Five Graphic Insights to Understand Streaming Media in MENA in 2024

New Platforms, Streaming Models, FAST Channels, Shahid’s Numbers, and Sports in MENA

Hey streamers 👋

Before looking ahead to the key trends in streaming in MENA for 2025, let’s take a quick look back at what happened in 2024.

And what’s better than a few graphics to catch up fast?

Today’s program

Streaming Growth in MENA

Free and Paid Streaming Models

Tracking FAST Channels: 2 Years On

SVOD & AVOD Trends on Shahid

Sports Streaming in MENA

And… Action!

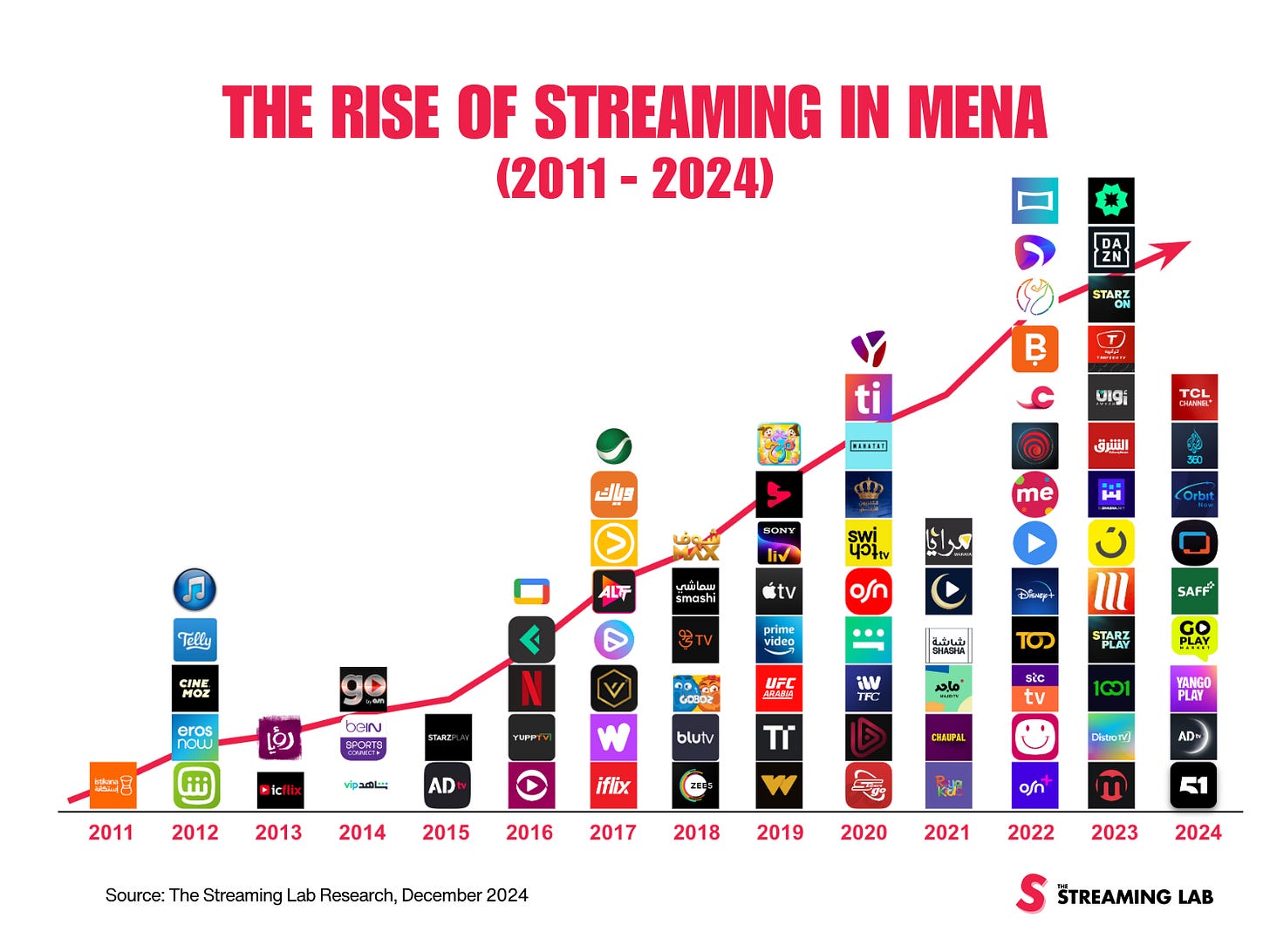

Streaming Growth in MENA

Streaming platforms have grown quickly in MENA over the years. They have evolved from ad-based models to subscription-based offerings and are now following a hybrid approach that combines paid and free options.

In 2024, several new platforms entered the market, including Yango Play, SAFF+, Orbit Now, and Al Jazeera 360, making it the 4th strongest year for launches after 2023, 2022, and 2021.

Half of these new platforms went for free streaming models, combining FAST, AVOD, and FVOD. The rest primarily focused on SVOD.The rest stuck to SVOD.

So What?

While 2025 might not see as many launches, we’re likely to see more SVOD platforms, both local and international, adding free streaming options to their mix.

It’s a smart way to attract a broader audience without fully giving up on subscriptions.

Free and Paid Streaming Models

Every year at MIPCOM in Cannes, I enjoy talking with streaming experts about how we categorize models as an industry. This year was no different, with plenty of discussions on the topic.

One simple way to think about it is from the consumer’s perspective. Content is obviously their main priority, but whether they pay for it, or not, is just as important.

That’s why I grouped in this graphic the local streaming ecosystem in MENA into two main categories: FREE STREAMING and PAID STREAMING, with the global giants added for comparison.

So what?

What stood out to me is this: there are the same number of platforms offering only paid options (like OSN+, TOD, and stc tv) as there are offering only free options (like SAFF+, Now, and Maraya).

Even more interesting? The number of platforms combining both free and paid options is higher. This hybrid model, mixing SVOD and AVOD, is something we see a lot in the MENA region.

And it’s not slowing down. Next year, we will likely see more hybrid experiments: AVOD + SVOD, ad-supported SVOD, SVOD + FAST, etc.

This trend is only getting bigger.

Found this article insightful? Don't keep it to yourself, share it with your team and start the conversation!

Tracking FAST Channels: 2 Years On

I’ve been tracking FAST for two years now, collecting a ton of data along the way. I know exactly when a channel launched, which platform it was on, and when it was dropped.

This data also comes with plenty of metadata, country of origin, language, genre, and more. I’m planning to publish a detailed report early next year to map out this two-year evolution of FAST in MENA.

So What?

There are two clear groups in the FAST race in MENA:

The FAST leaders: Platforms like STARZ ON, Roya TV, and Shahid take an active approach, regularly adding and removing channels. This shows they’re putting time and effort into the model, analyzing what works (genres, languages, and specific channels), and adjusting accordingly.

I would love to include the international FAST players in this category but I didn’t see enough localization effort from them yet.

The FAST followers: Mostly local broadcasters who use FAST as a way to make their linear channels available online. They rarely add new channels, and their approach seems much more passive.

What do I expect for FAST in MENA in 2025?

More local channels targeting local audiences. No more blind channel additions. Clearer strategies focused on what consumers are actually watching.

Here is my latest article about FAST in MENA in November:

SVOD & AVOD Trends on Shahid

With 4.8M SVOD subscribers and 17.8M AVOD monthly active users, SHAHID is dominating MENA streaming.

The growth is impressive: between Q4 2022 and Q3 2024, SHAHID’s subscribers jumped 68%.

I know direct comparisons with global platforms like Netflix might not be fair due to different market dynamics, but over the same period, Netflix subscriber base “only” grew by 22%, Prime Video by 17.5%, and Disney+ decreased by 2%.

So What?

Subscriber spikes align with Ramadan:

+25% from Q4 2022 to Q1 2023

+21% from Q4 2023 to Q1 2024

Ramadan’s new releases boost engagement but also lead to churn: 5.3% after Ramadan 2023, 4.5% in 2024. That said, SHAHID has improved retention.

AVOD follows a similar pattern, with 20M users in Q1 2024 and a 48% increase since 2022. While post-Ramadan dips are common, growth is steady.

Based on past performance, I anticipate Ramadan 2025 to potentially bring the AVOD audience to 23–25 million MAUs.

You can find my full analysis in this article:

Sports Streaming in MENA

The last five years have transformed sports content in MENA, driven by two big trends: fragmented international sports rights and the rise of local sports leagues.

My research found 24 sports represented across six platforms: TOD, Shahid, STARZ ON, DAZN, ADtv, and Smashi. The list includes football, tennis, combat sports, motorsport, cricket, esports, and more.

So What?

Sports streaming isn’t just about live matches anymore. Global platforms have been producing premium sports documentaries for years. It’s time for MENA platforms to tell the stories of their own athletes.

Several platforms like STARZ ON, Roya TV, Shahid, and DAZN are already expanding access with sports-focused FAST channels.

Piracy remains a challenge, but partnerships like 1001 and LaLiga prove that collaboration between local players and major leagues can make premium content more accessible.

Local sports are growing fast, fueled by passionate fans and strong community ties. Regional platforms need to work together to push these leagues and tournaments to a wider audience.

As global giants like Apple, Amazon, and Netflix invest heavily in sports (Apple with MLS, Amazon with the NBA, and Netflix testing live sports), competing for premium international rights will only get harder. For MENA platforms, focusing on local sports is the key to standing out.

For deeper insights, check out my recent special report on SPORTS in MENA

That’s all for today, 5 graphic insights to understand streaming media in MENA in 2024. If you found this breakdown valuable, spread the word and share it with your network!

Wishing everyone a fantastic week and a Merry Christmas! See you online next Monday for the final article of the year. In the meantime, enjoy PAW PATROL Holiday Fireplace like I am 😉

Master Streaming in MENA with exclusive data & analysis for streaming media professionals. Subscribe to TLS+:

Read all the previous edition of The Streaming Lab here.

Download my latest report, STREAMING in MENA - August 2024. Exclusively available to TSL+ Prime members!

Interested in advertising with The Streaming Lab and reach a qualified audience in MENA? Email me.

🤓.. 👏