Will BookMyShow Stream's TVOD model succeed?

Bonus content - Brief look at Indian Streaming Industry's first "professional" GPT

Hey Streamers 👋,

A warm welcome to the 42nd edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends and more in one of the fastest growing video markets! If you are not already a subscriber, please sign up and join 3,000+ others who receive it directly in their inbox every Wednesday.

We are thrilled to announce the launch of our latest innovation, Streaming India Guru, brought to you by Mehtta Ventures, Dubai. This specialized GPT is designed to revolutionize the media tech landscape by offering expert insights and solutions tailored for the Indian streaming industry.

With Streaming India Guru, you’ll gain access to:

Real-time analytics to drive your content strategy

Personalized consulting from industry experts

Cutting-edge market predictions and trends

Our goal is to empower media professionals and businesses to excel in the fast-paced world of online streaming. Whether you're a startup or an established player, Streaming India Guru is your trusted partner in navigating the dynamic streaming space.

Here's the answer and a great summary from the GPT:

Current Trends in the Indian OTT Industry

Market Size and Growth Projections

Market Worth: The Indian OTT market is projected to reach $5 billion by 2024, driven by affordable data plans and widespread smartphone use.

Subscriber Growth: The number of OTT subscribers in India is expected to hit 500 million by 2024, with mobile devices being the primary access point.

Content Investment: OTT platforms are anticipated to invest over $2 billion in original content production by 2024.

Regional Content Consumption: Regional language content is expected to make up 60% of the total content consumed on OTT platforms by 2024.

Subscription Video on Demand (SVOD) Subscriber Numbers and Pricing

Top Platforms and Their Subscribers:

Disney+ Hotstar: Leading the market with over 300 million monthly active users and 100 million paid subscribers.

Netflix: Estimated at around 5 million subscribers.

Amazon Prime Video: Significant presence with 17 million subscribers.

Zee5: Over 90 million monthly active users.

SonyLiv: Around 30 million monthly active users.

JioCinema: Approximately 237 million monthly active users as of September 2023 .

SVOD Annual Subscription Prices:

Netflix: ₹5988

Tata Play Binge: ₹3588

Lionsgate Play: ₹1596

Amazon Prime Video: ₹1499

Hotstar: ₹1499

SonyLiv: ₹999

Jio Cinema: ₹999

Hoichoi: ₹999

Fancode: ₹999

Zee5: ₹699

Other Platforms: Prices range from ₹250 to ₹999.

Mergers and Acquisitions

Amazon's Acquisition of MX Player: Valued under $100 million, down from a peak valuation of $500 million in 2019. This acquisition is aimed at enhancing Amazon MiniTV's content library and market reach.

Potential Merger of JioCinema and Disney+ Hotstar: This merger is expected to be valued at approximately $10 billion, creating a powerful entity in the Indian OTT space, combining the strengths of both platforms.

Impact of Major Events on Digital Consumption

YouTube's Role in Elections: During the 2024 Indian General Elections, YouTube emerged as a critical platform for political campaigning. Channels like Aaj Tak reached a peak concurrent viewership of 2.4 million during the election counting day.

Sports Streaming: Platforms like JioCinema have secured major sports streaming rights, including the IPL and Indian cricket home matches, driving significant viewership and engagement. JioCinema's IPL streaming rights are valued at ₹23,758 crores (approximately $3 billion) for five years.

Free Ad-Supported Streaming TV (FAST)

Growth and Appeal: The Indian FAST market is growing, with platforms like Samsung TV Plus leading the way. The number of connected TV (CTV) households is projected to grow from 30-35 million in 2023 to 40-45 million by 2025. FAST services are attracting considerable interest, with 33% of Indian consumers showing a preference for these services.

Revenue and Growth: The FAST market in India is expected to see significant growth, with ad impressions growing by 77% and viewing hours by 63.3% from 2022 to 2023. The CTV market is anticipated to reach 45 million households by 2025.

Hyperlocal and Regional Content

SportVot and FanCode: Platforms like SportVot focus on hyperlocal sports, providing streaming for grassroots events and integrating e-commerce. SportVot has streamed over 35,000 live matches and profiled over 200,000 athletes. FanCode has grown its user base fivefold over the past three years and aims to double its paid subscriber base in 2024.

Revenue and Growth Rates:

SportVot: Attracted users from local communities, towns, and smaller cities, contributing significantly to its growth.

FanCode: Received a $50 million funding from Dream Sports in 2021 and aims to aggregate 100 million users from 10,000 smaller events.

AI in Streaming

Tools and Applications: AI is being utilized extensively for content creation, personalization, and enhancing user experience. Companies like Dubverse offer tools for dubbing into multiple Indian languages, improving the efficiency and scale of content production.

Kids Content

Market Opportunity: The kids' content segment remains largely untapped in the Indian OTT market, presenting a significant opportunity for platforms to develop engaging and educational content for younger audiences.

Growth Potential: The market for kids' content is expected to grow at a compound annual growth rate (CAGR) of around 9% from 2021 to 2026. This growth is driven by increased screen time among children and the demand for educational and entertainment content.

Content Aggregation and Platform Impact

OTT Aggregators: Services like OTTplay are simplifying user access to multiple OTT platforms through subscription bundles, reducing fragmentation in the market. OTTplay aggregates content from over 65 OTTs, offering significant cost savings and convenience for users .

Market Impact: The aggregation model is expected to grow, with platforms like JioTV Plus, Watcho, Tata Play Binge, and Playbox TV gaining market share. This model helps reduce customer acquisition costs for platforms while offering a unified streaming experience for users .

Regulatory Environment

Government Regulations: New regulations focusing on content moderation and data privacy are expected, which could impact how OTT platforms operate in India.

In summary, the Indian streaming industry is characterized by rapid growth, technological innovation, and strategic business moves. With a diverse and expanding content library, significant investments in regional and localized content, and a focus on enhancing user experience and monetization, the industry is poised for continued expansion and transformation. The inclusion of aggregation services, the focus on kids' content, and the role of the diaspora further enrich the landscape, presenting new opportunities for growth and engagement.

^ This is a work in progress and we are continuously updating and refining training data - please do share your feedback!

Today’s program:

BookMyShow Stream - A TVOD (Transaction Video on Demand) beast focusing on Movie Rentals

My Views

And….Action!

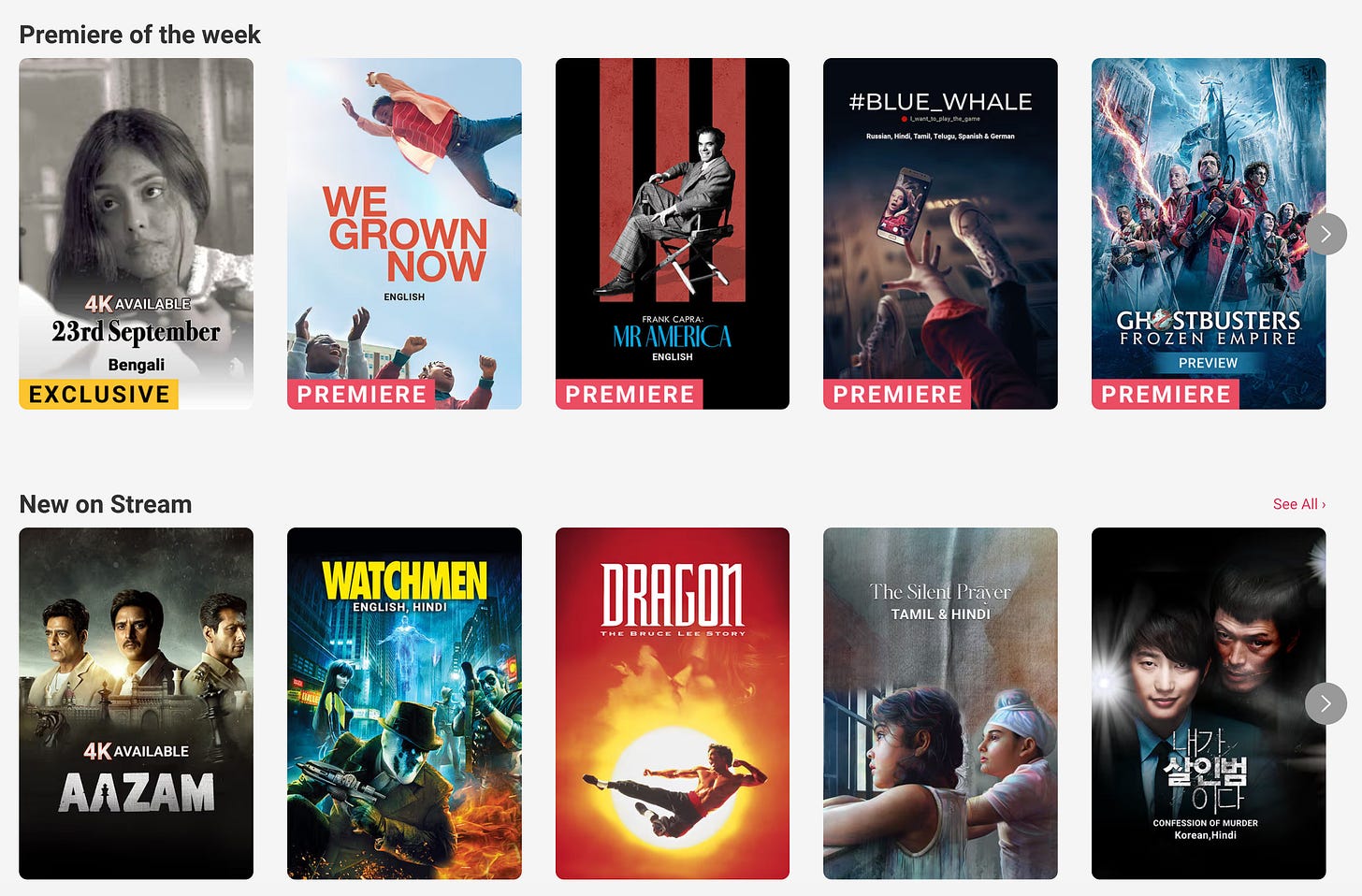

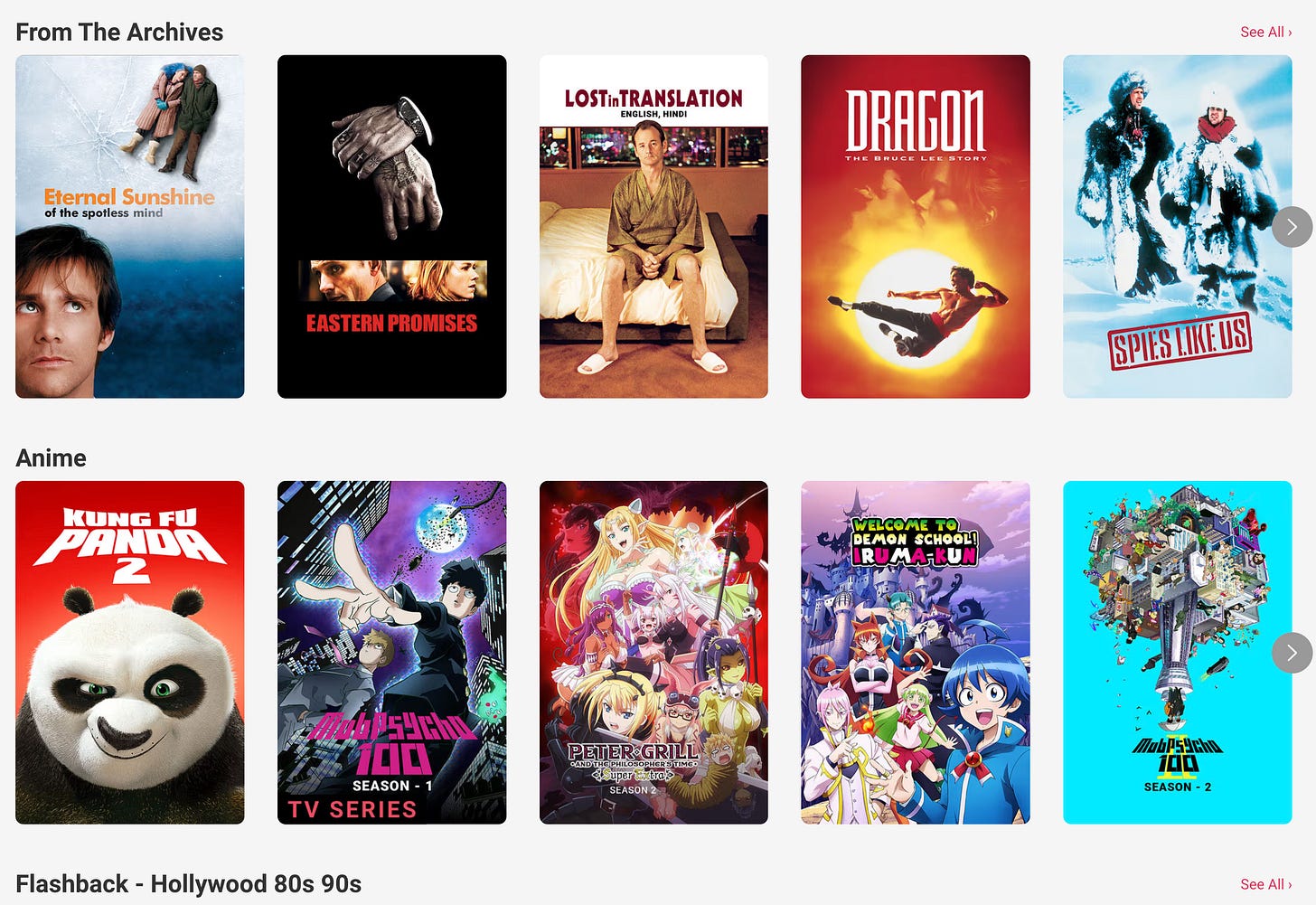

BookMyShow Stream - A TVOD beast focusing on Movie Rentals

BookMyShow Stream is an on-demand video streaming platform launched by BookMyShow, a popular ticketing and events hub in India.

This platform allows users to rent or buy movies without requiring a subscription, offering a pay-per-view model.

Here are some key aspects of BookMyShow Stream:

Content Library: BookMyShow Stream boasts a wide-ranging catalog that includes over 600 movie titles and 72,000 hours of content. This library includes Hollywood blockbusters, Bollywood hits, world cinema, and festival favorites. Notable movies available include "Tenet," "Wonder Woman 1984," "The Guilty" (Danish), and "Portrait of a Lady on Fire" (French).

Pricing and Access: Users can rent or purchase movies individually. Rentals typically last for 30 days, but once you start watching, you have 48 hours to finish the movie. Purchasing a movie allows for unlimited viewing. Prices are competitive, with rentals generally costing less than Rs 100, and purchase prices vary depending on the title.

Platform Availability: BookMyShow Stream is accessible on various devices, including web browsers, mobile apps, Apple TV, Android TV, Fire Stick, and Chromecast. This flexibility allows users to enjoy their favorite movies on any device of their choice.

Exclusive and Diverse Content: The platform offers exclusive titles and a diverse range of movies, including acclaimed films from international cinema. Examples include the Chinese film "Ash Is Purest White" and the Egyptian title "Yomeddine." This makes it a unique offering compared to subscription-based OTT platforms.

Special Features: BookMyShow Stream includes features like Friday Premieres, which bring new releases to the platform every Friday, and curated bundles that offer multiple movies together at a discounted price. These features are designed to enhance the user experience and provide more viewing options.

Overall, BookMyShow Stream provides a flexible and diverse streaming experience, allowing users to choose and pay only for the content they wish to watch. This model caters to viewers who prefer not to commit to monthly subscriptions and offers a wide array of movies across different genres and languages.

My Views

As of the latest updates, BookMyShow claims to have 200 million customer visits per month and 80 million monthly active users across its various services, including the Stream platform.

In terms of revenue, BookMyShow has a diversified revenue model that includes ticket sales commissions, convenience fees, advertising, corporate bookings, and partnership revenues. The overall company revenue for FY23 was Rs 1023 crore, with a significant portion coming from the sale of movie tickets and events. While specific revenue figures for BookMyShow Stream alone aren't disclosed, the platform's rapid user adoption and extensive content library indicate a positive contribution to the overall financial health of BookMyShow.

BookMyShow Stream, launched during the COVID-19 pandemic, exemplifies BookMyShow's adaptability and innovation in response to unprecedented challenges. As physical events and theaters shuttered, the company pivoted brilliantly, offering live streaming of events to audiences confined to their homes. This move was not just a survival strategy but a proactive step towards expanding its digital footprint. As an extension, BookMyShow Stream was introduced to provide a Transaction Video On Demand (TVOD) service, a relatively unexplored business model in India at the time.

The platform's TVOD model allows users to rent or buy individual movie titles without the need for a subscription. This model has proven appealing, particularly for hot-off-the-press titles that users might have missed in theaters. The convenience of watching new releases from the comfort of home, avoiding the hassles of traffic and parking, resonates well with certain urban audiences. With competitive pricing and flexible viewing options, BookMyShow Stream caters to a segment of users who value convenience and choice.

Looking ahead, BookMyShow Stream has the opportunity to explore additional business models to enhance user engagement and revenue. Introducing ad-supported content and launching a 24/7 Free Ad-Supported Streaming TV (FAST) movie channel could leverage its vast user base. Such initiatives would require strategic partnerships and renegotiated deals with movie studios, but they hold promise for increasing viewer stickiness and diversifying revenue streams.

In conclusion, BookMyShow Stream's innovative approach and strategic pivot during the pandemic have positioned it as one of the TVOD pioneers in India. By continuously evolving and exploring new opportunities, the platform can solidify its place in the competitive OTT landscape, offering unparalleled convenience and choice to its users.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

As we enter the business end of the T20 Cricket World Cup, do catch the Semi finals and Finals on the 27th and 29th of June, streaming exclusively on Disney+ Hotstar (free on mobile!) - truly a fantastic, low latency, live streaming experience.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA & India? Email me

Please sign up for my other newsletter focused on the Indian and Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai. You can also reach out to us to invest in any of these companies.

Download our market reports STREAMING in MENA and STREAMING in INDIA.

For advertisers, brands and even OTT platforms wanting to advertise on premium video inventory across 1000+ publishers, broadcasters and streamers across APAC, India and MENA using the world’s fastest growing ad network, Adsolut Media (Playstream), please Contact me here.