Why did Amazon buy MXPlayer?

The secret might lie within miniTV, Amazon's free streaming product for India

Hey Streamers 👋,

A warm welcome to the 41st edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends and more in one of the fastest growing video markets! If you are not already a subscriber, please sign up and join 2,950+ others who receive it directly in their inbox every Wednesday.

Disney+ Hotstar Amplifies CTV Advertising for ICC T20 World Cup 2024

Disney+ Hotstar is setting new targets for digital video advertising, focusing particularly on Connected TVs (CTV) to reach premium audiences. Dhruv Dhawan, the platform's Head of Ads (Source: Afaqs) , emphasized the strategic importance of CTV, given its penetration into 25 million premium households and an additional 20 to 25 million premium devices. This positioning aims to attract advertisers looking to target affluent viewers, offering a unique opportunity to engage with a family-centric viewer base behind a paywall during live sports.

Revolutionizing Advertising with Affordable and Accessible Options

Disney+ Hotstar is revolutionizing its advertising approach by offering self-serve advertising packages starting as low as Rs 49 CPM, with budgets from Rs 2 lakhs. This initiative is part of their broader strategy to democratize live sports advertising, making it accessible to a wider range of advertisers, including small businesses and first-time advertisers. The platform has successfully expanded its advertiser base from 200-500 to an impressive 5,000-10,000, catering primarily to local Indian brands and SMBs.

CTV Advertising: A Premium Choice

The emphasis on CTV advertising comes from its ability to provide a premium viewing experience, where ads can target households directly, often at rates three to four times higher than mobile. The co-viewing factor of CTV, where one device often represents multiple viewers, further enhances its value for advertisers, offering broader reach per ad spot.

Strategic Timing and Targeting During the Monsoon Season

Despite the T20 World Cup occurring during the monsoon—a traditionally low period for advertising spend—Dhawan is optimistic about continued interest from key sectors like fintech, auto, and BFSI. The platform's flexible digital advertising allows for precise demographic, geographic, and behavioral targeting, ensuring that even during off-peak seasons, advertisers can achieve significant engagement and reach.

Plans for Enhancing Advertiser Engagement and Reach

Looking forward to the World Cup, Disney+ Hotstar plans to introduce pre and post-live segments with expert commentary and technical integrations, available both on digital and TV streams. These new features aim to provide enriched content and additional advertising opportunities, allowing brands to tailor their campaigns more effectively and engage with viewers through innovative formats.

Summary

Disney+ Hotstar's strategic focus on CTV advertising for the upcoming ICC T20 Men's World Cup, combined with its expanded advertising options and targeting capabilities, positions the platform as a key player for brands aiming to reach premium and diverse audiences across India. With the promise of enhanced viewer engagement and innovative advertising solutions, Disney+ Hotstar is paving the way for a new era of digital advertising during major sports events.

For advertisers, brands and even OTT platforms wanting to advertise on Disney+ Hotstar during the T20 World Cup and also to access premium video inventory across 1000+ publishers, broadcasters and streamers across APAC, India and MENA using the world’s fastest growing ad network, Adsolut Media (Playstream), please Contact me here.

Today’s program:

Amazon Mini TV

Amazon Prime Video & MXPlayer: A match made in heaven?

My Views

And….Action!

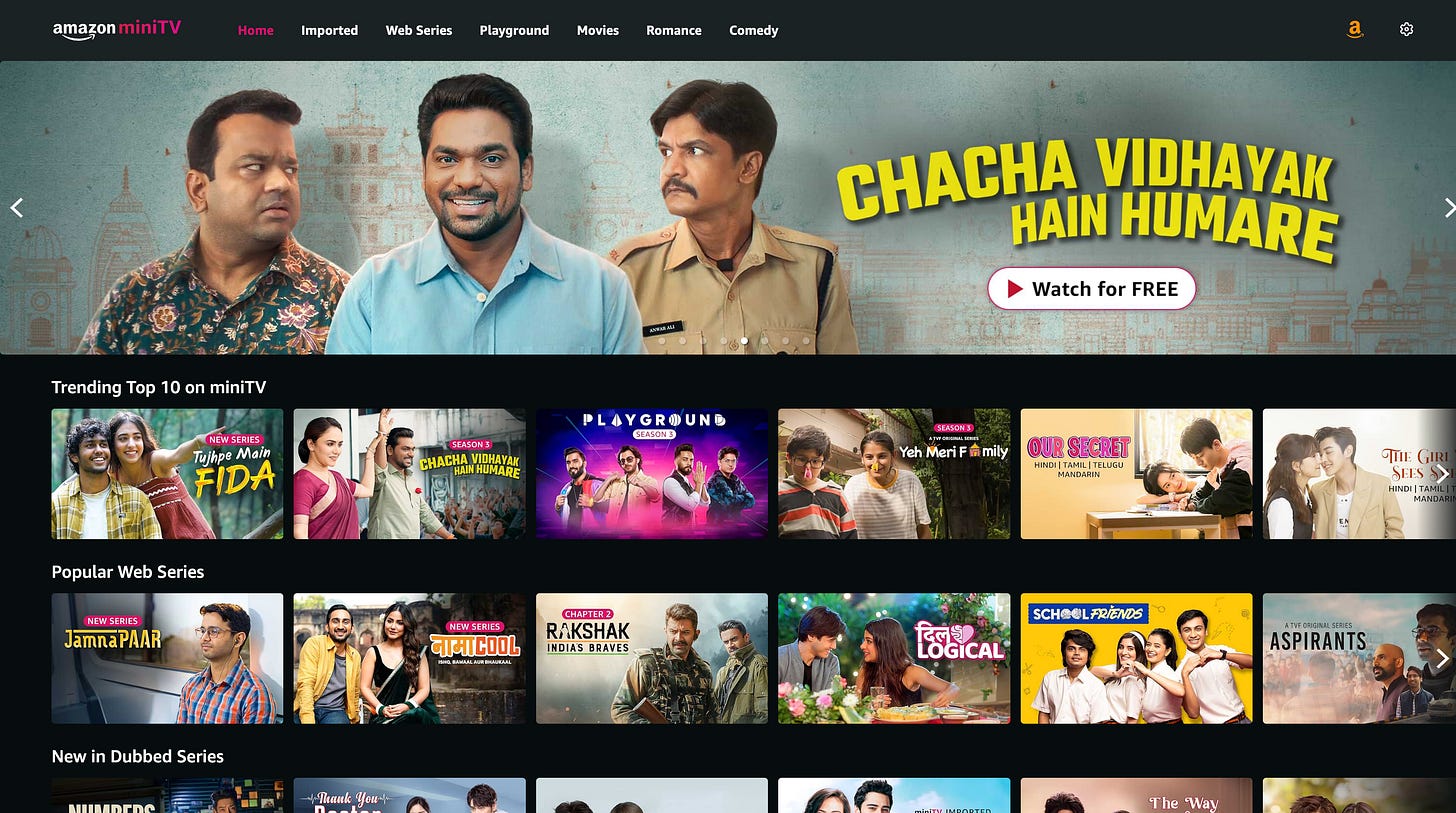

Amazon Mini TV

Amazon miniTV, launched in May 2021, is an ad-supported video streaming platform available for free. It provides a wide variety of content, ranging from web series and short films to reality shows, across various genres. This platform is integrated within the Amazon shopping app and its dedicated website, making it easily accessible without any additional cost.

Here’s what you can enjoy on Amazon miniTV:

Extensive Content Library: Dive into a rich selection of dramas, comedies, and more, including popular titles like "Aspirants," "Yeh Meri Family," and "Physics Wallah." Whether you’re into intense Korean dramas, insightful Turkish series, or homegrown content like "Swagger Sharma's Lucky Guy," there’s something to cater to every taste.

User-Friendly Features: Amazon miniTV is designed for ease of use, allowing viewers to effortlessly search for shows, add them to a watchlist, and enjoy seamless streaming with an autoplay feature for series.

Free Access with Ads: The service is completely free, supported by advertisements, ensuring that all content is accessible without a subscription.

Accessing Amazon miniTV:

In India Only: This service is exclusive to viewers in India.

Device Compatibility: Available on iOS (version 14 and above), Android (OS version 6 and above), Fire TV devices (with the latest software), and via major web browsers.

How to Watch: Simply download the Amazon shopping app and tap the miniTV icon on the top right of the homepage. For larger screen viewing, visit www.amazon.in/minitv on your laptop. You can also download the miniTV mobile app here

Explore New Releases: Keep up with the latest in entertainment with fresh releases like "Campus Beats," "Half Love Half Arranged," and "Half CA." Amazon miniTV continues to update its offerings, providing a continuous stream of new and engaging content, all available at no charge.

Amazon miniTV has seen a remarkable fourfold increase in viewership and revenue, largely due to an expanded distribution strategy and a robust content pipeline specifically tailored to distinct audience cohorts.

Key Strategies Leading to Growth:

Expanded Distribution Channels: Originally available on Amazon's shopping app, miniTV has extended its presence to the Prime Video app and its own Android application, and is now also accessible on Google TVs and Xiaomi TVs, as well as the Amazon website and Fire TV. This broadened access enhances viewer convenience across multiple devices.

Evolved Content Strategy: Transitioning from short-form to long-form content has allowed miniTV to cater more effectively to varied audience preferences. This strategic shift aims to establish miniTV as a premier destination for diverse, long-form entertainment.

Integrated Shoppable Ads: The introduction of shoppable ads within content has significantly boosted click-through rates. This innovative advertising format allows brands to integrate seamlessly, enhancing viewer engagement and interaction directly from the advertising content.

Linguistic and Regional Expansion: Plans are underway to extend content offerings beyond Hindi to include languages like Tamil and Telugu, targeting the diverse linguistic preferences of viewers, particularly in South Indian markets.

Content and Advertising Innovations:

Targeted Content Development: By focusing on specific demographic cohorts within the 18 to 34 age range, miniTV tailors its programming to resonate with different maturity levels and interests, such as young professionals and college students.

High Engagement Genres: While the platform offers a variety of genres, young romance has emerged as particularly popular, prompting miniTV to further invest in this area due to strong viewer demand and engagement.

Brand Integration and Advertising Opportunities: With its deep integration within the Amazon ecosystem, miniTV offers unique opportunities for brands to engage with a savvy, affluent audience through tailored advertising solutions that drive both brand awareness and e-commerce activities.

Future Plans and Outlook:

Content Expansion: Over the next year, miniTV plans to introduce more than 900 hours of exclusive content, diversifying its offerings to include international shows and expanding its localisation efforts to resonate with regional audiences.

Enhanced Viewer Interaction: The platform continues to innovate in advertising, planning to extend shoppable ads to smart TVs, thereby increasing interaction and potentially boosting e-commerce activities linked to content viewing.

Amazon & MXPlayer: A match made in heaven?

Amazon has signed an agreement to acquire key assets of MX Player, a prominent Indian video streaming service owned by Times Internet. This acquisition, valued at under $100 million, marks a significant decrease from MX Player's peak valuation of $500 million in 2019. The deal involves Amazon acquiring some, but not all, of MX Player's assets (Business Standard) (Verdict) (Indian Startup News).

Synergies with Amazon MiniTV

Enhanced Market Reach

Amazon aims to strengthen its presence in India's rapidly growing digital media market by leveraging MX Player's extensive user base, particularly in smaller cities and towns. This complements Amazon's existing urban popularity and aligns with its strategy to expand its video streaming offerings across India. Integrating MX Player's assets with Amazon MiniTV, which is a free, ad-supported video service, can significantly enhance Amazon's reach in these areas.

Diversified Content Portfolio

The acquisition is expected to boost Amazon's content library, particularly for its ad-supported service, MiniTV. MX Player’s diverse range of local originals and exclusive content will enhance Amazon's ability to offer a wider variety of entertainment options to Indian audiences. This enriched content portfolio will provide more engaging and relevant content for MiniTV's audience, attracting more viewers to the platform.

Competitive Edge

This move comes at a time of significant competition in the Indian OTT space, especially with the recent merger of Reliance Industries' and Walt Disney's media assets. By integrating MX Player’s assets, Amazon is better positioned to compete with major players like Disney+ Hotstar and JioCinema. The synergies between MX Player's strong user base and content library with Amazon MiniTV's ad-supported model can create a formidable competitor in the Indian streaming market.

Opportunities and Challenges

Integration and Branding

While retaining the MX Player brand, Amazon will need to ensure a seamless integration of technology and content. Maintaining MX Player’s existing user base and trust will be crucial as Amazon introduces its own services through this platform. The integration of MX Player's assets with MiniTV will require careful planning to avoid disrupting user experience.

Expanding Ad-Supported Services

Amazon's focus on ad-supported streaming through MiniTV will be bolstered by MX Player's established ad-based model. This can help Amazon diversify its revenue streams and cater to a broader audience that prefers free content over subscription services. The synergy between MX Player's content and MiniTV's platform can drive more ad revenue and user engagement.

In summary, Amazon's acquisition of MX Player's assets represents a strategic expansion into India's vast and diverse streaming market, aiming to enhance its content offerings and reach while leveraging synergies with Amazon MiniTV to compete with established local and global players.

My Views

The evolving landscape of India's OTT market is rapidly transforming into a battleground for major conglomerates and niche players alike, and the recent developments involving Amazon miniTV and MX Player underscore this shift. As Amazon integrates MX Player's assets, it's not just expanding its content library—it's strategically positioning itself to capture a larger share of the diverse and growing audience across India.

This move by Amazon is indicative of a larger trend where media giants are aggressively expanding their digital footprints to tap into the regional diversity of Indian audiences. The acquisition of MX Player, known for its strong regional content, provides Amazon with a significant edge, especially in reaching audiences in smaller cities and towns who may prefer content in their local languages.

Furthermore, the competition in the Indian OTT space is heating up with major mergers like Reliance Jio and Disney+ Hotstar. This consolidation is not just about content or market share—it's also about creating integrated ecosystems that can offer more than just video streaming, such as shopping, mobile services, and more, leveraging the synergies between different services.

The strategic moves by Amazon and other players like Jio (lets see what happens with SonyLIV and Zee5) are set to reshape how content is consumed and monetized in India. While this may pose challenges for smaller, niche platforms, it also presents an opportunity for them to carve out unique spaces by focusing on regional content that resonates deeply with specific audience segments. Platforms like SunNXT and Malayala Manorama have demonstrated that understanding cultural nuances and delivering tailored content can be a successful strategy.

In conclusion, the ongoing developments in the Indian OTT space are a testament to the dynamic nature of the media and entertainment industry. As the lines between different forms of media blur, the next few years will be crucial in determining how content is delivered and experienced by audiences across the diverse cultural landscape of India. The focus will likely shift from just competing on content to providing holistic digital ecosystems that offer a range of services and experiences, setting the stage for the next evolution of entertainment in India.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

"Maidaan" is an Indian Hindi-language sports biographical film centered around the golden era of Indian football from 1952 to 1962. The film is inspired by the life and times of football coach Syed Abdul Rahim, who is considered the architect of modern Indian football. Rahim served as the coach and manager of the Indian national team, leading them to several key victories during his tenure - what a performance by Ajay Devgan!

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on the Indian and Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.

Download our market reports STREAMING in MENA and STREAMING in INDIA.