Football Rights and Streaming Challenges: MENA vs Europe:

How streaming platforms are reshaping the Sports rights landscape

Hey streamers 👋

This month, we’re highlighting the dynamic world of Sports across Middle East & North Africa.

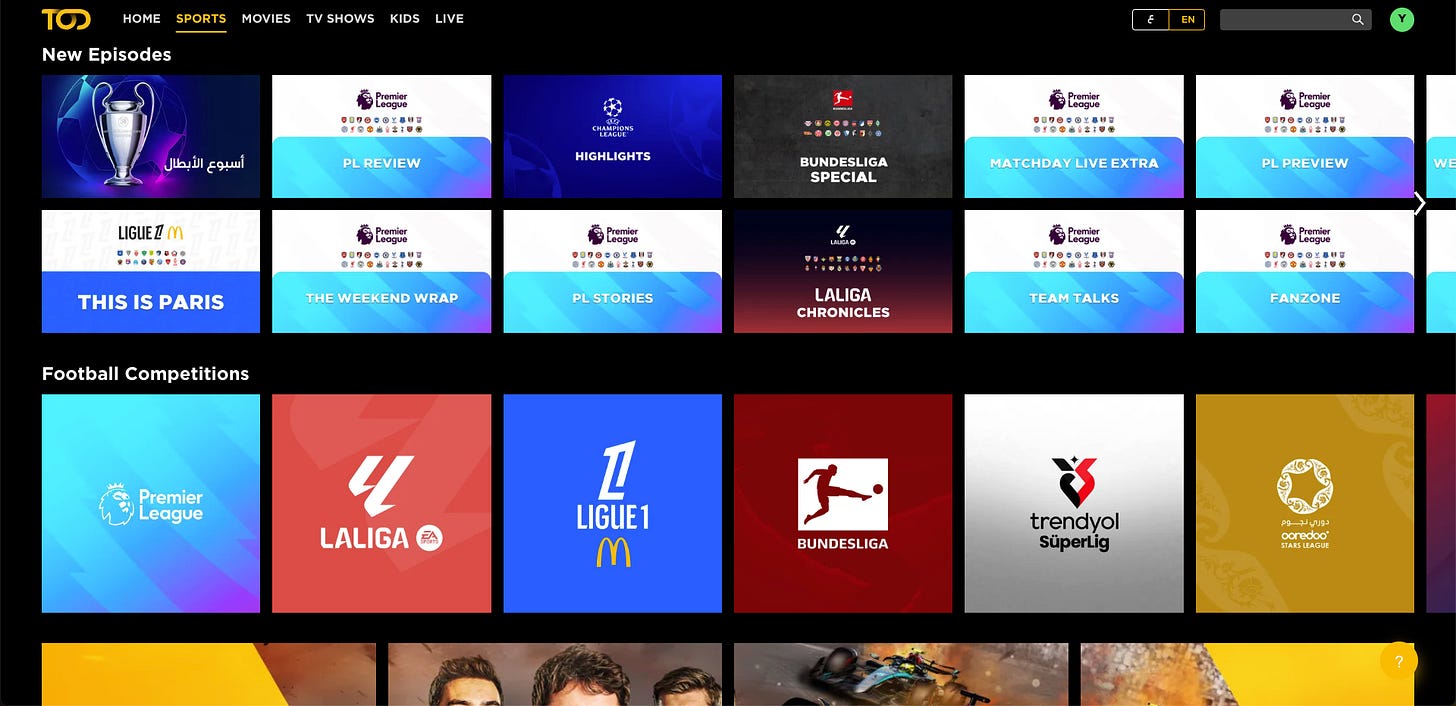

Why sports? Because the fragmentation of sports rights in MENA is accelerating at an impressive pace. Local streaming platforms are aggregating international sports rights, with TOD taking the lead, securing many of the most prestigious tournaments.

Over the past five years, top SVOD players have also joined the game: STARZPLAY with the Italian Serie A, Shahid with the Campeonato Brasileiro Série A and Primeira Liga, and more recently, 1001 with LaLiga in Iraq.

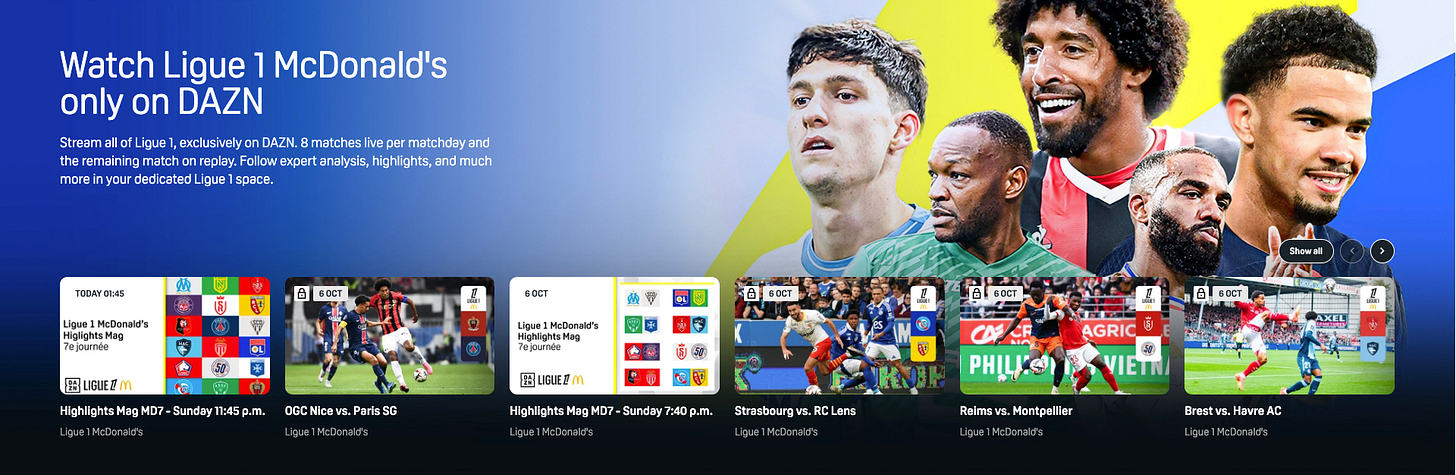

Meanwhile, pure sports players are doubling down on their localization efforts in the region. DAZN quietly extending its reach in MENA, launching its main platform and one FAST channels last year.

Even though the audience in MENA is hungry for international sports, I believe the potential for local sports is even bigger.

However, with opportunities come challenges.

Local platforms are still searching for the right model to elevate the local sports ecosystem. Smashi TV, for instance, now distributes UAE basketball, Volleyball, Handball or Futsal directly to fans.

What can you expect from The Streaming Lab Sports in MENA series this month?

We'll start with a first expert article focusing on football rights in Europe and MENA, and a second one about the active Saudi Sports scene. To wrap up the series, I’ll be releasing a special report: a guide to how streaming is transforming sports in MENA, including a summary of the sports rights available by platforms.

Today’s program

Unsuccessful tender and the road to direct negotiation

The consumer perspective: rising costs and streaming challenges

A simpler and stronger offering in the MENA region

This analysis is brought to you by Remi Olivan, a streaming professional (and former colleague) with experience in Entertainment, Sports, and Telecom across MENA, Asia, and Europe.

And… Action!

The European Sports rights market, particularly for football, has reached a plateau, marking a significant shift in the financial landscape of major leagues.

This trend is especially concerning given that TV rights constitute 50% to 75% of the revenue for football clubs.

In contrast, the Middle East and North Africa (MENA) region offers a more streamlined and promising approach, highlighting the stark differences in how these markets evolve.

Unsuccessful tender and the road to direct negotiation

In September 2023, France launched a tender for the broadcasting rights of Ligue 1, with the ambitious goal of securing €1 billion per season.

However, the tender failed to attract offers close to this target, leading to a direct negotiation phase between the league and potential buyers.

DAZN offered €500 million immediately after the tender, but this offer was rejected by the league as it fell short of expectations.

With no significant bids, the league considered a Direct-To-Consumer (DTC) option, bypassing traditional broadcasters entirely.

This unprecedented move in European football would have been risky, requiring substantial investment in infrastructure and marketing to directly engage with fans in a very short timeframe.

Ultimately, one month before the new season started, the league settled on a deal with DAZN for €400 million, covering 8 out of 9 games per match day.

Additionally, BeIN Sports secured the rights to broadcast one match per week for €100 million.

Found this article insightful? Don't keep it to yourself, share it with your team and start the conversation!

The consumer perspective: rising costs and streaming challenges

For consumers, the new broadcasting arrangements mean a significant increase in costs to access Ligue 1 games.

DAZN now offers 8 matches per week for €29.99 per month with a one-year commitment or €39.99 per month without a commitment.

BeIN Sports provides access to one Ligue 1 match per week, along with other major leagues such as LaLiga, and Bundesliga.

This marks a substantial price hike compared to the previous season, where consumers were paying €14.99 per month for the Ligue 1 Pass, or €99 for the season, on top of an Amazon Prime subscription, which cost €6.99 per month or €69.90 per year.

The increased cost has sparked concerns among fans. According to a survey by Odoxa, 65% of Ligue 1 fans believe that the cost of a DAZN subscription encourages illegal streaming.

Unfortunately, piracy has become an attractive option for many fans due to excessive pricing, with consequences so significant that it has even impacted international broadcasting rights.

CazéTV, the official broadcaster of Ligue 1 in Brazil, was forced to stop broadcasting the French league because many French viewers were using VPNs to access the content, bypassing local broadcasters and paying significantly less for the service.

This highlights the growing challenges leagues face in protecting their content and revenue streams from piracy, which is often fueled by rising subscription prices.

In response to these issues and the possible low number of subscribers, DAZN recently announced a promotional offer:

From September 10 to 22, the annual subscription to watch Ligue 1 was reduced from €29.99 to €19.99.

Additionally, the no-commitment monthly subscription costed €19.99 for the first two months, instead of €39.99.

This sudden price cut raises questions about DAZN’s pricing strategy and whether the initial rates were too high, reflecting potential difficulties in attracting subscribers.

A simpler and stronger offering in the MENA region

While European markets face complex negotiations and rising consumer costs, the situation is much more favorable in the MENA region.

beIN Sports, through its TOD platform, holds the rights to nearly all major leagues except Serie A, which is available on STARZ ON.

TOD offers three packages that include both sports and entertainment:

Mobile-only package: USD 10 per month

Full HD package: USD 18 per month

4K package: USD 30 per month

This tiered pricing structure offers flexibility to consumers, allowing them to choose a package that fits their needs and budget.

Despite this comprehensive offering, piracy remains a significant issue in the region. The availability of illegal streaming services undermines legitimate broadcasters, affecting revenue and the overall sustainability of sports broadcasting.

Unfortunately, there is no clear commitment from the different governments in the region to tackle this issue effectively.

To conclude, the plateauing of football rights in Europe highlights the challenges faced by leagues and broadcasters as they navigate a complex and increasingly expensive landscape.

In contrast, the MENA region, with beIN Sports/TOD’s comprehensive and flexible offerings, presents a more promising scenario for both consumers and rights holders.

However, the issue of piracy remains a significant hurdle, one that needs to be addressed to fully capitalize on the potential of the MENA market.

With a strong commitment to combat piracy, the MENA region could become a model for sustainable sports broadcasting, offering fans high-quality content at competitive prices while ensuring that leagues and broadcasters can thrive.

That’s all for today, an analysis of the Football rights in Europe and MENA. If you found this breakdown valuable, spread the word and share it with your network!

I hope everyone has a great week, see you online next Monday. Until then, enjoy The Penguin on OSN+. Following the events of The Batman (2022), Oz Cobb, a.k.a. the Penguin, makes a play to seize the reins of the crime world in Gotham.

Master Streaming in MENA with exclusive data & analysis for streaming media professionals. Subscribe to TLS+:

Read all the previous edition of The Streaming Lab here.

Download my latest report, STREAMING in MENA - August 2024. Exclusively available to TSL+ Prime members!

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA? Email me.