,000 hours of content in nine languages, and Discovery India introduced a kids' genre on Discovery+. Recently, Jio Cinema entered the kids' entertainment category, partnering with the Pokemon Company to host over 1,000 episodes and 20 movies. Moonbug Entertainment and BBC Kids are also eyeing the Indian market, with BBC Kids partnering with Amazon Prime.

Future Prospects

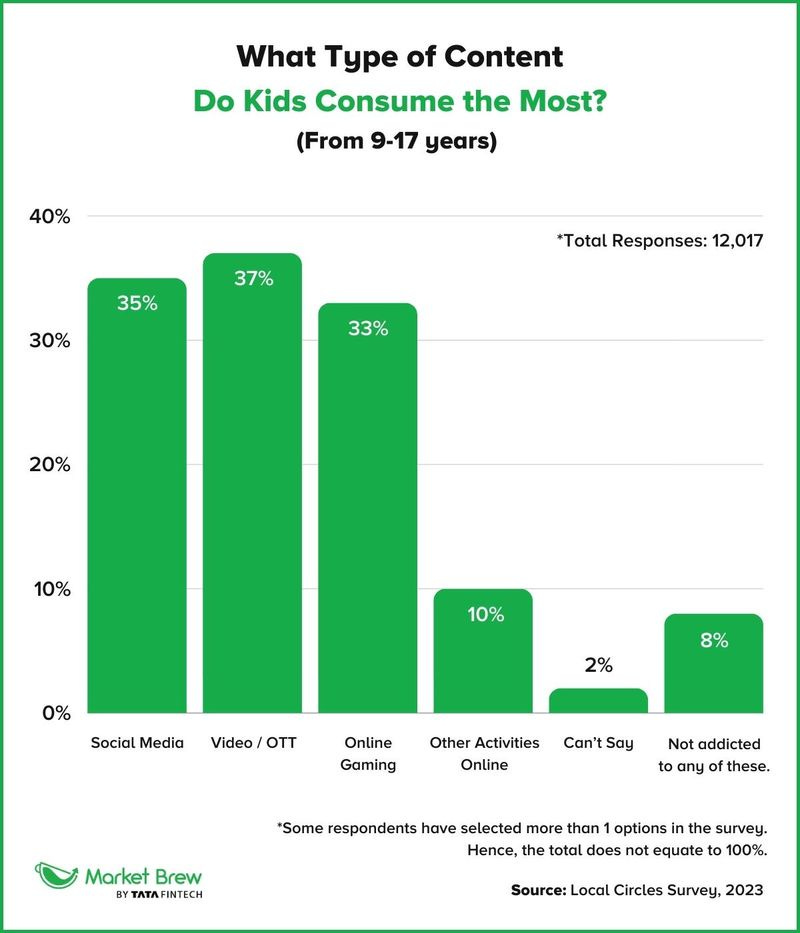

With 35% of kids addicted to social media and 37% spending most of their time watching videos, a new market for infotainment apps is emerging. Apps like Khan Academy Kids, YouTube Kids, ABC Kids, and Nickelodeon Jr are blending educational content with entertainment. Platforms like YouTube Kids also allow children to become creators, fostering creativity.

Inclusive Growth

Indian companies are aggressively pushing content globally. Hyderabad’s Green Gold Animation's Chhota Bheem has seen international success, spawning a Netflix spin-off, Mighty Little Bheem. This underscores the value of homegrown content. Platforms like Eenadu Television's ETV Bal Bharat and Warner Media's POGO and Cartoon Network are expanding their reach by offering content in multiple languages.

Bottomline

While it’s crucial to monitor kids' exposure to content, the kids' entertainment space presents significant opportunities for producers & investors. The sector's growth prospects make it a potential goldmine.

Green Gold Animation: India’s best known kids content producer

One of the better known kids content production houses from India, Green Gold Animation, founded by Rajiv Chilaka in 2004, is renowned for creating the beloved Indian animated character Chhota Bheem (As of recent estimates, the Chhota Bheem franchise has a brand value exceeding INR 300 crore (approximately USD 40 million). This valuation reflects the character's immense popularity, extensive licensing deals, and merchandising success (Indian Retailer). The company has grown into a major player in the animation industry with over 800 artists producing more than 10 shows, 700 episodes, 80+ TV movies, and 4 feature films. Green Gold Animation has expanded its footprint globally, reaching over 60 million children worldwide.

Future Slate

Green Gold Animation has an ambitious slate for 2024, including:

Live-Action Projects: The first live-action movie, "Chhota Bheem and the Curse of Damyaan," is set to release in May 2024 under the Chilaka Productions banner.

Original Content: The studio is actively developing a range of original content for future releases, aiming to connect better with audiences through various platforms.

Key Partners

Green Gold Animation has partnered with major global and regional networks and platforms, including:

Amazon Prime Video

Netflix (notably for the globally successful series "Mighty Little Bheem")

Cartoon Network

Disney and Disney XD

Discovery Kids

Pogo TV

JioCinema

These partnerships highlight the studio's broad reach and significant influence in both Indian and international markets.

Major Indian OTTs’ Kids Content Strategy

Disney+ Hotstar

One would think that with such a vast library and some awesome IP, Disney+ Hotstar would be the leader in the kids content category, however they could do a lot more to improve discovery of kids content (for example asking users who sign up if they are a parent and what the age of their child is to personalize and recommend relevant titles etc). From Disney classics to Pixar hits to Indian IPs such as Chacha Chaudhary, Hanuman, they have it all. Well soon they might have a new home in JioCinema!

Zee5

Almost a similar experience to SonyLIV - Zee5 Kiddie Delights was hidden towards the end of the app homepage. Discovery is an issue, however they do have some great Indian and international kids titles such as Toonpur ka Superhero, Peter Rabbit, Stuart Little etc; a few of them are available to rent for Rs. 69 ($0.85).

JioCinema

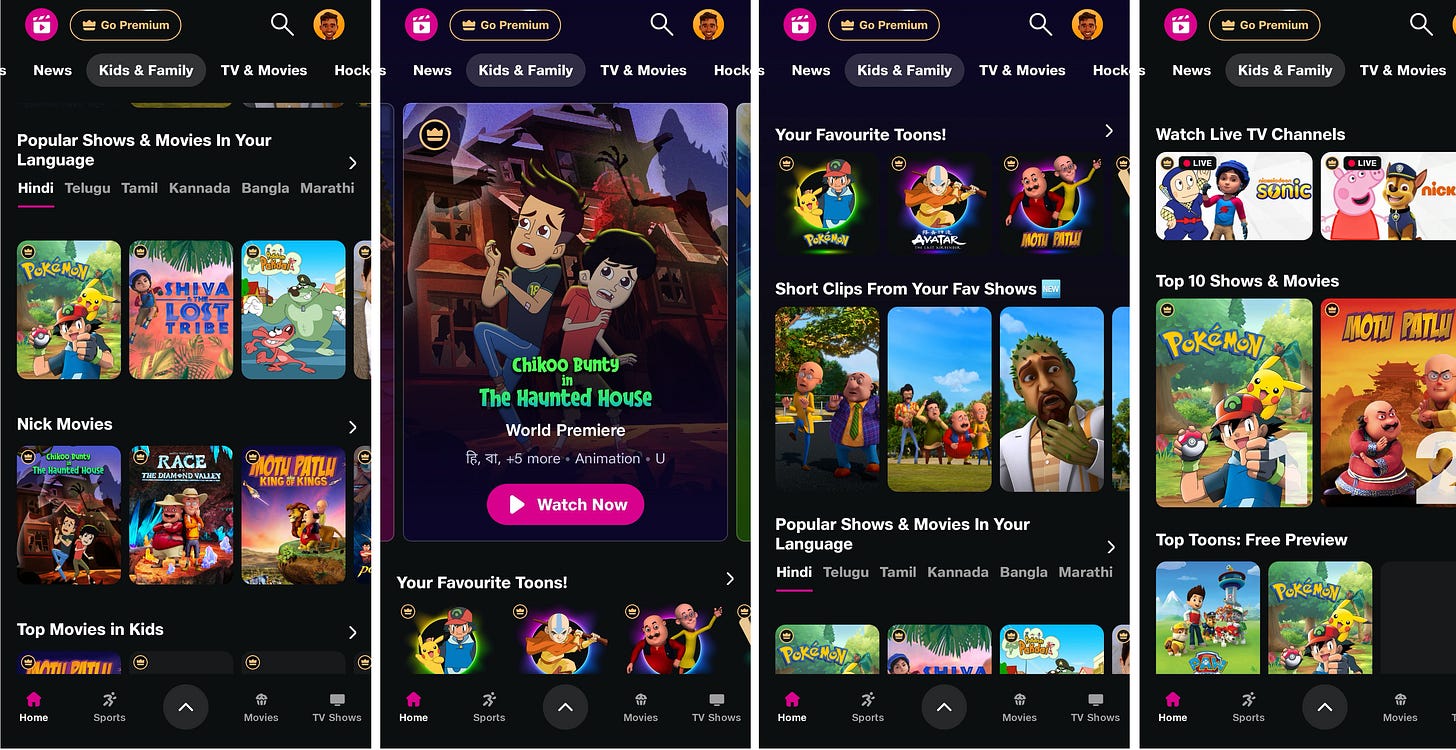

And the winner is JioCinema! It helps that you get a massive kids library with the Voot content inclusion (as part of Viacom18), which had a standout Voot Kids app, however they have built on focusing efforts to highlight some marquee content IPs such as Pokemon, Motu Patlu, Nickelodeon titles and also live kids channels by character (FAST) with the ability to search titles by language - kudos.

Overall, Indian OTTs can still do a lot more to cater to Indian parents and kids - from a kid friendly UI / UX to recommending titles by age group to basic “kids content” discovery - this space is ripe for disruption. I would not discount the ability of up starts to come in and make a mark in this space. Think Stage OTT working on a “Kids” app for the heartland!

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

TVF’s “Kota Factory” is three seasons with the third season recently launching on Netflix - filmed in pristine monochrome, full of perspective-inducing aerial shots, cinematic filmmaking that lets you see from under the tables, behind the whiteboards, and a super teacher who can solve it all.

After two seasons of letting us in on the aims and preparations of Vaibhav (Mayur More), Meena (Ranjan Raj), Uday (Alam Khan), their star Physics instructor Jeetu Bhaiya (Jitendra Kumar), and glossing over the hellhole that is the Rajasthan student-town for most IIT-JEE aspirants, Kota Factory finally unravels in this new installment. Worth a watch even for our international readers to have a peak into the pressures, dynamics and more associated with arguably the most competitive entrance exams in the world.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on the Indian and Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.

Download our market reports STREAMING in MENA and STREAMING in INDIA.

For advertisers, brands and even OTT platforms wanting to advertise on premium video inventory across 1000+ publishers, broadcasters and streamers across APAC, India and MENA using the world’s fastest growing ad network, Adsolut Media (Playstream), please Contact me here.