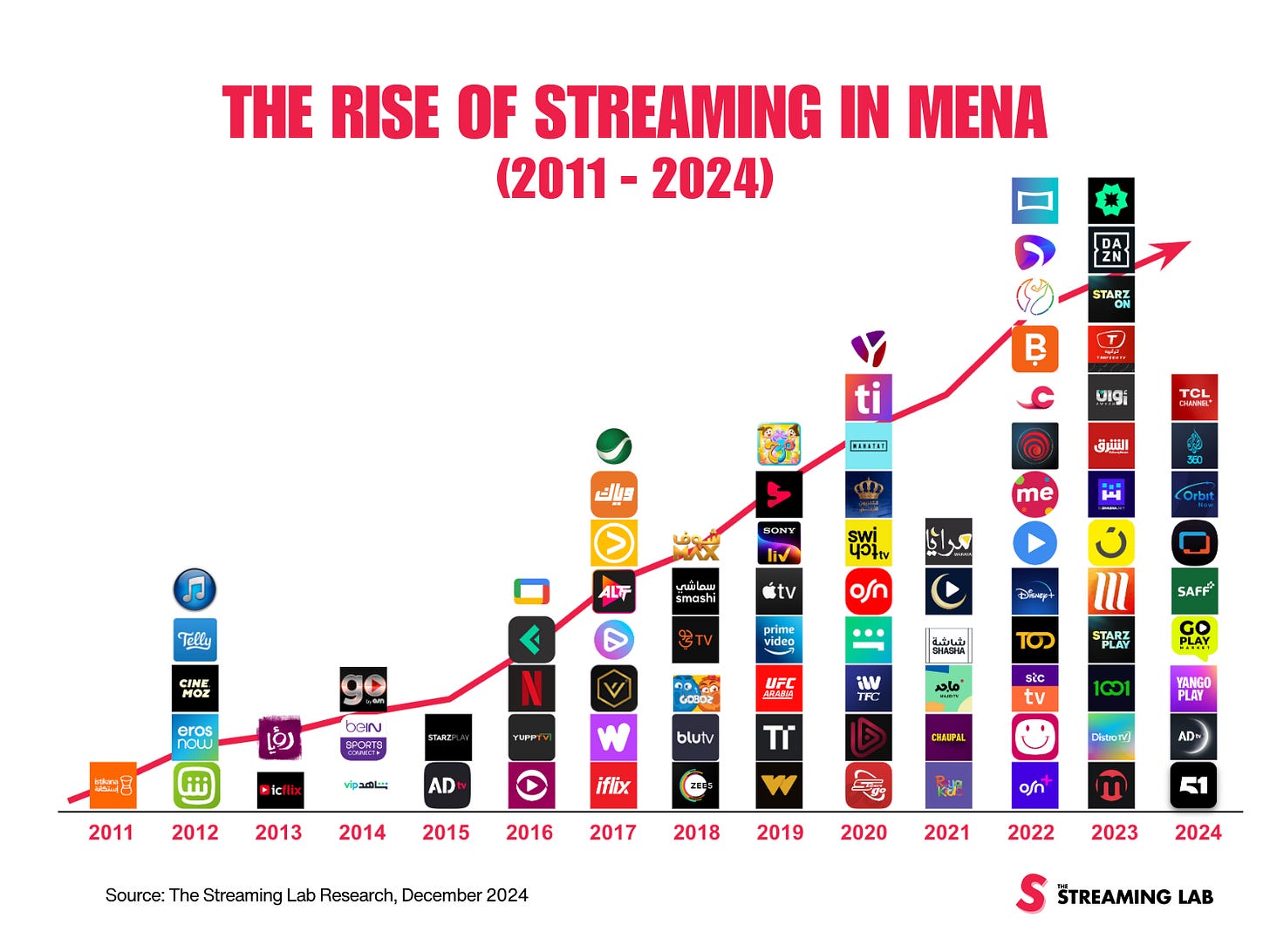

My Predictions for the MENA Streaming Media Industry in 2025

Insights and expectations for the year ahead

Hey streamers 👋

It’s that time of the year again!

What can we expect from the streaming media industry in Middle East & North Africa in 2025?

Today’s program

How did last year’s predictions hold up?

Key 2025 predictions and trends

Your turn: what do you expect?

And… Action!

How did last year’s predictions hold up?

One year ago, I shared my thoughts on what the MENA streaming industry would look like in 2024. Let’s review each prediction and see how close (or far) I was!

Want to see the full list from last year? Check out my article:

The rise of hybrid streaming services

What I predicted: In 2024, I anticipated that the number of hybrid platforms combining SVOD and AVOD/FAST would increase. SVOD platforms would introduce ad-supported tiers to diversify revenue, and new platforms would adopt multi-model strategies.

What happened:

OSN+ introduced an ad-supported tier, “OSN+ Standard with Ads.”

New platforms such as Yango Play, SAFF+, Orbit Now, and Al Jazeera 360 launched. Half of these adopted free models (FAST, AVOD, FVOD), while the rest focused on SVOD.

✅ Verdict: On point! Hybrid models are gaining traction.

The emergence of super Media Apps

What I predicted: I anticipated the launch of super media apps merging video, audio, and more into a single platform.

What happened:

Yango Play became MENA first super media app, combining movies, series, music, mini-games, and live TV.

OSN+ and Anghami focused on tech upgrades and rebranding rather than merging into a single platform.

❌ Verdict: Not quite there yet. Yango Play showed potential, but the broader trend hasn’t taken off.

The overlap between e-commerce and streaming

What I predicted: I expected local e-commerce players to enter the streaming space with a full content offering.

What Happened:

Noon stayed focused on sports streaming with IPL.

However, STARZ ON partnered with Trendyol to integrate ads encouraging in-app purchase

❌ Verdict: Not the revolution I expected, but we’re starting to see bridges between streaming and real-time consumer engagement.

Global FAST platforms are coming to MENA

What I predicted: At least 3 global FAST platforms would enter MENA by the end of 2024.

What happened:

Samsung TV Plus, DAZN, and TCL Channel launched in the region.

✅ Verdict: Spot on! 3 major FAST services entered the market.

The fragmentation of sports rights

What I predicted: More local platforms would enter the sports streaming space, making international sports more accessible.

What happened:

LaLiga signed a co-exclusive deal with Iraqi platform 1001.tv

Shahid, STARZ ON, and TOD expanded their sports offerings to ensure broader access.

✅ Verdict: Nailed it! Sports rights are becoming increasingly fragmented as platforms compete to win over sports fans across the region.

The untapped potential of local sports

What I predicted: Local sports leagues and teams would launch streaming partnerships or their own platforms.

What happened:

Nassr TV: DAZN launched a dedicated channel for Saudi team Al Nassr.

SAFF+: The Saudi Arabian Football Federation introduced SAFF+ with live matches, analysis, and exclusive content.

Smashi TV: Expanded coverage to UAE leagues and new sports like padel.

✅ Verdict: Another win! Local sports content is becoming more diverse and accessible.

—

Scorecard: 4 out of 6

Not too bad! Let’s see if I can do even better with my 2025 predictions ↓

Found this article insightful? Don't keep it to yourself, share it with your team and start the conversation!

Key 2025 predictions and trends

2024 was a year of experimentation, with platforms launching new models and expanding regionally.

Here’s what I expect in 2025: