The Jio - Hotstar Unification Impact

And "Hotstar Specials" - Disney+ Hotstar's Original Shows for India

Hello Streamers!

Welcome to the 10th edition of “Streaming in India”!

We wish you and your family a very Happy Diwali - may it fill all our lives with new hopes for the future and amazing dreams for tomorrow, especially for the families and children ravaged by war. #DIWALIFORPEACE

If you are not already a subscriber, please sign up and receive this newsletter directly in your inbox every Wednesday!

Today’s program:

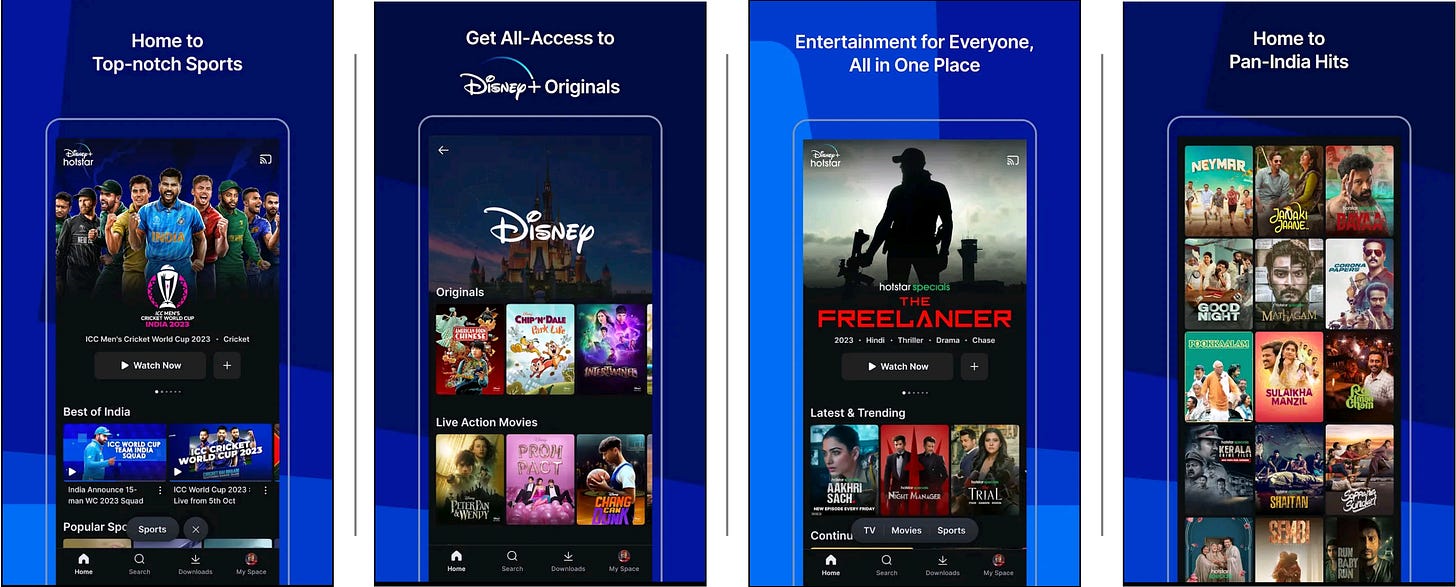

The Disney+ Hotstar OTT Platform

Hotstar Specials

User Experience Highlights

JioCinema / Disney+ Hotstar combination - What it could mean for the OTT consumer?

And….Action!

The Disney+ Hotstar OTT Platform

In addition to this newsletter, we have an extensive report for each of the Top 30 OTT platforms in India - it’s available for download here! Also, this report will be continuously updated with newer versions as new players come in, market evolves and so on.

Disney+ Hotstar is one of India’s largest premium streaming platforms with more than 100,000 hours of drama and movies in 17 languages, and coverage of several major global sporting events, including the current Cricket World Cup (CWC) in India.

Their September traffic on web and mobile combined stood at 217 million visits and the current CWC is being streamed FREE on the Hotstar mobile app for the first time with the hope that advertising revenue will offset the impact of a subscriber exodus which was a result of Disney+ Hotstar losing the IPL streaming rights to Viacom18 ($2.9 billion winning bid).

The India streaming operations, which were Disney's biggest last year globally by users, posted a loss of $41.5 million on revenue of $390 million for the year to March 2022, its last disclosed results.

^ As you can see from the chart, Disney+ Hotstar was down to 40.4 million subscribers in July 2023 from a peak of 61 million subscribers in August 2022, showing a deep cut which was a result of Disney losing the IPL streaming rights to JioCinema.

In addition, Disney’s announcement that it is acquiring the remaining 33 percent stake of Hulu that was held by Comcast paying at least $8.61 billion is also weighing it down and forcing it to re-look at alternative funding options including a potential sale in India.

Star India officially launched Hotstar on 11 February 2015 coinciding with the 2015 Cricket World Cup.

By 2019, Hotstar became the #1 OTT player in the country with IPL cricket as it's core offering and 46 million subscribers.

Following the acquisition of Star India's parent company 21st Century Fox by Disney in 2019, Hotstar was integrated with the company's new global streaming brand Disney+ as 'Disney+ Hotstar' in April 2020.

The co-branded service added Disney+ original programming, and films and television series from its main content brands of Walt Disney Studios, Pixar, Marvel Studios, Lucasfilm and National Geographic, alongside domestic and third-party content already carried on the platform.

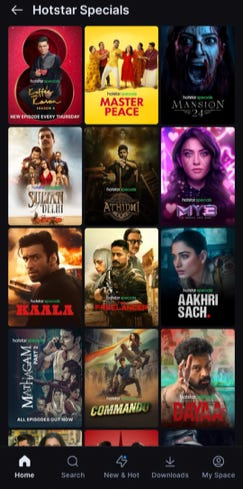

The Disney+ Hotstar Specials

Disney+ Hotstar has 59 Original shows targeting India called HOTSTAR SPECIALS across a wide variety of genres.

On a more technical level, it’s interesting to see that they have expanded the genre types to include many more categories as compared to the standard ones that subscribers are used to across other popular OTT platforms.

For example, the popular talk show, Koffee with Karan, has the following tags mentioned on the series description page: Talk Show, People and Culture, Comedy, Casual Viewing, Controversial, Competition, Dysfunctional Relationships, Light-hearted, Curious, Feel-Good, Reality Addicts, Celebrities & Metropolis / Big City! This is probably done to make the shows more search friendly and include as many keywords / tags per show so as to cover a wide number of search options / try to mimic user behaviour.

For the purpose of this newsletter, we will focus on the “popular genres” so that it is easier to digest and analyze:

As you can see from the chart above, Drama, Thriller & Crime make up 69% of the Original Indian web show genres currently available on Disney+ Hotstar. Surprising that Comedy is just about 10% of the overall genres.

Also, almost every Hotstar Specials show is dubbed in 7 Indian languages - Hindi, Telugu, Malayalam, Bengali, Tamil, Kannada, Marathi and has subtitles in English.

User Experience Highlights

The layouts on the mobile app are search friendly and organized by studio, language, channel, genres, sports and more, making it fairly easy to find what you want.

Over the years the Disney+ Hotstar mobile apps have evolved significantly especially when it comes to personalization and content discovery - I remember complaining about their recommendation engine, which most likely was not prioritised earlier given that all the focus was on the IPL! It is a fairly advanced user experience on the app now with a robust recommendation engine.

Quick video start times, ability to download content, Data saver streaming mode, ability to select audio language and subtitles round of a superior user experience for Disney+ Hotstar’s mobile app and video player.

Also, these features are now table-stakes for any streamer in India.

We like the fact that it is easy to “Report an Issue” which surfaces when you click on the “Settings” button on the video player - kudos to the team for thinking this through!

JioCinema / Disney+ Hotstar combination - What it could mean for the OTT consumer?

Disney is planning to sell its Indian entity to Reliance for $10 Billion!

The proposed deal between Star India (owned by Walt Disney) and Viacom18 (owned by Reliance Industries) could lead to the establishment of India's largest media and entertainment conglomerate, with roughly Rs 25,000 crore (~ $3 billion) in revenues.

The combined entity will own 115 TV channels (Star India – 77 and Viacom18 – 38), two large streaming platforms—Disney+ Hotstar and JioCinema and over 2 lakh hours of content. Essentially, the media and broadcasting sectors in India will become a duopoly: Zee & Sony + Reliance & Star.

For Reliance this deal makes a lot of sense as it solves for two major content buckets where it needs help - Sports & serials (soap operas etc). Yes it has the rights for the IPL, however this is seasonal and therefore JioCinema requires other sports to fill in the gaps. In addition, Star’s tremendous experience in creating strong content IPs (think Koffee with Karan, Criminal Justice, etc) with a repeatable viewing base plus sporting events like ICC tournaments in India, Kabaddi, Football etc add ingredients to Jio’s OTT plans which can potentially establish the platform as one that is viewed daily.

Also, Reliance is buying “world class streaming infrastructure” which has been tried, tested and scales well - we all saw Virat Kohli’s 49th century live on the 5th of November on Disney+ Hotstar breaking yet another live concurrent user record - they are at 44 million live concurrent users, knocking on the 50 million door, which should be achieved by the end of this cricket world cup! It is true that most of the top technology talent that built this infrastructure at Hotstar now find themselves at JioCinema, however the sheer scale and experience that has already been built at Hotstar is worth it’s price in gold. With this acquisition, Reliance is buying it’s way to lightning PACE to SCALE!

For OTT customers, were this deal to go through, it means -

One super “entertainment & sports” streaming app across devices.

Less competition usually does not augur well for consumers as we are then at the mercy of an 800 pound gorilla who could give us content for “free” for a limited time, however then have much more flexibility to increase prices, thereby taking more $ over time / owning a larger share of our wallets.

It is likely that a duopoly in media & entertainment will cause “collusion” and “price fixing” which means that we will end up paying more for OTT subscriptions in the long term with fewer alternatives.

One of the content segments which needs to be red-flagged were this deal to go through is “live sports” - Viacom18 just bagged the BCCI media rights for all international and domestic cricket matches played in India for both TV and digital for the next five years and has rights for the Indian Super League. The Indian Premier League is already split between Disney Star and Viacom18. Disney Star also owns digital rights for ICC’s Men’s Cricket for four years besides Cricket Australia, the English Premier League and Wimbledon. The newly merged entity would have a clear monopoly in “live sports” as a result.

That’s all for today folks. If you enjoyed this breakdown, please share it with your friends and colleagues!

Go ahead and check out Aarya, Season 3, exclusively on Disney+ Hotstar, about a mother intent upon protecting her children till her dying breath, and a drug baroness running her business with the help of a few loyal men. This time around, in Aarya Season 3, Sushmita Sen as Aarya Sareen is about to find that being in bed with Russian mobsters is not as easy as she thought it would be, even as she is up against dangers closer home.

Streaming in India is a weekly newsletter exploring the trends that matter to streaming professionals in India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Wednesday.

Interested in advertising with Streaming in India? Email me.

Get full access to my market reports STREAMING in INDIA