Inside SHAHID Growth: What the Numbers Tell Us

With 4.8M SVOD subscribers and 17.8M AVOD monthly active users, SHAHID is leading MENA streaming

Hey streamers 👋

Today, I’ll analyze MBC Group financial results from Q4 2022 to their most recent Q3 2024 report, with a focus on SHAHID performance across Subscribers, Monthly Active Users, Revenue, and Net Loss.

Today’s program

Key highlights from MBC Group Q3 2024 earnings

The insights behind SHAHID numbers

And… Action!

Key highlights from MBC Group Q3 2024 earnings

Last year, MBC Group announced plans for an IPO, offering 10% of its post-listing share capital. At the time, 60% of MBC was owned by Istemeddah Holding (a Saudi Ministry of Finance subsidiary), with the rest belonging to its founder Waleed bin Ibrahim Al Ibrahim.

Fast forward to 2024: Istemeddah stake dropped to 54% and was transferred to the Public Investment Fund (PIF).

As part of its IPO, MBC Group must now release regular performance updates. Great news for data analyst like me!

Let’f first review the number of SVOD subscribers at the end of each quarter. As a reminder, SHAHID offers four main subscription packages in the UAE, priced as follows:

VIP AED 39.99

VIP | Big Time AED 49.99

VIP | Sports AED 69.99

Ultimate AED 79.99

SHAHID has also increased its efforts to develop a powerful AVOD model, offering today about 86% of its content free to users.

Additional initiatives such as the launch of FAST channels in late 2022, shows even more this focus on advertising.

If you're looking to track the evolution of FAST and better understand the potential of this model in MENA, check out my latest article here:

Here’s the first graph illustrating the quarterly evolution of SHAHID SVOD subscribers and AVOD Monthly Active Users (MAU):

—

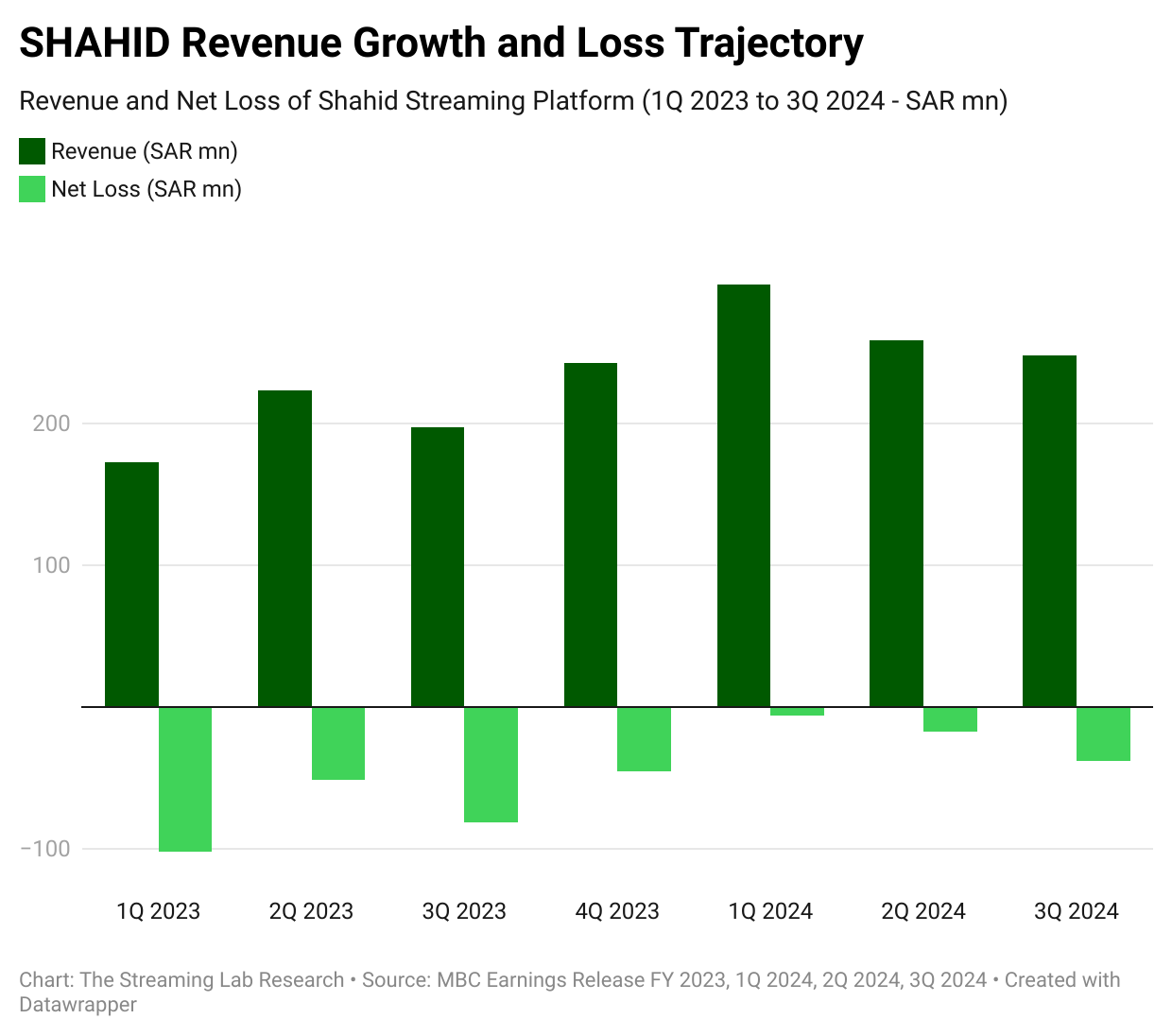

I created a similar graph for SHAHID Revenue and Net Loss over the same period:

You can explore the full data yourself, available here:

Now, let’s take a closer look at the data and find some key insights ↓

Found this article insightful? Don't keep it to yourself, share it with your team and start the conversation!

The insights behind SHAHID numbers

SHAHID subscriber base has grown by 68% between Q4 2022 and Q3 2024. I know direct comparisons with global platforms like Netflix might not be fair due to different market dynamics, but over the same period, Netflix subscriber base “only” grew by 22%, Prime Video by 17.5%, and Disney+ decreased by 2%.

This steady growth in subscribers happened over five of the seven quarters within this period.

The only declines were seen from Q1 2023 to Q2 2023 and from Q1 2024 to Q2 2024. It’s not a surprise, as the most significant spikes are often around Ramadan. Between Q4 2022 and Q1 2023, SHAHID recorded a 25% growth, followed by 15% from Q2 to Q3 2023, and 21% from Q4 2023 to Q1 2024.

The holy month, which was from March 22 to April 20 in 2023 and from March 10 to April 9 in 2024, is a period of intense TV new releases and increased viewer engagement.

However, this seasonal boost comes with a challenge: high churn in the following quarters.

SHAHID faced a 5.3% decline in subscribers after Ramadan 2023 and a 4.5% decline after Ramadan 2024. What’s encouraging is that the platform managed to limit churn more effectively in 2024, so we can hope for better numbers in 2025.

—

AVOD user growth also seems linked to Ramadan, with even bigger ups and downs. For instance, SHAHID recorded 20 million monthly active users in Q1 2024.

However, post-Ramadan period always sees a decline in active users. Despite these drops, the platform has managed to maintain year-over-year growth, with a 48% increase in AVOD users from Q4 2022 to Q3 2024.

The AVOD growth is slower than that of SVOD, but the overall trend is positive. Based on past performance, I anticipate Ramadan 2025 to potentially bring the AVOD audience to 23–25 million MAUs.

From Q1 2023 to Q3 2024, SHAHID revenue grew by 44%. However, this growth has been irregular, with quarterly increases matched by decreases. It seems that the revenue fluctuations are directly linked to subscriber churn after Ramadan, which impacts earnings.

While AVOD revenue is growing, it has not yet compensated for the loss of SVOD revenue during high-churn periods. However, SHAHID efforts in developing its AVOD offerings, including launching FAST channels and making 86% of its content available for free, could balance this in the future.

Net loss tells an even more interesting story. SHAHID losses have significantly decreased, from SAR 102 million in Q1 2023 to SAR 38 million in Q3 2024. During Q1 2024, losses reduced to just SAR 6 million, indicating that Ramadan revenues almost covered expenses.

That said, those graphs prove again that SHAHID business remains in a high-investment phase. Revenue growth is often linked to rising costs in content acquisition, technology, and marketing.

For SHAHID to achieve profitability, it must keep its revenue objective while finding ways to limit expenses, a challenging but necessary balance.

—

The rise of streaming in MENA is still in its early stages. With an OTT penetration rate of just 4.4% compared to 81% in the U.S., the region has a strong growth potential.

SHAHID has identified several key drivers to capitalize on this opportunity, including expanding its AVOD audience, targeting the Arab diaspora, optimizing marketing efficiency, enhancing the user experience, maintaining competitive pricing, and reducing churn.

Do you see other growth opportunities for SHAHID? Reply to this email and share your thoughts!

That’s all for today, what the latest SHAHID earnings tell us? If you found this breakdown valuable, spread the word and share it with your network!

I hope everyone has a great week, see you online next Monday. In the meantime enjoy PAUL VS TYSON on Netflix. Jake Paul battles Mike Tyson as they headline this must-see boxing mega-event streaming live in five languages from AT&T Stadium in Arlington, Texas.

Read all the previous edition of The Streaming Lab here.

Download my latest report, STREAMING in MENA - August 2024. Exclusively available to TSL+ Prime members!

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA? Email me.