Decoding 100 Editions of India’s Streaming Story

What our most engaging editions reveal about monetization, fandom, and attention

Hey Streamers 👋,

A warm welcome to the 100th edition of the “Streaming in India” newsletter, your weekly news digest about streaming players, OTT trends, and analyses. If you are not already a subscriber, please sign up and join thousands of others who receive it directly in their inbox every Wednesday.

Agenda

Streaming in India – The 100th Edition

Pricing: The Relentless Search for Viability

JioHotstar: Cricket as a Distribution Weapon

Kabaddi & Indigenous Sports: The Power of Local

Micro-Drama: The Next Big Bet in Short-Form

Global Players: The Quiet Build-Outs

What the Top 5 Tell Us About Viewer & Investor Interest

The Road Ahead

And….Action!

Streaming in India – The 100th Edition

What 100 Newsletters Tell Us About India’s Streaming Story

Hey Streamers,

Reaching our 100th edition is a moment to pause, reflect, and ask: What have we really learned about India’s streaming and attention economy from the conversations that sparked the most engagement?

Looking back, the five most engaging and debated editions of this newsletter were:

OTT Subscription Pricing in India

JioHotstar’s Bold Plays with Free IPL & the YouTube Exit

Disney+ Hotstar’s Kabaddi Revolution

QuickTV & the Rise of Micro-Drama

Warner Bros. Discovery’s Expansion Plans in India

Together, these stories reveal how Indian streaming is being shaped by pricing innovation, sports-led strategies, local storytelling formats, and global entrants rethinking their India playbook. Let’s evaluate.

1. Pricing: The Relentless Search for Viability

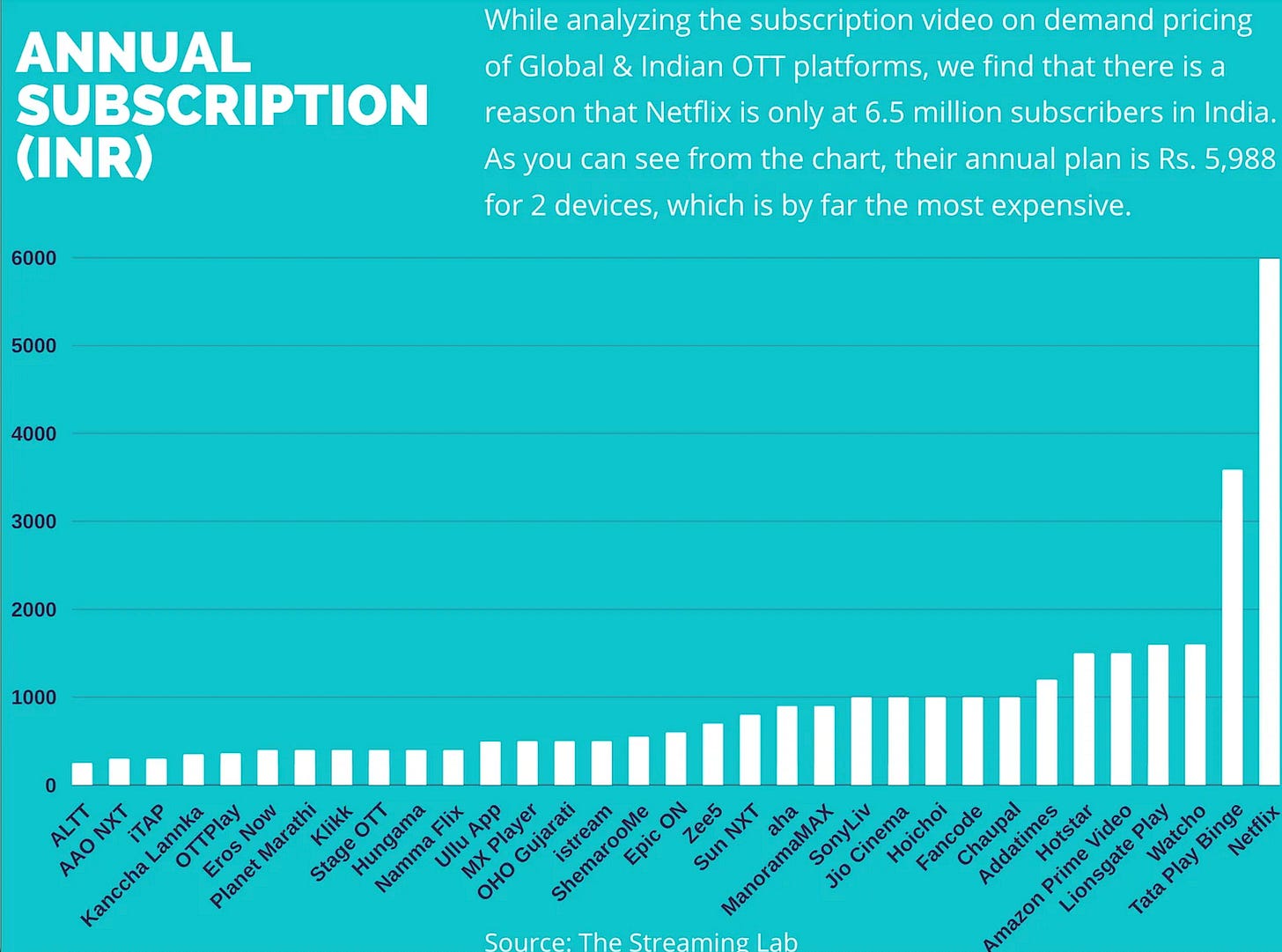

Our evaluation of India’s OTT subscription pricing struck a chord because it gets to the heart of India’s streaming paradox: the world’s most engaged video market, yet one of the lowest ARPU bases globally.

Average annual OTT pricing was around ₹735 ($9) – barely 75 cents per month.

Bundles (Jio, Tata Play, OTTPlay) are driving adoption, while niche platforms experiment with sachet pricing, micropayments, and AVOD.

The lesson: India’s streaming future will be hybrid, with content-commerce-community integrations needed to lift revenues beyond subscriptions.

Reader interest in this topic shows that:

Monetization remains the existential question for Indian OTTs.

2. JioHotstar: Cricket as a Distribution Weapon

The edition on JioHotstar’s IPL 2025 strategy highlighted how Reliance is reshaping the market by:

Bundling IPL streaming with Jio recharges, making premium sports feel “free.”

Exiting YouTube to build its own ad-monetization ecosystem.

Using 4K streaming to accelerate Connected TV adoption.

This was one of our most debated issues, and for good reason:

JioHotstar is building India’s closest equivalent to Tencent Video/iQIYI in China—sports as the hook, bundling as the moat, data ownership as the prize.

3. Kabaddi & Indigenous Sports: The Power of Local

Our look at Disney+ Hotstar’s Pro Kabaddi League revealed the potential of India’s indigenous sports economy.

PKL drew 435 million viewers in its debut season, proving that “second sports” can rival cricket with the right franchise model.

Disney+ Hotstar’s tech, multilingual commentary (even Indian Sign Language), and grassroots focus turned kabaddi into a national spectacle.

The popularity of this edition tells us something bigger:

Audiences and investors are hungry for stories beyond cricket. Indigenous sports, when paired with strong streaming infrastructure, can build loyal fan ecosystems.

4. Micro-Drama: The Next Big Bet in Short-Form

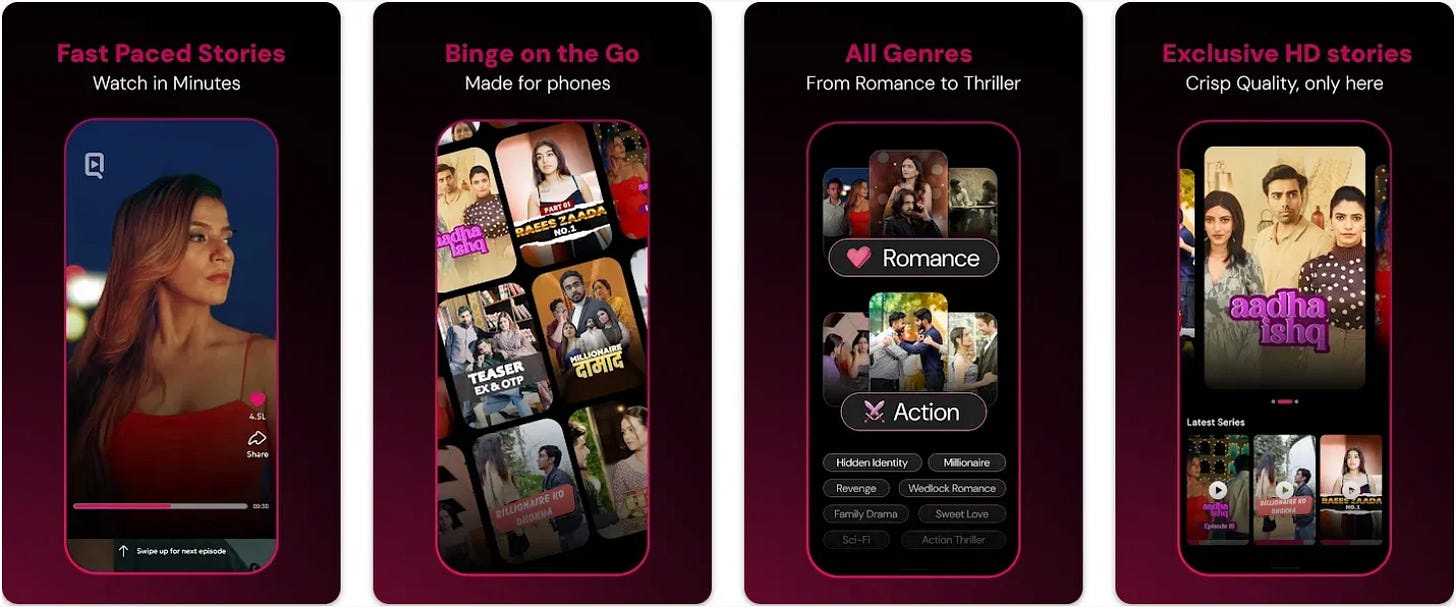

When we covered ShareChat’s QuickTV pivot into micro-dramas, engagement spiked around two themes:

Format innovation: Episodic, mobile-first dramas are India’s answer to China’s $5B micro-drama boom.

Monetization potential: Micropayments, in-story commerce, and AI-assisted production are monetization models UGC platforms never cracked.

This reflects a broader shift:

The attention economy in India is fragmenting, and the “short, serialized, sticky” model is emerging as the new growth frontier.

5. Global Players: The Quiet Build-Outs

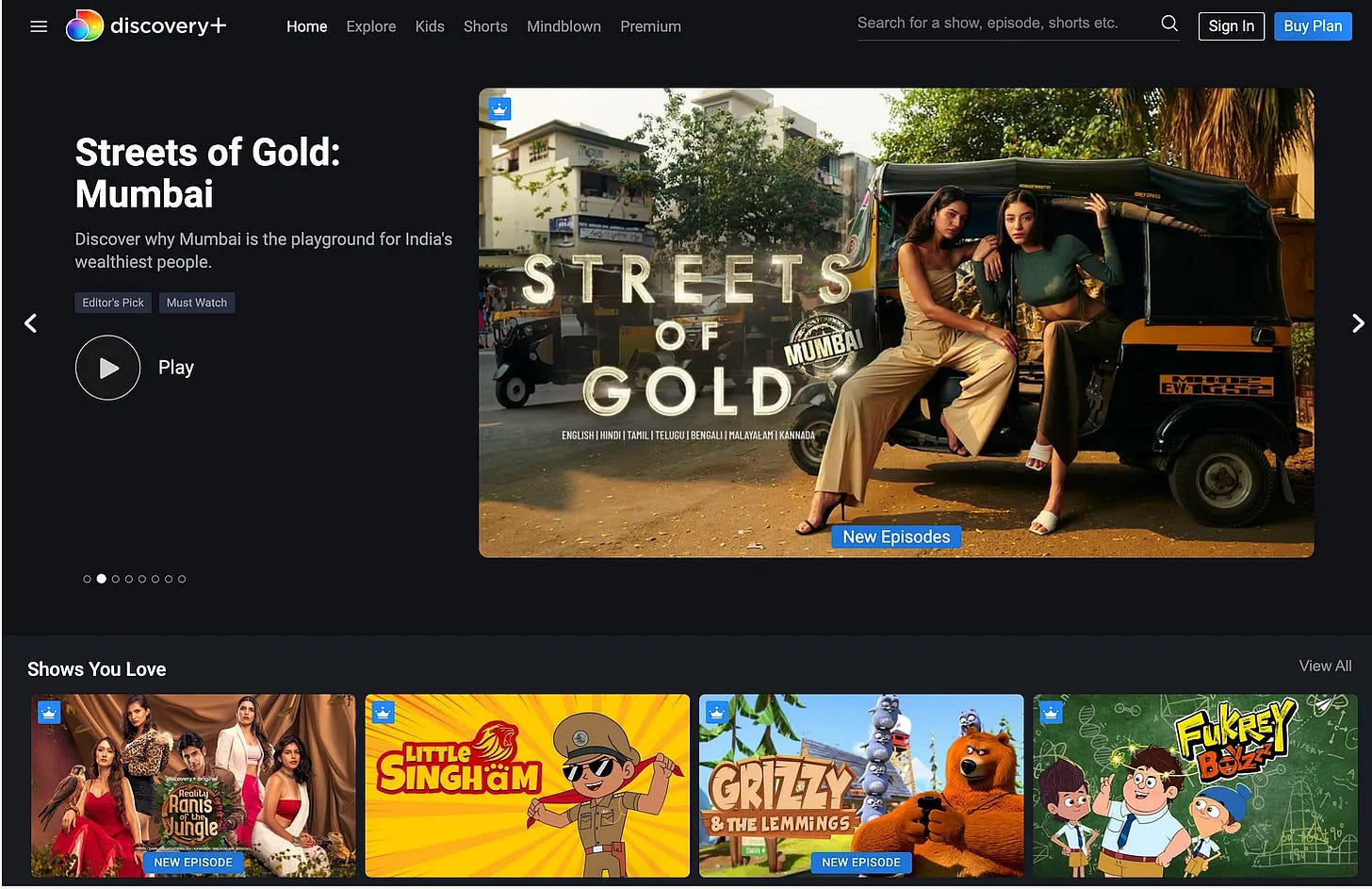

Finally, our edition on Warner Bros. Discovery showed that global streamers are not retreating from India—they’re adapting:

WBD is balancing linear TV and OTT, dubbing aggressively in regional languages, and pricing discovery+ at ₹499/year.

Unlike some peers who pulled back, WBD is steadily scaling 3,500+ hours of content, blending local originals with global IP.

Reader takeaway:

India is no longer a “copy-paste” market for global streamers. Those who localize deeply (languages, genres, pricing) are the ones winning traction.

What the Top 5 Tell Us About Viewer & Investor Interest

Across these editions, three themes stand out:

Monetization Models Matter Most – whether via pricing innovation, bundling, or commerce, readers are most engaged when we unpack how money is made in streaming.

Sports is Still King, But Not Alone – cricket is the sledgehammer, but kabaddi, football, and indigenous formats are rising, proving India’s fandom is wide, not just deep.

Attention Economy is Fragmenting – from micro-dramas to AI-driven personalization, new formats are capturing younger, mobile-first audiences in ways traditional OTT never did.

The Road Ahead

If the first 100 editions were about defining the battlefield—pricing, sports, local formats, and global entrants—the next 100 will be about execution and exits.

Who monetizes beyond subscriptions first?

Which sports leagues rise alongside cricket?

Can micro-drama become India’s “5-minute Netflix”?

And which global + local hybrids will define India’s next streaming chapter?

One thing is clear: India’s streaming market is no longer about if it will scale, but how the scaling will pay for itself.

Here’s to the next 100 editions, and to all of you who’ve shaped this journey with your curiosity, debate, and insights!

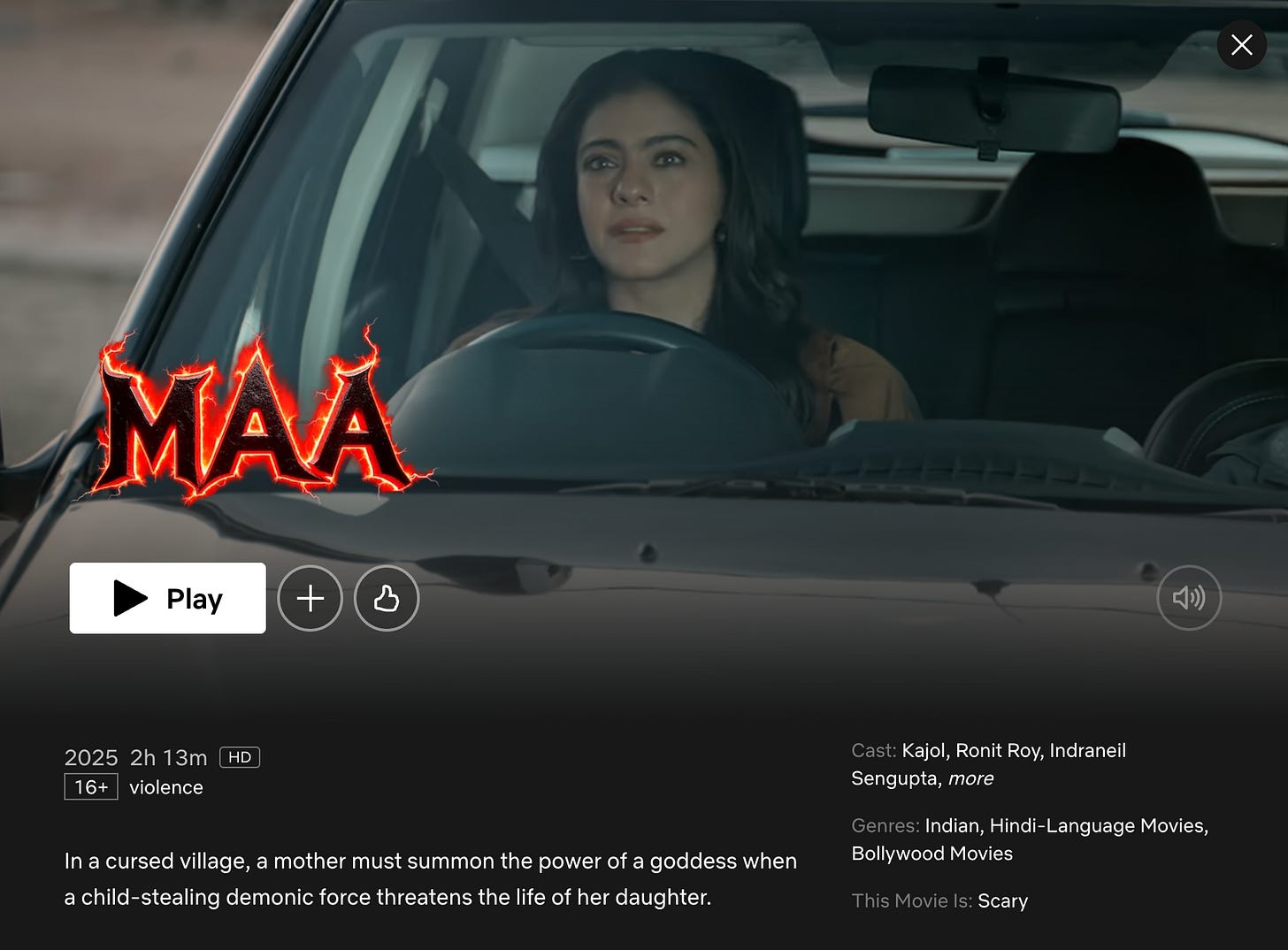

If you are a fan of Kajol and horror content, this one is for you - fantastic performance and a riveting ride on Netflix. The film delivers a mythologically rooted horror tale that makes for a decent one-time watch.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Raising capital for an “attention economy” / sports tech fund with an amazing global startup pipeline - DM me for more details!

Please sign up for my other newsletter focused on “eyeball economy” focused startups (Media, Entertainment, Gaming, Ad Tech & Sports), the Indian / Middle East startup and venture capital ecosystem; in your inbox every Monday: Mehtta Ventures Dubai.

I represent the Adsolut Media business in the Middle East and am a “board observer” for their growth. We have amongst the largest supply of Connected Television premium inventory in the Middle East - Sub-continental corridor along with one of the largest mobile / web inventories as well. Please get in touch for your monetization requirements.